How to Create an Office Template Donation Receipt

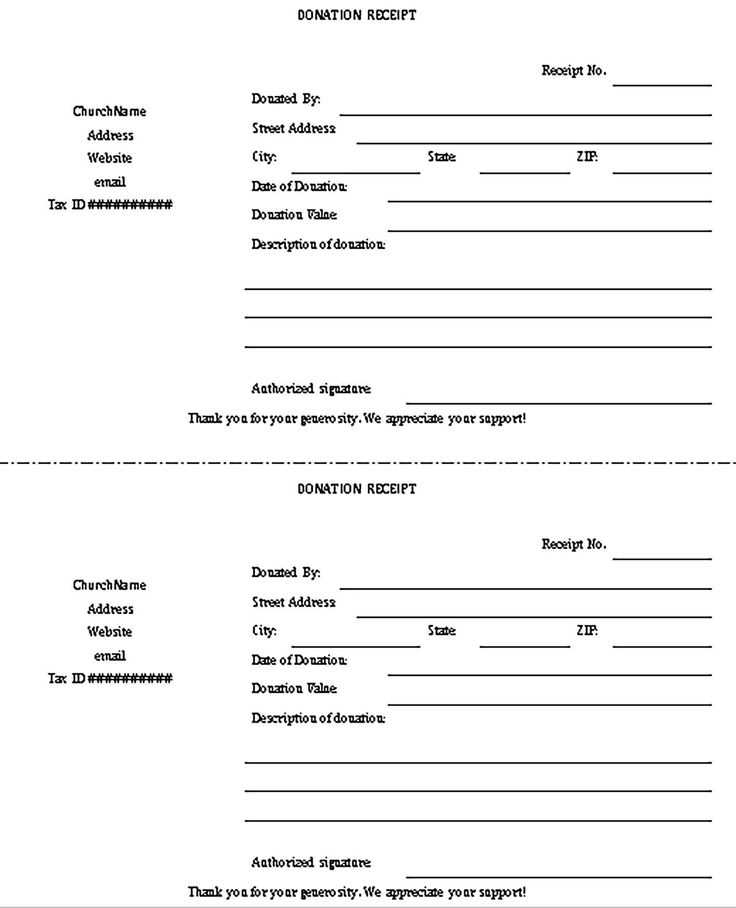

To keep your donations well-organized, create a clear, professional donation receipt. This template should include donor details, donation amount, and the purpose of the donation. Use a clean, readable format for ease of understanding. Include the following essential elements:

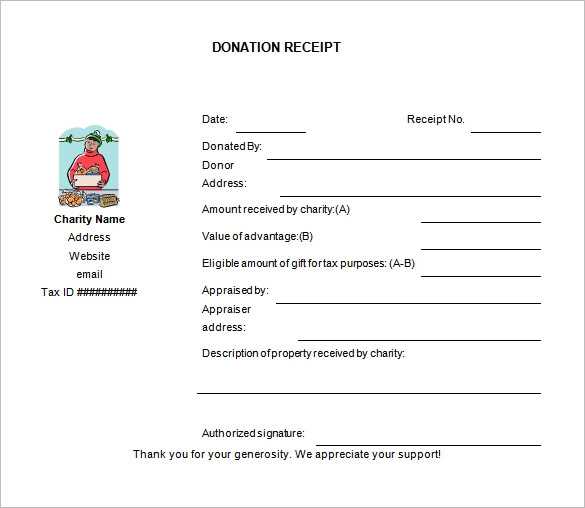

- Donor Information – Name, address, and contact details.

- Donation Amount – Specify the exact monetary value or item donated.

- Purpose – Mention the purpose of the donation or the specific project it supports.

- Date of Donation – Ensure the donation date is clearly stated.

- Tax ID – Include the charity’s tax ID if the donor plans to claim deductions.

What to Include in a Donation Receipt Template

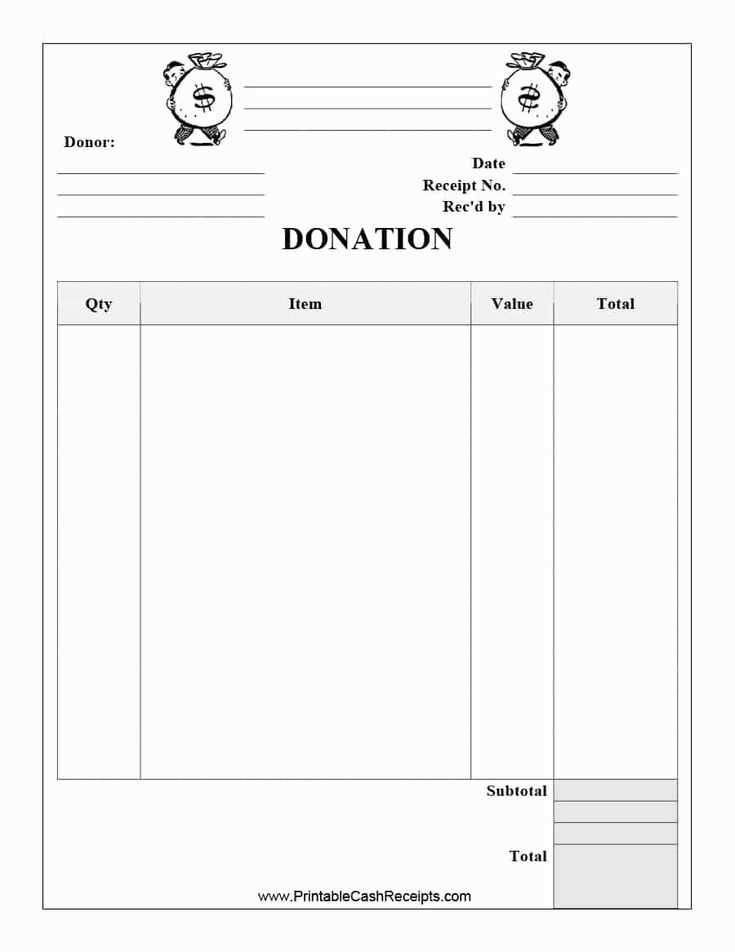

For smooth processing, structure your office template with these key sections:

- Header – Include your organization’s name, logo, and contact information.

- Donation Acknowledgement – Provide a statement acknowledging the donor’s contribution.

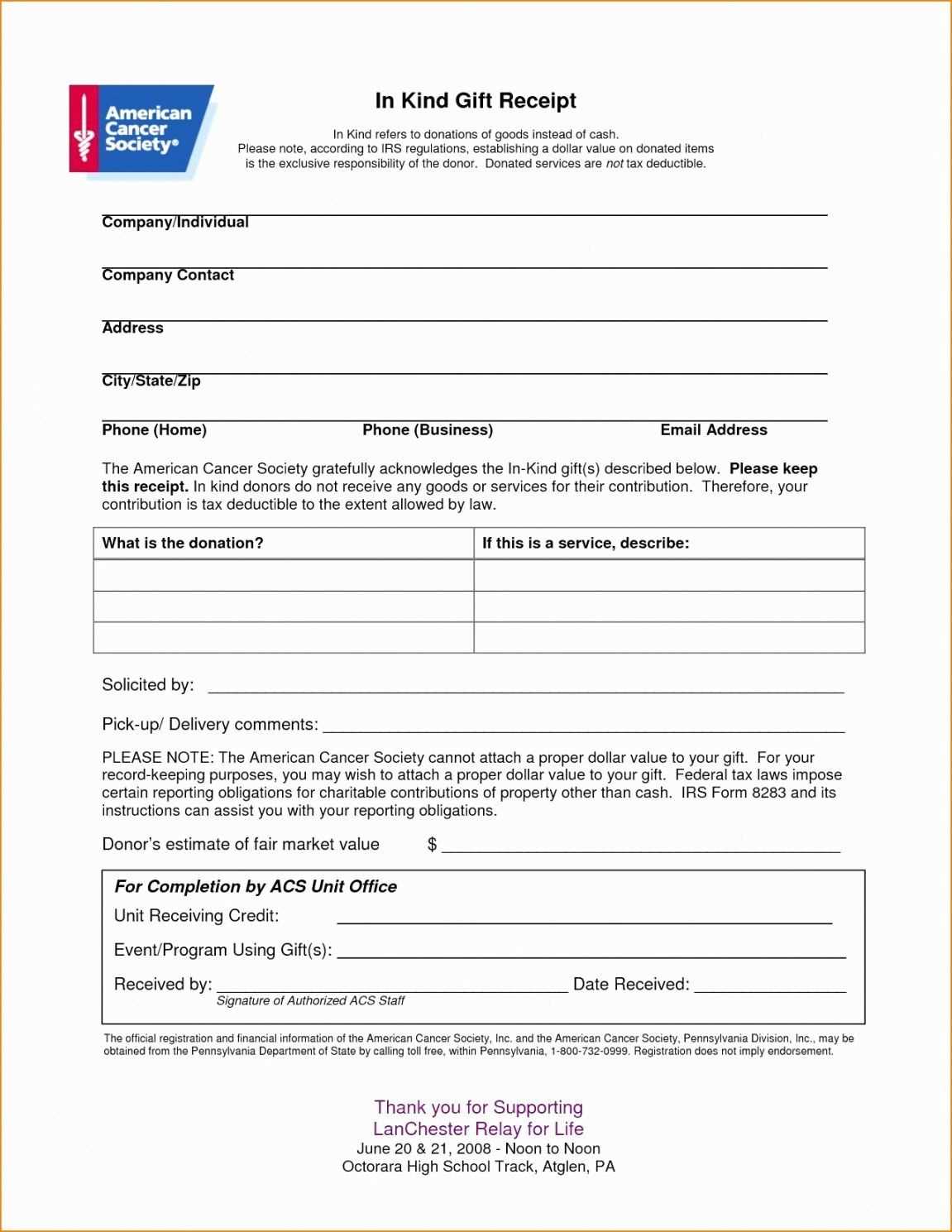

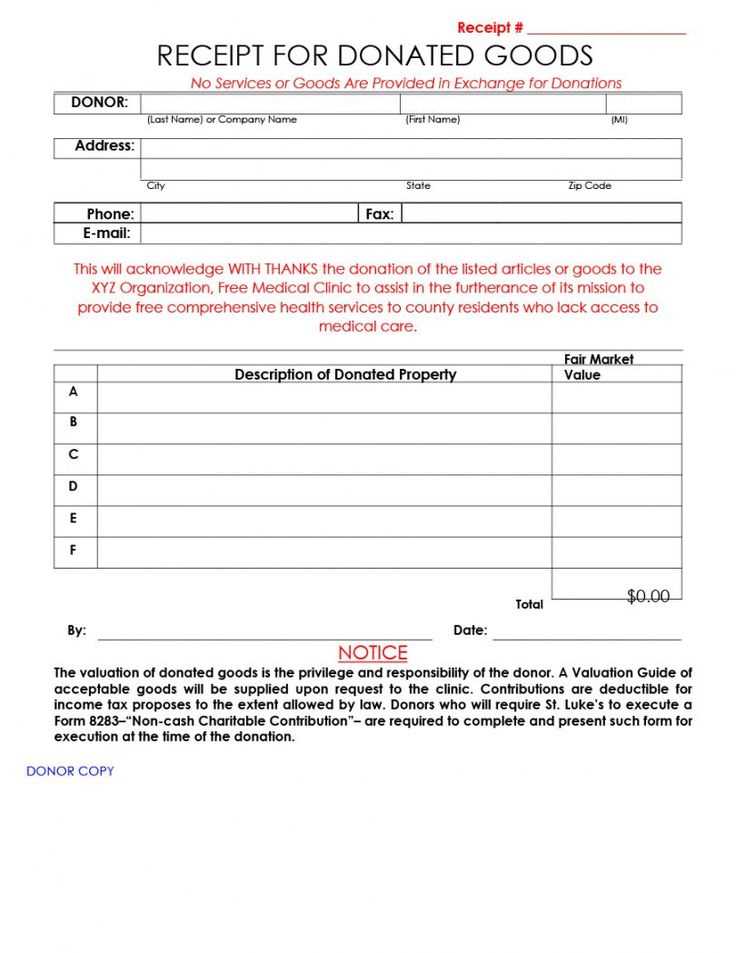

- Amount and Itemization – List specific items or the dollar value of the donation.

- Legal Statement – Include a disclaimer about the tax deductibility of donations.

Streamlining Donation Management with Office Templates

Using office templates allows for easy tracking and fast creation of receipts. Store them digitally to access or print whenever needed. Customize templates for different types of donations to suit the specific needs of your donors and your organization’s requirements.

By maintaining clear and consistent templates, you ensure a streamlined process for acknowledging donations and keeping accurate records, saving time and effort in the long run.

Office Template Donations and Receipt

How to Structure a Donation Receipt in Office

Key Elements to Include in an Office Donation Template

Customizing Templates for Different Donation Types

Ensuring Legal Compliance in Receipts

Automating Receipt Generation in Microsoft Office

Common Mistakes to Avoid in Donation Templates

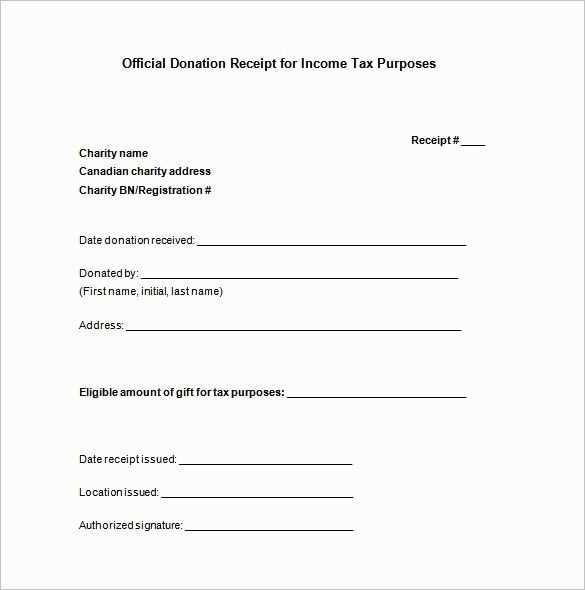

To structure a donation receipt in Office, start by incorporating key details such as the donor’s name, donation amount, and the date of the donation. This information should be clearly listed at the top of the receipt for quick reference. Follow with a statement confirming whether the donation is monetary or non-monetary. For non-monetary donations, be sure to describe the item donated and its estimated value.

The template should include the organization’s name, address, and tax identification number. Adding a personalized message thanking the donor will strengthen the relationship and encourage future contributions. Always include a disclaimer regarding the non-refundable nature of donations, as well as a statement that the receipt is not an exchange for goods or services unless applicable.

Customizing templates for different types of donations is simple. For cash donations, focus on amounts and payment methods, while for items, ensure the template includes space for item descriptions, quantities, and estimated values. Be sure to adapt the template depending on the donation type to maintain clarity and relevance.

Legal compliance requires including specific information, such as the tax-exempt status of the organization and compliance with IRS regulations. This guarantees that the receipt serves as valid proof for tax purposes. Make sure the receipt contains the correct wording to meet the guidelines for charitable contributions.

Automating receipt generation in Microsoft Office can be done by using tools like Word templates or Excel spreadsheets. By using mail merge in Word, you can easily generate multiple receipts at once by linking to a database of donor information. This method saves time and ensures consistency.

Avoid common mistakes by double-checking the donation amount, date, and donor details. Ensure all fields are filled out correctly, as errors can lead to confusion or tax-related issues. Be mindful to keep track of donation receipts in an organized system to ensure accurate record-keeping and easy retrieval when necessary.