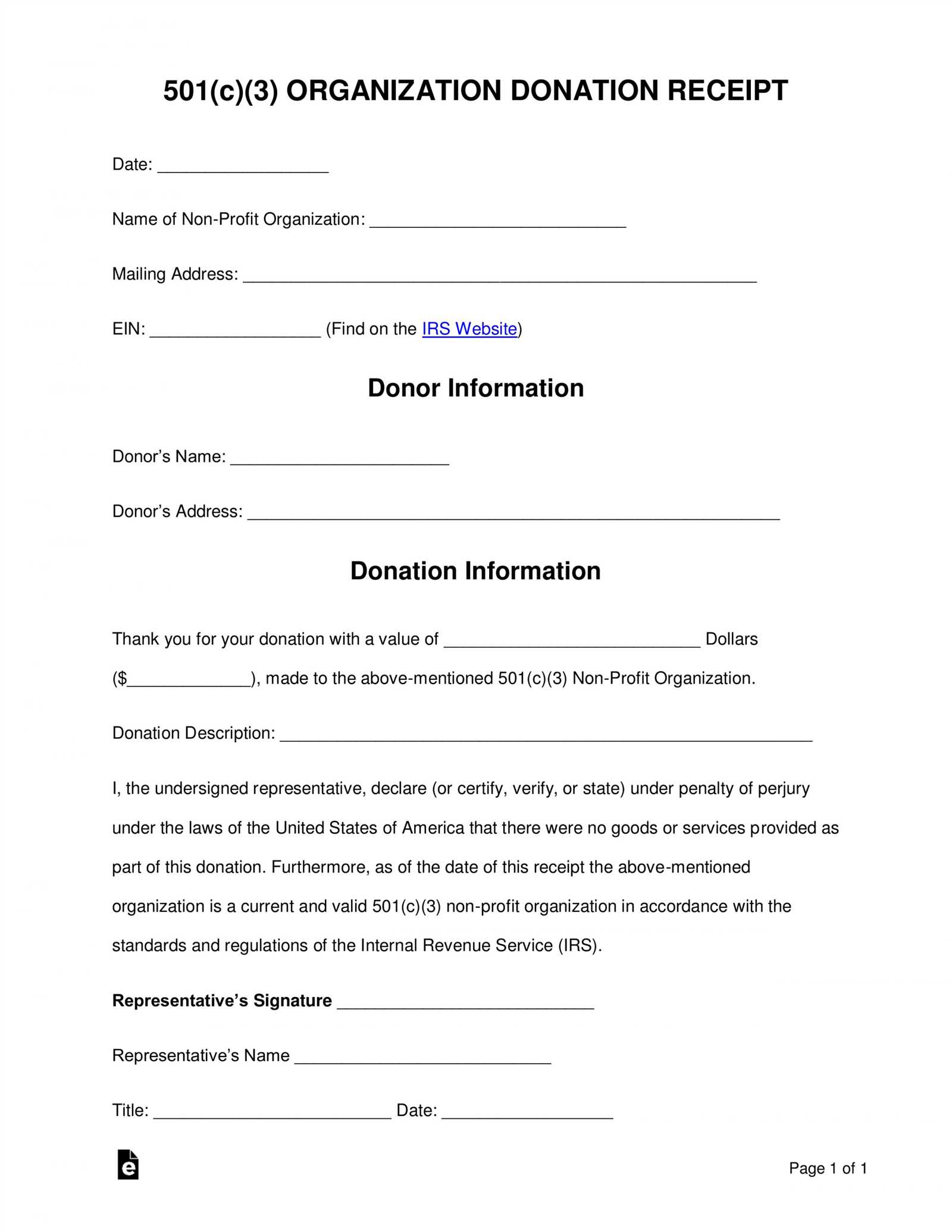

Use this template to create an official donation receipt for income tax purposes, ensuring compliance with tax regulations. Include all required details such as donor information, donation date, amount, and the organization’s name. This template simplifies the process and guarantees that all key points are addressed, saving you time and avoiding potential issues during tax filing.

Make sure to include the donor’s full name and address, the amount donated, and the charity’s registration number. This information is necessary for both the donor to claim a tax deduction and for the charity to maintain accurate records. Be sure to also include a statement that the organization is a registered charity, as this establishes the legitimacy of the donation.

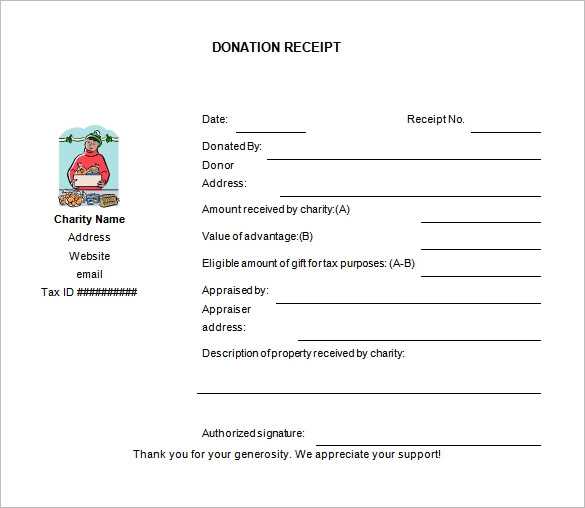

If the donation involves non-cash items, list the item description, its fair market value, and the date it was received. Also, clarify whether the donor received any benefit or goods in exchange for the contribution. This transparency is key for both parties to comply with tax laws and to avoid future complications.

Here is the revised version with the repetitions reduced:

To simplify your official donation receipt for income tax purposes, remove unnecessary repetition in key fields. Focus on clear, concise details that align with the legal requirements for tax deductions. Each receipt should contain only the donor’s name, donation amount, date, and organization’s information. Avoid restating details like the donation type more than once. This approach makes it easier for the donor to understand and for the tax authorities to verify.

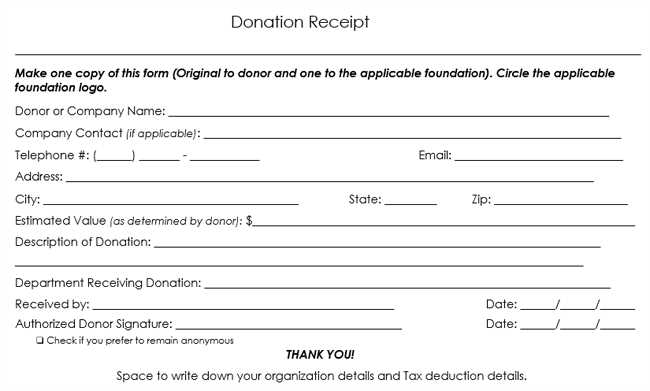

Key Elements to Include

Ensure the following details are accurately captured:

- Donor’s full name

- Donation amount

- Date of the donation

- Organization’s name and charitable registration number

- Signature of an authorized person

Keeping It Simple

By limiting repetitive content, you create a straightforward document that meets tax requirements without confusion. This clarity helps both the donor and the tax authorities process the information quickly.

Official Donation Receipt for Tax Purposes Template

To create an official donation receipt for tax purposes, include the following elements to ensure compliance with tax laws and allow donors to claim their charitable contributions on their taxes:

Required Information

The receipt should contain these details:

- Organization’s Name and Address: Ensure the full legal name of the charity or nonprofit, along with its complete address.

- Charity Registration Number: Include the registration number of the charity as issued by the relevant tax authority.

- Donor’s Information: List the name and address of the donor, including their email or phone number if applicable.

- Donation Details: Specify the date of the donation, the amount donated, and whether the donation was made in cash, cheque, or other forms.

- Value of Non-Cash Donations: For in-kind donations, provide an estimate of the value of the goods donated, if applicable.

- Signature and Authorized Person’s Title: The receipt must be signed by someone authorized within the organization, such as the executive director or financial officer.

Format and Legibility

Ensure the template is clear and easy to read. Use simple formatting and readable fonts. Ensure all sections are clearly labeled to avoid confusion.

By following this template, you help donors secure their eligible tax deductions while maintaining your nonprofit’s compliance with tax authorities.

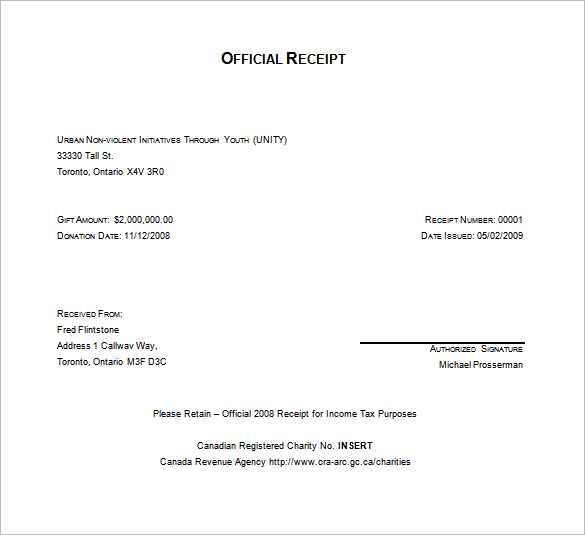

Clearly display the organization’s legal name, address, and registration number at the top of the receipt. This provides transparency and ensures proper identification for tax purposes.

Donation Details

List the donation amount both in figures and words. If the donation is in-kind, describe the donated items or services with their fair market value. Specify the currency if it’s different from the standard local one.

Donor Information

Include the full name and address of the donor. If the donation is made by an entity, ensure the business name and address are clearly stated.

Assign a unique receipt number for each donation. This helps track and verify donations efficiently.

If goods or services were exchanged, note their value. If no goods or services were provided in exchange, explicitly state that the donor received no tangible benefit, which confirms eligibility for a full tax deduction.

To issue a valid donation receipt for income tax purposes, ensure your organization complies with the specific legal requirements outlined by the tax authority. This includes including the donor’s name, address, and donation amount. The receipt should clearly state the official name of the charitable organization, its registration number, and confirmation that the donation is eligible for tax benefits.

Key Details to Include on Donation Receipts

Donation receipts must contain certain pieces of information to qualify for tax deductions. The organization’s name, address, and registration number should be listed. Additionally, ensure that the donation amount is recorded accurately, whether it is a monetary contribution or an in-kind donation, including a fair market value for goods donated.

Tax Authorities’ Guidelines

Tax agencies may have specific rules regarding the format and distribution of donation receipts. Review the official guidelines to ensure your organization is meeting legal requirements, including timelines for issuing receipts. For example, receipts must typically be issued within a certain period after the donation is made, and the donor must receive an acknowledgment for their contribution in a timely manner.

Ensure the donation amount is correct. Many errors arise when the donor’s contribution is recorded incorrectly. Double-check the total amount before issuing the receipt. If the receipt includes a tax-deductible portion, verify that the breakdown is accurate.

Don’t forget to include the donor’s information. Missing or incomplete details such as the donor’s name, address, or contact information can invalidate the receipt. Confirm that all information is clearly listed and spelled correctly.

Check the Date

Issuing receipts without the correct date can cause confusion. The date should match the day the donation was made. Record both the date of the donation and the date the receipt was issued, if different.

Properly Describe the Donation

Clearly describe the donated items or services. Vague descriptions such as “miscellaneous items” or “general donation” can create issues during tax filing. For non-cash donations, include specific details like the type of item and its estimated value if applicable.

- Include a detailed description for non-cash donations.

- For cash donations, ensure the amount is correct.

- List any tax-deductible portions of the donation separately.

Don’t skip the official registration number. This unique identifier ties the receipt to your organization. It’s required by tax authorities for verification, so ensure that it’s included on every receipt you issue.

Avoid vague or generic wording in the receipt’s statement. Use clear, precise language to avoid ambiguity regarding the tax implications of the donation. Instead of just stating “donation received,” specify whether it’s a charitable donation eligible for tax purposes.

Ensure your official donation receipt template includes all required fields. This guarantees both compliance and clarity for donors when claiming tax benefits. Below is a list of the key elements to incorporate in your template:

| Field | Description |

|---|---|

| Organization Name | List the full legal name of your charity or nonprofit. |

| Registration Number | Include your charity’s official tax registration number. |

| Donor Information | Provide the donor’s full name, address, and contact details. |

| Donation Amount | Clearly state the exact amount donated in both words and figures. |

| Donation Date | Indicate the exact date the donation was made. |

| Receipt Number | Assign a unique number to each receipt issued for record-keeping purposes. |

| Signature | Include the signature of an authorized representative from your organization. |

| Purpose of Donation | If applicable, briefly explain the specific purpose or campaign the donation supports. |

Make sure to include all of these fields on your receipt template to meet the legal requirements and help donors easily apply for tax deductions. Avoid including excessive details or confusing language that could lead to misunderstandings.