Use a PDF charitable donation receipt template to create professional and accurate receipts for donations. A receipt is a legal document that helps both the donor and the charity track charitable contributions for tax purposes. By providing clear details such as the donor’s name, donation amount, and the charity’s information, you ensure transparency and compliance.

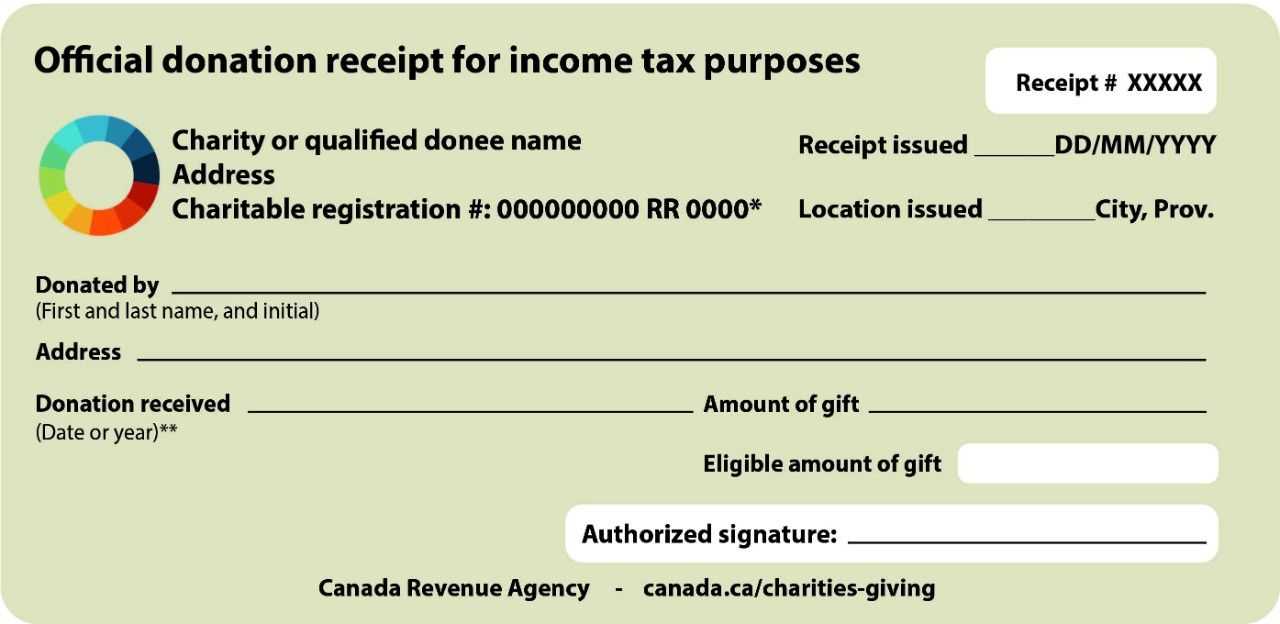

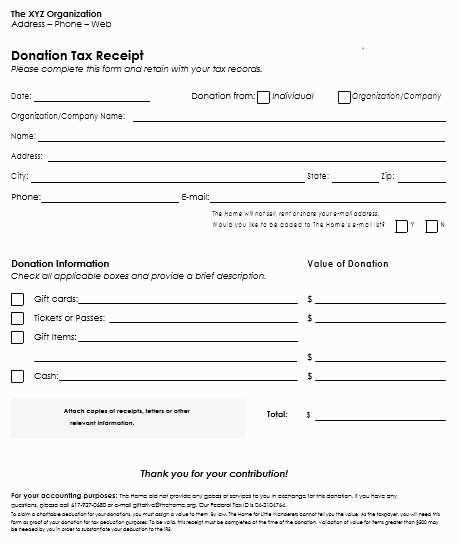

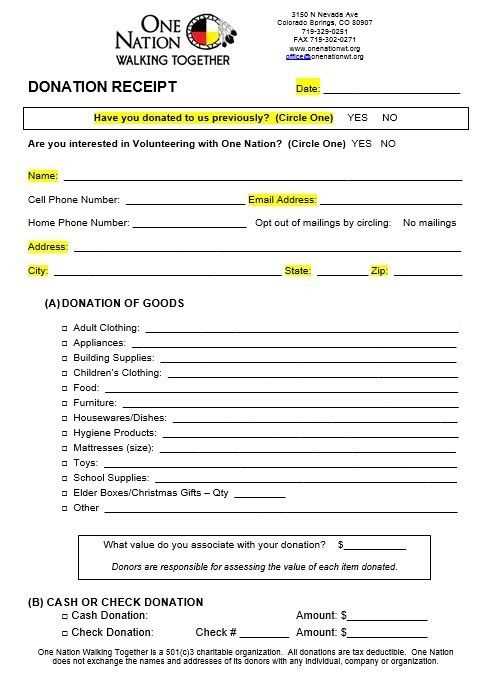

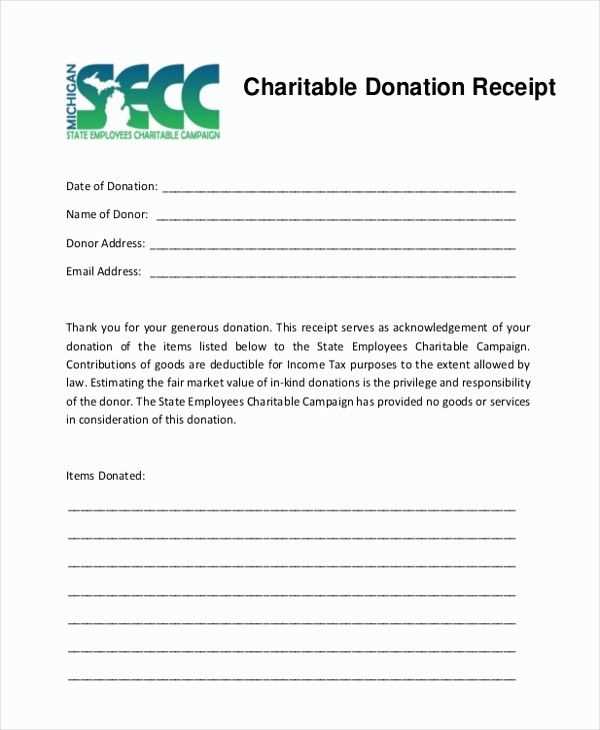

A good receipt template should include specific information: donor details, donation date, donation amount, and charity’s tax-exempt status. Make sure the template is easy to modify, allowing you to personalize the details for each donation quickly. Always include a unique receipt number to avoid confusion with previous donations.

Choose a template that also meets IRS requirements for record-keeping. This includes stating whether any goods or services were provided in exchange for the donation, as this affects the amount eligible for tax deduction. Keep your template professional, with all necessary fields clearly visible for quick reference.

Here are the corrected lines:

Ensure your donation receipt includes the donor’s full name, donation date, and amount. Avoid using vague terms like “generous contribution” and provide specific numbers. Clearly state whether the donation was in cash or goods, and ensure the donation value is properly calculated if it’s non-cash. Include your organization’s name, address, and tax-exempt status to guarantee the donor can claim tax benefits. Confirm the receipt contains no ambiguous statements regarding the organization’s intent. Make sure to sign the document to authenticate it.

- PDF Template for Charitable Donation Receipt

Use a structured PDF template to streamline the donation receipt process. This ensures the receipt contains all required elements while saving time. Below are key components for a complete template:

Key Elements of a Charitable Donation Receipt

- Donor Information: Include the name and address of the donor.

- Charity Information: List the charity’s name, address, and tax ID number.

- Donation Amount: Specify the exact amount of the donation, including whether it was cash or goods.

- Non-cash Donations: If applicable, describe the donated items along with their fair market value.

- Date of Donation: Clearly state the date the donation was made.

- Statement of No Goods or Services Provided: Include a statement confirming that no goods or services were exchanged for the donation or specify what was received, if any.

Additional Considerations

- Charity’s Authorization: Ensure the charity’s authorized signature or officer’s name is included.

- Tax Deduction Details: State that the donor may claim the donation as a tax deduction, if applicable.

- Template Layout: Keep the layout clean, with clearly labeled sections and ample space for the relevant information.

Using a PDF template ensures a consistent format that meets legal requirements and is easy to distribute electronically or print. Download a ready-made template or create one tailored to your charity’s needs.

Begin by selecting a PDF template tool like Adobe Acrobat, Google Docs, or online form generators. Choose a layout that allows for customization and fits the nonprofit’s branding. Ensure the template includes the following key elements:

- Organization’s name, logo, and contact information.

- Donor’s full name, address, and donation date.

- Donation amount, including the value of goods or services received, if applicable.

- A clear statement confirming the donation is tax-deductible.

- Signature or authorization field for the organization.

Once the template is set up, save it as a PDF. For convenience, create an editable version to accommodate different donor details. When sending receipts, ensure they are personalized with accurate donor information and donation values.

Include the charity’s legal name, address, and tax ID number at the top of the receipt. This ensures that both the donor and the charity can verify its legitimacy and that the donor can claim the donation on taxes.

Donation Details

Clearly state the donation amount or description of goods donated. For monetary contributions, list the specific dollar amount. For non-cash donations, describe the item(s) and their fair market value. Always note if any goods or services were provided in exchange for the donation.

Date and Acknowledgment

Record the date of the donation and include a statement confirming that no goods or services were provided in return. This clarifies the donor’s eligibility for a tax deduction. If goods or services were given, state their estimated value and adjust the donation receipt accordingly.

Charitable organizations must issue receipts for donations that meet specific legal standards to ensure both the donor and the organization comply with tax regulations. These receipts must contain several key pieces of information, including the donor’s name, the donation amount, and the date of the contribution.

Key Information to Include

Ensure the following are present on the PDF receipt:

- Donor’s name and contact information (if applicable).

- Donation amount (in monetary terms or a description if it’s a non-cash donation).

- Date the donation was made.

- Charity’s information, including name, address, and tax identification number.

- Statement of no goods or services provided in exchange for the donation, unless applicable, in which case the value of goods/services must also be listed.

Additional Legal Considerations

Organizations should also check their local tax laws for any additional specific requirements, such as limits on the value of goods received by the donor or requirements for donations of a certain amount. It’s important to provide the donor with the proper documentation to ensure they can claim their tax deduction.

Pdf Charitable Donation Receipt Template

Include the following key details in a charitable donation receipt template:

| Item | Description |

|---|---|

| Organization Name | Clearly display the name of the charity receiving the donation. |

| Donor Name | Include the full name of the person making the donation. |

| Donation Date | Specify the exact date of the donation to confirm the timing of the contribution. |

| Donation Amount | State the total amount donated, including currency, for transparency. |

| Tax-Exempt Status | Indicate whether the donation is tax-deductible, along with the charity’s tax ID number if available. |

| Donation Purpose (Optional) | Detail the specific cause or program the donation supports, if applicable. |

| Receipt Signature | Have a designated person sign the receipt to authenticate the document. |

Ensure that the template is clear and easy to fill out, leaving no ambiguity about the donation details. This information is crucial for both the donor’s records and the charity’s compliance with tax regulations.