A 501c3 donation receipt template provides a convenient and reliable way for nonprofits to issue tax-deductible donation receipts. It helps donors keep track of their charitable contributions while ensuring that your organization remains compliant with IRS guidelines. When selecting a template, make sure it includes all required details, such as the donor’s name, donation date, donation amount, and a clear description of the donated items or services.

The receipt must also state that the organization is a registered 501(c)(3), which qualifies it for tax-exempt status. If no goods or services were provided in exchange for the donation, be sure to include a statement to that effect. This transparency ensures that the donor can use the receipt for tax purposes.

Using a template ensures consistency across your receipts and saves time in issuing them. It helps your organization maintain accurate records and improves communication with donors. Customize the template to reflect your nonprofit’s branding while keeping it clear and straightforward for donors to understand.

Here are the lines with duplicates removed:

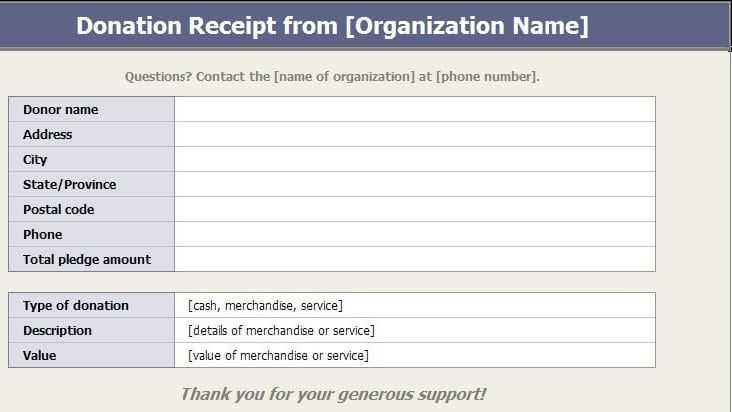

When designing a 501c3 donation receipt template, it’s essential to ensure clarity and accuracy in the information presented. Removing redundant lines or phrases in the template is one of the most effective ways to keep it clean and professional. Below, you’ll find a sample layout showcasing donation receipt lines without unnecessary repetition.

Donation Receipt Template Breakdown

Here are the necessary elements you should include in a 501c3 donation receipt template, with duplicates removed:

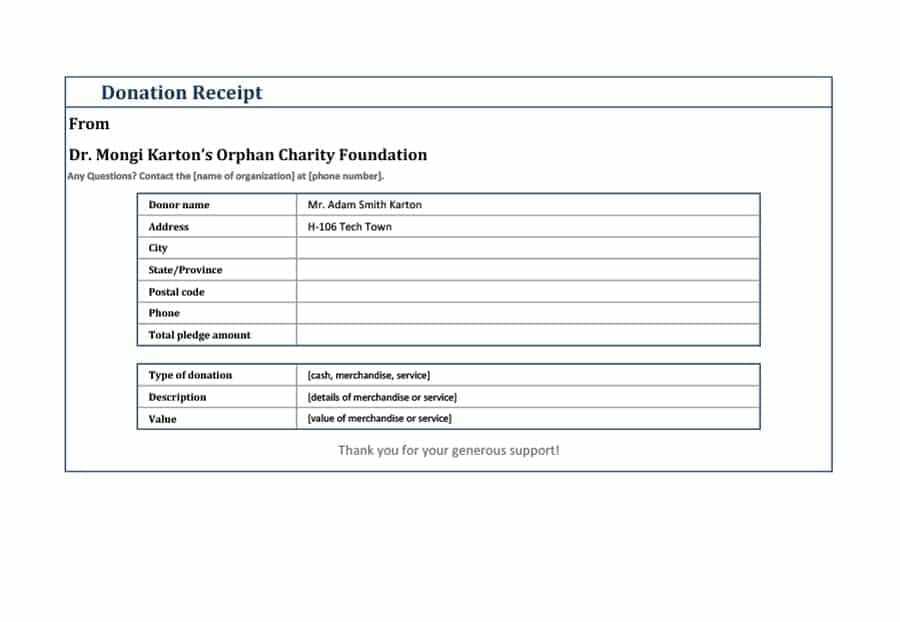

| Field | Details |

|---|---|

| Donor’s Name | Full name of the donor. |

| Donation Date | Date of the donation. |

| Donation Amount | Amount of the donation, in monetary terms. |

| Non-Cash Donation | Value of the donated goods, if applicable. |

| Organization Name | Name of the 501c3 organization. |

| Tax ID | Tax identification number of the 501c3 organization. |

| Statement of No Goods or Services Provided | Clear statement that no goods or services were exchanged for the donation. |

| Signature | Authorized signature of the organization representative. |

This structure provides a streamlined, clear receipt that avoids redundancy while still covering all the necessary information. Ensure that each line is only listed once, and confirm that the required fields are filled accurately to maintain compliance with IRS regulations.

- Printable 501c3 Donation Receipt Template

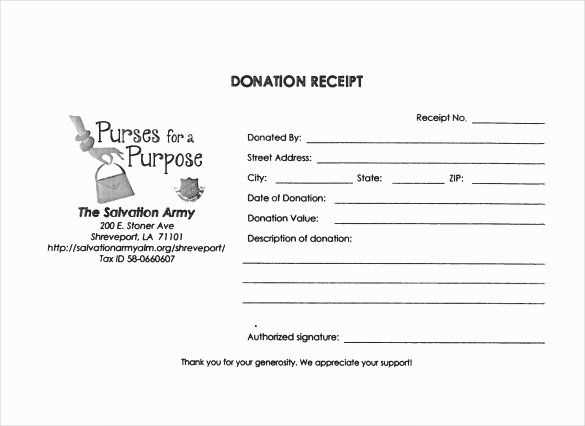

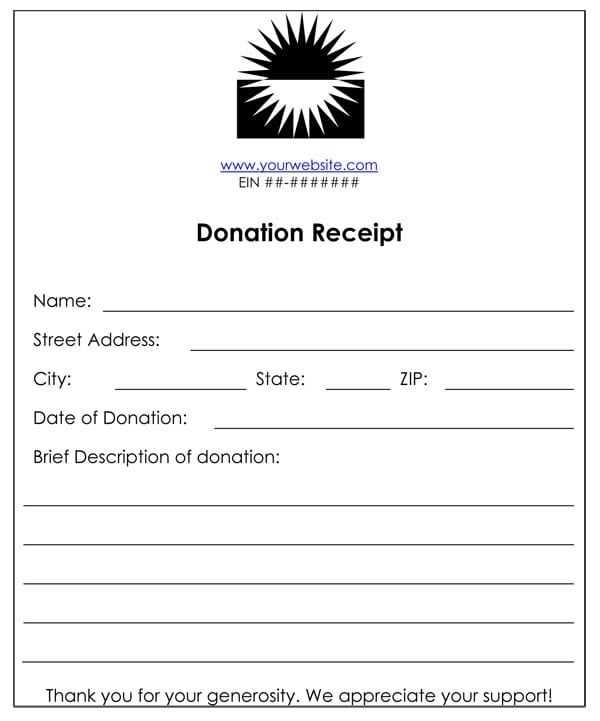

A 501c3 donation receipt template is necessary for nonprofit organizations to properly acknowledge and document donations for tax purposes. Ensure your receipt template includes the following details:

- Organization Name and Contact Info: Clearly state the nonprofit’s name, address, and phone number. Include the IRS determination letter if applicable.

- Donor Information: Name and address of the donor should be included to ensure proper tax reporting.

- Date of Donation: The date the donation was made, which is crucial for tax records.

- Donation Amount or Description: For cash donations, specify the amount. For non-cash donations, describe the item(s) donated.

- Statement of No Goods or Services: Include a statement that no goods or services were provided in exchange for the donation, if applicable. This is critical for IRS reporting.

- Nonprofit Tax-Exempt Status: Include a statement confirming that the organization is a 501c3 nonprofit and can receive tax-deductible donations.

What to Avoid in a Template

- Do not include any vague language or unclear wording that could lead to confusion about the donation amount or tax deduction status.

- Be sure not to omit necessary IRS-required details like the 501c3 status statement or donor’s personal information.

- Avoid generic language that does not specify whether the donation was monetary or in-kind. This detail is important for accurate recordkeeping.

Additional Tips

- Customize the receipt template to match the nonprofit’s branding for a professional appearance.

- Ensure the template can be easily printed and shared with donors.

- Store a copy of the receipt for your nonprofit’s records and provide a receipt to each donor as soon as possible.

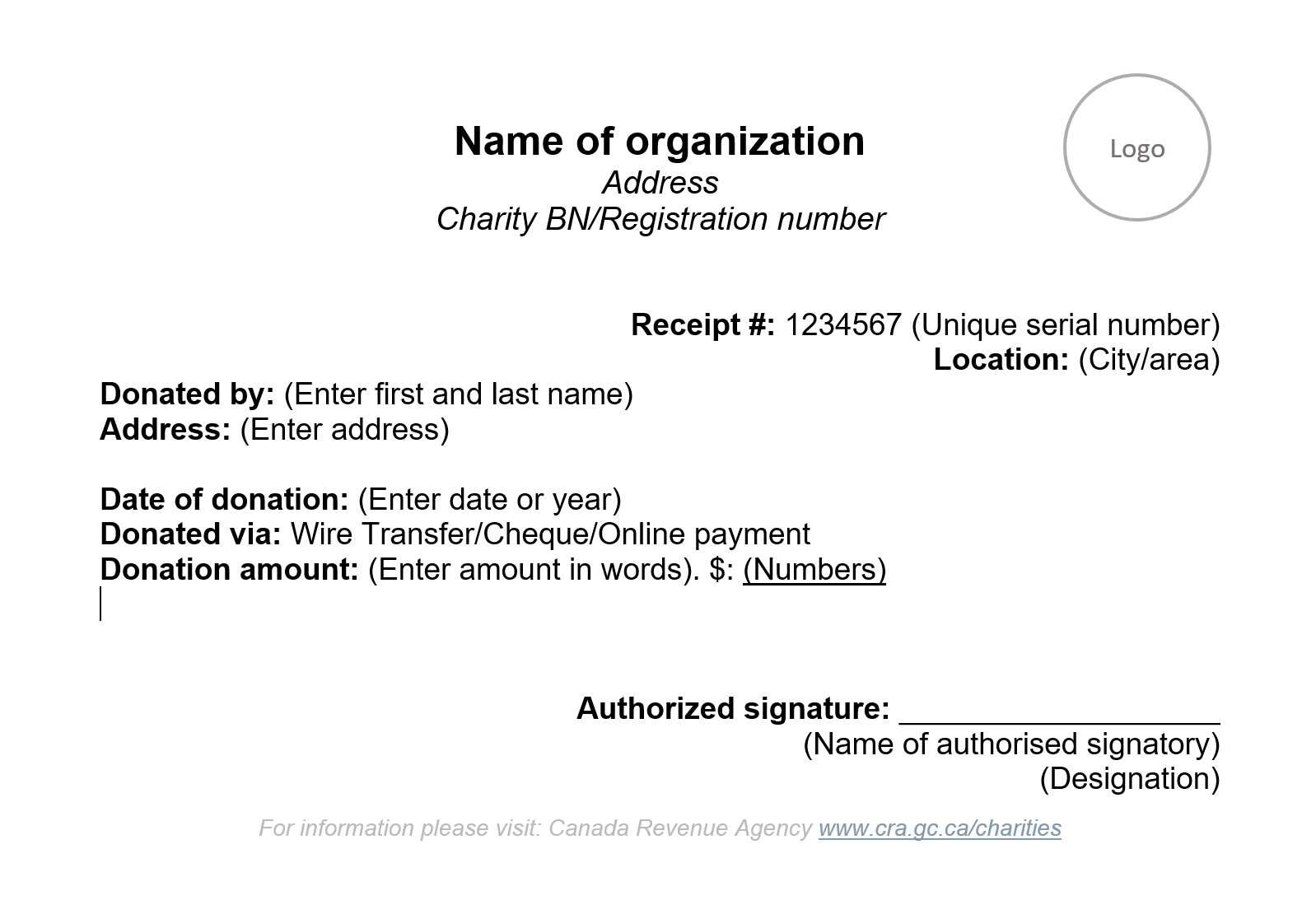

Customize your 501c3 donation receipt by tailoring it to reflect your nonprofit’s unique information and specific requirements. Start with adding your organization’s name, address, and tax ID number in a clear, prominent position at the top. This establishes trust and verifies that the donation is being made to a legitimate nonprofit entity.

Include a Detailed Description of the Donation

Specify the donation type (cash, goods, or services) and the value. If it’s a cash donation, clearly state the amount. For non-cash donations, provide a description of the items received, and if possible, note their estimated fair market value. This helps the donor when claiming deductions and ensures compliance with IRS standards.

Provide a Clear Statement of No Goods or Services Provided

If the donation was fully tax-deductible, include a statement like, “No goods or services were provided in exchange for this donation,” which is required by the IRS for gifts over $75. If something was exchanged, detail what was provided, including the fair market value of the goods or services.

Don’t forget the date of the donation, and if applicable, the designation (such as a specific campaign or project) to help track where the funds are allocated. Make sure the receipt is signed by an authorized representative of your nonprofit to validate the document.

By customizing your donation receipt, you ensure transparency and help your donors feel confident about their contributions while maintaining full IRS compliance.

To ensure compliance with IRS regulations, your 501c3 donation receipt must include specific legal details. These details help the donor claim their tax deduction and provide the necessary documentation for both parties.

1. Organization’s Name and Address

Clearly list the full name of your organization and its physical address. The IRS requires this to verify the legitimacy of the nonprofit organization. If your nonprofit has a different mailing address, include that as well.

2. Date of Donation

The exact date the donation was received must be stated. This is important for donors to substantiate the correct tax year for their deduction.

3. Donor’s Information

Include the name of the donor as it appears on the receipt. While the IRS doesn’t require an address, including it can help avoid any confusion.

4. Donation Description

Describe the donated items or the amount of the monetary donation. For non-cash donations, provide enough detail to identify the items (e.g., clothing, furniture). For cash or check donations, include the specific amount given.

5. Statement of No Goods or Services Provided

State whether any goods or services were provided in exchange for the donation. If no goods or services were provided, include a statement like: “No goods or services were provided in exchange for this donation.” If any goods or services were exchanged, the receipt must include a description and a good faith estimate of their value.

6. Tax-Exempt Status

Include a statement confirming your nonprofit’s tax-exempt status under section 501(c)(3) of the IRS code. This assures the donor that their contribution is eligible for tax deductions.

7. Value of Donated Goods or Services

If the donation consists of physical goods or services, include a good faith estimate of their value. Do not assign a monetary value yourself if it is a non-cash donation; instead, let the donor determine the value. However, if you provide goods or services in exchange, the value of what was given should be reflected.

Hey there! How’s it going? Is there something on your mind today, or do you just want to chat?

Ensure that your 501(c)(3) donation receipt template is clearly formatted to meet IRS standards. Include the organization’s name, address, and tax-exempt status. Specify the date of the donation and the amount, or a description of non-monetary items donated. Be explicit about whether goods or services were provided in exchange for the donation, and if so, include a good faith estimate of the value of those goods or services.

For non-cash donations, provide a description of the items donated. Avoid listing values; instead, leave that determination up to the donor. Make sure to include a statement that no goods or services were provided if that is the case, as this is critical for the donor’s tax purposes.

It’s important to update the template regularly, ensuring all necessary fields are present and compliant with IRS guidelines. Double-check the formatting for ease of understanding and for accurate information capture.