Key Elements of a 501c3 Donation Receipt

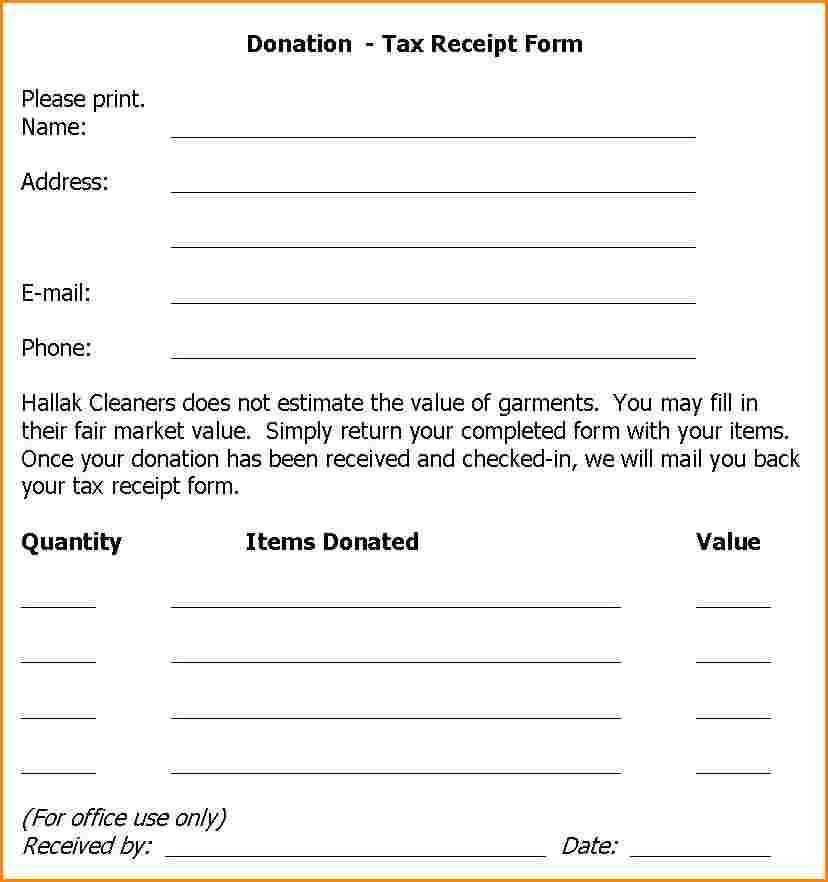

A proper donation receipt must include specific details to meet IRS requirements. Missing information can lead to compliance issues, so ensure each receipt contains the following:

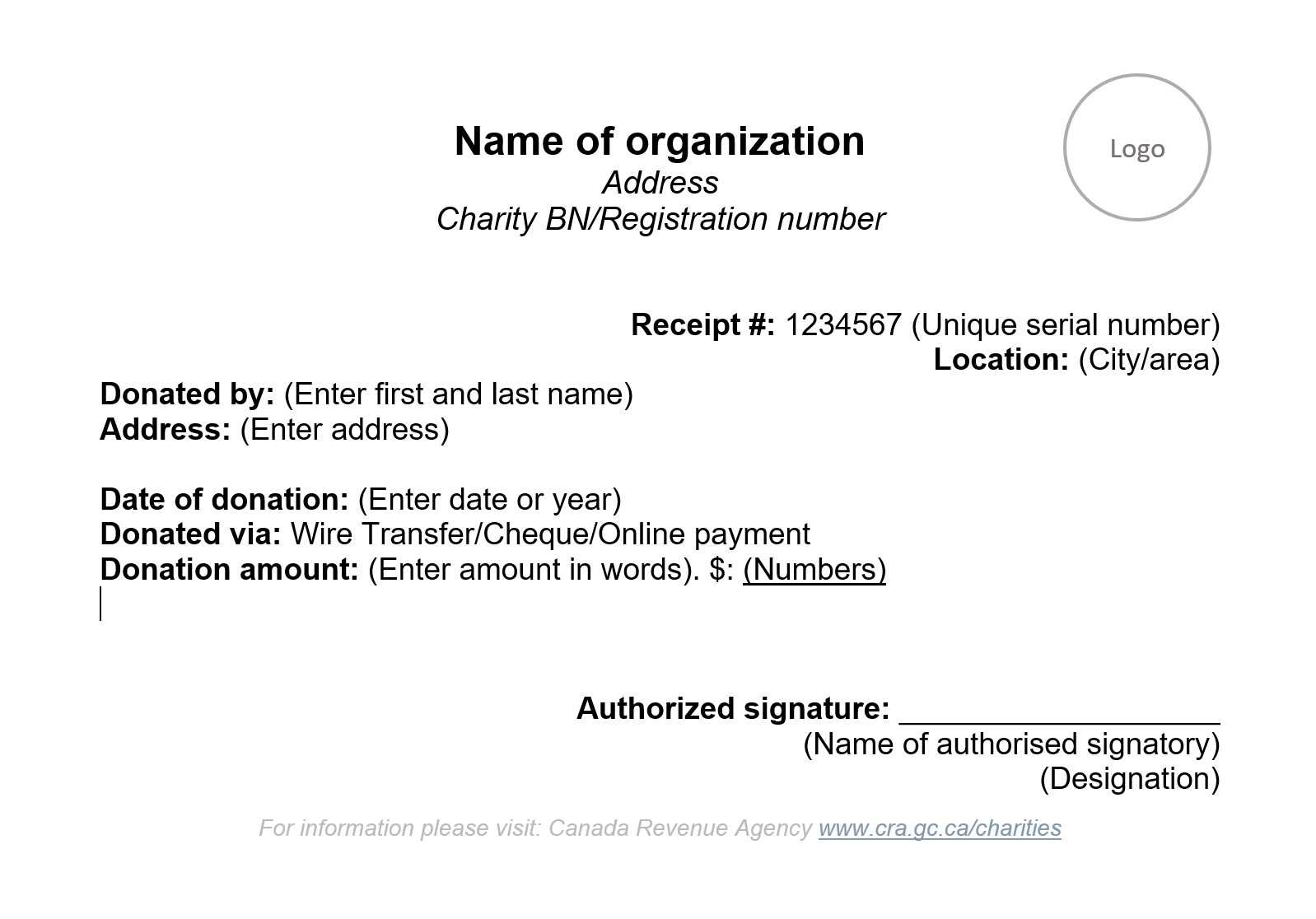

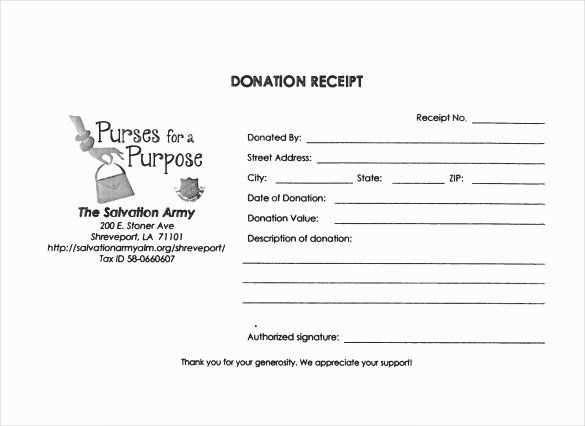

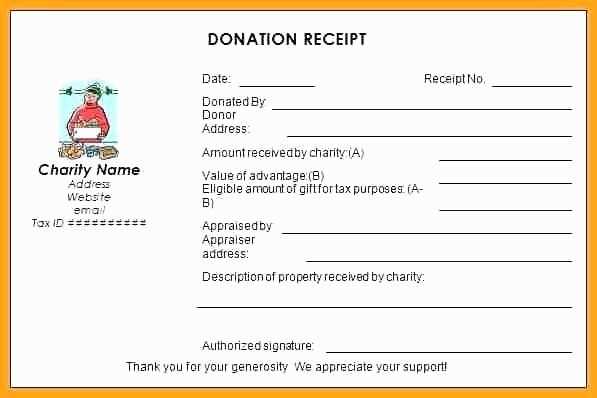

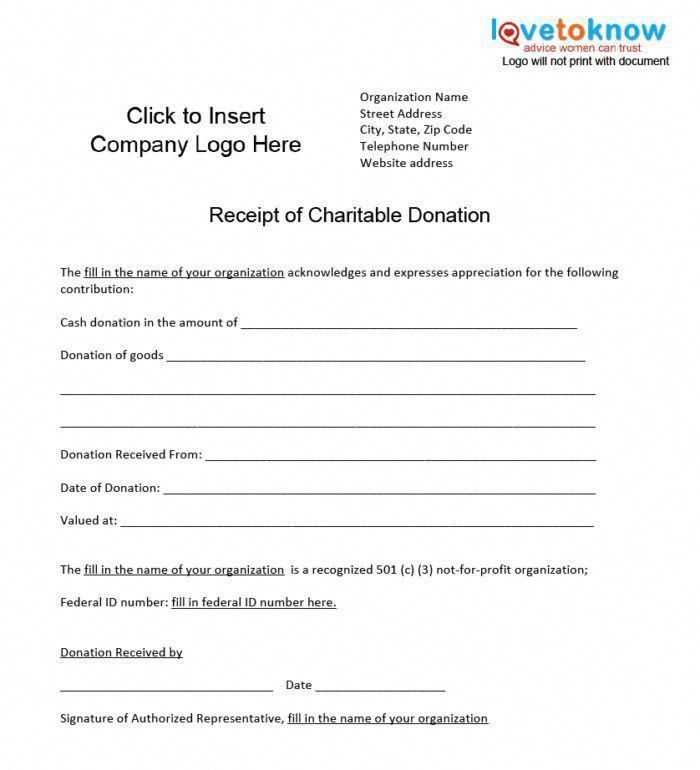

- Organization Name: The full legal name of the 501c3 nonprofit.

- Donor Information: Name and contact details of the donor.

- Donation Date: The exact date when the donation was received.

- Donation Amount or Description: The total monetary donation or a description of non-cash contributions.

- Tax-Exempt Statement: A confirmation that the organization is a 501c3 nonprofit and that no goods or services were provided in exchange for the donation, if applicable.

- Signature: A signature or official acknowledgment from the nonprofit.

Download and Customize Your Receipt

Using a printable eForm simplifies the process and ensures accuracy. Many templates are available in Word, PDF, or Excel formats, allowing easy customization. Follow these steps:

- Download a Template: Choose a format that suits your needs.

- Edit with Your Organization’s Details: Update the template with your nonprofit’s name, address, and tax ID.

- Include Donation Information: Fill in donor details, amount, and date.

- Save and Print: Keep a digital record and provide printed copies to donors.

Why Use a Printable eForm?

A structured eForm ensures consistency and saves time. Digital templates allow easy updates and quick distribution, making record-keeping more manageable for nonprofits and donors alike.

Printable 501c3 Donation Receipt Template – eForms

Key IRS Requirements for 501c3 Contribution Receipts

Mandatory Information to Include in a Receipt for Donations

Best File Formats for Printable Contribution Receipt Templates

How to Customize a 501c3 Receipt for Your Organization

Common Mistakes to Avoid When Issuing Contribution Receipts

Where to Find Free Printable 501c3 Receipt Templates

Key IRS Requirements for 501c3 Contribution Receipts

The IRS requires that donation receipts include the organization’s name, donor’s name, contribution amount, and a statement confirming whether any goods or services were provided in return. For donations over $250, a written acknowledgment is mandatory. If goods or services were given, their estimated value must be specified.

Best File Formats for Printable Contribution Receipt Templates

PDF and DOCX formats work best for printable donation receipts. PDFs ensure consistency across devices and are easy to share, while DOCX files allow for quick customization. Some organizations also use Excel for batch processing.