To ensure proper acknowledgment of donations, using a printable donation receipt template helps streamline the process. A well-structured receipt provides transparency and serves as documentation for both the donor and the recipient organization. It’s crucial to include all necessary details, such as the donor’s name, donation amount, date, and any relevant tax-exempt status information.

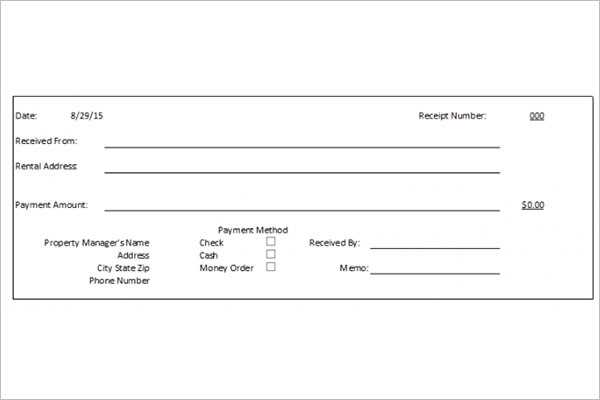

When designing a template, prioritize clarity and organization. Include fields for the donor’s contact information, the donation’s value (whether monetary or in-kind), and a statement of the organization’s tax status. Make sure that the template is easy to edit, allowing for quick updates to the recipient details or the donation amount.

Choosing the right format, whether for print or digital use, can save time. With a clear layout and essential information in place, donors receive prompt, organized acknowledgment. The template ensures both the charity and the donor have the documentation needed for tax purposes.

Here’s a revised version of the text with word repetitions minimized:

Keep your donation receipt clear and concise. Limit unnecessary details while ensuring all required information is present. The template should include the donor’s name, the donation amount, the date, and the charity’s name or EIN number. You can also add a short thank-you note, but avoid over-explaining or repeating phrases. This keeps the receipt focused and professional.

Key Elements to Include

Provide the donor’s name, the amount donated, and the date of the donation. For tax purposes, including the charity’s name or EIN (Employer Identification Number) is necessary. A brief message of appreciation is fine, but too much text can clutter the receipt and reduce its effectiveness.

Template Tips

Design your receipt with legibility in mind. Use a clean layout, and ensure that the font is easy to read. Stick to a standard format to help recipients quickly find the information they need. Avoid decorative elements that can distract from the main points of the receipt.

Printable Donation Receipt Template

How to Create a Donation Receipt Template for Your Organization

Key Elements to Include in a Printable Receipt

Legal Requirements for Receipts in Various Jurisdictions

Customizing a Template for Different Donation Types

Common Errors to Avoid When Issuing Receipts

How to Safely Distribute and Store Printed Receipts

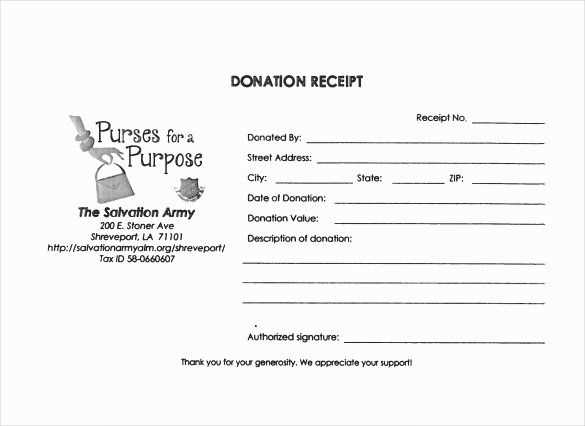

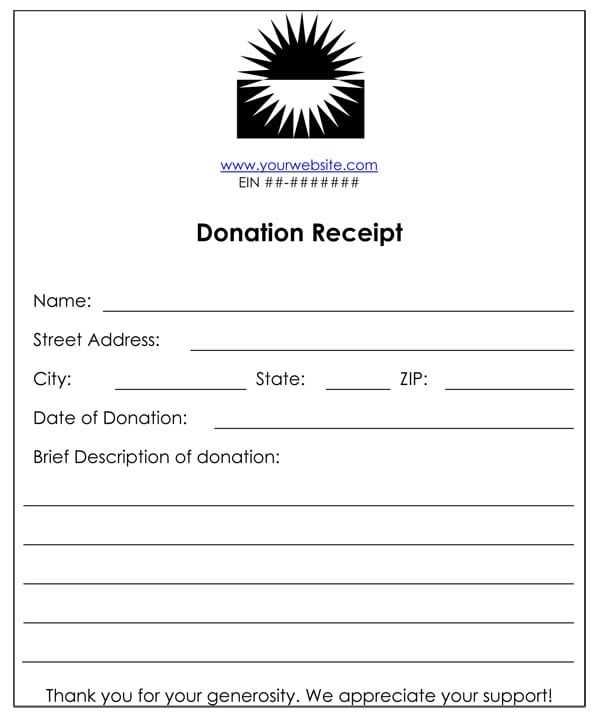

To create a donation receipt template, start by including key details such as the donor’s name, the donation amount, and the date of the donation. Ensure your organization’s name and contact information are visible. For tax-deductible donations, specify that no goods or services were provided in exchange for the gift, as this is required for IRS compliance in the U.S.

Key Elements to Include in a Printable Receipt

Your receipt should clearly list:

- Donor information: Full name, address, and contact details.

- Donation details: The amount donated, including any notes about donated items or services.

- Receipt date: The exact date the donation was made.

- Organization details: The organization’s name, address, tax ID number, and contact details.

- Statement of goods/services: Indicate if the donor received any goods or services in exchange for the donation, or state that they did not.

- Official signature: An authorized representative’s signature adds legitimacy to the document.

Legal Requirements for Receipts in Various Jurisdictions

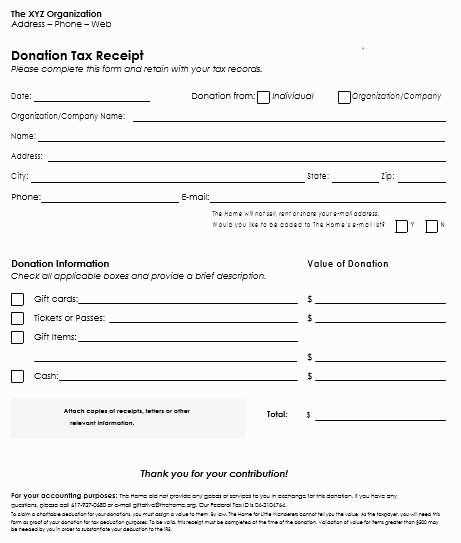

Tax laws vary across jurisdictions, so it’s important to follow local regulations. For example, in the United States, the IRS mandates specific language on receipts for donations over $250, including a statement that the donor did not receive any goods or services in return. In the UK, charities must issue receipts for donations above a certain value to be eligible for Gift Aid claims. Make sure your template reflects these specific legal requirements for the regions your organization operates in.

For organizations dealing with international donations, consult local tax regulations to ensure compliance with each country’s donation receipt rules. Failure to provide the correct documentation may result in penalties or delays in tax deductions for donors.

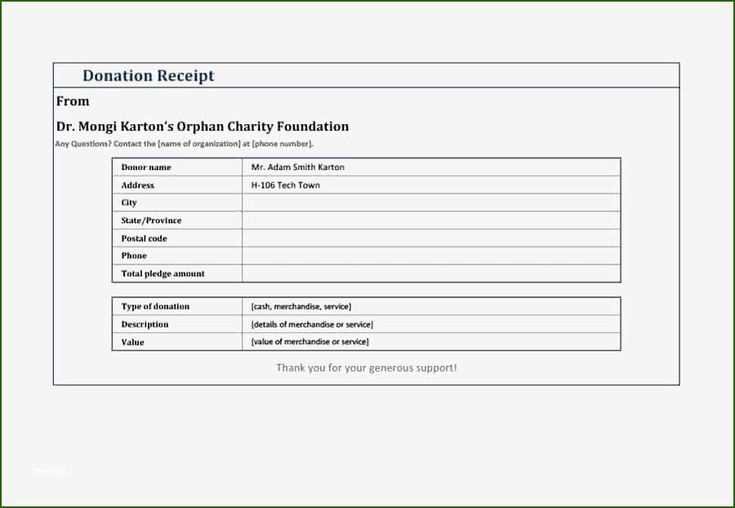

To customize your receipt template for different types of donations, differentiate between cash, in-kind, and recurring donations. For in-kind donations, clearly describe the items donated and their estimated value. For recurring donations, include a breakdown of each payment within the year. Customizing the template for each type will keep the documentation accurate and clear.

Common Errors to Avoid When Issuing Receipts

Avoid vague descriptions on in-kind donations, ensuring that every item is listed with a fair market value. Failing to include the required information like the donor’s full name, the donation amount, and the date can also lead to legal complications. Double-check that your tax ID number is correct and up-to-date to prevent issues with the IRS or other governing bodies.

Another common mistake is not providing receipts on time. Issue receipts promptly after the donation is made to maintain transparency and trust with donors.

When distributing and storing printed receipts, prioritize security. Keep physical copies in a safe, organized location, and use a secure method (e.g., encrypted emails or password-protected files) for digital receipts. Never share donor information publicly without consent.

This version maintains the meaning while reducing redundancy.

To streamline your donation receipt template, focus on clarity and conciseness. Remove unnecessary phrases and redundant details, such as repeating the donor’s information or adding excessive explanations. Keep the purpose of the receipt clear: acknowledging the donation, specifying the amount, and confirming the charity’s details.

Key Elements to Include

Ensure your template has these core elements: donor’s name, donation amount, date, and the charity’s name and tax identification number. If necessary, include a brief description of the donation’s purpose, such as “general support” or “specific project funding,” but avoid lengthy descriptions.

Reduce Repetition

Don’t repeat the same details multiple times. For example, the donor’s name and address should appear once, while the donation amount should be clearly stated without reiterating the same information. This minimizes clutter and keeps the receipt professional and easy to read.