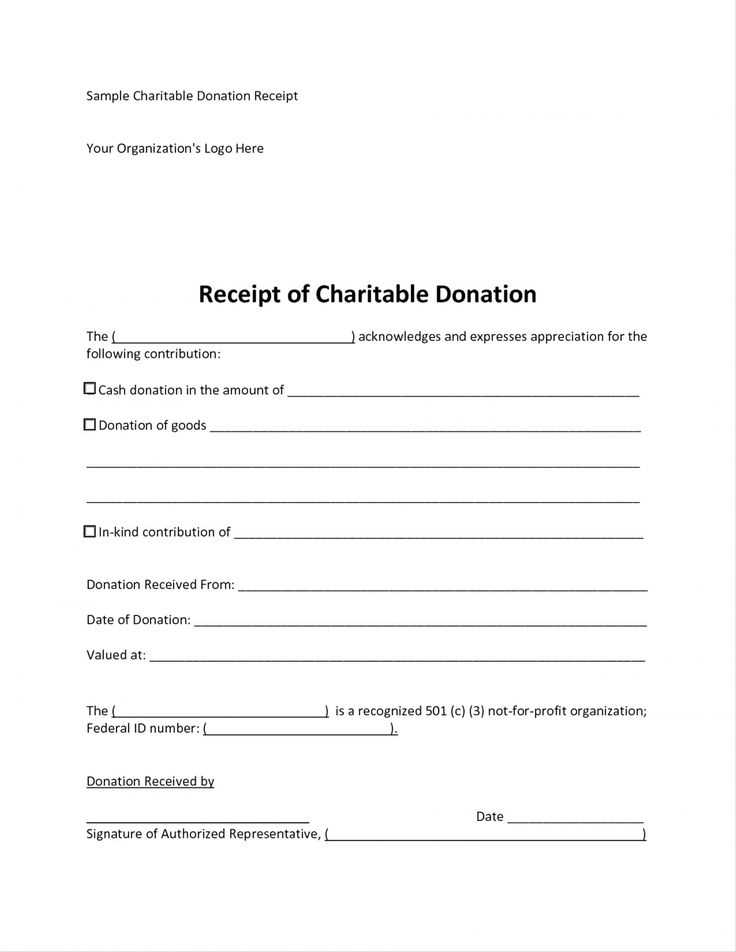

When creating a PTO donation receipt, ensure the document includes the necessary details to comply with IRS regulations. Start with the donor’s name, address, and the amount of PTO hours donated. Clearly state that no goods or services were exchanged in return for the donation, which is required for tax deduction purposes.

Incorporate the date of donation, the recipient organization’s name, and their tax-exempt status. Include a statement confirming that the donated hours are not subject to any restrictions and are fully transferable. A well-organized receipt helps both the donor and recipient track PTO donations accurately.

Finally, don’t forget to include your company’s name and contact details for any follow-up questions. A professional and straightforward format ensures the document serves its intended purpose, offering both clarity and reliability.

Here’s the adjusted version with reduced repetition:

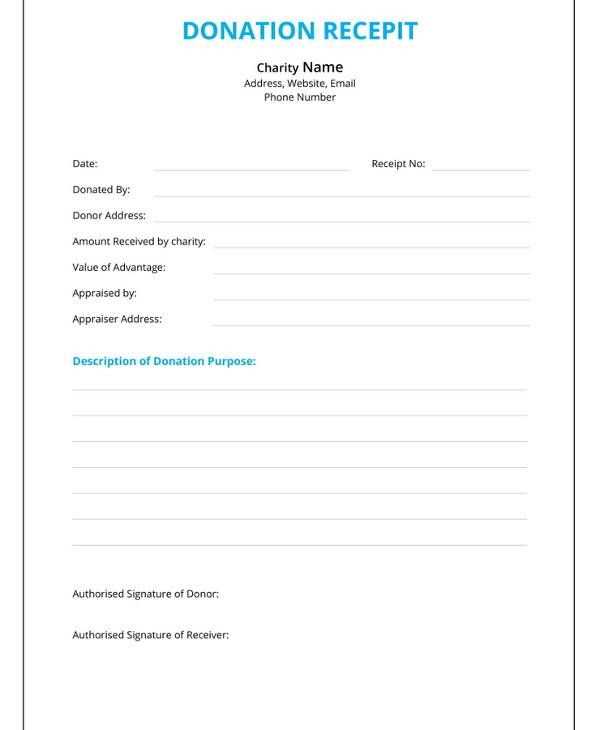

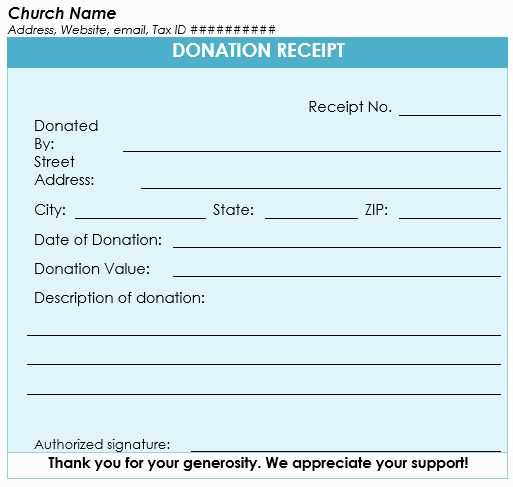

To create a streamlined and clear PTO donation receipt template, include the date of the donation, the donor’s full name, and the number of PTO hours donated. Clearly specify the recipient organization, the PTO policy terms, and any applicable tax details. Include a unique receipt number for reference, and ensure the donor’s acknowledgment of the donation. Provide space for both signatures and keep the format simple, avoiding unnecessary wording that does not add clarity or legal value.

Ensure the template is easy to update with relevant details and can be printed or shared digitally. Focus on the key points that verify the transaction and remove superfluous information that doesn’t serve the donor or recipient.

PTO Donation Receipt Template

How to Structure a PTO Receipt

Key Elements to Include in Your Donation Receipt

Formatting Tips for a Professional Donation Receipt

Legal Considerations for PTO Receipts

How to Customize a PTO Receipt Template

Best Practices for Distributing PTO Receipts

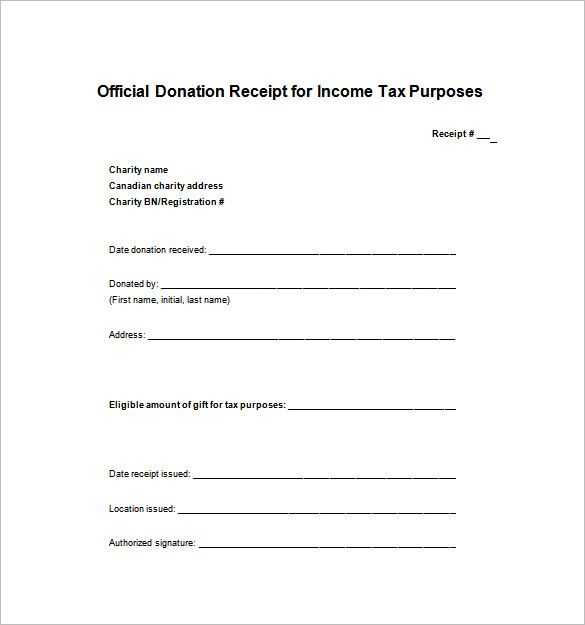

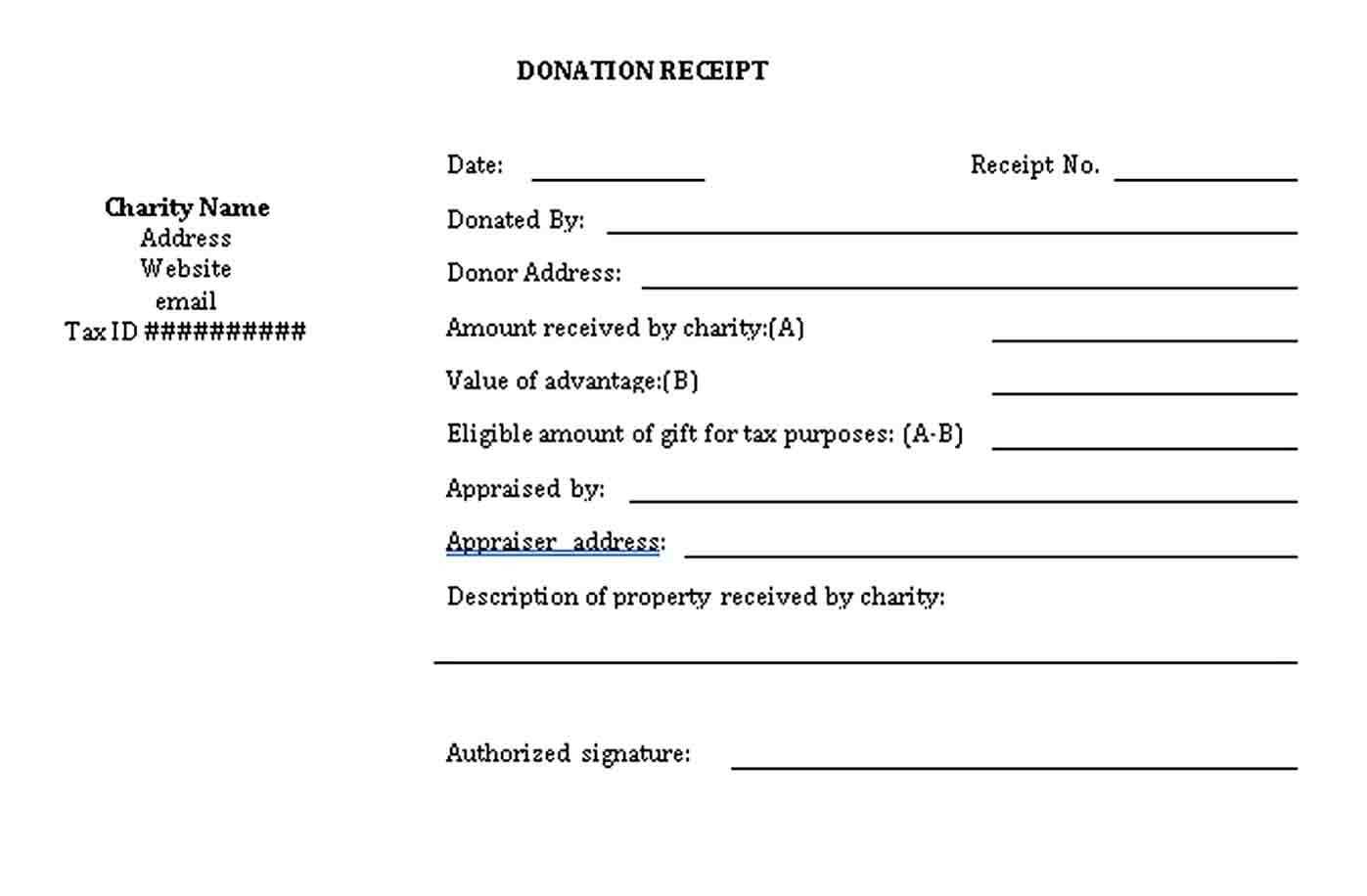

Start with clear identification of the donor and recipient. Include the names, addresses, and contact details of both parties. Specify the date of the donation and the exact number of PTO hours donated. Clearly state that no goods or services were provided in exchange for the donation to comply with tax requirements.

Key Elements to Include in Your Donation Receipt

Each receipt must include the donor’s name, the donation date, and the PTO hours donated. Include a statement that confirms the donation was voluntary, and that no compensation or benefits were given. If applicable, list the employer’s name and contact details. Ensure a unique receipt number for easy tracking.

Formatting Tips for a Professional Donation Receipt

Maintain a clean, organized layout with legible fonts. Use headings for each key section, such as “Donor Information,” “Donation Details,” and “Employer Information.” Ensure the document is easy to read and follow. Include your company logo and address for consistency and professionalism.

Keep the receipt to one page, and ensure it is available in both printed and digital formats. This allows donors to store or share the receipt for tax purposes or future reference.

Legal Considerations for PTO Receipts

Ensure the receipt complies with IRS requirements for charitable donations. It must confirm that no goods or services were provided in exchange for the donation. If PTO donations are tax-deductible, include the necessary disclaimers. Confirm the value of PTO donated in hours, as the IRS does not assign a fixed monetary value to PTO hours.

How to Customize a PTO Receipt Template

Use a template that suits your organization’s needs. Customize it with your company logo, address, and contact information. Adjust sections for special PTO policies or unique conditions. Include any legal disclaimers relevant to your location or industry. Make sure it’s easy to update as needed.

Best Practices for Distributing PTO Receipts

Send PTO receipts promptly after the donation is made, preferably within a week. Provide the receipt through email for digital storage or mail it for physical records. Always ensure that the donor receives their receipt before the end of the tax year to guarantee they can use it for their tax filings.