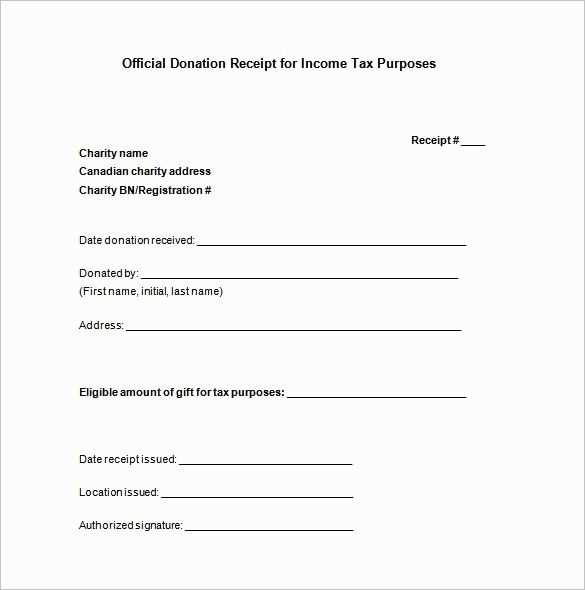

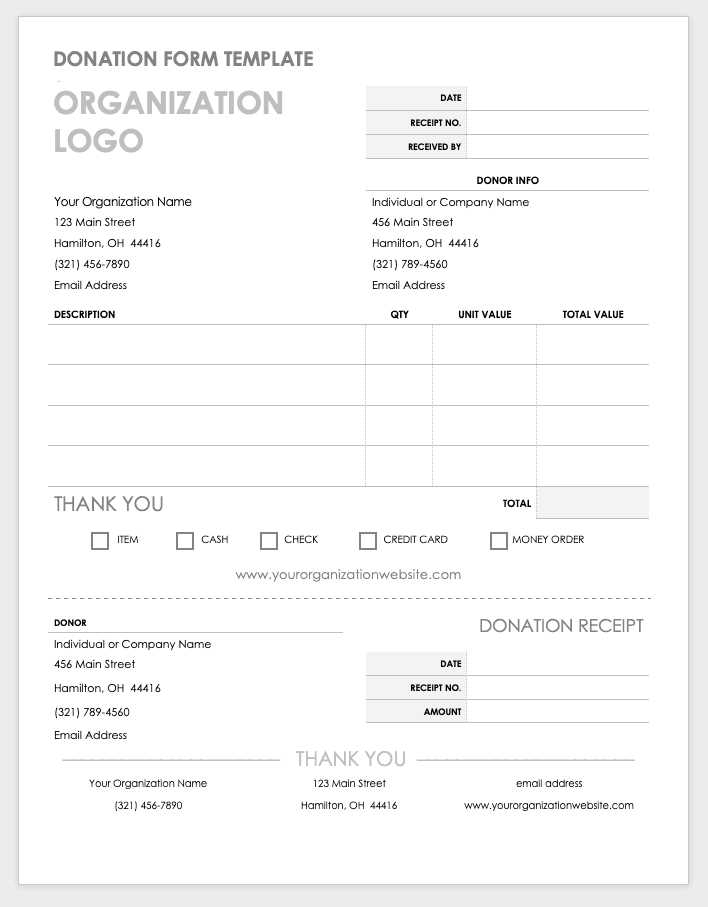

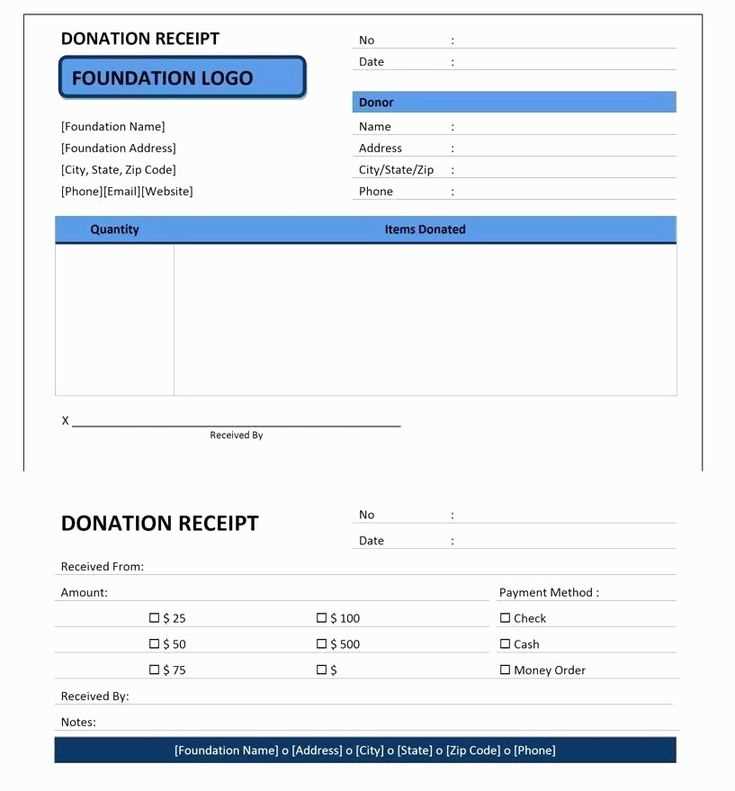

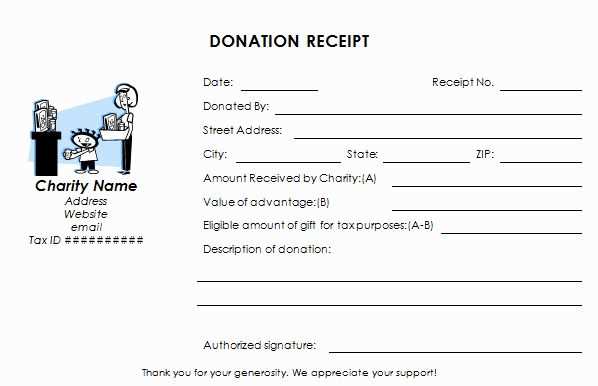

When issuing a donation receipt, use a structured template to ensure clarity and compliance with tax regulations. A well-designed template includes the donor’s name, donation amount, date, and a description of the contribution. If the organization is tax-exempt, include its tax ID and a statement confirming no goods or services were exchanged for the donation.

Key details to include:

- Organization Name and Contact Information: Ensure donors can easily verify and contact you.

- Donation Date: Accurate records help both the donor and the organization during tax season.

- Contribution Details: Specify whether the donation was monetary, goods, or services.

- Tax-Exempt Status: If applicable, mention IRS 501(c)(3) status or other relevant certification.

- Signature (if required): Some organizations prefer to include an authorized signature for authenticity.

For consistency, use a template that aligns with your organization’s branding. A clean layout with clearly labeled sections makes it easier for recipients to understand and store their receipts. If sending electronically, consider using a PDF format to maintain document integrity.

By following these guidelines, you provide donors with a professional receipt that meets legal requirements and reinforces trust in your organization.

Receipt Donation Template: Practical Guidelines and Examples

A donation receipt should clearly outline key details about the donation. Include the donor’s name, the amount given, and the purpose of the donation. Specify whether the donation was cash, check, or another form of contribution, and ensure that the receipt reflects whether it is tax-deductible.

Follow these practical guidelines for a well-structured donation receipt:

- Provide your organization’s name and contact information at the top of the receipt.

- Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable.

- Include the date and amount of the donation, with a clear breakdown of any special instructions, if necessary.

- Ensure the donor’s information is accurate, with their full name and address for potential tax filings.

- Provide your organization’s tax-exempt status number if applicable, ensuring clarity for tax purposes.

Here’s an example of a donation receipt format:

| Field | Description |

|---|---|

| Organization Name | Your Nonprofit Organization |

| Donor Name | John Doe |

| Donation Date | February 11, 2025 |

| Amount Donated | $100.00 |

| Donation Type | Cash |

| Purpose | General Fund |

| Tax-Exempt Status | Tax ID #123456789 |

| Statement | No goods or services were provided in exchange for this donation. |

This simple template ensures your receipt is easy to read and contains all necessary details for both your donor and your organization. Keep your format consistent to build trust and make tax-related matters simpler for your supporters.

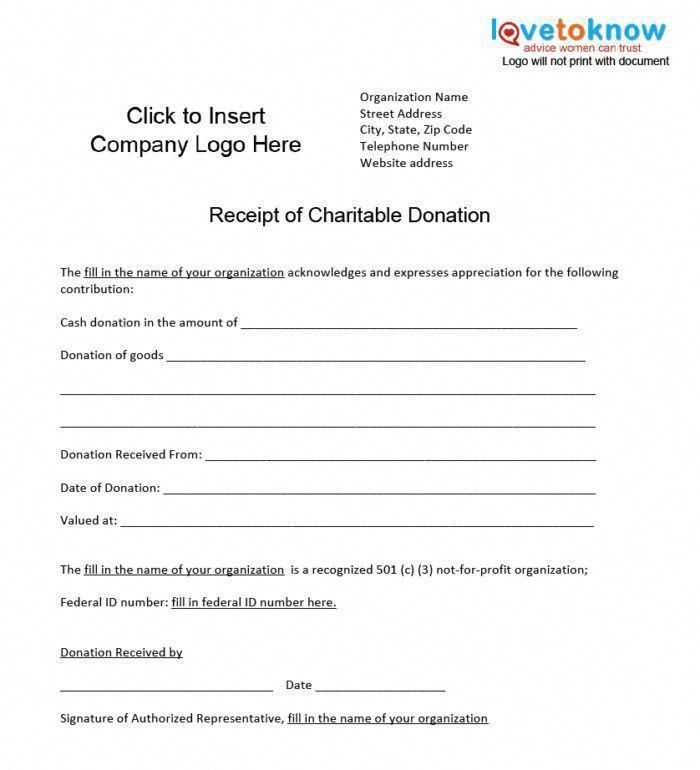

Key Elements to Include in a Donation Receipt Template

A donation receipt template should be clear and concise, ensuring the donor receives all the necessary details for their records and tax purposes. Make sure to include these critical elements:

1. Organization Details

Include the name of the charity, its tax-exempt status (such as 501(c)(3) in the U.S.), and its address. This information verifies that the donation is tax-deductible and associates the receipt with a legitimate organization.

2. Donor Information

List the donor’s full name and address. This confirms the identity of the person making the donation and supports tax filing. In case of a company donation, include the organization’s name and contact details.

3. Donation Information

Clearly specify the amount donated, along with the date of the donation. If the gift is in-kind (non-monetary), describe the items donated, including their general condition. Provide a reasonable estimate of their fair market value.

4. Acknowledgment of No Goods or Services Received

If the donation was purely monetary and no goods or services were provided in return, state that the donor did not receive any compensation. This helps ensure the donation qualifies as fully tax-deductible.

5. Donation Purpose (Optional)

If the donation is designated for a specific project or purpose, include this information to clarify how the funds are allocated. This can help the donor track the impact of their contribution.

Legal Compliance and Tax Deduction Requirements

Ensure your donation receipts meet IRS standards to qualify for tax deductions. The IRS mandates that non-profits provide written acknowledgments for donations of $250 or more, detailing the amount, date, and any goods or services provided in exchange. This documentation supports donors in claiming deductions on their tax returns.

For donations under $250, a simple record of the contribution, such as a bank statement or canceled check, can also serve as proof. However, a written acknowledgment from the charity is recommended for clarity and tax compliance.

Be mindful of non-cash donations, such as goods or property. Donors must obtain a qualified appraisal for contributions exceeding $5,000, which must be attached to the tax return. The charity should provide a detailed description of the donated items, their estimated value, and a statement regarding any goods or services provided in exchange.

For tax purposes, charities must maintain accurate records of all donations and ensure that acknowledgments are provided within a reasonable time frame–ideally by January 31st of the year following the donation. This helps donors stay within IRS filing deadlines and avoid issues during tax preparation.

Adhering to these requirements not only ensures compliance but also enhances donor trust, allowing them to confidently claim their deductions without complications.

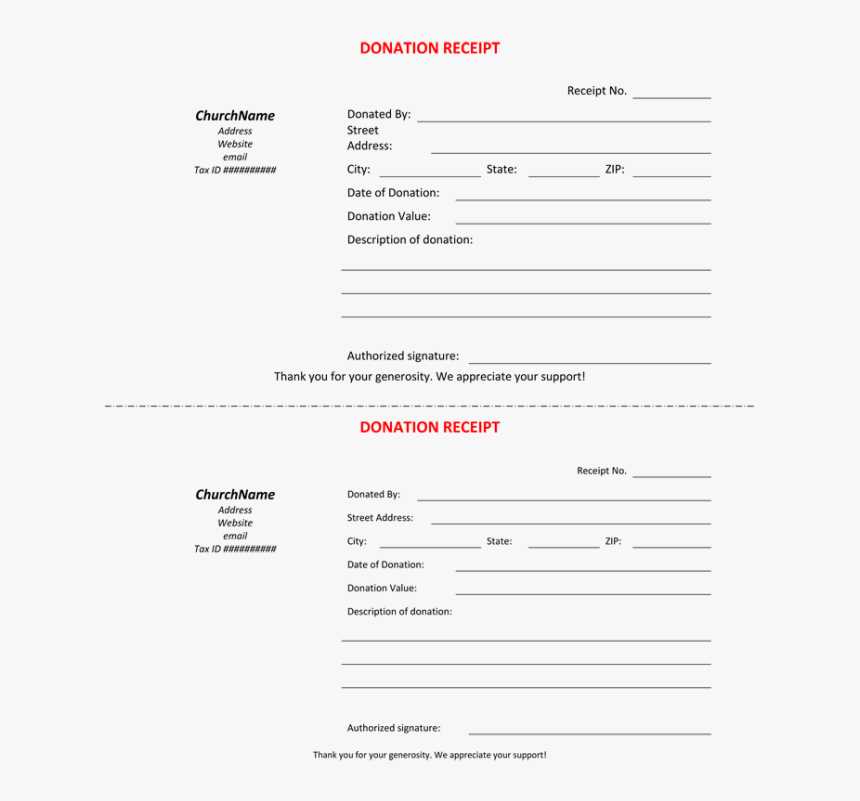

Customizing a Donation Receipt for Different Organizations

Adjust your donation receipt based on the type and mission of your organization. Tailor it to reflect your values, enhance donor experience, and ensure legal compliance. Here are key steps to customize effectively:

- Include Organization-Specific Information: For non-profits, mention your 501(c)(3) status and tax-exempt number. Religious organizations should note their affiliation and tax-exempt status. Educational institutions can add accreditation details.

- Personalize Donor Information: Always address the donor by their name. Adding their contact details helps maintain a personal touch. Some organizations include a brief thank-you message, recognizing the donor’s specific contributions.

- Donation Type and Value: Clearly define the donation type (monetary, in-kind, volunteer hours, etc.). For in-kind donations, describe the items received and estimate their fair market value.

- Legal Requirements: Organizations focused on charitable causes must follow IRS regulations for receipt formatting. Ensure your receipt includes the required disclaimers, such as a statement that no goods or services were exchanged in return for the contribution (if applicable).

- Additional Customization: Depending on your organization, include relevant sections like recurring donation details, membership benefits, or upcoming fundraising events. For example, for animal shelters, a brief message on the impact of the donation on animals can add warmth and relevance.

Every organization should aim for clarity and transparency. Customize your receipts to reflect your identity while maintaining all legal obligations to ensure they serve both functional and relational purposes.