A donation receipt should clearly outline the details of the contribution and provide both the donor and the nonprofit with a record for tax purposes. This template is designed to cover all necessary information in a straightforward, user-friendly manner.

The receipt should include the nonprofit’s name, contact information, and tax-exempt status. Be sure to specify the amount of the donation, the date it was made, and any goods or services provided in exchange for the donation. If the donation is a non-cash item, such as a gift or service, a description of the item and its fair market value must also be noted.

In addition, it’s helpful to include a clear statement confirming that no goods or services were provided, if that’s the case. This is particularly important for donations made in cash or checks. A concise and accurate description ensures both parties are compliant with tax reporting regulations.

How to Create a Simple Donation Receipt Template

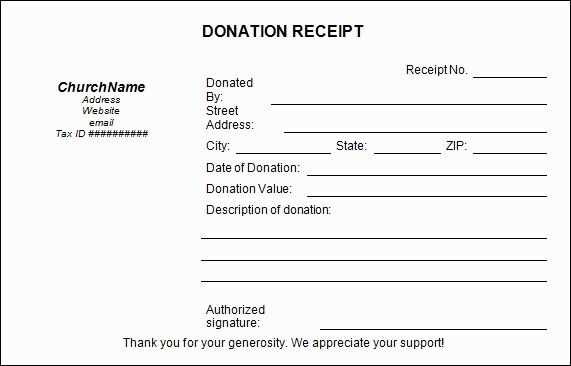

To create a straightforward donation receipt template, include these key elements: the name of the nonprofit, the donor’s name, the donation date, the amount donated, and a clear statement of whether the donation was cash or goods. Be sure to include a thank you note for the contribution, as this adds a personal touch and acknowledges the donor’s generosity.

Step 1: Basic Information

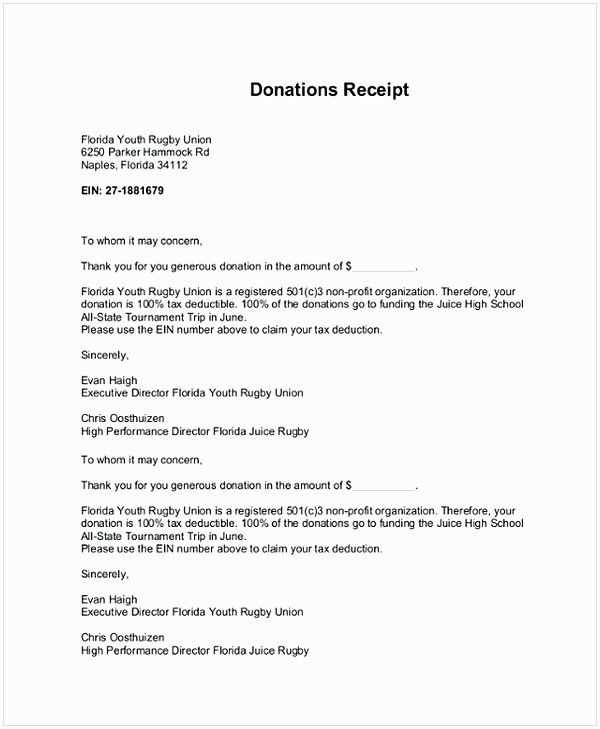

Begin with the nonprofit’s name, address, and contact details at the top of the receipt. This helps establish authenticity. Below that, write the donor’s full name and contact information. This will ensure both parties have a record of the transaction.

Step 2: Donation Details

Clearly list the amount donated and the method of donation. If it’s a monetary donation, specify whether it was a check, cash, or credit card. If it’s in-kind, describe the donated items, including their estimated value. Include a statement indicating the donor did not receive any goods or services in exchange for the contribution.

Key Legal Elements to Include in Your Donation Receipt

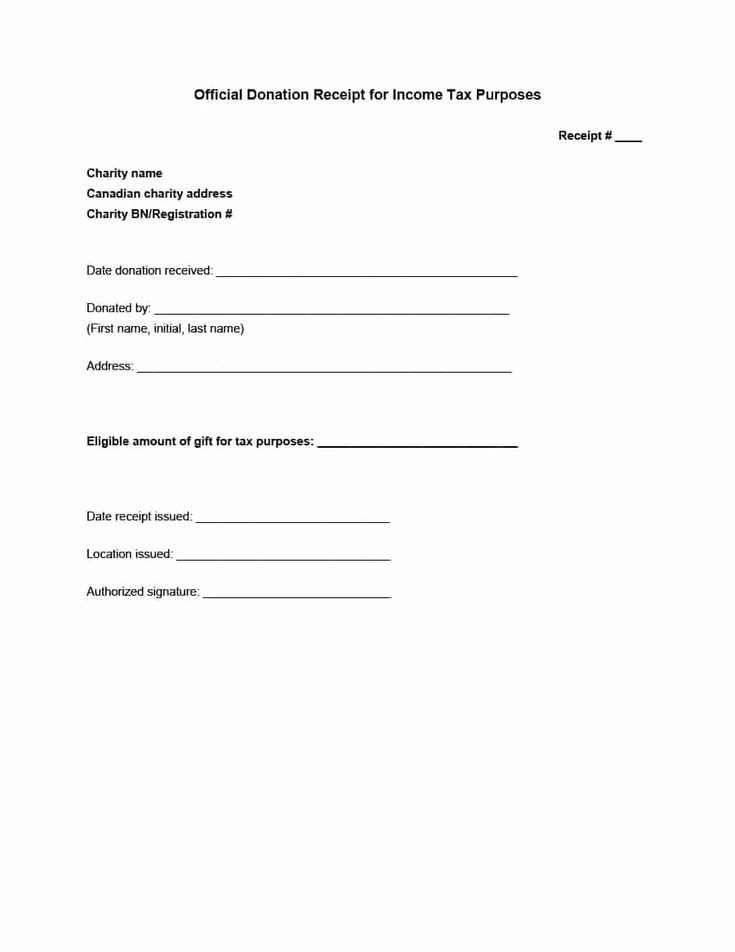

A donation receipt must include several key details to comply with legal requirements and ensure donors can claim tax deductions. Start by specifying the name of your nonprofit organization and its tax-exempt status. This establishes the legitimacy of your organization and confirms that the donation is tax-deductible.

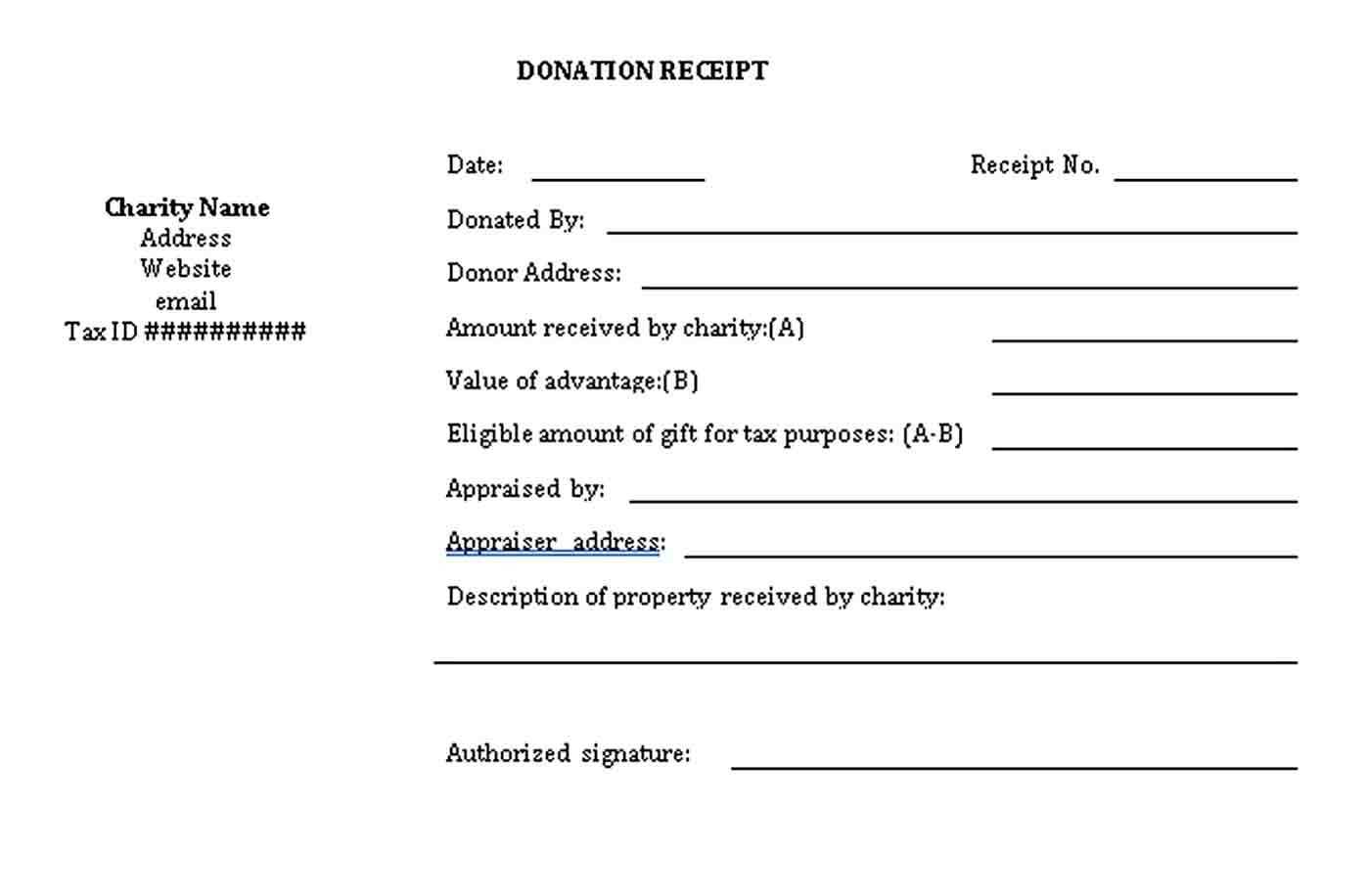

Details of the Donation

Clearly state the amount donated, whether it’s cash or property. For non-cash donations, provide a description of the donated items without assigning a value. It’s the donor’s responsibility to assess the value of in-kind gifts. Additionally, include the date of the donation to maintain an accurate record for tax purposes.

Statement of No Goods or Services Provided

If the donation was purely monetary, include a statement confirming that no goods or services were provided in exchange for the contribution. If any goods or services were provided, list them with their estimated fair market value. This is necessary for the donor to claim the correct tax deduction.

Lastly, include the nonprofit’s contact information for any future inquiries. This ensures transparency and provides a clear point of communication for your donors.

Customizing the Donation Receipt for Different Nonprofit Purposes

Tailor donation receipts to fit the unique needs of your nonprofit by including relevant details that align with your mission and activities. For example, if your nonprofit focuses on education, include specific references to the programs supported by the donation, such as scholarships or materials for students. This helps donors connect their contributions directly to the impact they are making.

For organizations that offer goods or services, specify in-kind donations with clear descriptions. A receipt for a donated item should include the item’s name, quantity, and approximate value, helping both the donor and the nonprofit accurately reflect the donation for tax purposes.

If your nonprofit conducts fundraising events, customize the receipt to mention the event details. Include the event’s name, date, and any specific purpose the donation supports, such as a project or campaign funded by the event’s proceeds. This ensures donors feel their support is directed towards a cause they care about.

For larger or recurring donations, consider adding sections to receipts that acknowledge the donor’s ongoing support, such as a membership or sponsorship recognition. This makes the receipt not only a tax document but also a token of appreciation and a tool for fostering long-term relationships.