Creating a receipt for an in-kind donation is a straightforward yet important task. A well-structured receipt provides both the donor and the recipient with a clear record of the transaction. It’s important to include key details like the description of the donated items, their estimated value, and the date of the donation.

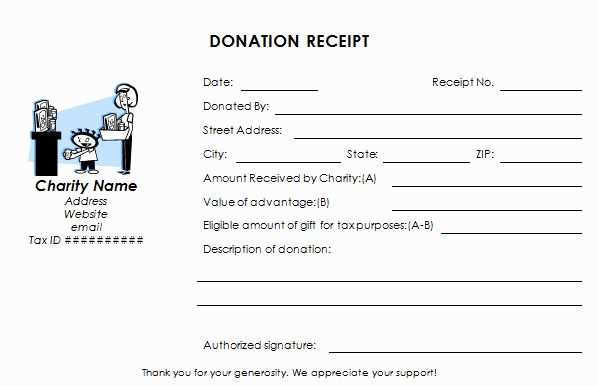

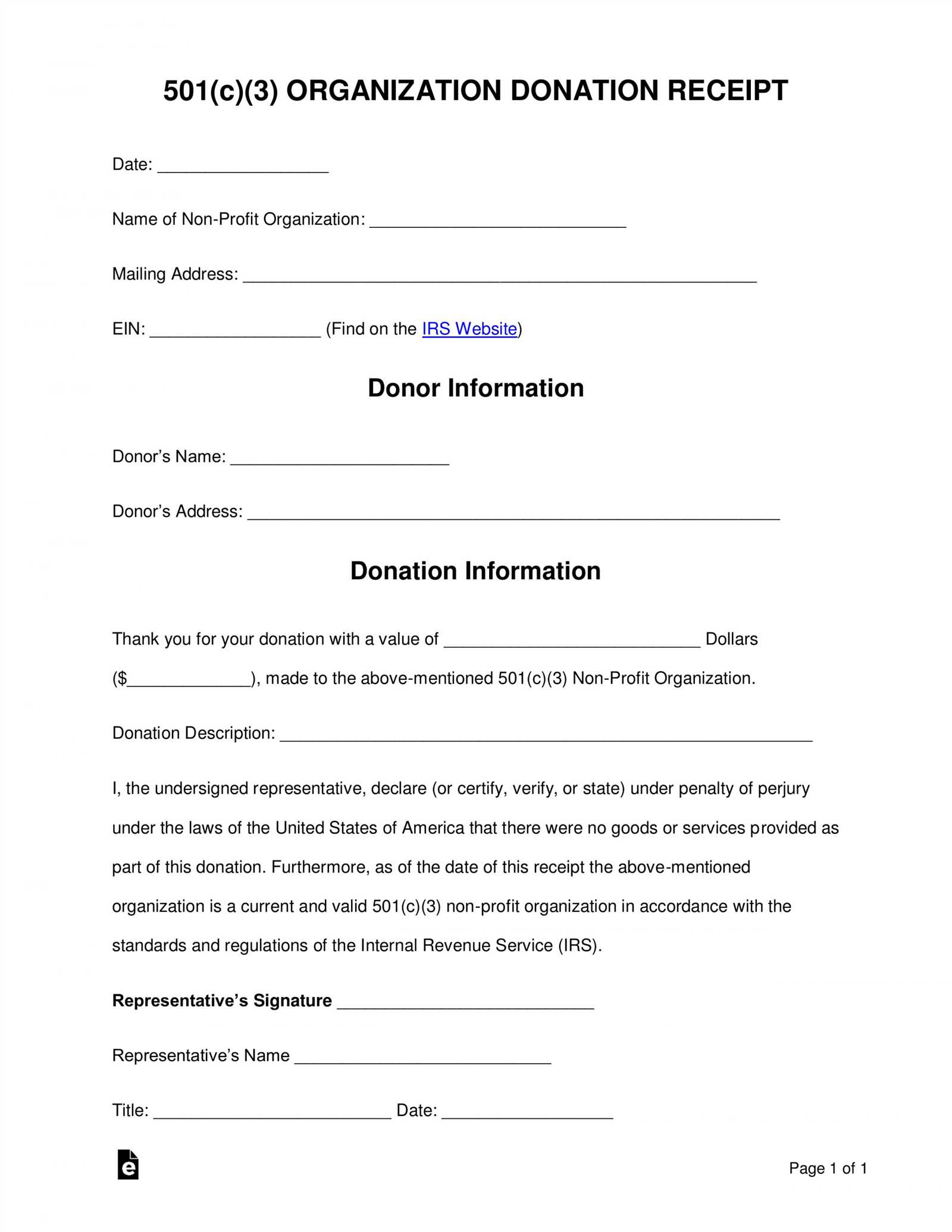

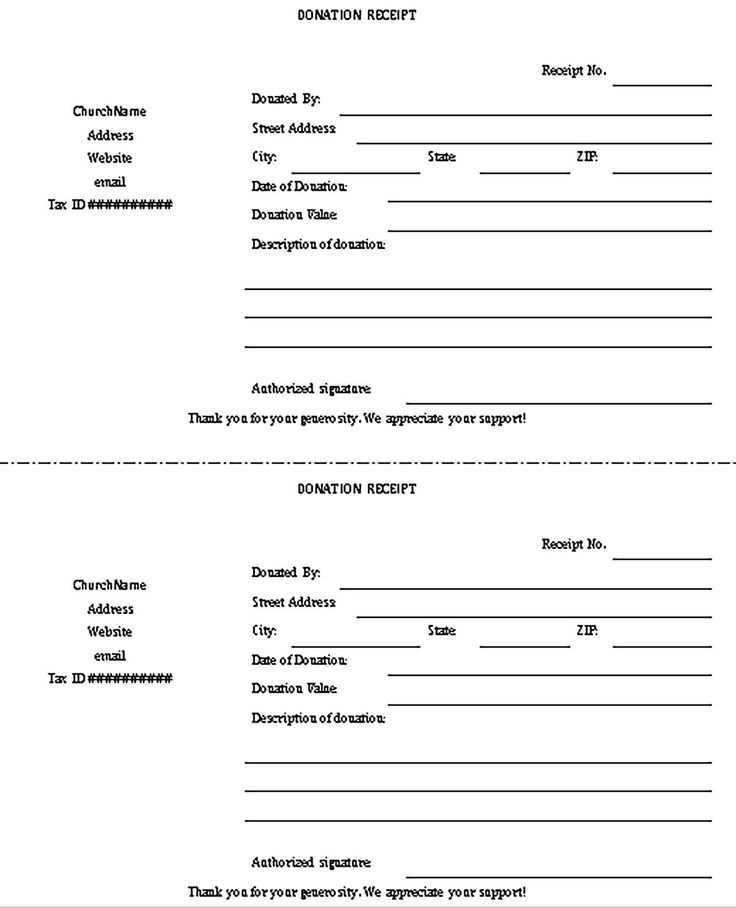

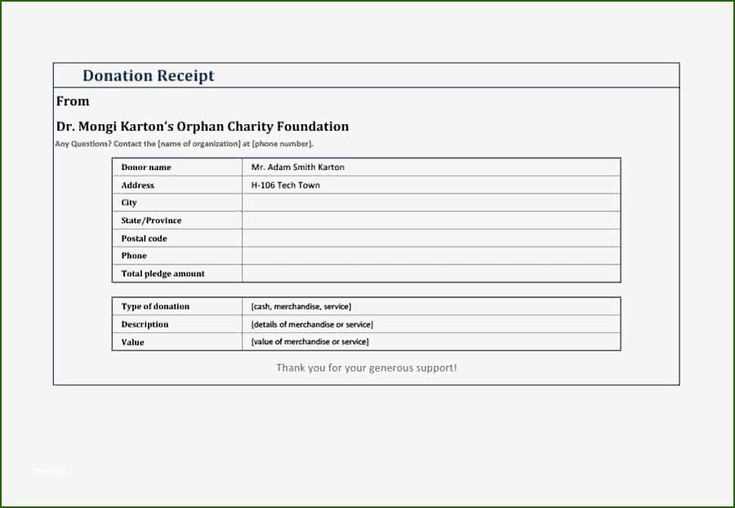

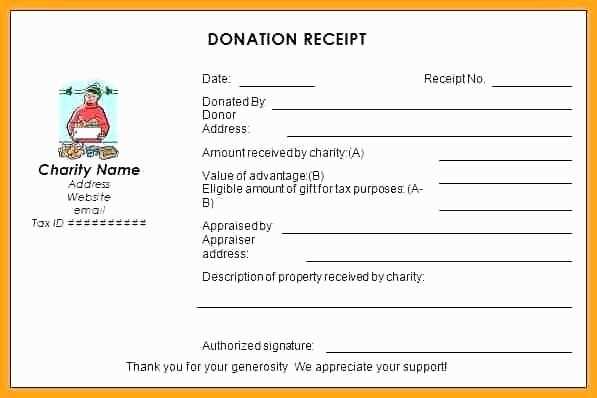

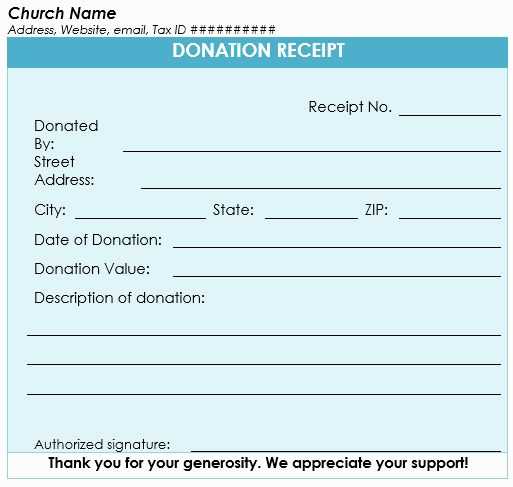

Use a simple and clear format that captures the essential information. This template should list the donor’s name, the items or services donated, and the fair market value of each item. Additionally, include a statement acknowledging that no goods or services were exchanged for the donation to comply with tax regulations.

Don’t forget to include your organization’s details, such as name, address, and tax identification number. This will make the receipt useful for the donor when claiming a deduction. A well-detailed receipt will not only make the donation process smoother but also build trust and transparency with your donors.

Receipt for In Kind Donation Template: A Practical Guide

Start by including the date of the donation at the top of your receipt. This helps both the donor and the recipient keep accurate records for tax and organizational purposes. Next, list the name and address of the charity or nonprofit organization receiving the donation. Make sure to clearly identify the donor’s name and contact information as well.

For the donation description, provide a detailed breakdown of the donated items or services. Specify the quantity, condition, and value of each item donated. If you’re unsure about the value, refer to guidelines from the IRS or a relevant local authority to ensure accuracy. If applicable, note that the donor did not receive any goods or services in exchange for the donation.

Include a statement confirming that the organization did not provide any goods or services in return for the donation. This is crucial for the donor’s tax purposes. At the end, include a thank-you note or expression of gratitude for the donation. This reinforces positive relations with your donors.

Finally, provide space for both the organization representative and the donor to sign and date the receipt. This confirms both parties agree on the details and conditions of the donation. Ensure the receipt is clear, concise, and easy to understand, helping both the donor and recipient maintain accurate records.

How to Customize a Template for In-Kind Donations

Adjust the template to match the specific details of the donation, ensuring all key information is clear and easy to understand. Begin by updating the donor’s name and contact information, as well as the date of the donation. This personalizes the receipt and confirms the transaction.

Define the Donated Items

List the items donated in a detailed and organized manner. Include the description, quantity, and estimated value of each item. If applicable, clarify the condition of the items. If a single item is donated, provide a clear breakdown. Avoid general terms; precise descriptions help avoid misunderstandings.

Provide Legal and Tax Information

Include a statement confirming that the donation is tax-deductible. Mention that the donor should consult with a tax professional for valuation of items. Ensure the wording complies with local laws regarding charitable donations.

Finally, customize the template’s footer with your organization’s contact details, mission statement, or website link, reinforcing transparency and accessibility for future inquiries.

Key Information to Include in a Donation Receipt

Provide the donor’s full name and address. This identifies the individual or organization that made the donation and ensures accurate record-keeping.

Clearly state the name of the receiving organization. Include any relevant identification numbers, such as a tax-exempt status or EIN, which can be important for tax deductions.

Include the date of the donation. This helps track when the donation was made, which is necessary for both the donor’s and the organization’s records.

Describe the donated items or services. For in-kind donations, list each item with an accurate description, including quantities and condition. Avoid estimating the value unless it’s appropriate.

State whether the donation was monetary or non-monetary. If it’s a non-monetary gift, provide enough detail about the items to allow the donor to establish their own valuation for tax purposes.

If applicable, indicate whether the donor received any goods or services in exchange for the donation. This is a key requirement for ensuring proper tax deductions.

Provide the signature of an authorized representative from the organization. This adds credibility and authenticity to the receipt.

Include a statement explaining that no goods or services were provided in exchange for the donation if it is true. This is important for tax purposes to ensure that the donation qualifies as a charitable contribution.

Best Practices for Issuing and Storing Donation Receipts

Ensure each receipt contains accurate details about the donation. Include the donor’s name, the donation amount, and a brief description of the donated goods or services. If possible, provide the fair market value of the items donated.

- Issue Receipts Promptly: Send donation receipts immediately after receiving the donation. This allows donors to claim deductions in a timely manner and avoids any confusion later on.

- Include Legal Information: Clearly state that no goods or services were provided in exchange for the donation, if applicable. This is required for tax-deduction purposes.

- Organize Digital Records: Store donation receipts in a secure, organized digital system. This makes it easier to retrieve and manage records during tax season or for audits.

- Use Templates: Streamline the receipt process by using a consistent template. This ensures accuracy and reduces the chance of missing important information.

Store physical receipts in a safe, accessible place. If you use paper receipts, consider scanning them to create digital backups. This makes it easier to track donations over time and prevents loss due to physical damage.

- Retain Records for Tax Purposes: Keep donation receipts for at least three years to comply with tax laws. Donors may need them for tax filings, and your organization may need to provide them in case of an audit.

- Implement Access Control: Restrict access to sensitive donation records. This ensures the privacy of donors and protects your organization from data breaches.

- Verify Accuracy Regularly: Double-check receipts before sending them out. Mistakes can lead to confusion or errors in tax filings, which could affect donor relations.

By following these best practices, you’ll ensure that donation receipts are not only accurate but also well-organized, secure, and accessible when needed.