To ensure transparency and compliance with tax laws, non-profit organizations must issue receipts for donations received. A well-structured donation receipt not only serves as proof for the donor but also meets legal requirements. Use this template to easily generate receipts that include all necessary information.

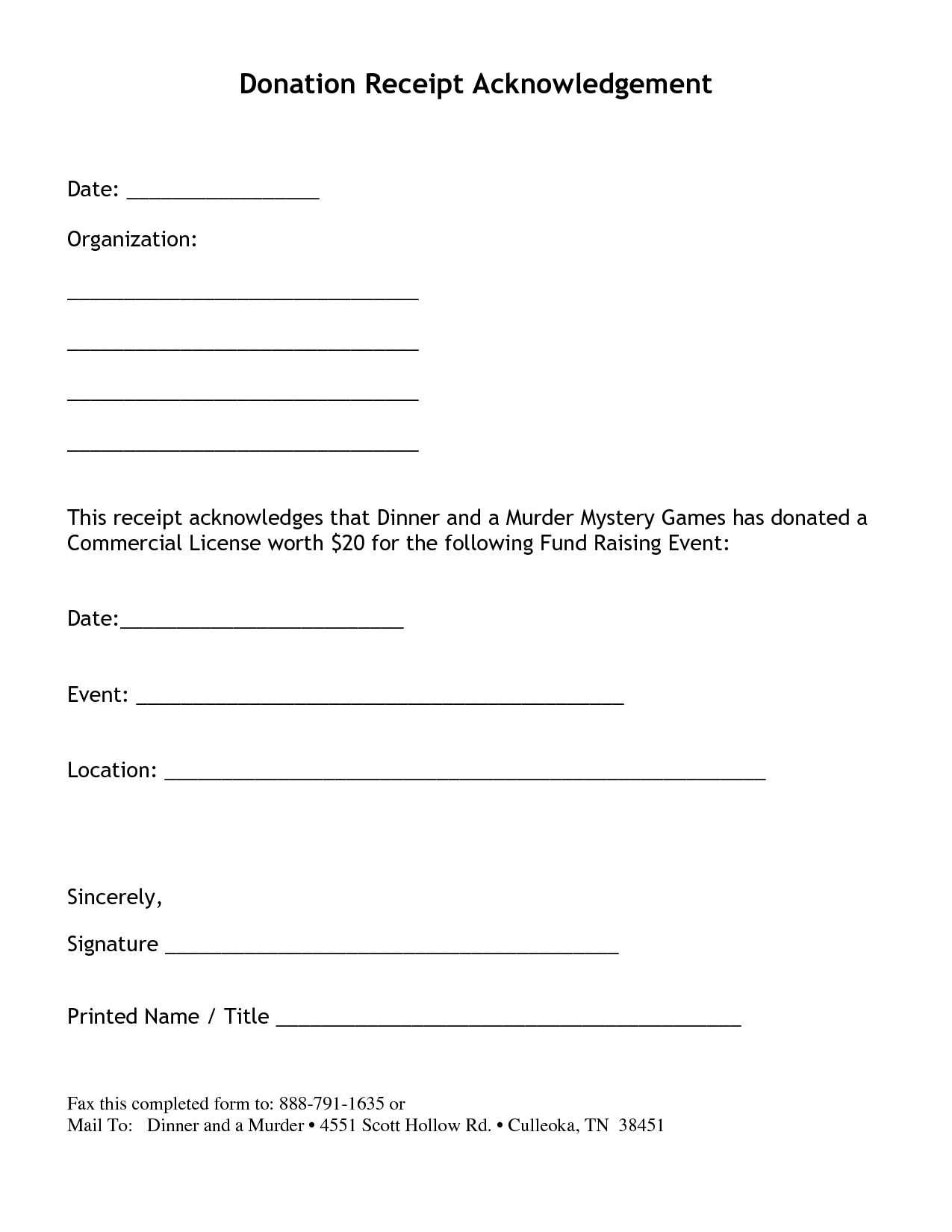

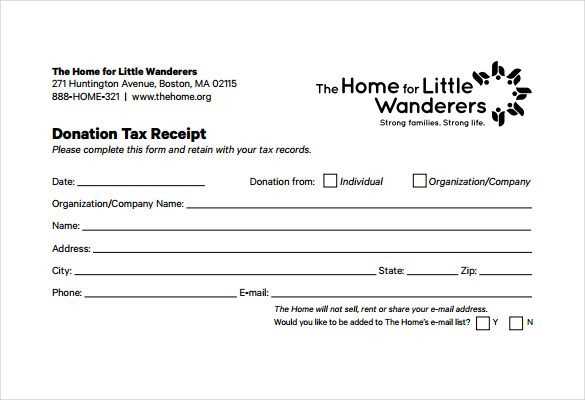

Start by clearly stating the organization’s name, address, and tax identification number. Include a description of the donation, whether it was a cash gift or in-kind contribution. Be sure to mention the date of the donation and the donor’s name, ensuring they match the details provided by the donor.

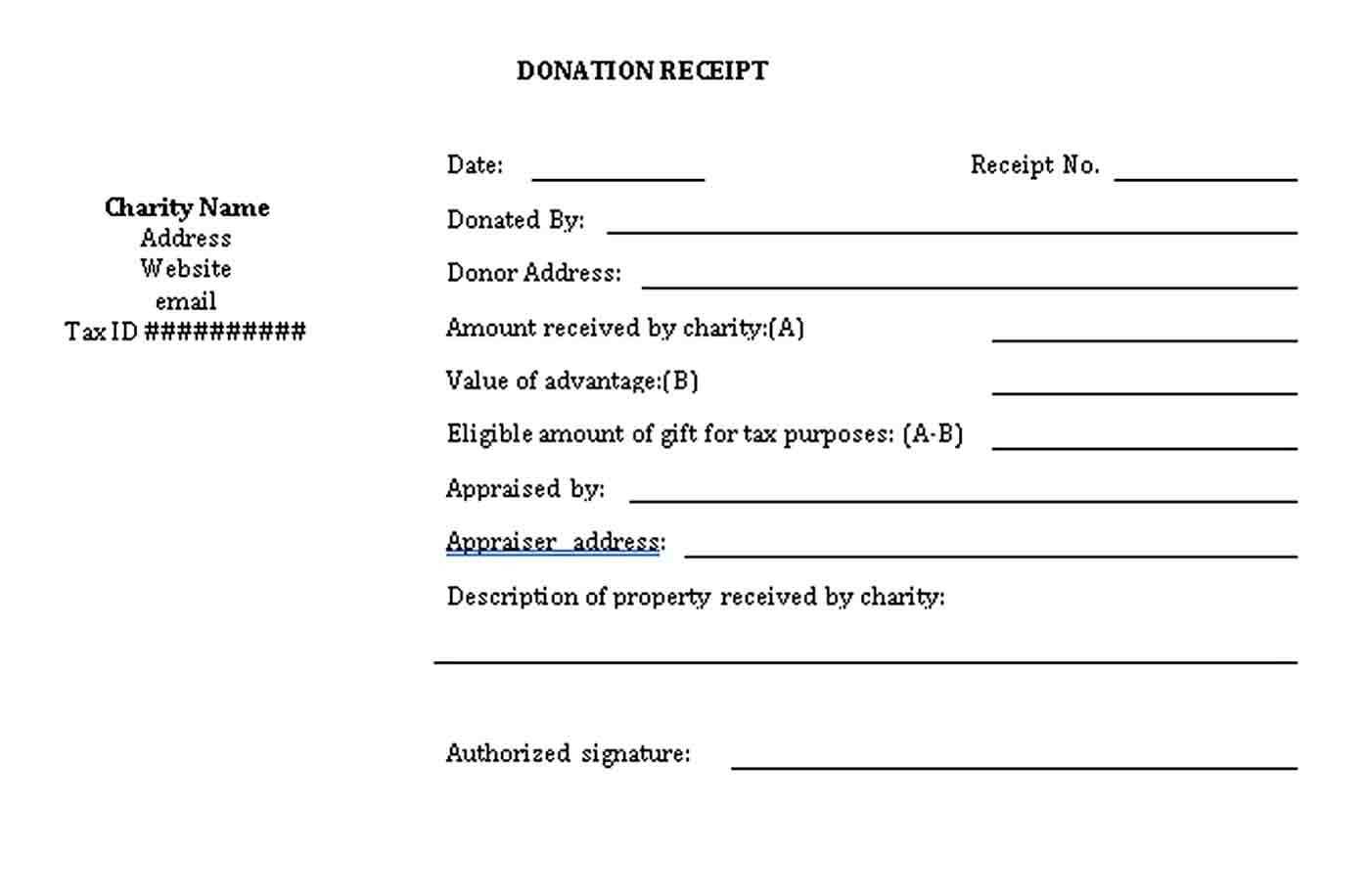

Ensure accuracy by specifying the donation amount or value of goods donated. If the donor receives any goods or services in exchange, clearly disclose the fair market value of those items to avoid tax complications. This makes the receipt valid for tax deduction purposes.

Finally, include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This reinforces the receipt’s validity and helps donors in claiming their tax deductions without issues.

Here are the corrected lines with duplicates removed:

Make sure your receipt includes the donor’s full name and address to ensure proper acknowledgment. Add the donation amount, specifying whether it was monetary or in-kind. If the donation was in-kind, describe the item or service given. Clearly state the nonprofit’s tax-exempt status, including the 501(c)(3) number, if applicable. Include a statement that no goods or services were provided in exchange for the donation, unless this is not the case. Don’t forget to add the date of the donation for proper record-keeping.

For accuracy, the nonprofit’s legal name and address should be listed, along with a signature from an authorized representative. These details help both the donor and nonprofit maintain clear and correct records for tax purposes.

- Receipt for Non-Profit Donation Template

A well-structured receipt for a non-profit donation should include key information for both the donor and the organization. This helps maintain clarity and meet legal requirements for tax purposes. Here’s how to structure it:

Key Components

- Organization Name: Clearly state the name of the non-profit organization.

- Donor Information: Include the donor’s full name and address.

- Date of Donation: Record the date the donation was received.

- Donation Amount: State the exact monetary value or describe the donated goods/services.

- Donation Type: Specify whether the donation was cash, goods, or service

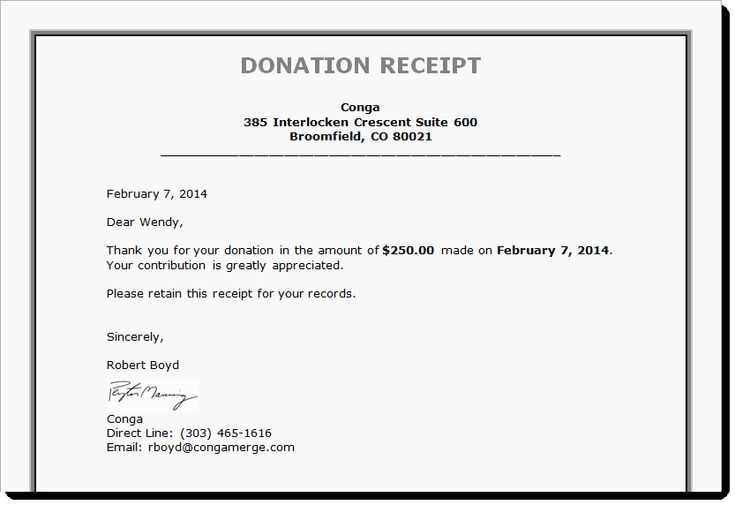

- How to Structure a Receipt for Tax Purposes

- Nonprofit Name and Contact Information: Clearly state the nonprofit’s legal name, address, and phone number. This helps the donor identify the organization.

- Date of Donation: Specify the date the donation was made. If it’s a monetary donation, also include the amount and whether it was a cash, check, or credit card transaction.

- Donor’s Information: Include the donor’s name and address. If the donation is anonymous, ensure the receipt reflects that.

- Donation Description: Provide a brief description of the items donated, including quantities if applicable. For non-cash donations, provide an estimate of the items’ fair market value.

- Tax-Exempt Status: Include a statement confirming that your organization is a tax-exempt entity, often with the IRS 501(c)(3) status if relevant.

- Statement of No Goods or Services Received: Add a declaration that the donor did not receive any goods or services in return for their donation, if applicable. If any goods or services were received, specify their value.

- Signature and Date: Have an authorized representative sign the receipt and include the date of signing.

- Key Information to Include in Your Donation Template

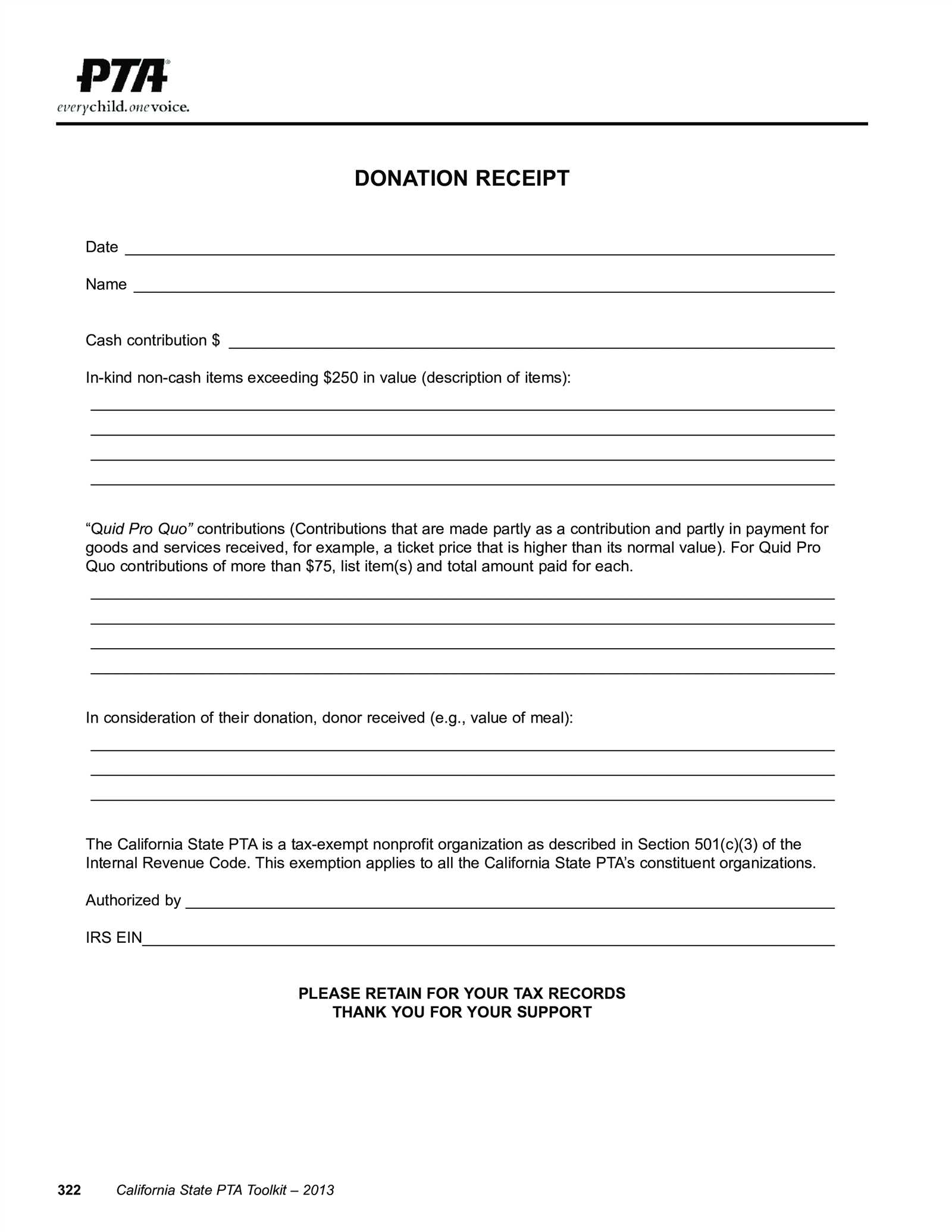

- Legal Considerations When Issuing a Receipt

Include the following details in your receipt to meet tax requirements:

Ensure all the details are accurate, as this will make the donation valid for tax deductions. Avoid vague descriptions, and double-check that the donation’s value is properly documented.

Begin with the date of the donation to clearly identify the donation timeline. This ensures both you and the donor have accurate records for tax purposes.

Include the full name and contact information of the donor. This is necessary for sending acknowledgment letters and for maintaining communication with the donor.

Donation Details

Specify the donation amount and the method of payment, such as cash, check, or credit card. If possible, include any relevant transaction reference numbers or confirmation codes.

Nonprofit Organization Information

List your nonprofit’s name, tax-exempt status (EIN or 501(c)(3) number), and mailing address. This allows the donor to verify the legitimacy of your organization for their tax records.

Clearly indicate if the donor received any goods or services in exchange for the donation. If the donation was 100% tax-deductible, mention that as well.

Finish the receipt with a thank-you message. A personalized acknowledgment shows appreciation and helps maintain a positive relationship with the donor.

Ensure that your receipt includes all the required information to comply with legal standards. This includes the donor’s name, the donation amount, the date, and a description of the donated items. For monetary donations, the receipt should clearly state the amount given. For non-monetary gifts, provide an accurate description of the donated items, but avoid assigning a value to them unless you are an appraiser.

Key Information to Include

Include the non-profit organization’s name, address, and tax identification number. You must also state whether any goods or services were provided in exchange for the donation. If so, include a good faith estimate of the value of those goods or services. This is important for the donor’s tax deduction records.

Tax Implications

Donors can only claim tax deductions for donations that are made to qualifying charitable organizations. Therefore, always ensure your organization’s 501(c)(3) status is up to date and that your receipts meet the IRS guidelines. Providing incomplete or inaccurate information could lead to issues with tax claims for both your organization and the donor.

| Required Information | Notes |

|---|---|

| Donor’s name | Ensure the name is clearly spelled out for record accuracy. |

| Donation amount or description of items | Do not assign a value for non-monetary donations unless an appraisal has been done. |

| Date of donation | The date should match the transaction or donation event. |

| Goods or services provided | If any, include an estimate of their value to help donors with tax filings. |

By following these guidelines, you can ensure your receipts comply with legal requirements and assist your donors with their tax filings accurately.

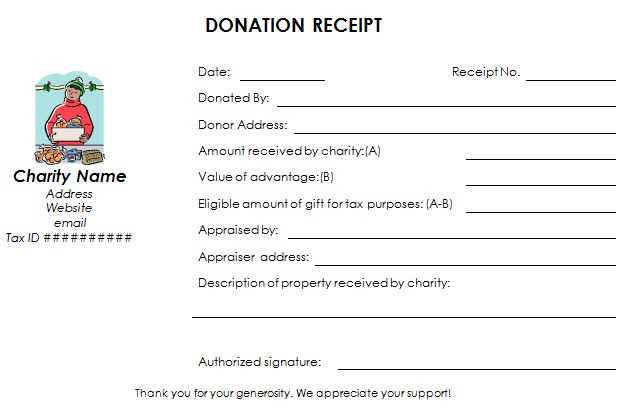

Receipt for Non-Profit Donation Template

Provide a clear breakdown of the donation details. The donor’s name, address, and donation date should be easily identifiable. Include the amount donated and specify whether the contribution was monetary or in-kind. Be sure to mention the non-profit’s tax-exempt status, including the relevant EIN (Employer Identification Number). If the donation includes goods or services, describe them accurately, with an estimation of their fair market value. If applicable, note that no goods or services were provided in exchange for the donation, as required by IRS regulations.

It’s a good practice to add a thank you note expressing appreciation for the donor’s support. This strengthens the relationship and ensures that donors feel valued. Always review IRS guidelines to ensure compliance, especially if you’re issuing a receipt for donations exceeding certain amounts, as specific regulations apply in those cases.