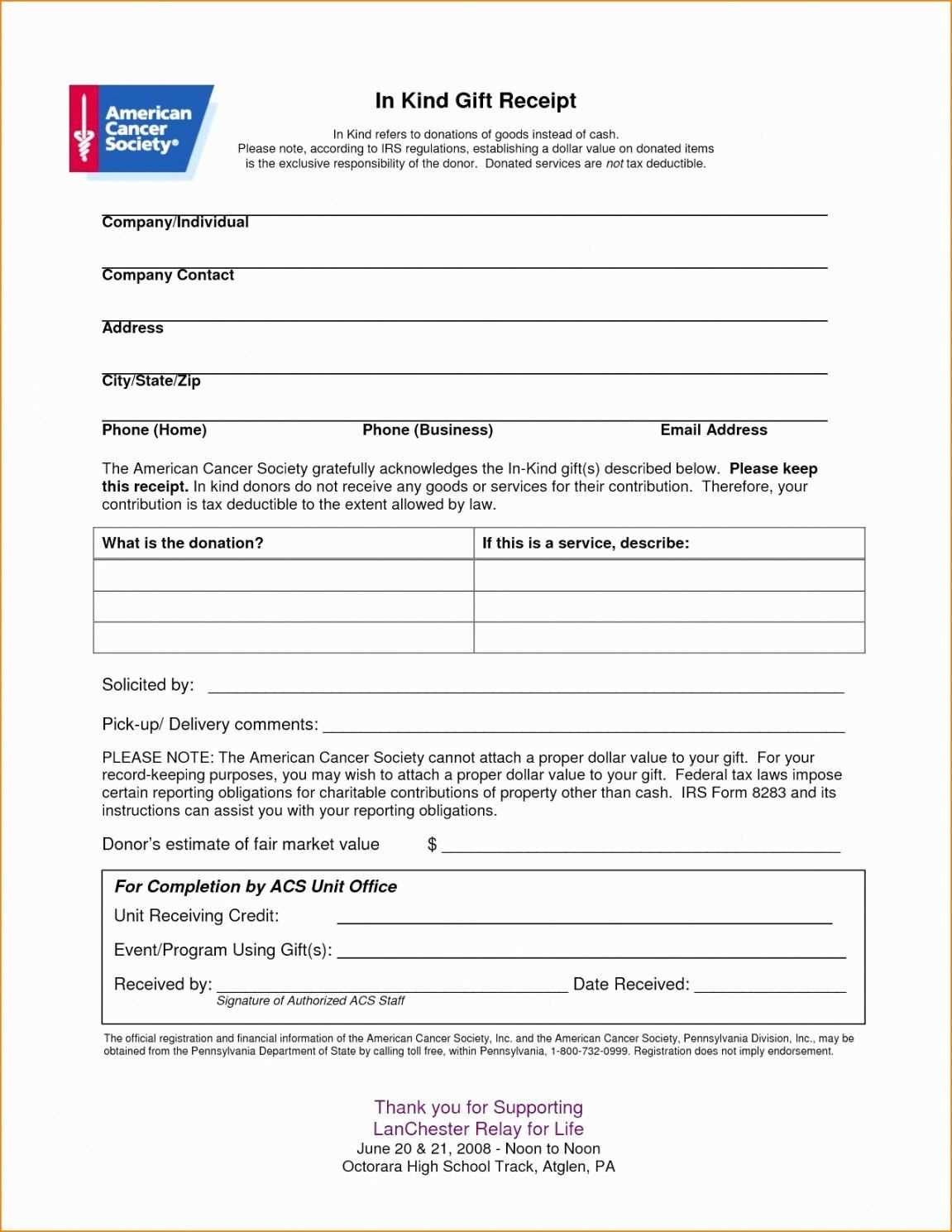

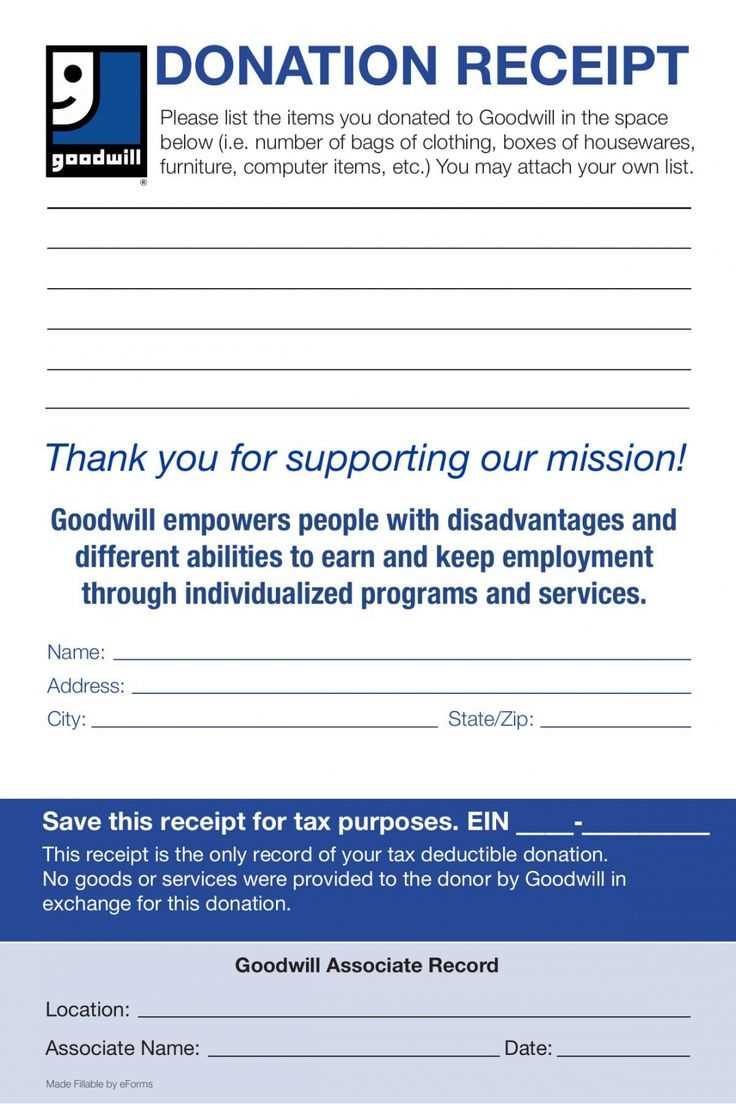

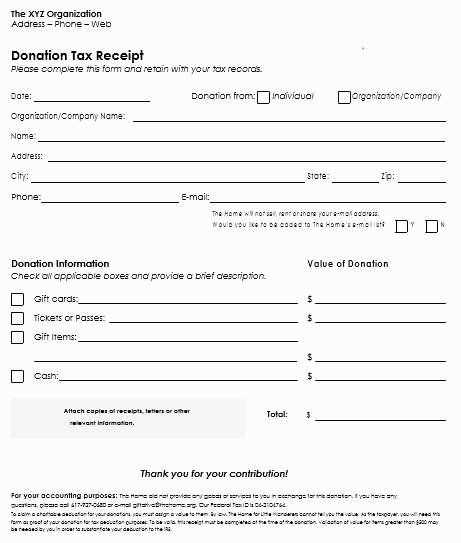

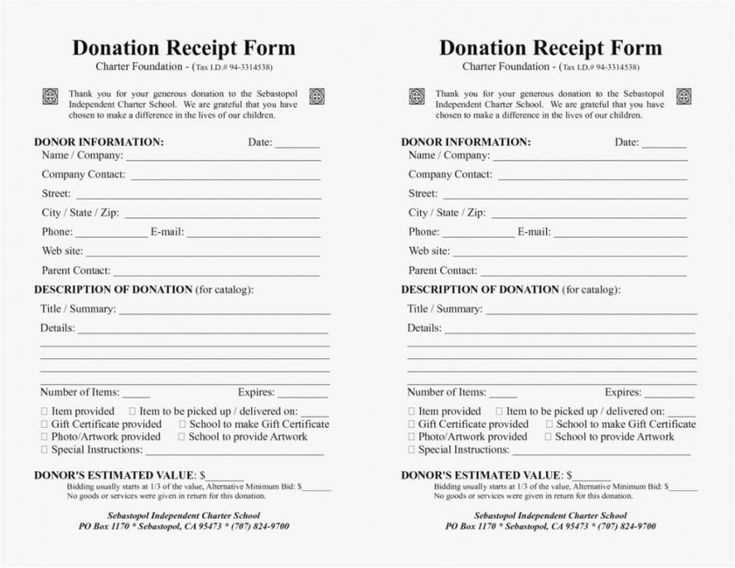

Begin by recording the donor’s full name, address, and donation amount. If the donation is monetary, clearly indicate the dollar value. For non-cash donations, describe the donated items and estimate their fair market value. Specify whether the donation was made in cash, check, or through other means.

Include your organization’s name, address, and tax-exempt status identification number to ensure the receipt is valid for tax purposes. If the donor received anything in exchange for their donation, make sure to note the value of the goods or services provided and adjust the deductible amount accordingly.

Finish with a statement confirming that no goods or services were exchanged for the donation, if applicable. Add an authorized signature from your organization to make the receipt complete and valid for tax deduction purposes. This will ensure that the donor can use the receipt to claim their deduction when filing taxes.

Receipt for Tax Deductible Donation Template

Provide clear documentation for tax-deductible donations with a receipt template that includes the following key elements: the donor’s name, the charity’s name, the donation amount, and the date of the donation. Specify whether the donation was monetary or in-kind. Include a statement confirming that no goods or services were provided in exchange for the donation, as required by tax laws. Also, note the tax-exempt status of the charity, referencing its official 501(c)(3) status or equivalent. Ensure the receipt is signed by an authorized representative of the charity for validity.

Ensure all information is accurate and legible to avoid confusion or issues during tax filing. Customize the template with the charity’s logo and contact details for added professionalism. Keep a copy of each receipt for record-keeping purposes, and provide the donor with their copy for tax filing. This will streamline the process for both the charity and the donor when claiming the deduction.

How to Structure a Tax Deductible Donation Receipt

Begin with the donor’s full name and address. This ensures that the donation can be properly credited to them for tax purposes.

Include the Donation Date

Clearly state the exact date the donation was received. This is critical for tax filing and establishing the donation’s eligibility for deductions in a specific tax year.

Describe the Donation

Provide a detailed description of the donation. If it’s a monetary donation, specify the amount. For in-kind donations, describe the items and their estimated value. Avoid using vague terms; provide clarity.

State whether any goods or services were provided in exchange for the donation. If there were, include their fair market value. This helps the donor determine the exact deductible amount.

Finish with the organization’s name, address, and tax identification number (TIN) to verify the legitimacy of the nonprofit organization. This reassures the donor that their contribution is eligible for tax deduction.

Legal Requirements for Tax Deductible Donations

Tax-deductible donations must meet specific criteria to qualify for deductions. To ensure eligibility, donors should confirm that the recipient organization is registered as a tax-exempt entity with the appropriate tax authorities. Typically, this means the organization is classified as a 501(c)(3) nonprofit in the United States or holds equivalent status in other countries.

Receipt Issuance

For a donation to be tax-deductible, the donor must receive a receipt from the charity. The receipt should include the organization’s name, tax-exempt status, the amount donated, and the date of the contribution. If the donation is non-cash, the receipt must describe the donated item and provide an estimate of its fair market value. Donors should keep these receipts for their records, especially for donations exceeding a specific threshold, typically $250.

Donation Limits

Donors can only deduct a portion of their income depending on the type of donation and the tax laws in their jurisdiction. In the U.S., for example, individuals can generally deduct up to 60% of their adjusted gross income (AGI) for cash donations, but this limit may vary for different types of gifts. It is important to be aware of specific limits based on the donor’s income and the type of donation being made.

Common Mistakes to Avoid in Donation Receipts

Always provide the exact amount of the donation. Omitting this key detail can lead to confusion and potential issues during tax filing. Ensure it is listed clearly, both in numerical and written format.

Inaccurate or Missing Donor Information

Donor details, such as name and address, should be correct. A missing or incorrect address can cause problems when the donor tries to claim their deduction.

Failure to Include a Statement of No Goods or Services Provided

If no goods or services were exchanged for the donation, it must be clearly stated on the receipt. This helps the donor confirm that the donation qualifies for tax deductions. If something was provided, its fair market value must also be stated.

- Clearly mention “no goods or services were provided in exchange” for the donation.

- If items were given, include their value to ensure transparency.

Keep the date of donation accurate and ensure the receipt is signed or includes the authorized signature. Missing this can create complications for both parties.