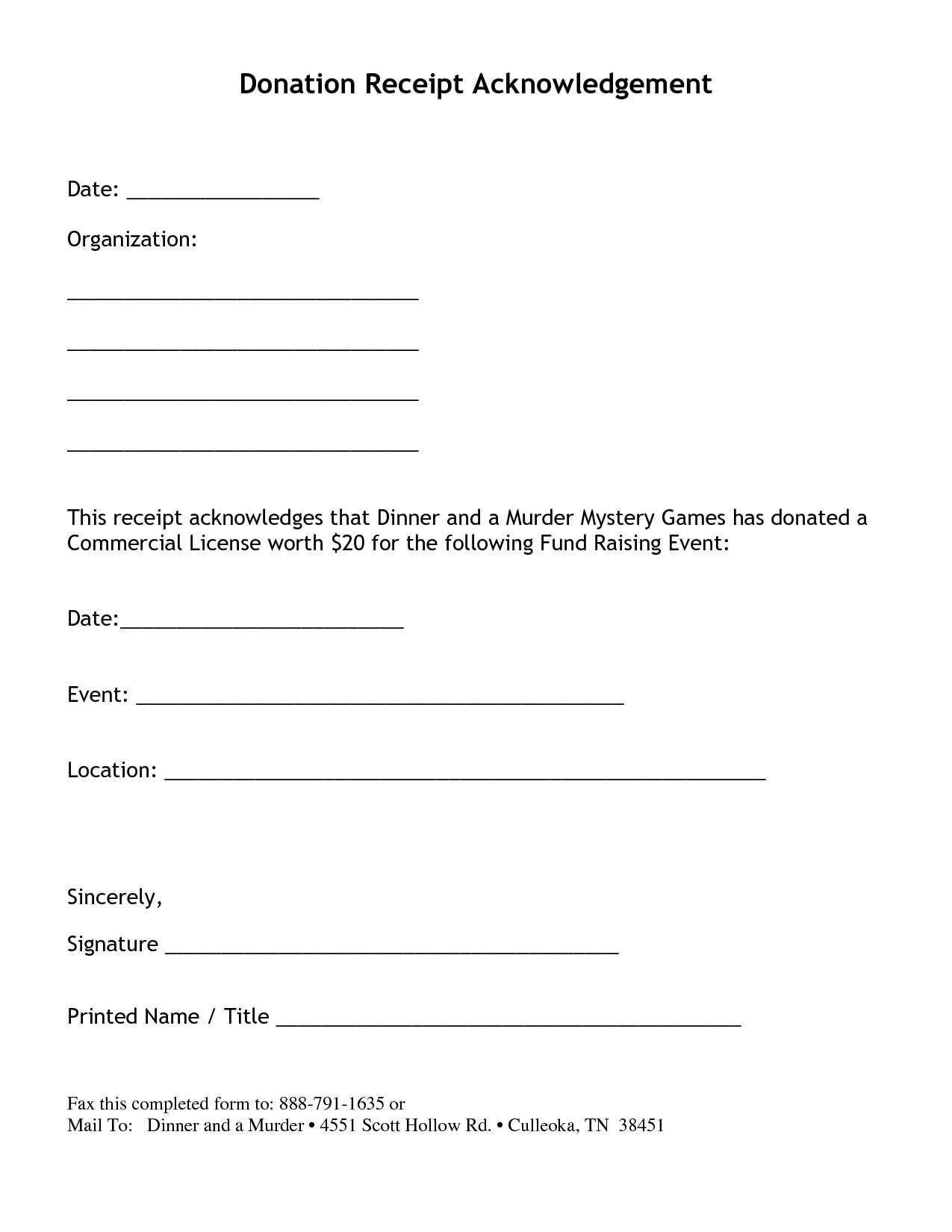

To simplify the donation process, create a clear and professional receipt for nonprofit donations. This not only ensures compliance with tax laws but also builds trust with donors. A well-structured receipt template should include all necessary details, such as the name of the donor, the amount donated, the date of the donation, and the organization’s tax-exempt status.

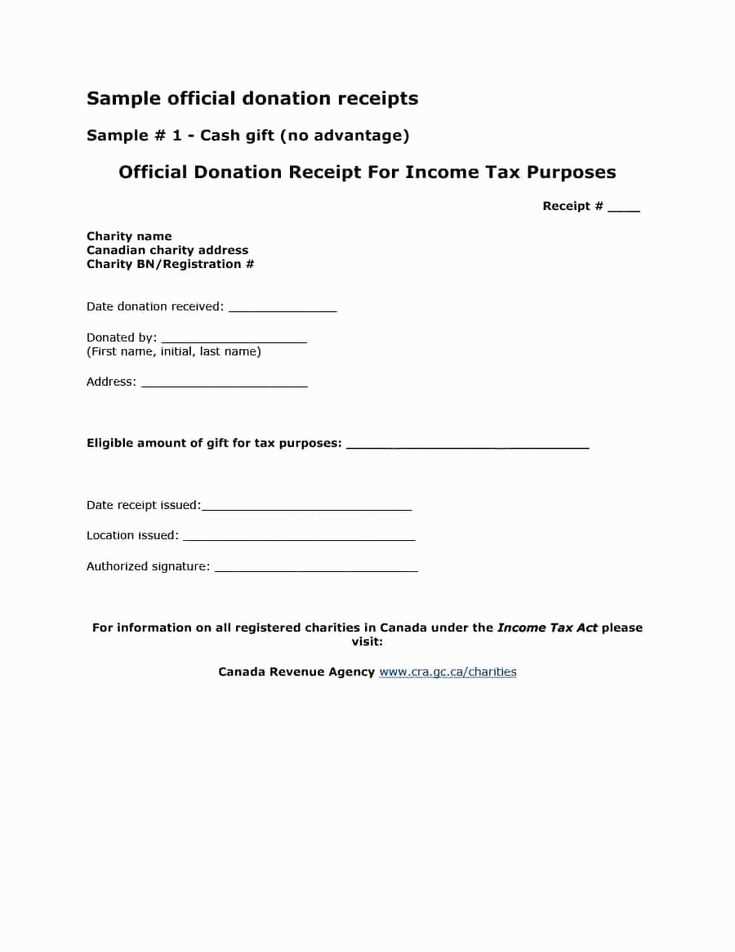

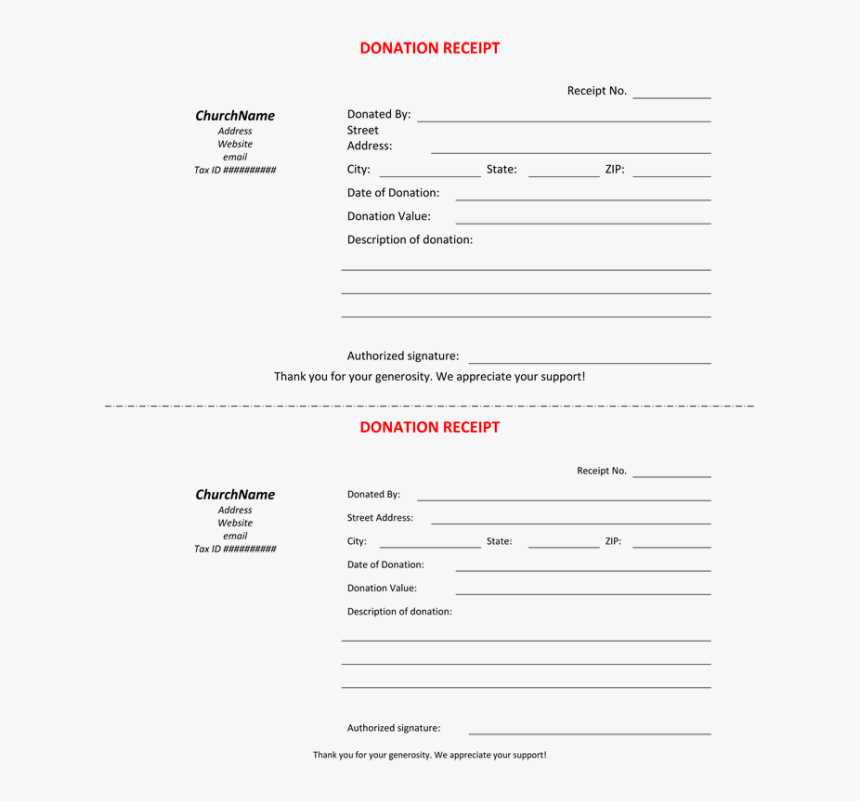

Include a Unique Identification Number for each receipt. This will help track donations easily and prevent confusion for both the donor and your organization. Make sure to also add your nonprofit’s name, address, and contact details for future reference.

Be transparent about the purpose of the donation. If applicable, specify whether the donation is restricted to a specific cause or for general use. This helps to avoid misunderstandings and clarifies your organization’s commitment to the donor’s intent.

Finally, ensure the format is easy to read and professional. Include a statement acknowledging that no goods or services were exchanged for the donation if applicable. This is key for donors who may want to use the receipt for tax deductions.

Here is the corrected version:

Make sure to include the donor’s name and address at the top of the receipt. This creates a clear record of the donation and can help both the donor and the nonprofit track contributions accurately.

Receipt Content

The receipt should state the nonprofit organization’s name, address, and tax-exempt status. Clearly specify the amount donated and the date of the donation. If applicable, mention any goods or services received in exchange for the donation. This ensures transparency and clarity.

Tax Deductibility Notice

It is vital to add a statement confirming whether the donation is tax-deductible. For example, include a sentence such as: “No goods or services were provided in exchange for this donation” if that applies. This helps donors with tax filing and provides them with necessary documentation.

Receipt for Non-Profit Donation Template

Create a clear and concise receipt to ensure both your organization and donors have a record of the charitable contribution. A donation receipt must include specific details to be valid for tax deduction purposes.

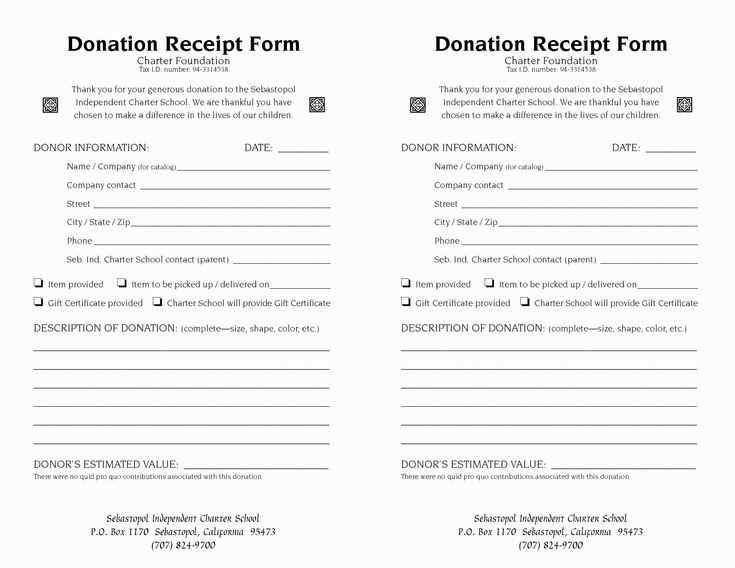

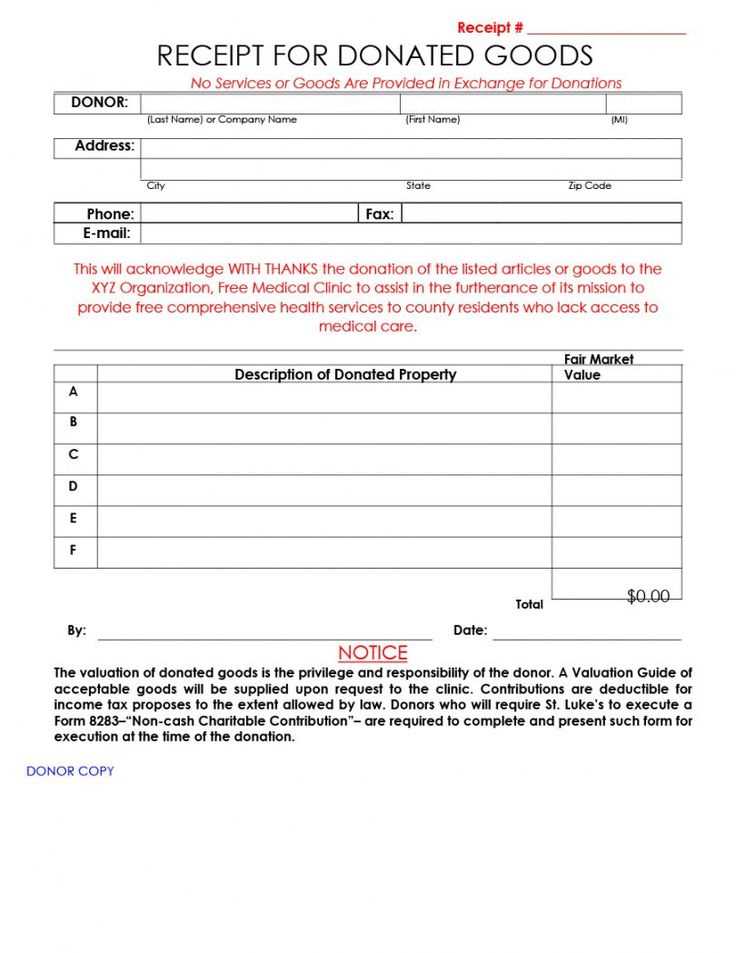

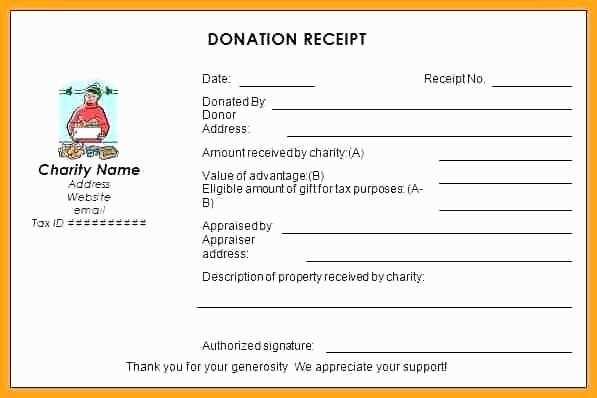

The template should include the donor’s name, the organization’s name, and its IRS status as a 501(c)(3) organization, if applicable. Include the donation date and a description of the donation (e.g., cash, goods, or services), specifying the amount or value. If it’s a non-cash donation, indicate whether an appraisal was provided or the value was determined by the donor.

It’s important to state if any goods or services were exchanged for the donation, with a value for those items. This ensures that the donor knows the amount of their contribution that is tax-deductible. Avoid vague terms–be specific in your wording, such as “donation of $50” or “donation of clothing valued at $100.”

For cash donations, always include the donation amount. For non-cash donations, include a detailed list or description and an estimate of its fair market value. If you don’t assign a value, state that it is up to the donor to determine the value for tax purposes.

End the receipt with your non-profit’s contact details, such as address and phone number, along with a statement that no goods or services were provided in exchange for the donation, if applicable. Sign and date the receipt to make it an official record for the donor.

To create a straightforward donation receipt for tax reporting, include the following key elements:

- Organization’s Information: List the name, address, and contact details of your non-profit organization at the top of the receipt.

- Donor’s Information: Include the donor’s full name and address to identify the person who made the contribution.

- Date of Donation: Specify the exact date when the donation was received to ensure accurate tax records.

- Donation Amount: Clearly state the dollar amount of the monetary donation. For non-cash donations, provide a description of the items donated.

- Donation Type: Indicate whether the donation was monetary or in-kind (non-cash). If it’s non-cash, include a description of the items, but do not assign a value for the donor.

- Tax-Exempt Status: Include a statement confirming the organization’s tax-exempt status (e.g., “501(c)(3)” in the United States) to help the donor claim tax deductions.

- Statement of No Goods or Services Provided: If applicable, provide a statement such as “No goods or services were provided in exchange for this donation.” This is required for donations over $75.

- Receipt Number: Assign a unique receipt number for better tracking of donations.

Once you have these details, you can generate the receipt and issue it to the donor, keeping a copy for your records. This helps ensure transparency and facilitates smooth tax reporting for both parties.

A donation receipt for a non-profit organization must include certain details to be both accurate and legally compliant. Here are the key elements that should be included:

| Element | Description |

|---|---|

| Organization Information | Include the non-profit’s name, address, and contact details to ensure transparency and provide easy communication channels. |

| Donor’s Information | List the donor’s name and address to confirm the donation’s receipt and for future correspondence. |

| Donation Amount | Clearly state the exact amount donated, specifying if it was cash or a non-cash donation. For non-cash donations, provide a description of the items donated. |

| Date of Donation | The date on which the donation was received should be noted, as it is important for tax purposes and financial record-keeping. |

| Non-Refundability | State that the donation is non-refundable. This can be particularly important in case of misunderstandings or disputes later on. |

| Statement of No Goods or Services Received | If applicable, include a statement that the donor did not receive any goods or services in exchange for the donation, especially for tax-exempt purposes. |

| Tax Identification Number (TIN) | Include the organization’s TIN (or Employer Identification Number) to ensure the donor can claim the appropriate tax deductions. |

| Signature | The signature of a representative of the non-profit organization validates the receipt. |

Each of these elements ensures the receipt serves as a proper legal record, allowing donors to claim their tax deductions and the organization to maintain accurate financial records.

Ensure the donor’s name is spelled correctly. Incorrect names on receipts can lead to confusion and complications, especially if donors need to provide the receipt for tax purposes.

- Double-check that the receipt includes the donation date. Missing dates create ambiguity, which may cause issues during tax filing or when tracking contributions.

- Provide accurate details about the donation amount. If it’s a cash donation, clearly state the sum. For non-cash donations, ensure a description of the items donated and their estimated value is included.

- Avoid vague descriptions for non-cash donations. Provide a detailed breakdown of the donated items or services to ensure clarity and transparency.

- Don’t forget to include your organization’s official name and tax-exempt status number. This is important for donors to substantiate their claims for deductions.

- Always indicate whether the donation was made in exchange for goods or services. This affects the deductible amount, and failing to note this could lead to issues later on.

- Be mindful of the receipt format. Ensure it is easy to read and that all required information is present in a clear and logical order. A disorganized receipt might confuse donors and create complications for tax filing.

- Never overlook the donor’s address. Including an address can be important for future communications, especially if additional documentation is needed later.

Ensure your receipt clearly indicates the non-profit status of your organization. Mention the organization’s name, address, and tax-exempt status clearly on the receipt.

State the donation amount, along with the date and the donor’s details (name and contact info). Make sure to include the exact wording: “No goods or services were provided in exchange for this donation” for tax purposes.

If the donor receives any goods or services, specify their value to help in accurate tax reporting. Keep the receipt simple, organized, and professional to avoid confusion during tax season.

Always issue a receipt promptly after a donation is made. For larger donations, consider providing a thank-you letter along with the receipt to strengthen your relationship with the donor.