Creating a receipt for an in-kind donation should be clear, accurate, and concise. It helps both the donor and the recipient keep track of valuable items donated for tax or accounting purposes. This document serves as a formal acknowledgment of the donation, ensuring transparency and legality.

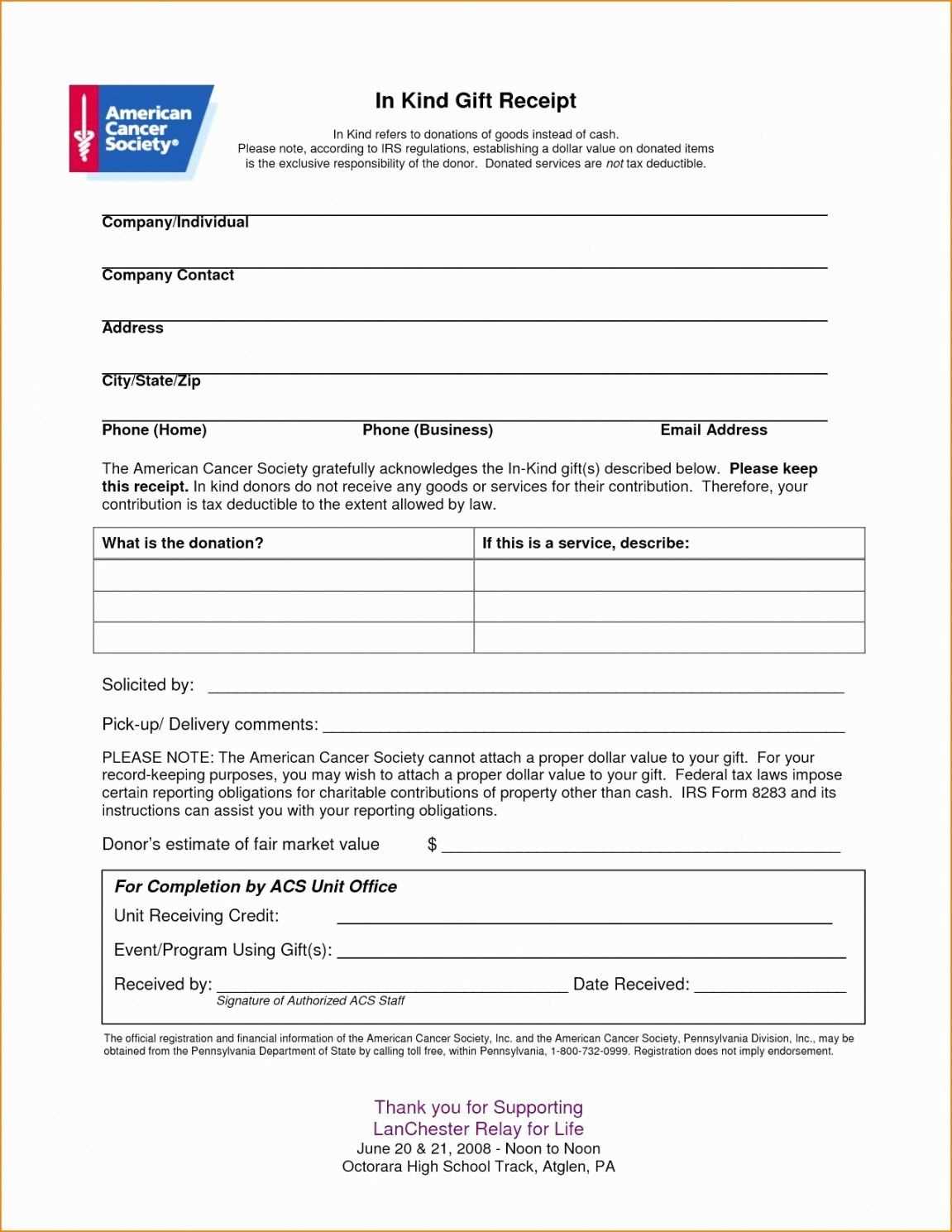

Make sure to include the donor’s full name, address, and the donation date. List the donated items with as much detail as possible, including their condition. If the items are not easily valued, the receipt should state that the donor is responsible for assigning a value to the donation.

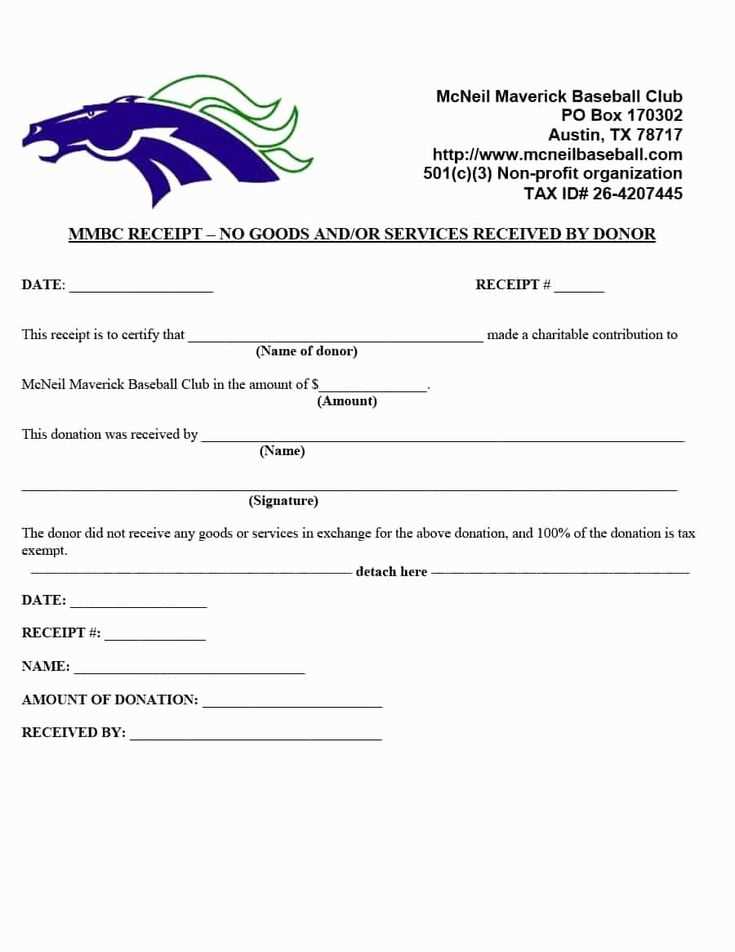

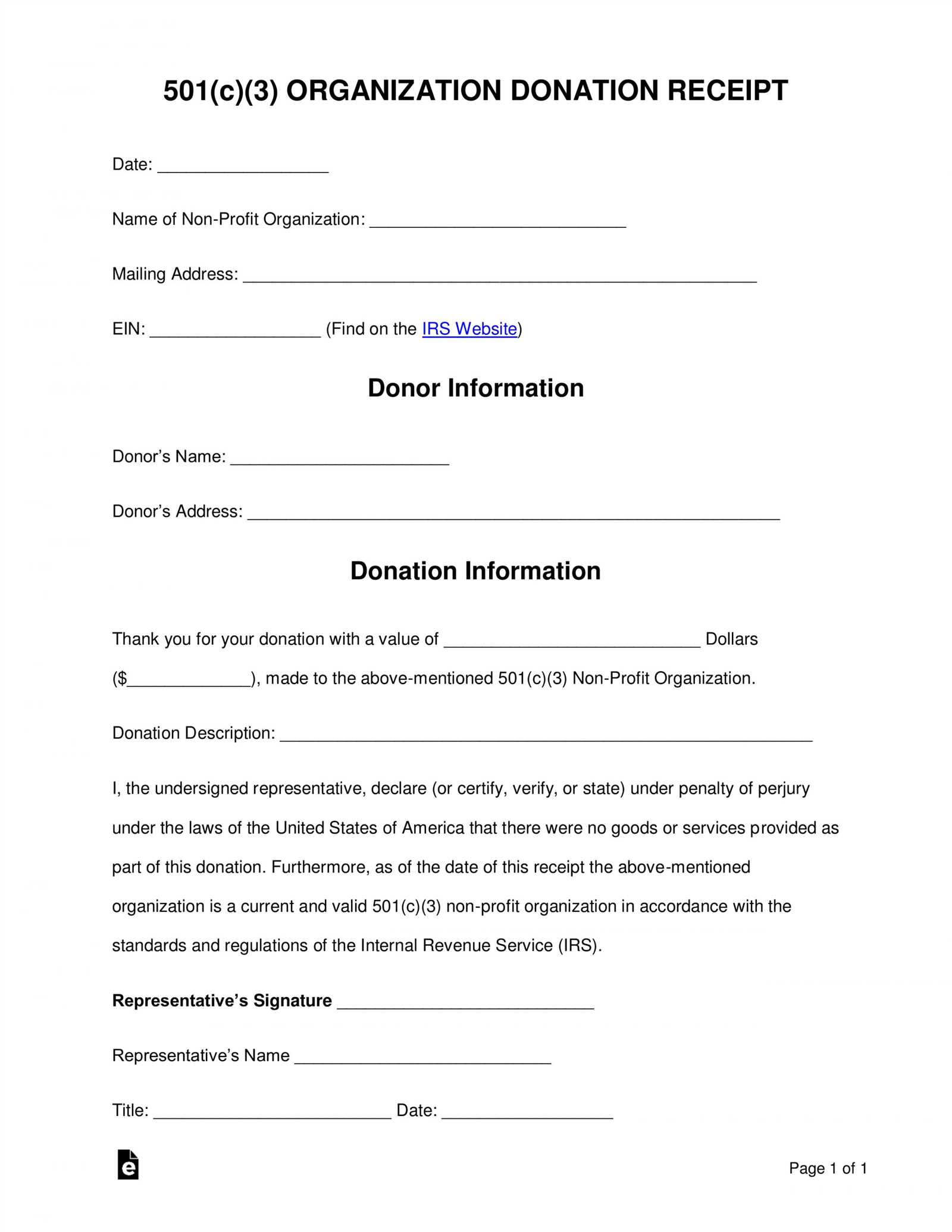

For tax purposes, it’s crucial to specify that no goods or services were provided in exchange for the donation. This helps ensure that the donation is fully deductible. Including a brief statement like “No goods or services were exchanged for this donation” will suffice.

Additionally, having a section for both parties to sign and date the receipt is recommended. This ensures that both the donor and the recipient acknowledge the transaction in writing, which can be beneficial if questions arise later.

Receipt in Kind Donation Template

A receipt for an in-kind donation serves as documentation for the donor and the recipient organization. It should clearly outline the donated items and their estimated value. The key components of a template for such a receipt include the following:

1. Donor’s Information: Include the full name, address, and contact details of the donor. This is necessary for tax purposes and ensures proper acknowledgment.

2. Date of Donation: Specify the exact date the donation was received. This helps both parties keep accurate records.

3. Description of Donated Items: List each item donated. Be specific about the nature, quantity, and condition of the items. For example, “Five boxes of used books” or “Ten pairs of gently used shoes.” A detailed description helps avoid any ambiguity.

4. Estimated Value: While the donor typically determines the value of the items, it’s a good practice to include an estimate or state that the recipient organization does not provide appraisals. For example, “The donor estimates the value of the items to be $100.” If the items are of higher value, encourage donors to seek a professional appraisal.

5. Tax Deductibility Statement: If applicable, include a statement indicating that the donation is tax-deductible, as per IRS regulations, if the recipient organization is a qualified charitable organization. For instance, “Your donation may be tax-deductible. Please consult a tax professional for more details.” It’s important not to provide tax advice, but to encourage donors to seek guidance if necessary.

6. Signature of Representative: The receipt should include the signature of a representative from the organization receiving the donation, confirming the receipt of the items. This adds legitimacy to the document.

7. Acknowledgment: Include a thank you note to show appreciation for the donor’s generosity. A simple “Thank you for your donation” can go a long way in maintaining positive relations.

By including these elements in an in-kind donation receipt, you help ensure clarity and provide the necessary documentation for the donor’s records. Be consistent with your format to streamline the donation process for both parties.

How to Structure a Receipt for Non-Cash Donations

Begin by including the donor’s name and contact information at the top of the receipt. This helps both parties keep a record of the donation. Include the organization’s full name, address, and contact details as well, to clearly identify the charity receiving the gift.

Next, list the date of the donation. If the donation was made in installments, specify the date for each item. Itemize the donated goods, including descriptions and quantities. If possible, include an estimated value of each item, but make sure to clarify that this value was determined by the donor, not the organization. This ensures transparency in the process.

Donor’s Declaration and Value

Clearly state that the donor did not receive any goods or services in return for the donation. This statement helps the donor claim a tax deduction if applicable. It’s also important to note that the organization does not assess or verify the value of non-cash donations. Provide a space for the donor to sign, affirming that the information provided is accurate.

Tax Information and Acknowledgement

End with a statement acknowledging the receipt of the donation, confirming that the organization appreciates the contribution. If the donation qualifies for tax deduction purposes, mention the IRS regulations (or relevant tax laws in your jurisdiction). Make sure to sign the receipt, and include the name and position of the person issuing it for added legitimacy.

Key Legal Requirements for Donating Goods

Donating goods involves specific legal responsibilities that both donors and recipients should be aware of. Here are the primary requirements to ensure the donation process complies with the law:

- Item Valuation: Donors must provide a fair market value for the donated items, especially for tax deduction purposes. The IRS requires donors to accurately estimate the value of donated goods and provide receipts or documentation as proof.

- Tax Deduction Guidelines: Donations made to qualified charitable organizations are generally tax-deductible. The charity should be registered with the IRS and recognized as a tax-exempt organization. Always request a written acknowledgment from the organization for donations valued over $250.

- Non-acceptable Donations: Donated items should be in good condition. The law prohibits donations of items that are deemed hazardous or unsellable. Charities may refuse donations that do not meet their specific guidelines.

- Receipt Requirements: When donating goods, you must request a receipt from the receiving organization. The receipt should include the name of the charity, a description of the donated items, and the date of donation. If the items are valued at $500 or more, you may need to complete Form 8283 for tax reporting.

- Liability and Ownership: Donors must ensure that the goods they are donating are legally owned by them and free from liens or encumbrances. Any restrictions or conditions on the donated items should be clearly stated and agreed upon in advance.

Following these guidelines will help ensure that your donation is legally sound and can potentially provide tax benefits. Be sure to check with the recipient organization for any specific requirements they may have.

Common Mistakes to Avoid in Donation Receipts

Always include the exact date of the donation. Without it, donors may struggle to match their receipt with their tax records. This is especially true for year-end donations where timing can affect tax deductions.

Do not forget to specify the donation’s fair market value, particularly for non-cash gifts. If you receive items, such as clothes or electronics, describe their condition and estimated value. A vague or missing value can complicate the donor’s ability to claim deductions.

Do not leave out a statement confirming your organization’s tax-exempt status. The receipt should include the IRS tax-exempt status number and your nonprofit’s name. Without this, donors may face issues when filing taxes.

Avoid generic descriptions of the donation. Instead of “a donation of items,” be specific about the type of items received, such as “five boxes of winter coats” or “two bicycles.” This transparency helps ensure both you and the donor have accurate records.

Ensure your receipt has your organization’s contact information and address. An outdated or incomplete address can raise questions from donors or tax authorities about the legitimacy of your nonprofit.

Do not overstate the value of donated items. Giving an inflated valuation can lead to tax issues. Always rely on fair market value estimates and advise donors on how to appraise their items correctly.

Avoid providing any direct goods or services in exchange for a donation without clearly stating the value. If a donor receives something in return, you must specify the value of the goods or services provided and subtract that from the total donation amount.