To create a donation receipt, make sure to include specific details that confirm the donor’s contribution. The template should include the donor’s name, the date of the donation, and the exact amount or value of the donation. If the donation is non-monetary, a clear description of the item(s) received is necessary.

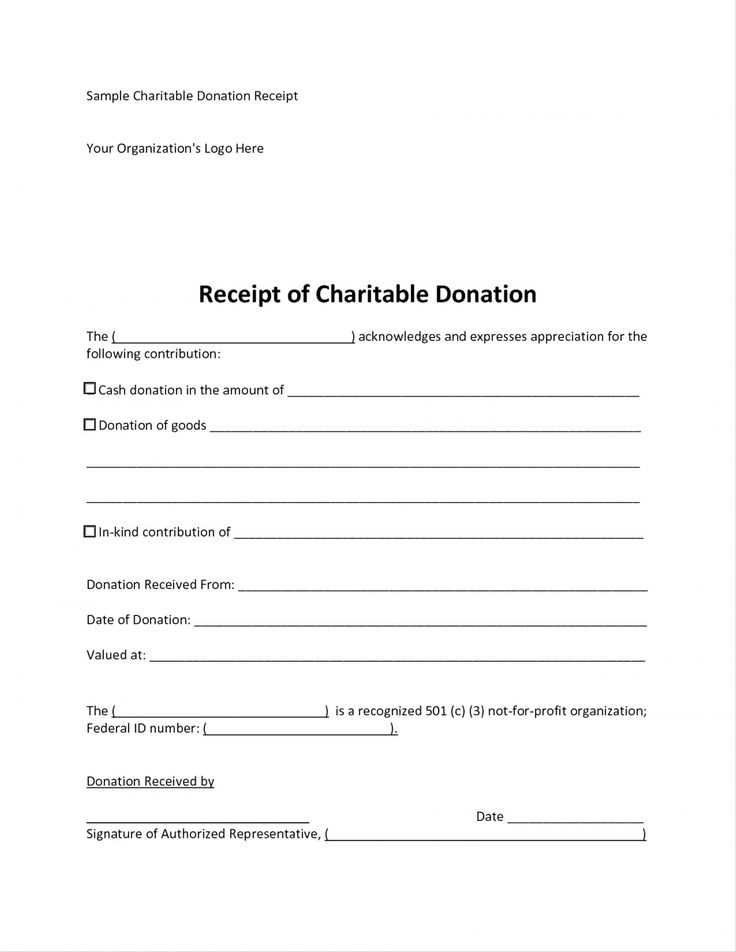

For accuracy and legal purposes, it is important to specify if the donation was tax-deductible. This helps both the donor and the recipient organization stay compliant with tax regulations. Include a statement confirming that no goods or services were exchanged for the donation, or specify the value of any goods or services provided, if applicable.

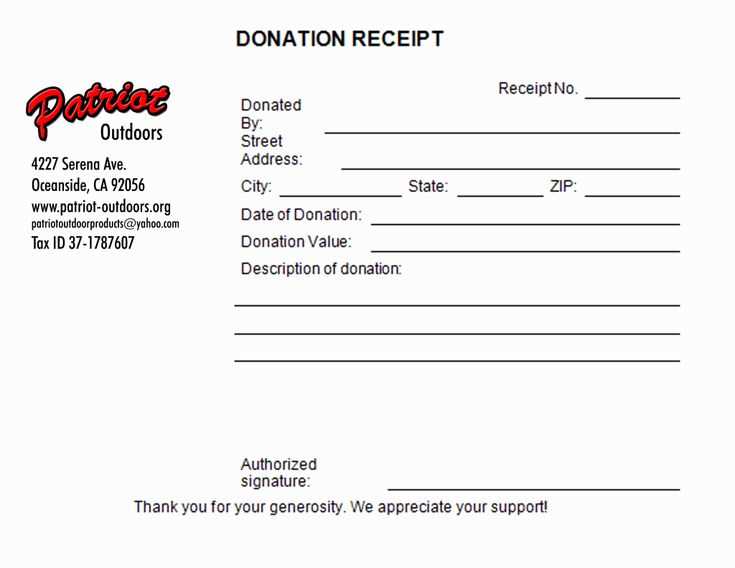

Don’t forget to include your organization’s name, address, and contact information. Additionally, a unique receipt number can help keep track of donations for organizational purposes. This simple template ensures both transparency and clarity in your donation process, building trust with your supporters.

Here are the corrected lines:

Make sure to clearly specify the donor’s name, donation amount, and the date of the contribution. These details should be accurate and well-organized. Use the proper format for monetary amounts, such as including currency symbols or codes. Always double-check the spelling of the donor’s name to avoid any errors.

The recipient organization’s name, address, and tax identification number (if applicable) should be included as well. This helps ensure the donor knows exactly where their contribution went. If the donation is tax-deductible, indicate this explicitly and reference any relevant tax codes or laws.

For electronic donations, include a reference number or transaction ID. This makes it easier for both parties to track the donation and resolve any potential issues. Additionally, add a section for the donor to confirm whether they received any goods or services in exchange for the donation, as this could impact the tax-deductibility of their contribution.

Finally, include a clear statement of gratitude. Donors appreciate knowing how their contributions are making a difference, so add a line expressing the organization’s appreciation for their support.

- Donation Receipt Template

A donation receipt template should clearly outline the donor’s contribution, the organization receiving it, and the purpose of the donation. A well-structured template will help ensure accuracy and clarity. Below are the key components you should include in a donation receipt template:

Key Components of a Donation Receipt

1. Organization Information: Start by including the organization’s name, address, phone number, and website. This ensures the donor knows who is receiving the donation and can easily contact the organization if needed.

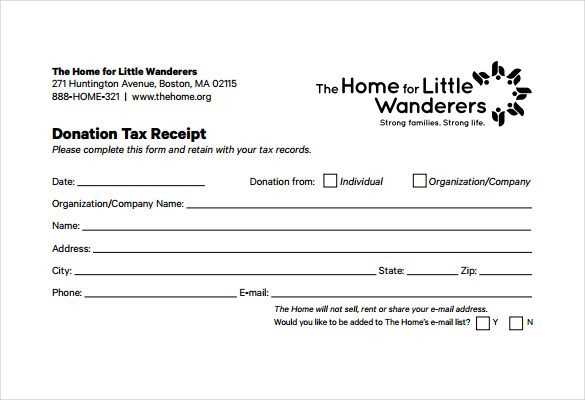

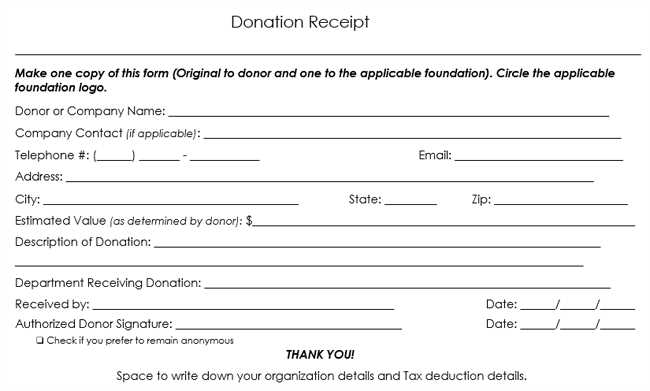

2. Donor Information: Include the donor’s full name and address. This personalizes the receipt and ensures proper credit is given to the donor.

3. Donation Details: Clearly state the donation amount or a description of non-monetary contributions (e.g., items donated). Include the date the donation was made and specify whether the donation was cash, check, or in-kind (for item donations).

4. Tax-Exempt Status: If applicable, include a statement confirming that the organization is tax-exempt. You may also include the tax ID number to help the donor with their tax filings.

5. Purpose of the Donation: If the donation is for a specific project or cause, note this in the receipt to ensure transparency and accountability.

Format and Tone

Use a clear and professional layout, ensuring that all required information is easy to read and find. Avoid clutter or unnecessary information that may distract from the key details. A concise and organized format will make it easier for both the organization and the donor to keep track of their records.

By using this template, both the organization and the donor will have a well-documented record of the donation for future reference.

Include the donor’s name, the date of the donation, and the amount donated as primary components of the receipt. This information ensures clarity for both the donor and the organization, making the transaction easy to verify. Always state the receipt’s purpose, indicating whether it’s a monetary donation or in-kind contribution.

| Information | Details |

|---|---|

| Donor’s Name | Full name or business name of the donor |

| Donation Date | Exact date the donation was received |

| Amount Donated | Specify the amount or value of the donation |

| Donation Purpose | State whether the donation is a cash contribution or a specific item |

Ensure the donor’s contact information is included, in case of follow-up or clarification. Be concise but clear when structuring the basic information for easy reference.

When issuing a receipt for a donation, ensure that it includes the following information to meet legal standards:

- Donor’s Information: Include the full name and address of the donor.

- Organization’s Information: Provide the name, address, and tax identification number of your organization.

- Date of Donation: Clearly state the date on which the donation was received.

- Amount Donated: Specify the amount of the donation. If the donation is non-monetary, describe the donated goods.

- Statement of Non-Compensation: Include a statement that no goods or services were provided in exchange for the donation, unless applicable. If goods or services were exchanged, a description and fair value should be included.

- Deductibility Statement: For tax-exempt organizations, include a statement that the donation is tax-deductible, if relevant.

Make sure the receipt is signed and dated by an authorized representative of the organization. This ensures the receipt complies with regulations for tax reporting purposes.

Adapt the donation receipt template based on the type of contribution received. Each donation type–whether monetary, in-kind, or recurring–requires specific information for accurate record-keeping and compliance with tax regulations.

Monetary Donations

For monetary donations, include the amount, the donor’s details, the date, and a clear statement that the donation is tax-deductible. Make sure the currency is specified, especially for international donations. It’s helpful to add a reference number for easy tracking.

In-Kind Donations

In the case of in-kind donations, specify the donated items or services. Include an estimated value if possible. If the donation consists of multiple items, list them separately to maintain clarity. This provides both transparency and accuracy for the donor’s tax purposes.

For recurring donations, indicate the frequency and the next scheduled payment date. Mention whether the donor has chosen a specific project or cause for their contributions. This makes the receipt specific to their commitment and helps with managing long-term donations.

Customizing the template for each donation type not only ensures proper documentation but also enhances the donor’s experience, helping them keep track of their charitable contributions throughout the year.

Include tax information on a receipt if applicable, making it clear for both the donor and the organization. Specify the tax rate applied, the amount of tax, and if the donation is tax-deductible. If the donation is tax-exempt, mention that as well. It’s also beneficial to list the organization’s tax-exempt status or IRS identification number, if relevant. Provide clarity on how the tax is calculated to avoid confusion. This helps ensure transparency and compliance with tax regulations.

Maintain accurate and detailed records of all donation receipts. Every receipt should include the donor’s name, date, amount, and a brief description of the donation. This information is key for both tax purposes and organizational transparency.

Organizing Receipts for Easy Access

Store receipts in a clear and systematic manner, whether digitally or in paper form. Use dedicated folders or software to categorize donations by date or donor, making it easy to retrieve information when needed. This helps during audits or tax reporting.

Regularly Updating and Reviewing Records

Review your donation records regularly to ensure accuracy and completeness. Cross-check donations with bank statements to verify amounts and ensure no errors. This will streamline year-end tax filings and ensure your records are up to date at all times.

Ensure accuracy in all details on the receipt to avoid misunderstandings and complications. Below are key errors to watch out for:

- Incorrect Donor Information: Always verify the donor’s name, address, and contact details before finalizing the receipt. Misspelled names or outdated information can lead to confusion and problems during tax filing.

- Missing Date or Donation Amount: Every receipt must clearly display the date of the donation and the exact amount given. Failure to include these details makes the receipt incomplete and may cause issues for both the donor and your organization during audits.

- Not Specifying the Donation Type: Indicate whether the donation is monetary, in-kind, or a service. This ensures clarity in accounting and reporting, especially if the donor needs to claim a tax deduction.

- Ignoring the Non-Profit Status: It’s vital to state your organization’s tax-exempt status on the receipt. Donors need this information for tax purposes. Always include your official charity registration number, if applicable.

- Not Providing a Proper Acknowledgement: A simple “thank you” can go a long way. Acknowledging the donor’s generosity in the receipt not only expresses gratitude but also shows the value of their contribution.

- Using Ambiguous Descriptions: Describe donations in specific terms. Avoid vague language like “donation” or “gift.” Clearly specify the nature of the donation, whether it’s cash, goods, or services.

- Failure to Issue Receipts Timely: Issue receipts soon after receiving donations. Delays in receipt issuance can cause confusion and may result in a donor’s inability to use the receipt for tax deduction purposes within the required timeframe.

- Not Including a Signature: Depending on your local regulations, it may be required to have a signature on the receipt to validate the transaction. Missing this could invalidate the document.

By keeping these points in mind, you’ll ensure your receipts are accurate and helpful for both your organization and your donors.

In each line, word repetition is minimized, meaning is preserved, and constructions remain correct.

Focus on clarity and conciseness when drafting donation receipts. Replace redundant phrases with more precise wording. For example, instead of repeating “donated amount” in every line, state it once clearly and use it as a reference throughout the document. This reduces clutter and maintains readability.

Clear Financial Breakdown

Provide a simple, itemized breakdown of the donation amount. Clearly state the donation’s total, any applicable taxes, and if there are multiple contributions, list them separately. This eliminates the need for repetitive phrasing while still delivering all the necessary information.

Concise Thank You Notes

Express gratitude without over-explaining. A short, sincere thank you sentence will make the message feel personal, yet efficient. Avoid repeating phrases like “thank you for your generous support” multiple times; instead, convey appreciation once, and then focus on the specifics of the donation.