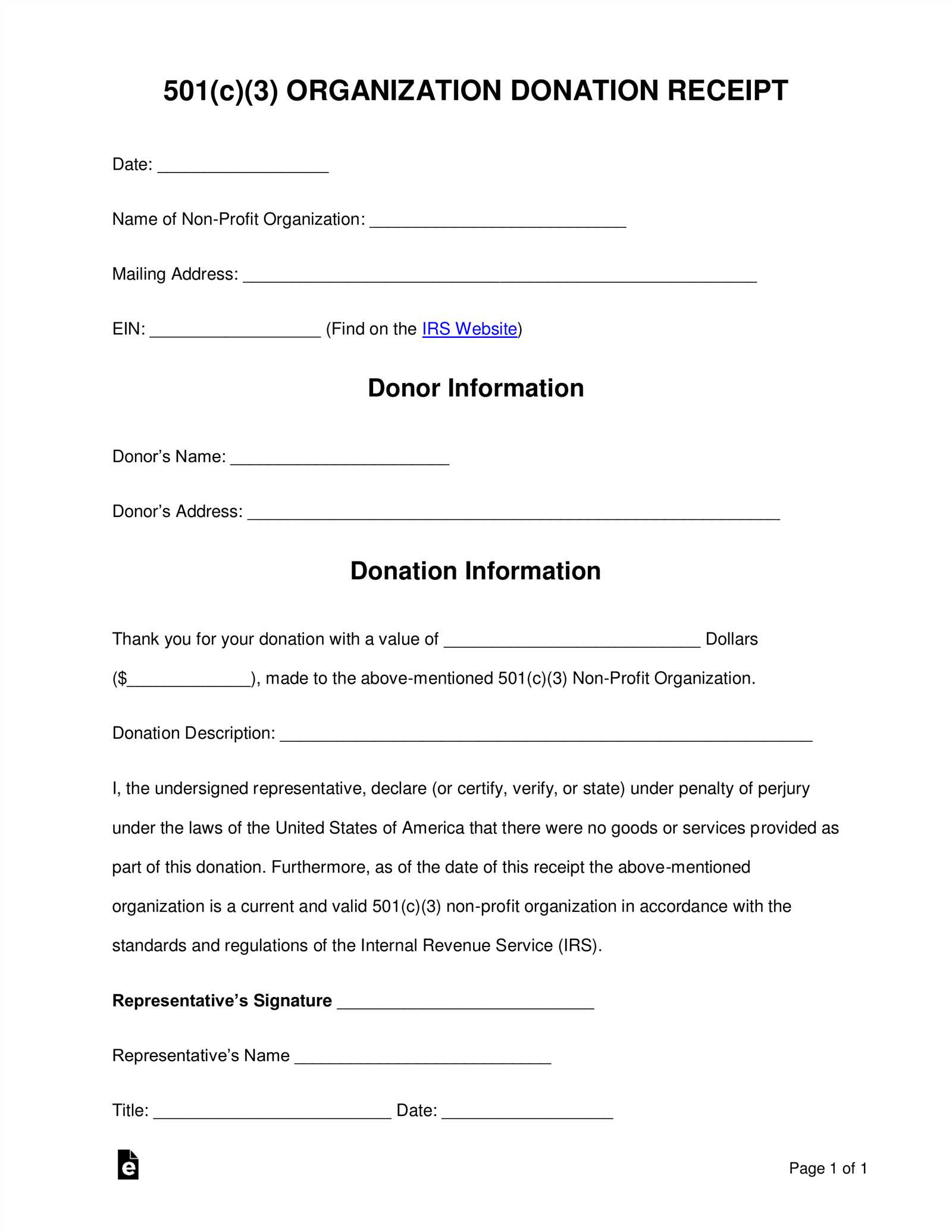

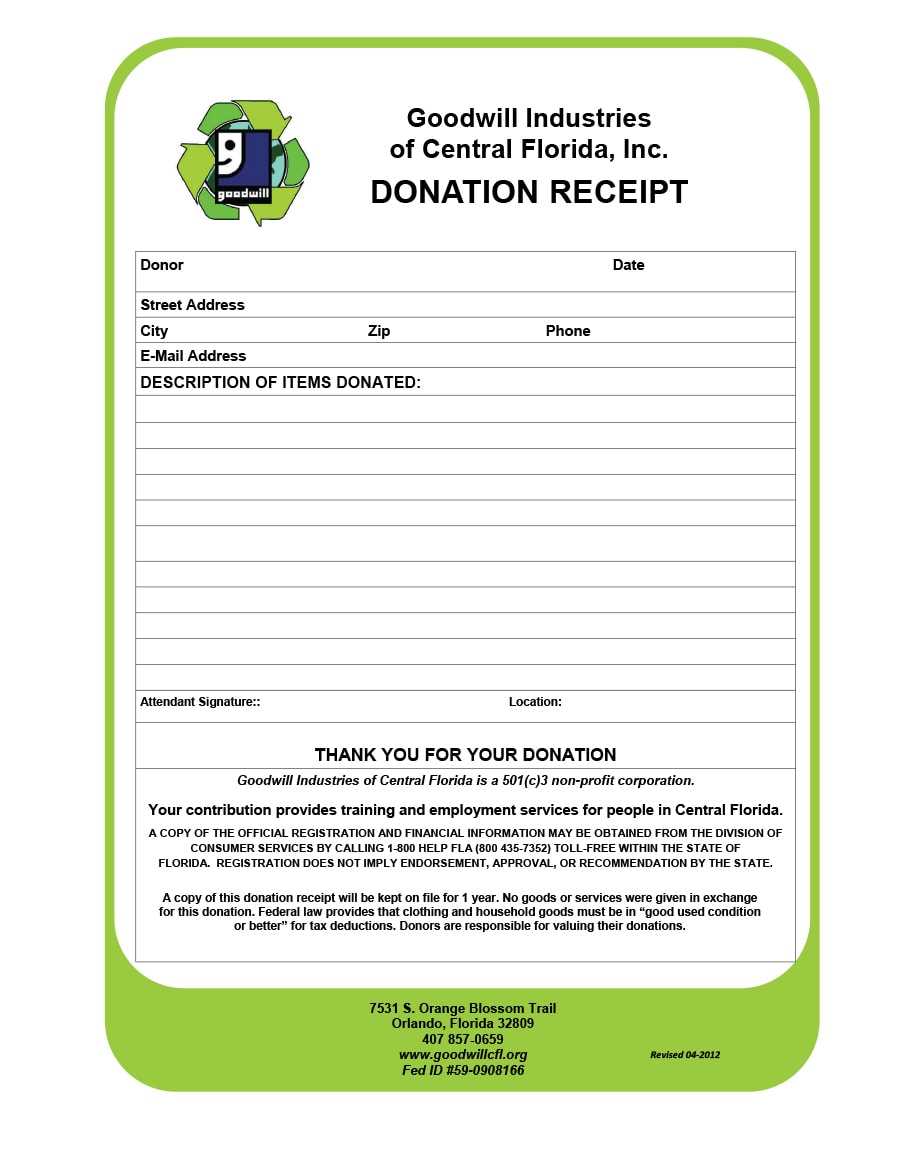

A clear and accurate receipt template is critical when providing donors with documentation for their 501c charitable contributions. A well-structured receipt will ensure compliance with IRS guidelines and make tax filing smoother for both the donor and the organization.

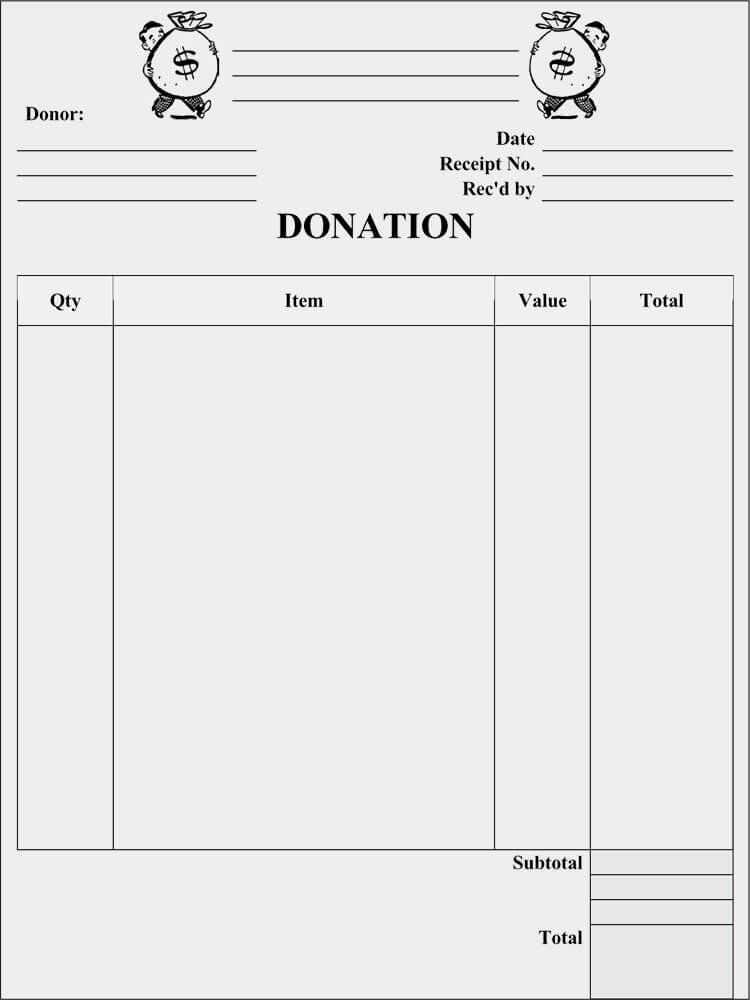

The receipt should include the organization’s name, address, and EIN (Employer Identification Number). Specify the donation amount and whether the contribution was monetary or non-monetary. If it’s a non-cash donation, list a brief description of the item(s) donated and their condition. Do not assign a value to the items, as that is the donor’s responsibility.

Ensure that the receipt includes a statement confirming whether the donor received any goods or services in exchange for their donation. If no goods or services were provided, the IRS requires a specific wording to acknowledge this fact. Finally, include the date of the donation, which is critical for tax purposes.

By following this template, you can create a receipt that meets the legal requirements while simplifying the donation process for both your organization and your supporters.

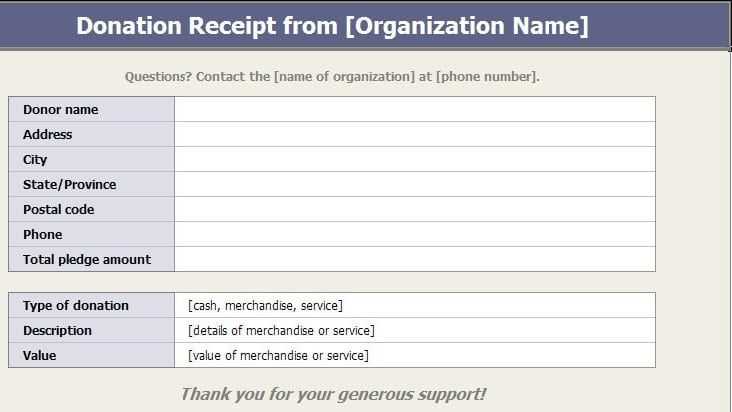

Receipt Template for 501c Donation

Include the organization’s name and IRS tax-exempt status on the receipt. Clearly state that the organization is a 501(c)(3) nonprofit. Mention the donor’s name, address, and the date of the donation. Specify the exact amount of the donation or describe the donated items with an estimated value if applicable.

Provide a statement about any goods or services provided in exchange for the donation, or clearly state that no goods or services were received. This is required for tax purposes. The donor must be able to verify that the donation is fully deductible.

Ensure that the receipt includes the signature of an authorized person from the organization and the organization’s EIN (Employer Identification Number) for additional authenticity and reference.

End the receipt with a thank-you note expressing appreciation for the contribution, which helps reinforce the relationship between the donor and the organization.

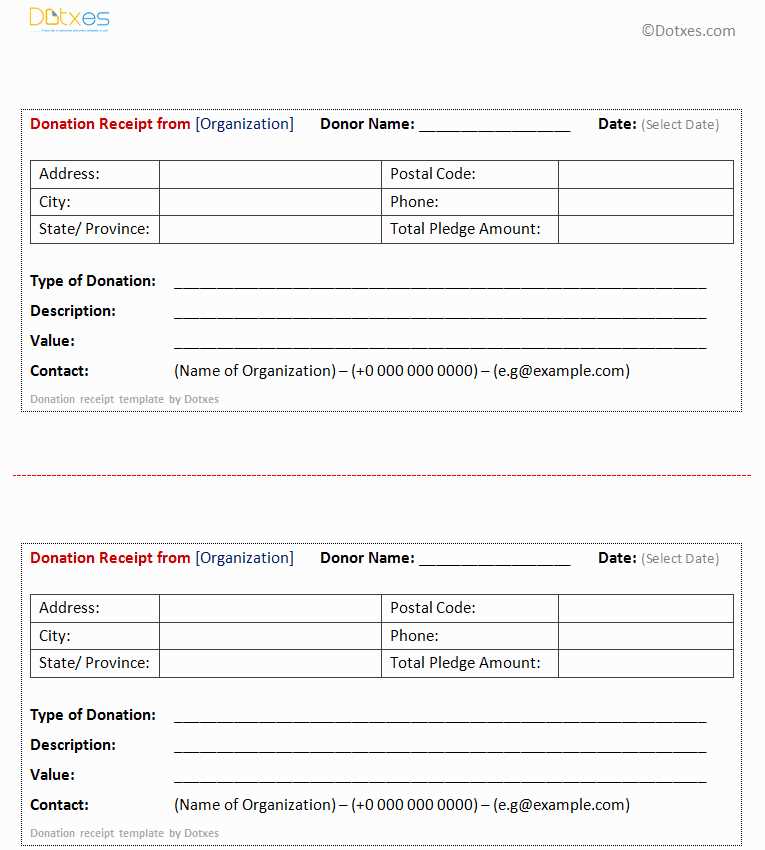

How to Format the Donor Information in Your Receipt

Place the donor’s full name at the top of the receipt, exactly as they provided it. Include any relevant titles (Mr., Mrs., Dr., etc.) to match their legal documentation. If the donation is made by an organization, list the organization’s official name and contact details instead of an individual’s name.

Directly after the name, include the donor’s mailing address. If available, break it down into separate lines for the street address, city, state, and ZIP code. This ensures proper record-keeping and easy future reference.

If the donor has provided an email address, add it below the address section. This can help in future communication, though it is not mandatory. Ensure the email is current to avoid any communication gaps.

Finally, include a unique donor ID or a transaction reference number. This will help both the organization and the donor track donations easily, especially if a donor makes recurring contributions.

Including Required Tax-Exempt Status Details in Donation Receipts

Donation receipts for 501(c)(3) organizations must include specific tax-exempt status information. This ensures donors can claim tax deductions on their contributions. The IRS requires that receipts clearly state the organization’s tax-exempt status, typically noting its 501(c)(3) designation. Make sure the receipt mentions that the organization is a tax-exempt charity under section 501(c)(3) of the Internal Revenue Code.

Include the organization’s full legal name and the employer identification number (EIN), which is used by the IRS to identify the organization. This is critical for donors who need it for tax reporting purposes. The receipt should also state whether any goods or services were provided in exchange for the donation. If there were, the value of those goods or services should be clearly listed.

For cash donations, the receipt should note the amount donated. For non-cash donations, include a description of the items donated. Avoid assigning a value to the non-cash donation, as the donor is responsible for appraising the value of such contributions. Be sure to issue receipts for donations over $250, as these are required to claim tax deductions.

Lastly, clearly communicate any restrictions on the use of the donation. If the donation is restricted to a specific purpose, such as a program or project, this should be noted on the receipt. Transparency helps donors with their tax filings and ensures they comply with IRS requirements.

Step-by-Step Instructions for Customizing Your Donation Receipt Template

Customize your donation receipt template by following these steps to make it clear, professional, and aligned with your organization’s needs.

- Choose a Template: Select a basic receipt template or start from scratch with a blank document. Templates often provide a well-organized structure to begin with.

- Add Your Organization’s Information: Include your nonprofit’s name, address, phone number, and website at the top of the receipt. Make sure this is visible to donors for future reference.

- Insert Donation Details: Include the donor’s name, the donation date, and the donation amount. Be clear whether the donation is cash, check, or in-kind. If applicable, include the check number or payment method.

- State Nonprofit Status: Add a brief statement confirming that your organization is a 501(c)(3) nonprofit. This clarifies to donors that their contribution is tax-deductible.

- Include a Thank You Message: Personalize the receipt by expressing gratitude for the donation. A short thank you note can make a significant difference in building strong relationships.

- Provide a Description of the Donation (Optional): If the donor gave a restricted donation (e.g., for a specific program or project), clearly state how the donation will be used.

- Include a Unique Receipt Number: Assign a unique receipt number for tracking and organizational purposes. This helps to avoid confusion if receipts are ever questioned.

- Add the IRS Disclaimer: If required, include a statement specifying that no goods or services were provided in exchange for the donation. This is crucial for tax purposes.

- Include a Donation Acknowledgement Date: Clearly state the date on which the receipt is issued. This helps ensure accurate records for tax reporting.

- Review for Accuracy: Double-check all details before finalizing the receipt template. Ensure that donor information, donation amount, and legal statements are correct.

Once you’ve customized the template, save it as a reusable file format (such as PDF) for easy access and distribution. Customize the design to reflect your organization’s branding, making it easy for donors to recognize and trust your nonprofit’s professionalism.