Providing a clear and accurate donation receipt is a key step for nonprofits. It’s not just about tracking donations, but also ensuring transparency and building trust with supporters. A well-crafted receipt reflects the organization’s commitment to proper documentation and accountability.

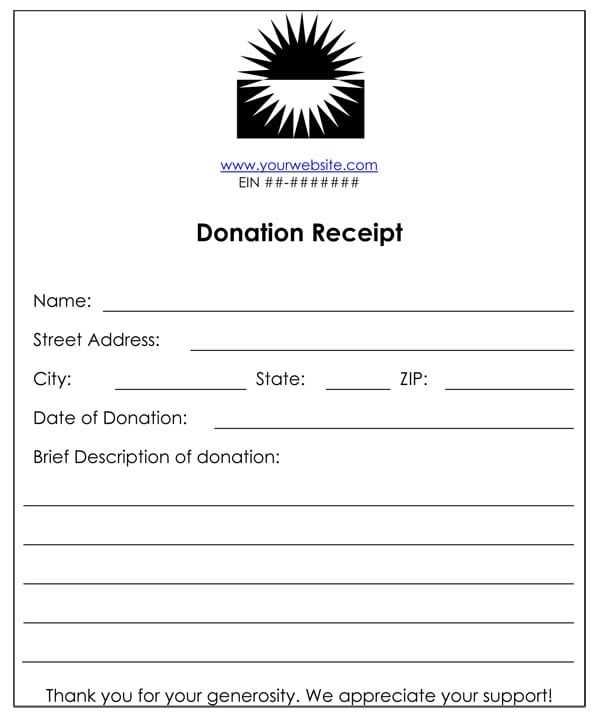

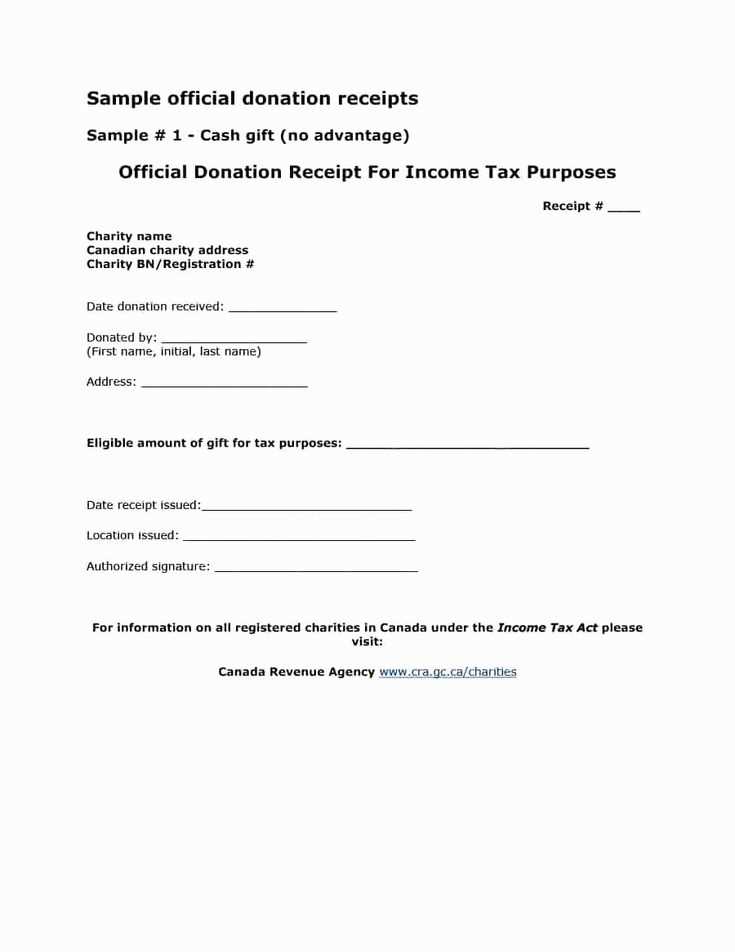

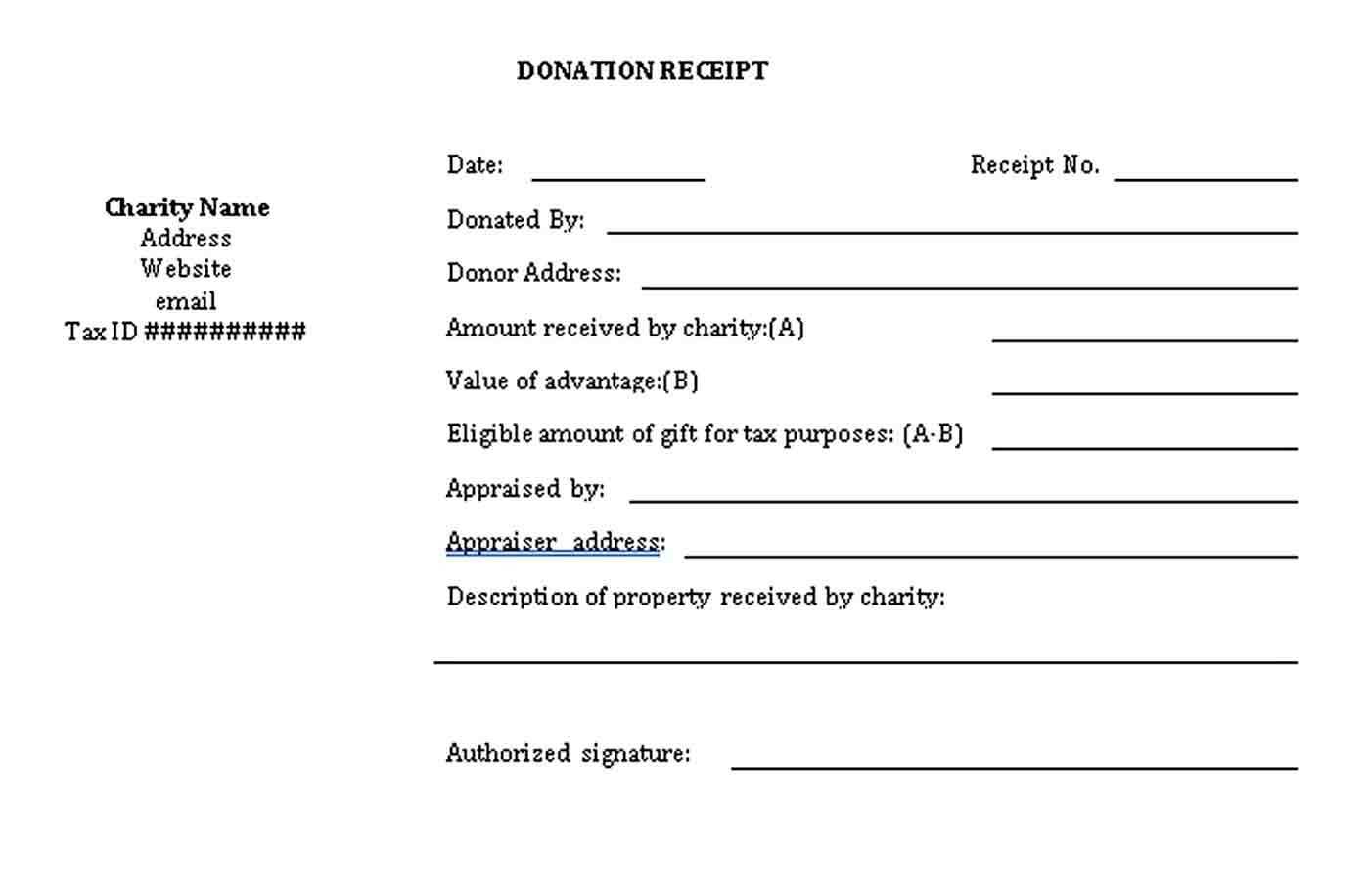

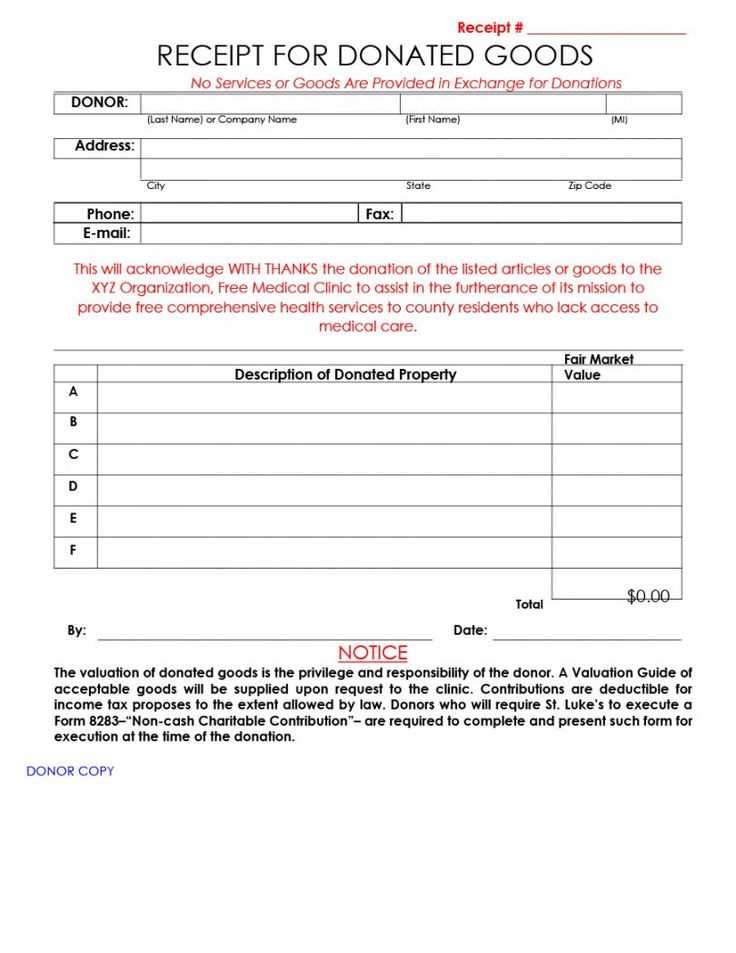

When creating a receipt template, be sure to include important details like the donor’s name, the donation date, the amount given, and the nonprofit’s tax-exempt status. A section stating whether the donation was cash or goods should also be present. If the donation was in kind, a brief description of the item should be listed.

Make it clear whether the donor received anything in exchange for their donation. This helps the donor determine the amount that is deductible for tax purposes. Including a statement that the donor did not receive anything in return is important for ensuring proper tax deductions.

A concise, professional design makes the receipt easy to read and store. Ensure the nonprofit’s contact information and a statement that the donation is tax-deductible are clearly visible. By following these steps, the template not only meets legal requirements but also reinforces the nonprofit’s professionalism and commitment to its mission.

Receipt Template for Donation to Nonprofit

Ensure that your donation receipt includes clear and concise details for both the donor and the nonprofit organization. Start with the name and address of the nonprofit, followed by the donor’s name, address, and the date of the donation. Make sure to include a description of the donated item or amount, as well as the total value, whether it is monetary or in-kind.

Key Information to Include

A valid receipt should cover the following:

- Donor’s Information: Full name, address, and contact information.

- Nonprofit’s Details: Full name, address, and tax identification number.

- Date of Donation: The specific date the donation was made.

- Donation Description: Briefly describe the donation, whether monetary or in-kind.

- Value of Donation: If it is a monetary gift, include the exact amount. For in-kind donations, provide a detailed list with estimated values.

- Statement of No Goods or Services Provided: Confirm that the donation was fully deductible and that no goods or services were provided in exchange for the gift.

Finalizing the Receipt

End the receipt with a statement thanking the donor for their generosity. Include space for an authorized signature from the nonprofit’s representative. Make sure the receipt is easy to read, professional, and free of errors, as it will serve as an important record for both the donor and the organization.

Key Elements of a Donation Receipt

Begin by including the nonprofit organization’s name, address, and contact information at the top of the receipt. This ensures that the donor knows where their contribution is going and how to reach the organization if needed.

Donation Details

Clearly state the amount donated, specifying whether it was in cash, check, or another form. If a non-cash item was donated, provide a description of the item(s) and their value, if applicable. Include the date of the donation for reference.

Tax Information

Indicate that no goods or services were exchanged for the donation, if applicable. If the donor received something in return, note the value of those items so they can properly account for the donation for tax purposes. This is essential for both parties to maintain accurate records.

How to Customize the Template for Your Organization

To create a personalized receipt template, begin with updating the organization’s name, logo, and contact details. This ensures the template reflects your brand and provides the necessary information for future communications.

- Insert your organization’s logo: Upload a high-quality logo to the template header for brand consistency.

- Update your contact information: Include your address, phone number, and email address so donors can easily reach you.

- Modify the donation description: Include specific language that describes the type of donation and its intended use within your organization.

Next, adapt the donation acknowledgment text to reflect your organization’s tone and approach. Customize it to express gratitude and explain the impact of the donation.

- Personalize the thank-you message: Write a message that speaks to your donor’s contribution, reflecting your organization’s mission and goals.

- Incorporate donation details: Include the donation amount, date, and method of payment for accurate record-keeping and transparency.

Ensure that the template includes legal requirements, such as your organization’s tax-exempt status and any other information necessary for donors to claim tax deductions.

- Tax-exempt status: Clearly state your nonprofit’s tax-exempt number to help donors with their tax filings.

- Legal disclaimers: Add any disclaimers regarding the non-refundable nature of donations, if applicable.

Finally, format the template so it’s easy to read and professional. Use clear fonts, well-spaced sections, and a consistent layout to make it user-friendly and visually appealing.

Legal Requirements for Donation Receipts

Nonprofit organizations must include specific details in donation receipts to comply with legal standards. A receipt should clearly state the donor’s name, the organization’s name, and the donation date. The IRS requires a description of the donation, particularly if it includes goods or services, and the fair market value of any non-monetary contributions.

Monetary Donations

For monetary gifts, the receipt must reflect the amount donated. If the donation is $250 or more, the organization must provide a written acknowledgment of the contribution. This acknowledgment must include a statement on whether the donor received any goods or services in exchange for the donation.

Non-Monetary Donations

If a donor contributes non-cash items, the receipt must describe the items and include a statement that the nonprofit does not provide an estimate of their value. For gifts valued over $500, the donor must file IRS Form 8283, and the nonprofit must sign this form.

How to Handle Donor Information Privacy

Store donor data in secure, encrypted systems. Ensure that sensitive information is only accessible to authorized personnel. Regularly update security protocols to prevent data breaches. Secure access points with strong passwords, multi-factor authentication, and limited permissions.

Limit Data Collection

Collect only necessary details. Avoid gathering excessive information that is not relevant to the donation process. Ask for personal information only when absolutely required and be transparent with donors about why their data is needed.

Inform Donors of Privacy Practices

Clearly communicate your privacy policies and practices. Provide donors with an easy-to-read document explaining how their data will be handled, stored, and protected. Assure them that their personal details will not be shared without consent, except when legally required.

Review your privacy practices regularly to stay compliant with data protection regulations. Be responsive to inquiries regarding data privacy, and offer donors options to update or delete their personal information if desired.

Tracking Donations with Digital Receipts

Digital receipts provide a streamlined method for tracking donations, ensuring that records are both accessible and secure. By adopting a system for issuing digital receipts, nonprofit organizations can offer donors an efficient way to monitor their contributions without the need for paper-based records.

Ensure your receipt includes key details such as the donation amount, date, nonprofit’s name, and the donor’s information. A digital receipt should be easily retrievable, so keeping a well-organized database is essential. Use cloud storage or secure servers to store records that can be accessed by both your team and donors.

| Key Element | Description |

|---|---|

| Donor Information | Name, contact details, and donation history |

| Donation Amount | Exact contribution, including any applicable fees |

| Date of Donation | The specific date of the contribution |

| Tax Deductibility | Confirmation of eligibility for tax deductions, if applicable |

By using digital receipts, your nonprofit can automate the tracking process, reduce administrative costs, and provide donors with an easy-to-use system for keeping track of their giving. Implementing a digital receipt system can also ensure accuracy, minimizing human error in record-keeping.

Additionally, these receipts serve as a reliable backup for both your organization and the donor. The digital format ensures that records won’t be lost or damaged, and they can be easily shared for verification purposes. Set up automated reminders or follow-up emails with receipts for added convenience for both parties.

Common Mistakes to Avoid in Receipt Templates

Make sure to include the correct donation amount. If the donor gives $100, the receipt should reflect exactly that, not an approximation.

- Incorrect Date: Always use the exact date of the donation. This helps both the donor and your organization track their charitable contributions accurately.

- Missing or Vague Descriptions: Be clear about what the donation is for. Instead of using “general donation,” specify if it’s for a particular project or cause.

- Failure to Include Nonprofit Details: Include your organization’s full legal name, address, and tax-exempt status. This information is needed for tax purposes.

- Unclear Tax Deductibility Statement: State whether the donation is tax-deductible, and include a disclaimer that no goods or services were provided in exchange, if applicable.

- Lack of Contact Information: Providing contact information on the receipt makes it easier for donors to reach out with any questions.

- Missing Receipt Number: Including a unique receipt number helps you keep records organized and allows donors to easily reference their contributions.

Avoid these mistakes to ensure your receipts are clear, accurate, and compliant with legal and tax standards.