Creating a receipt for donations requires clear and accurate details to ensure both transparency and legal compliance. A simple, well-organized donation receipt not only helps donors keep track of their contributions but also ensures that nonprofits can provide proper documentation for tax purposes.

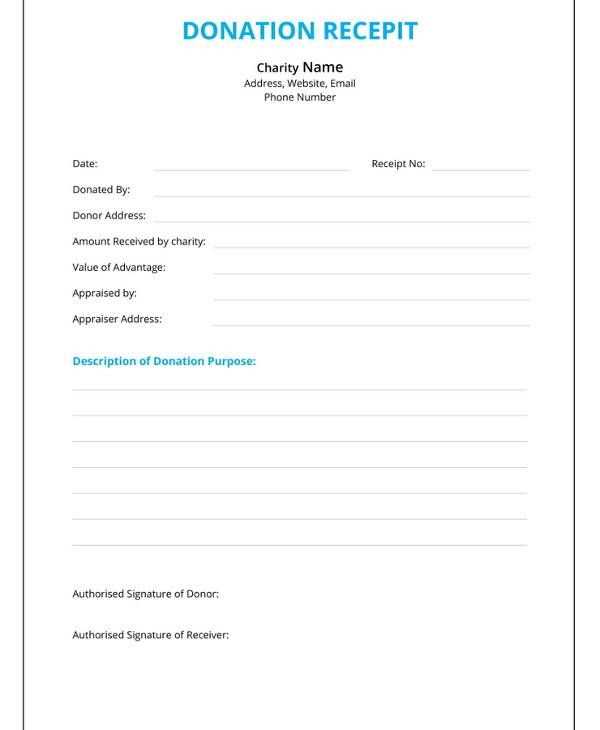

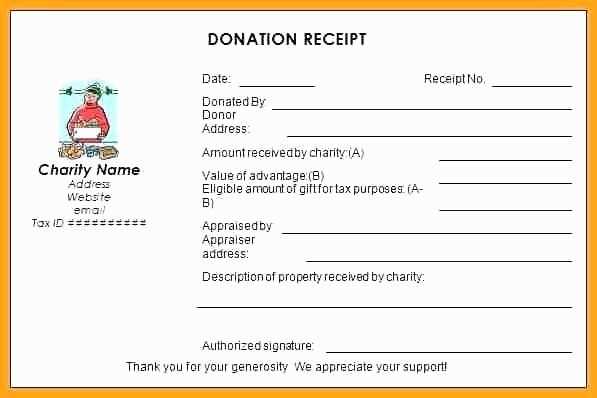

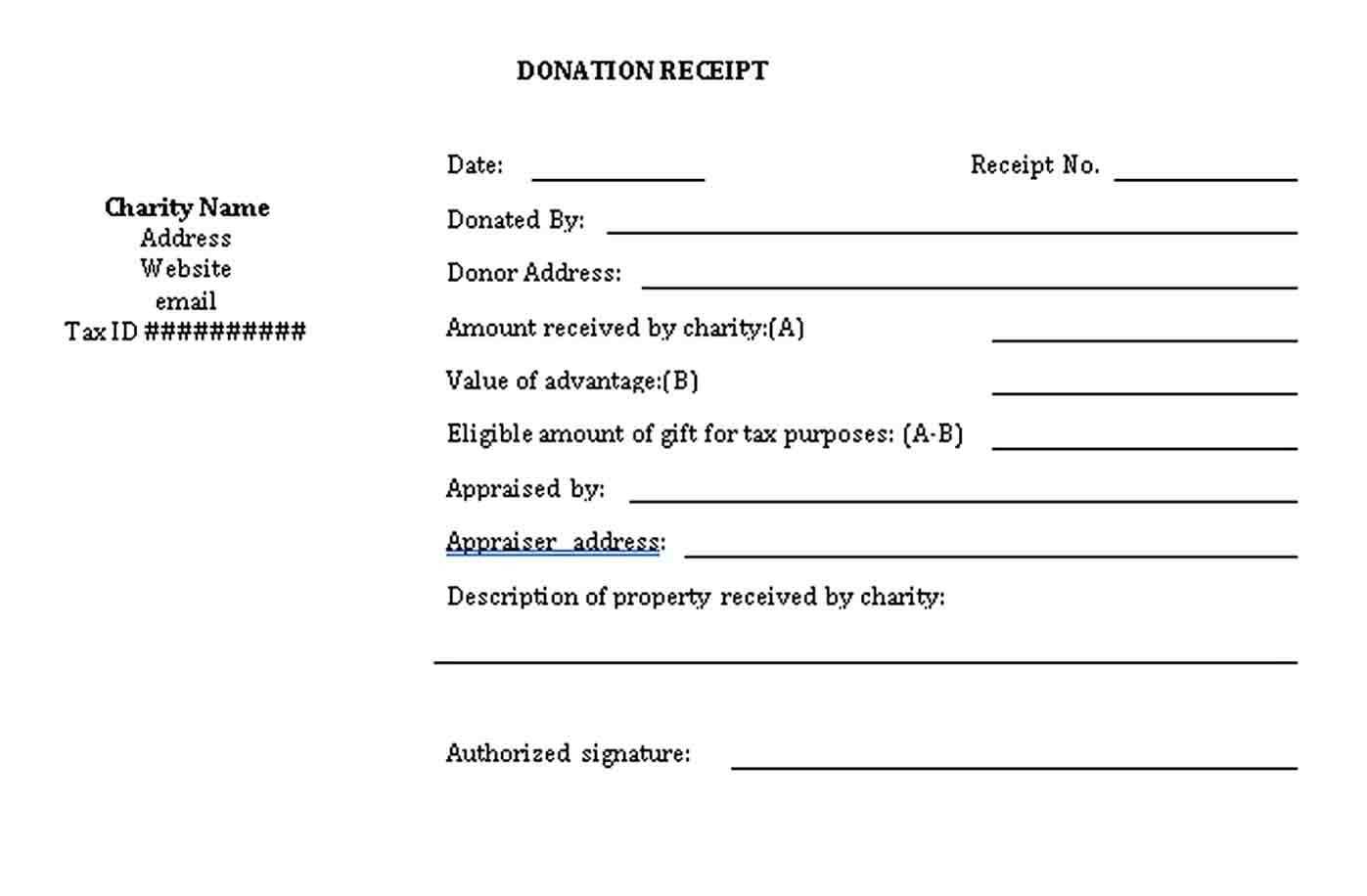

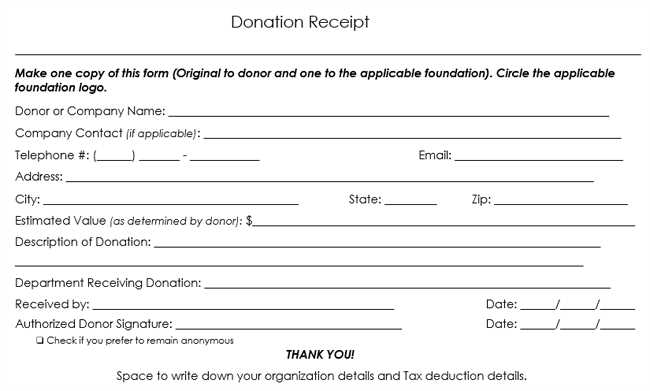

Start by including the name of the nonprofit organization, its official address, and tax identification number (TIN). This makes it easy for donors to verify the legitimacy of the donation. Include the donor’s name and address, as well as the amount donated, and specify the date of the donation. If the donation was made in-kind, be sure to provide a description of the items received along with their estimated value.

Next, it’s helpful to add a statement confirming that the nonprofit did not provide any goods or services in exchange for the donation, or if they did, specify what those goods or services were and their value. This is key for tax reporting purposes. For cash donations, make sure to clearly indicate the amount and for non-cash gifts, include the method of valuation.

Lastly, finish with a statement of gratitude for the donor’s contribution. A warm and sincere thank you adds a personal touch and encourages ongoing support. Keep your receipts concise, but comprehensive enough to fulfill legal requirements and maintain donor trust.

Here is the revised version:

Make sure your donation receipt includes the donor’s name, the amount donated, and the date of the donation. The organization’s name and contact details should also be clearly stated.

Key Information to Include:

Provide a statement confirming that no goods or services were exchanged for the donation, unless applicable. This will clarify the nature of the transaction and ensure compliance with tax regulations. A thank-you message is always a good touch but should not overshadow the necessary details.

Consider Adding Additional Notes:

If your organization is registered as a charity, include the tax-exempt status number or EIN. This information helps donors with their tax filings. Keep the layout clear and readable to avoid confusion during tax season.

Receipt Template for Donations

To create a legally compliant donation receipt, ensure it contains all the required information. The receipt should provide clarity and transparency for both the donor and the organization. Begin with the name and address of the organization, followed by the donor’s name and address. Include the date of the donation, a description of the contribution (without specifying the value of non-cash donations), and the donation amount. If the donor received any goods or services in exchange, include a description and a good-faith estimate of the value. Ensure the receipt is signed by an authorized individual in your organization.

The key information to include is: the organization’s name, the donation amount, the date, and a statement confirming whether the donor received any goods or services. This is required to substantiate the donation and provide the donor with necessary documentation for tax purposes. Also, ensure your receipt includes a statement that no goods or services were exchanged for the donation, if applicable. This assures the donor of the full tax-deductible status of their contribution.

Customize your receipt template based on the type of contribution. For monetary donations, provide the total amount donated and a clear statement that no goods or services were provided in exchange. For non-cash donations, specify the type of property donated (e.g., clothing, furniture) and provide a general description. If applicable, mention whether the donation was part of a fundraising event or campaign. Keep your templates adaptable to different donation scenarios while maintaining compliance with local tax laws.