If you’re looking for a reliable and professional stock donation receipt template, you’re in the right place. A well-crafted receipt is essential for both the donor and the charity, ensuring clarity for tax purposes and maintaining accurate records. It should include the donor’s details, the number of shares donated, their value on the donation date, and the charity’s acknowledgment. This information is necessary to comply with IRS guidelines and provide both parties with a clear record of the transaction.

The receipt template should list the donor’s name, address, and contact information. Additionally, include a description of the donated stocks, such as the name of the company and the number of shares donated. It’s also important to state the fair market value of the stocks on the date of donation. This helps ensure the donor can claim a proper tax deduction and avoid any complications in the future.

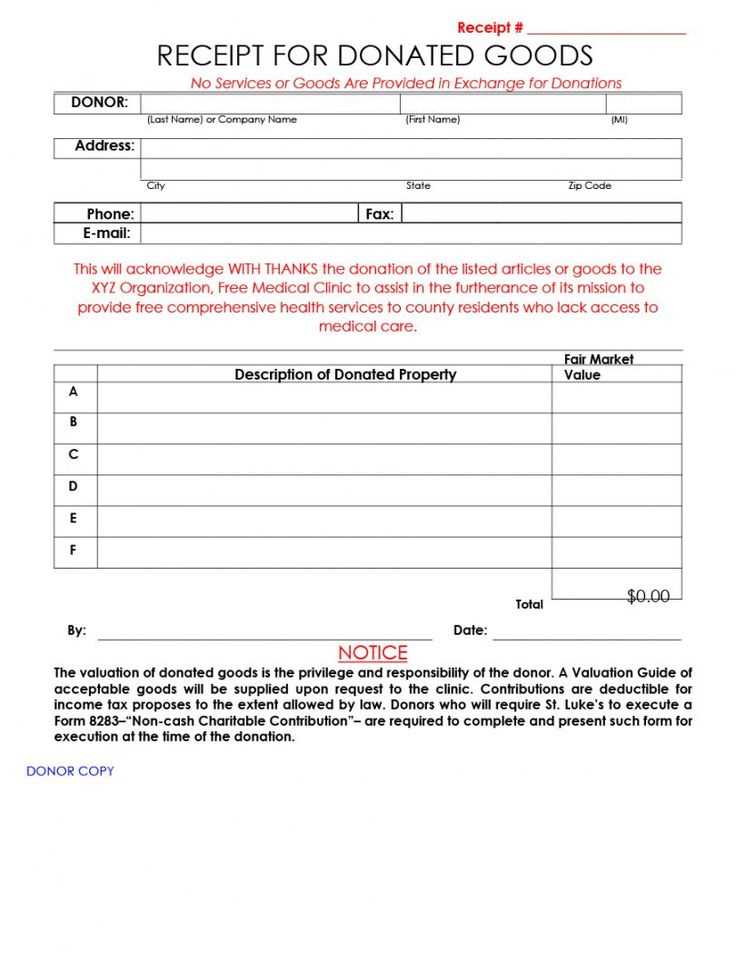

Make sure the receipt includes a statement confirming that no goods or services were provided in exchange for the donation, as this is a requirement for charitable contributions. If the donation exceeds $500, the donor may need to file additional forms with the IRS, so providing a receipt with accurate details is critical. This simple yet thorough template ensures both clarity and compliance, making the donation process smoother for everyone involved.

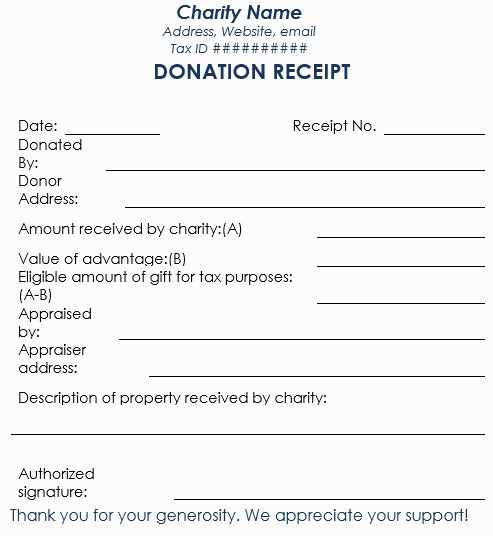

Stock Donation Receipt Template

Ensure your stock donation receipt includes all necessary details to comply with IRS regulations and provide transparency for donors. Use the following structured format:

| Field | Description |

|---|---|

| Donor’s Name | Full name of the individual or entity making the donation. |

| Organization Name | Registered name of the nonprofit receiving the stock donation. |

| Date of Donation | Exact date when the stock was transferred to the nonprofit. |

| Stock Details | Company name, stock ticker, and number of shares donated. |

| Value of Stock | Fair market value on the date of transfer (donors must determine this for tax purposes). |

| Brokerage Information | Name of the brokerage firm handling the transfer (if applicable). |

| Nonprofit EIN | Employer Identification Number of the receiving organization. |

| Statement of No Goods or Services | Confirmation that no goods or services were provided in exchange for the donation. |

| Authorized Signature | Signature of an official representative of the nonprofit. |

Provide this receipt promptly after receiving the stock to help donors with their tax documentation. Keep a copy for your records and ensure compliance with IRS guidelines.

How to Properly Format a Stock Donation Receipt

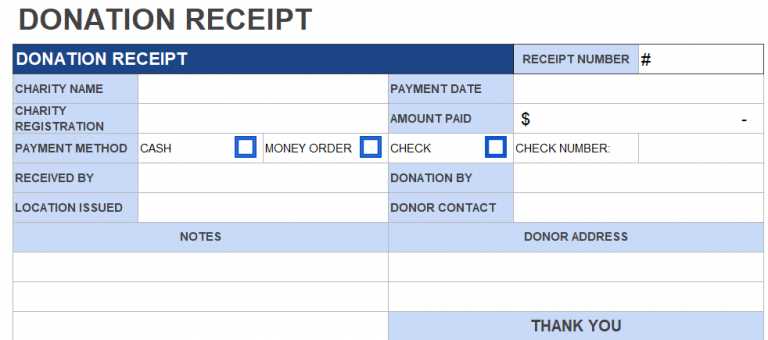

Include all required details to ensure compliance with tax regulations and provide clarity for donors. A complete stock donation receipt should contain:

- Donor’s Information: Full name and address.

- Recipient Organization: Legal name, EIN, and address.

- Stock Details: Name of the stock, number of shares, and transfer date.

- Value Confirmation: Statement indicating the organization does not assign a monetary value.

- Tax Compliance Statement: Note specifying that no goods or services were provided in exchange.

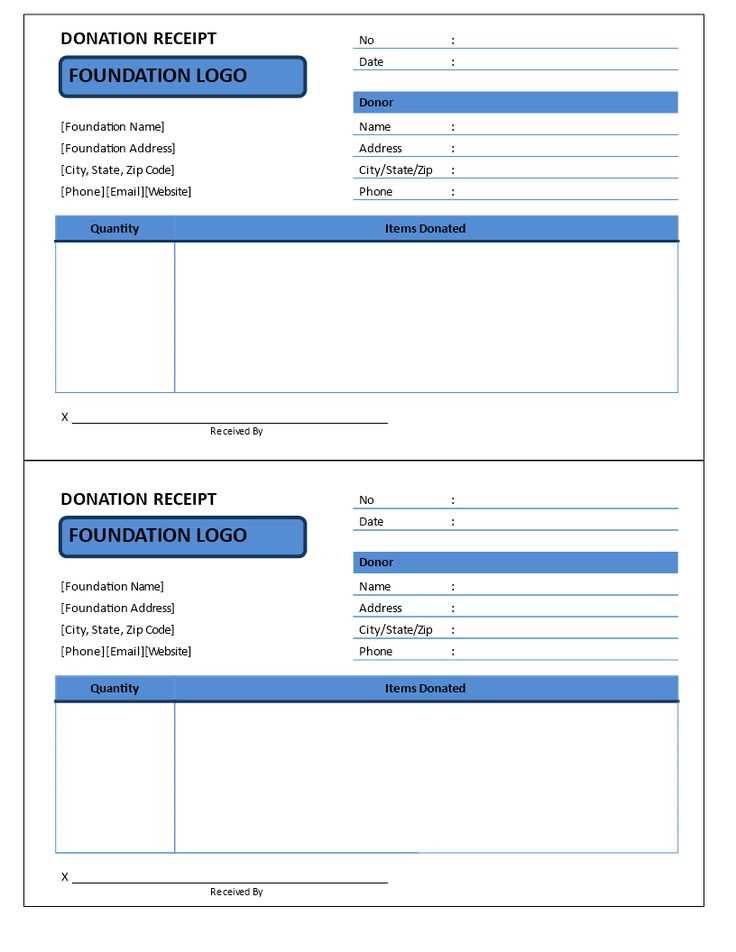

Use clear formatting with distinct sections. A structured layout enhances readability:

- Header: Organization’s name and contact details.

- Body: Donation specifics, including stock information.

- Closing: Signature of an authorized representative and date.

Ensure the receipt is delivered promptly, preferably as a PDF, for secure recordkeeping.

Understanding Valuation of Donated Stocks for Tax Purposes

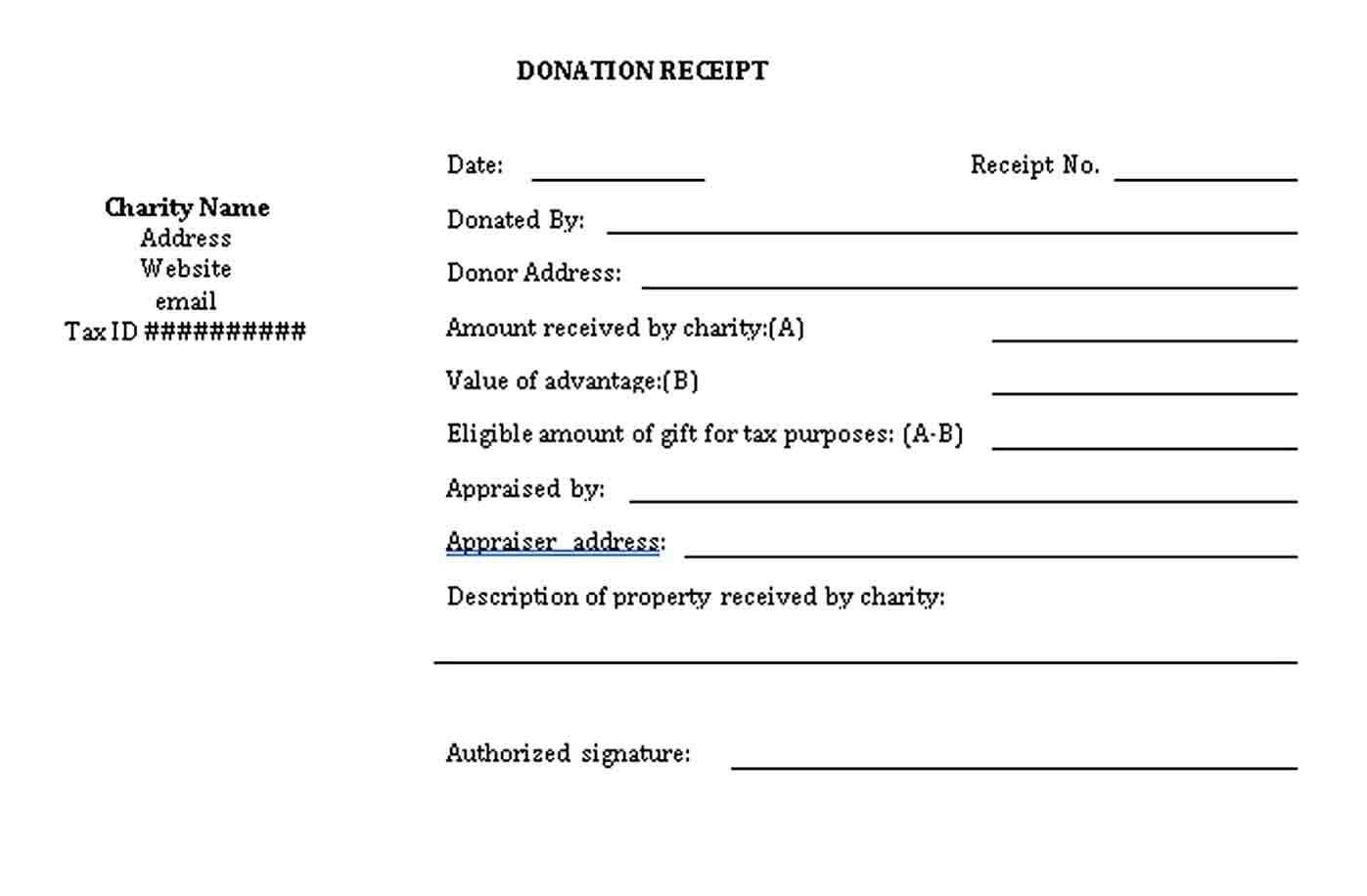

Use the fair market value (FMV) of donated stocks on the date of the transfer to determine the deductible amount. For publicly traded stocks, FMV is the average of the highest and lowest selling prices on that day. If the stock isn’t publicly traded, obtain a qualified appraisal to support its value.

Holding period matters. If stocks are held for over a year, donors can deduct FMV. If held for a year or less, the deduction is limited to the original purchase price (cost basis). Charities selling stocks immediately after donation do not impact the donor’s deduction.

Documentation is key. For donations over $500, file IRS Form 8283. If the value exceeds $5,000, a written appraisal is required. Retain brokerage statements or transaction records as proof.

To maximize tax benefits, donate stocks with the highest unrealized gains instead of selling them first. This avoids capital gains tax while providing a full deduction. If donating depreciated stocks, selling them first and donating the cash may be more advantageous to claim both capital loss and charitable deduction.

Common Mistakes to Avoid When Issuing a Stock Donation Receipt

Omitting Key Details – A receipt must include the donor’s name, the organization’s name, the date of the donation, a description of the donated stock, and a statement confirming that no goods or services were exchanged. Missing any of these elements can make the receipt invalid for tax purposes.

Incorrect Valuation

The issuing organization should not assign a dollar value to the donated stock. Instead, the receipt should only describe the shares donated. The donor is responsible for determining the fair market value based on IRS guidelines.

Failure to Specify Contribution Type

Avoid generic language. Clearly state that the donation was in the form of publicly traded securities and specify the number of shares and the company name. This prevents confusion and ensures compliance with tax regulations.

Not Providing a Timely Receipt – Delayed receipts can cause issues for donors during tax filing. Aim to provide documentation promptly after the donation is received and processed.

Neglecting IRS Compliance – Ensure the receipt follows IRS Publication 1771 requirements. If the donation exceeds $250, include a statement confirming whether the donor received any goods or services in exchange for the contribution.

Avoiding these errors helps maintain compliance and ensures donors receive the necessary documentation for tax reporting.