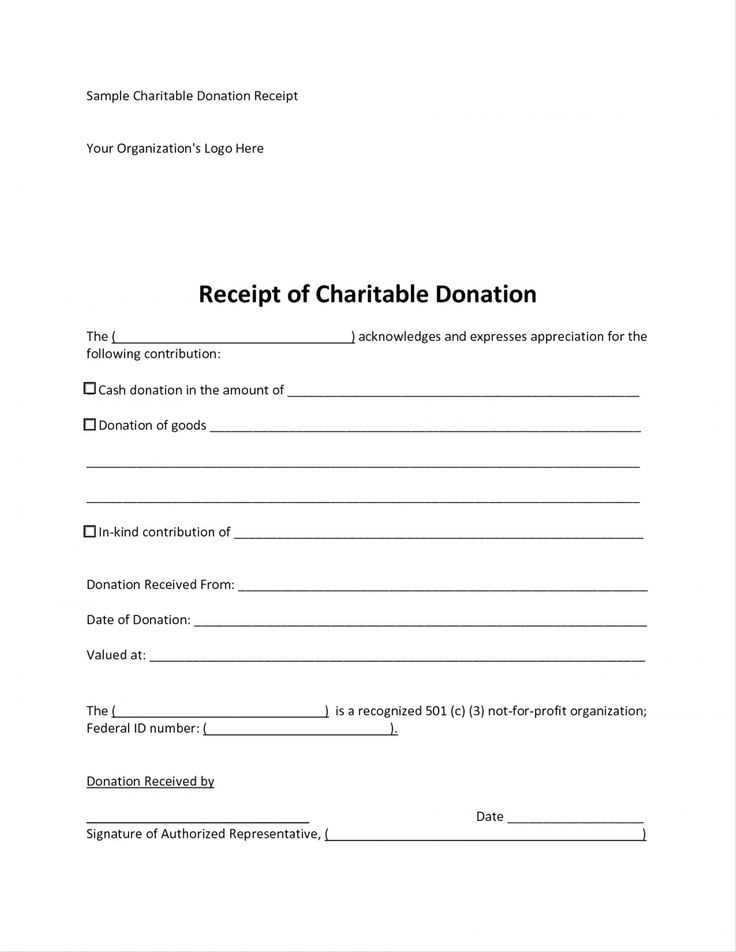

Provide a clear and concise donation receipt for each contribution to maintain transparency and ensure tax compliance. A donation receipt template helps simplify this process by outlining all necessary details, including the donor’s information, the donated amount, and the charity’s credentials.

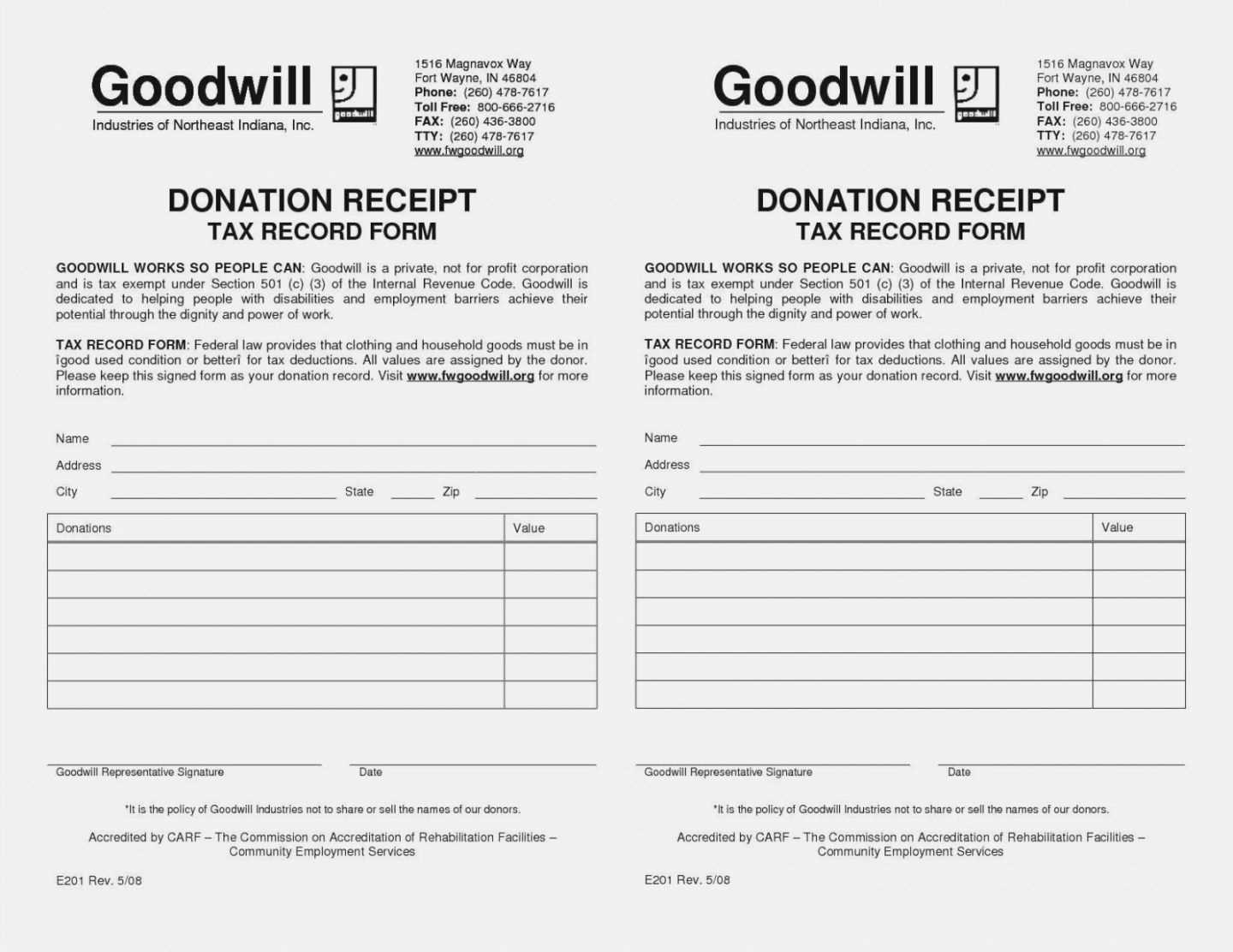

Make sure the template includes specific data, such as the charity’s name, address, and tax-exempt status, to meet legal requirements. This ensures donors can claim deductions with no complications. Use a simple layout with fields like the date of the donation, the value of the gift, and a description of the item, if applicable.

When preparing donation receipts, clarity and accuracy are key. Include your organization’s EIN (Employer Identification Number) and ensure the donor receives the receipt within the required time frame. This will make the process smoother for both parties, helping your supporters feel confident in their charitable contributions.

Here is the corrected version:

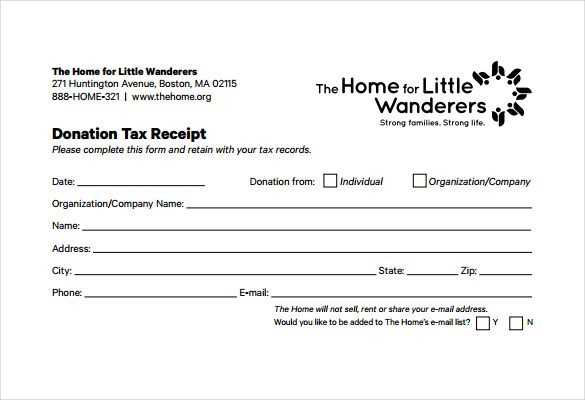

Make sure the tax donation receipt template includes the donor’s full name, address, and donation details. Clearly state the amount of the donation, along with the date it was received. If applicable, mention the fair market value of any goods or services provided in exchange for the donation.

Donor Information

Provide the donor’s name and contact details. This should include their address and phone number if available. Ensure that the details match the information on the donation record to avoid confusion.

Donation Details

Specify the amount of the monetary donation, or if the donation is of property, describe the items given. Include a statement confirming whether or not any goods or services were exchanged for the donation and, if so, provide a description and estimated value.

- Tax Donation Receipt Template

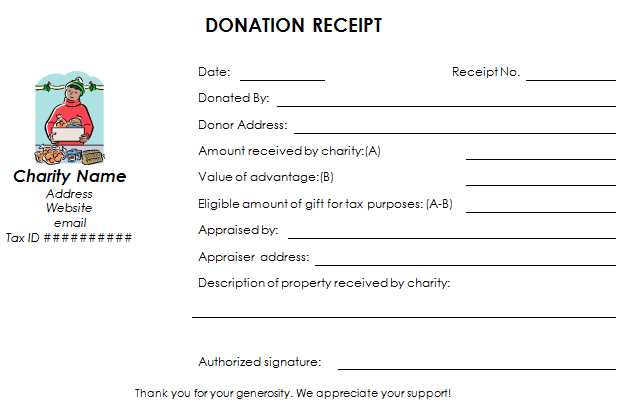

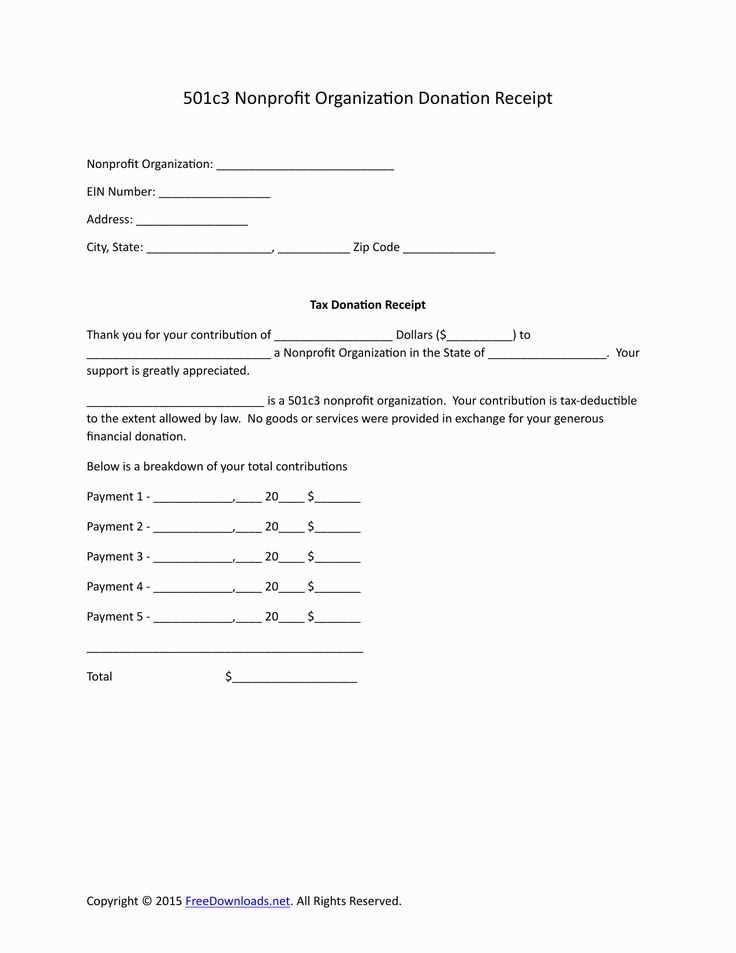

A tax donation receipt template should include several key elements to ensure compliance and provide donors with the necessary documentation for their tax filings. Start by including the charity’s name, address, and tax identification number (TIN). This confirms the legitimacy of the organization receiving the donation.

Next, list the donor’s information–name and address–to ensure the receipt is tied to the right individual or entity. It’s also important to specify the date of the donation and the amount donated, as well as a description of any non-cash items if applicable.

For donations of property or services, include a brief description of the item, its condition (if relevant), and its fair market value. If the donor received any goods or services in exchange for their donation, note this and include the fair market value of those items, subtracting them from the total donation amount to reflect the deductible portion.

Finally, include a statement confirming that no goods or services were provided in exchange for the donation if that is the case. This is crucial for tax deductions. It’s also recommended to add a space for the charity’s representative to sign and date the receipt.

By including these details, your tax donation receipt will meet the necessary requirements for both your organization and your donors.

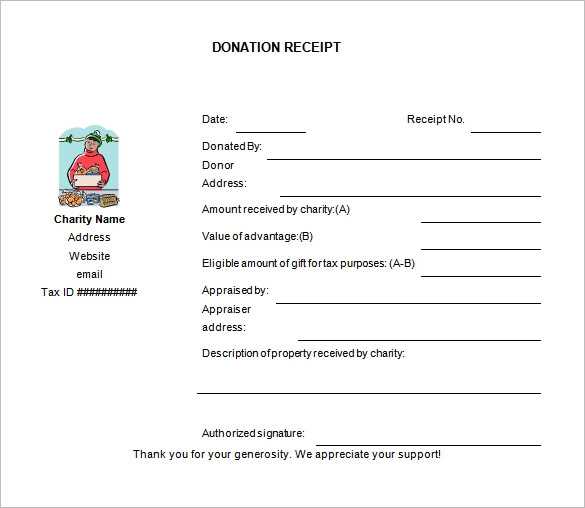

To create a tax donation receipt for charitable contributions, follow these straightforward steps to ensure the document meets IRS guidelines:

- Include the organization’s details: Provide the name, address, and tax-exempt status of the charity. This can typically be found on the charity’s website or tax filings.

- State the donation amount: Clearly mention the monetary value of the donation. If the contribution is in-kind, describe the donated items along with their fair market value.

- Include the date of donation: The receipt must include the exact date when the donation was made to keep the record accurate.

- Describe the donation method: Note if the donation was made via check, credit card, or in cash, to clarify how the funds were transferred.

- Declare no goods or services were provided: If the donor did not receive anything in return for the donation, include a statement confirming this, as required by IRS rules for tax-deductible donations.

- Issue a unique receipt number: Assign a unique identifier to each donation receipt for tracking and organizational purposes.

- Provide a thank-you note: Including a personal message of thanks can reinforce the donor’s positive experience and encourage future contributions.

Ensure the receipt is issued promptly after the donation and keep a copy for your own records. Properly documenting donations benefits both the donor and the charity, ensuring transparency and compliance with tax regulations.

Ensure that your tax donation receipt includes the following details for accuracy and compliance:

Donor Information: Clearly list the donor’s name, address, and contact information. This helps in matching the receipt to the donor’s records for tax purposes.

Donation Date: Include the exact date when the donation was made. This helps determine the year for tax deductions and ensures proper record-keeping.

Donation Amount: Specify the exact value of the donation. If it’s monetary, state the cash amount. For non-cash donations, provide a description of the items along with their estimated value.

Organization Information: Include the name, address, and contact details of your organization. Adding your charity registration number is also recommended for legitimacy.

Tax-Exempt Status: Indicate whether your organization is tax-exempt. This assures the donor that their contribution is eligible for tax deductions. Include your tax-exempt number if applicable.

Purpose of the Donation: If applicable, state the specific cause or program the donation supports. This adds transparency and helps the donor understand how their contribution will be used.

Donor Acknowledgment: Add a statement confirming that the donor did not receive any goods or services in exchange for the donation, which is required for tax deduction purposes.

Signature: Include a signature from an authorized representative of the organization to validate the receipt.

Ensure the receipt includes the correct donor and charity information. Missing or inaccurate names and addresses can lead to confusion and potential legal issues. Double-check that both the donor’s and organization’s details are clearly listed.

Include the Date and Amount of Donation

Always specify the exact date of the donation and the amount received. Without this information, the receipt lacks clarity and may not meet legal standards for tax purposes. It’s important to include both the total amount and any breakdowns of donations, such as in-kind gifts.

Do Not Forget the Tax-Exempt Status

If the organization is a tax-exempt entity, include its tax-exempt number. Failing to do so may render the receipt invalid for tax deductions. Verify the number and ensure it’s clearly visible on the template.

Be Specific About Non-Cash Donations

For non-cash donations, provide a detailed description of the item(s) donated. It’s also crucial to indicate whether the donor received any goods or services in return for their contribution. The IRS requires this information for donations over a certain value.

Review for Legal Compliance

Each country or region may have specific legal requirements for donation receipts. Make sure your template complies with the local regulations. Failing to follow these could cause issues with audits or tax filings.

Avoid generic language. Make sure the receipt template is tailored to your organization’s policies and donor expectations. Specific, accurate details build trust and ensure smooth operations with tax authorities.

Include a clear heading at the top of your tax donation receipt template, such as “Donation Receipt” or “Tax Deductible Donation Receipt”. This ensures recipients immediately understand the document’s purpose.

Provide the name and contact information of your organization. Make sure this section is easy to locate. This can be placed at the top or bottom of the receipt.

Clearly state the donation amount, whether it is a monetary contribution or an itemized list of donated goods. For donations in-kind, provide a description and estimated value of each item.

Specify the date of the donation and the method of contribution (e.g., cash, check, credit card, or goods). This detail is necessary for accurate record-keeping and tax reporting.

Include a statement indicating that the donor received no goods or services in exchange for the donation, which is required for tax purposes. If any goods or services were provided, mention the fair market value of those items.

Always sign the receipt with the name and position of the individual authorizing the receipt. This adds authenticity and ensures proper documentation for both parties.

If applicable, include any additional legal or tax-specific language required by local laws or regulations.