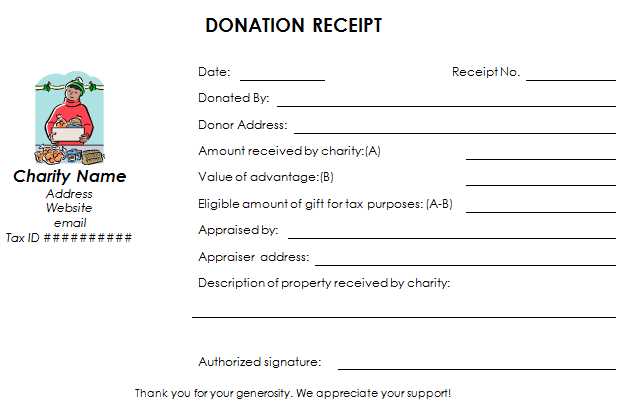

Provide donors with a tax-exempt donation receipt to ensure they can claim their contributions for tax deductions. A well-structured template should include key details like the donor’s name, the donation amount, the date of the donation, and a statement confirming the organization’s tax-exempt status. These elements help streamline the receipt process for both the donor and the nonprofit organization.

The receipt must specify whether the donation was in cash or property, and if any goods or services were exchanged, this should be clearly noted. If the donation exceeds a certain value, include the fair market value of the goods or services provided. This transparency prevents misunderstandings and ensures compliance with tax regulations.

Consider including a section for the donor’s contact information and a thank-you note to enhance donor relationships. Customize your template to reflect the unique needs of your nonprofit, ensuring it aligns with legal requirements and fosters trust with your supporters.

Here’s the revised version:

Use this template for a tax-exempt donation receipt:

Organization Name: [Organization Name]

Address: [Organization Address]

Phone: [Phone Number]

Email: [Email Address]

Donor Information:

Name: [Donor Name]

Address: [Donor Address]

Email: [Donor Email]

Donation Details:

Amount: [Donation Amount]

Donation Date: [Date]

Payment Method: [Payment Method]

This receipt confirms that the donation is tax-exempt under section 501(c)(3) of the Internal Revenue Code. Please retain this document for your records.

Authorized Signature: ___________________

- Tax Exempt Donation Receipt Template

A tax-exempt donation receipt should include specific information to ensure it meets the requirements of the IRS. It must clearly state that the donation is tax-deductible and contain the organization’s name, address, and tax-exempt status. Include the donor’s name, the date of the donation, and the amount or description of the items donated. If goods or services were provided in exchange for the donation, list them and provide their fair market value.

Use the following format for your donation receipt:

- Organization Name and Tax-Exempt Status: Include the official name and indicate your tax-exempt status, such as “501(c)(3) organization.”

- Donor Information: Record the donor’s full name and address.

- Date of Donation: Clearly state the date the donation was received.

- Donation Amount or Description: Specify the amount for cash donations or a detailed description of non-cash items donated. Do not assign a value to non-cash donations.

- Value of Goods or Services: If the donor received goods or services in return, provide an estimated fair market value. Subtract this from the total amount to determine the tax-deductible portion.

- Signature: Include the signature of an authorized person from the organization, such as the treasurer or executive director.

Ensure that the receipt is clear and accurate. A well-structured document will not only serve the donor but also meet IRS guidelines for tax purposes.

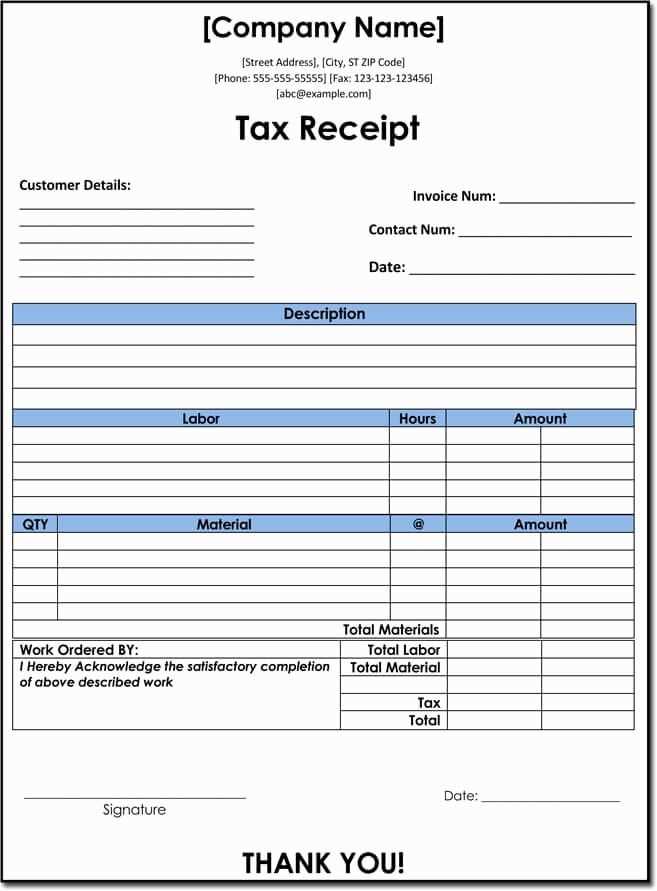

Include the following key elements to ensure your tax exempt receipt complies with regulations:

1. Donor and Organization Information

List the donor’s name and address, as well as your organization’s name, address, and tax identification number (TIN). This ensures proper record-keeping for both parties.

2. Donation Details

Clearly specify the date of the donation, the donation amount, and whether the contribution was in cash or goods. If goods were donated, provide a description and estimate their fair market value.

3. Tax Exempt Status Statement

State that the organization is tax-exempt under IRS section 501(c)(3), and confirm that the donor did not receive goods or services in exchange for the donation, or describe any benefits received if applicable.

4. Language for Non-Cash Donations

If the donation includes property, include a statement like “No goods or services were provided in exchange for this donation.” For higher-value items, mention the donor’s responsibility for appraising the property.

| Element | Description |

|---|---|

| Donor and Organization Information | Name, address, and TIN of both parties |

| Donation Details | Amount, date, and type (cash or goods) |

| Tax Exempt Status Statement | 501(c)(3) status and whether benefits were received |

| Language for Non-Cash Donations | Statement on goods or services provided and appraisal responsibility |

Make sure your receipt is accurate and clear to meet IRS guidelines and to provide the donor with all the necessary information for their tax records.

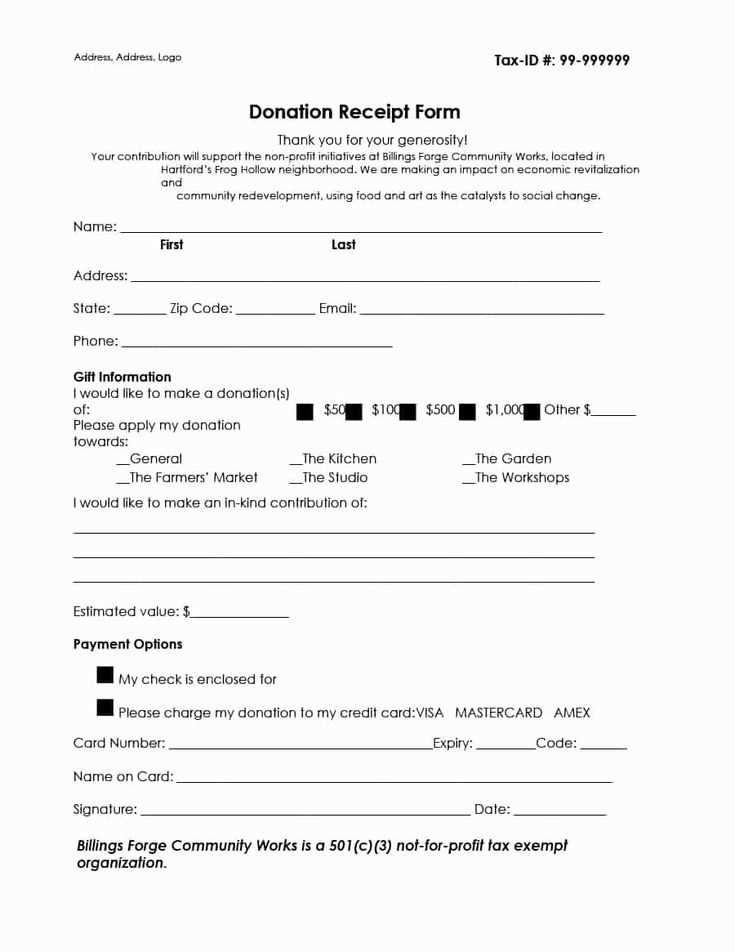

Include the following key elements in the tax-exempt donation receipt template to ensure clarity and compliance:

- Donor Information: Clearly state the donor’s name and address to confirm the identity of the individual or entity making the contribution.

- Organization Information: Include the charity’s name, address, and tax-exempt status, as well as the organization’s EIN (Employer Identification Number).

- Donation Amount: Specify the exact monetary value of the donation. For non-cash donations, describe the donated items or services and include an estimated value.

- Date of Donation: Indicate the exact date the donation was made, ensuring accuracy for tax reporting purposes.

- Statement of No Goods or Services Provided: If applicable, state that no goods or services were provided in exchange for the donation, which is necessary for tax exemption purposes.

- Signature: A representative from the organization must sign the receipt to validate it. This signature confirms the receipt and confirms compliance with tax-exempt status.

Each type of donation requires specific information to be clearly reflected on the receipt. Adjust the template based on the donation’s nature to ensure accuracy and compliance.

- Monetary Donations: Include the donation amount, date, and method (e.g., cash, check, credit card). Acknowledging whether the donor received any goods or services in exchange for the donation is also necessary.

- In-Kind Donations: Provide a detailed description of the donated item(s) with an estimated value. If an appraiser was involved, note the appraisal details to ensure the donor’s records are complete.

- Charitable Pledges: For pledges, specify the total amount pledged and the payment schedule. Include the amount already paid and the remaining balance. Update the receipt with each payment made.

- Donations of Stocks or Securities: Record the donation’s fair market value at the time of transfer, and if applicable, the donation’s date of transfer. Specify if the donor received any compensation in exchange.

- Event-Based Donations: If the donation was made through an event (such as a gala or fundraiser), include the fair market value of any goods or services received. Subtract this from the total donation amount to calculate the tax-deductible portion.

Update the receipt format accordingly to fit each donation type and ensure transparency in the details provided.

Tax-exempt donation receipts must include specific details to comply with IRS guidelines. Clearly state the donor’s name, the organization’s name, and its tax-exempt status. Mention the date of the donation and the amount contributed. If the donation includes goods or services, describe them and provide an estimate of their fair market value. Ensure the receipt clearly states whether the donor received any goods or services in return for the contribution.

In case of a non-cash donation, list a description of the property donated and, if applicable, the method of valuation. For donations over $250, a written acknowledgment is required, including the statement that no goods or services were provided in exchange for the donation. Make sure the receipt is issued in a timely manner, typically within a reasonable period after the donation is made.

Failure to include these key elements may result in the rejection of the donor’s tax deduction claim. Review IRS requirements regularly to ensure your receipts remain compliant and avoid any issues during tax filings.

Use a clear and structured format for online donation receipts. Ensure all necessary information is included and easy to find. This helps donors keep track of their contributions and helps organizations remain compliant with tax regulations.

Key Information to Include

Start with the organization’s name and contact details at the top. Follow with the donor’s name, donation date, and the total amount given. If the donation is in-kind, specify the item or service and its fair market value. Include a statement confirming whether the donation is tax-exempt or not.

Format Details

Present the data in a clean layout with legible fonts. Clearly separate sections using white space. Use headings to highlight key details such as the donation date and amount. Provide a unique receipt number for reference. This makes the receipt easy to track in case of questions or future audits.

End the receipt with a thank-you message to show appreciation for the donor’s support. Make sure the message is personalized but concise.

Issue donation receipts promptly after receiving a contribution. Include all required information, such as the donor’s name, donation amount, date, and a statement confirming the donation is tax-exempt.

Ensure the receipt reflects the charity’s legal status. Clearly state the organization’s tax-exempt number or registration details to verify legitimacy.

Provide a detailed description of the donation. For non-cash donations, include specifics like the type of item or service, its estimated fair market value, and any appraisal or documentation related to its value.

Include a statement that no goods or services were provided in exchange for the donation, if applicable. This helps the donor qualify for tax exemptions.

Keep a copy of all receipts for your records, along with any correspondence related to the donation, in case of audit or verification requirements.

Tax Exempt Donation Receipt Template

Include the full legal name of the charitable organization at the top of the receipt. Clearly state that the donation is tax-exempt. Specify the amount donated, whether it is monetary or in-kind, and provide a description of the item(s) if applicable. Indicate the date of the donation and the donor’s name. If the donation was in goods, include an estimation of their fair market value. State if any goods or services were provided in exchange for the donation, as this affects the deductible amount.

Ensure that the receipt includes the organization’s IRS tax-exempt status, as well as its federal identification number. The donor must also be informed that they received no goods or services in return for the gift if that is the case. This must be clearly marked for transparency and compliance with IRS guidelines.

Finally, sign and date the receipt for authenticity. Keep a copy for your records, as well as providing one to the donor for their tax filing purposes.