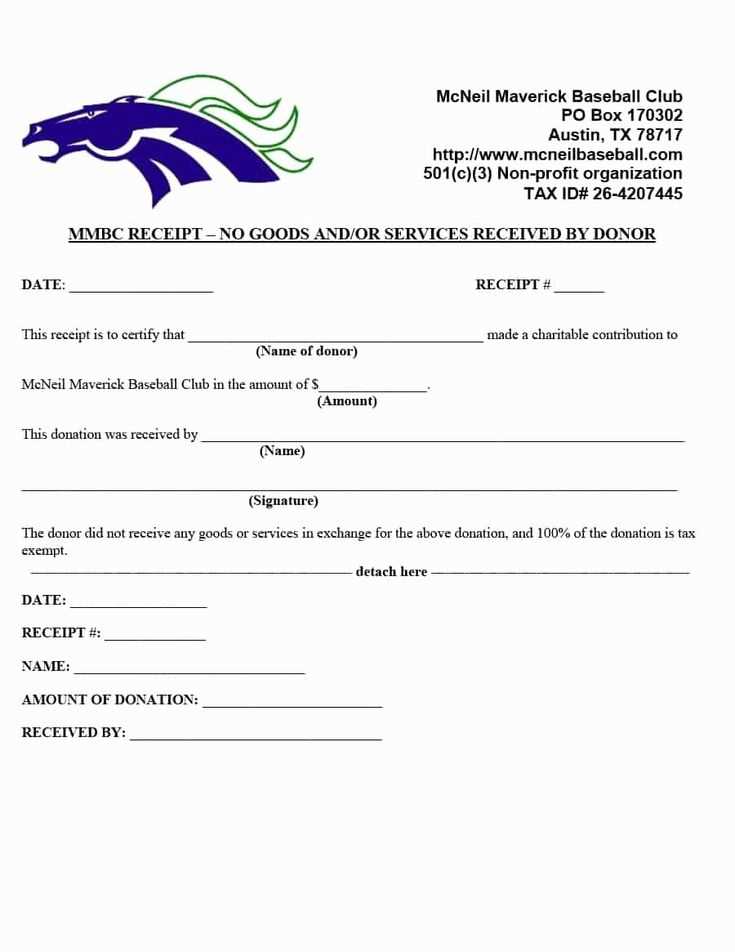

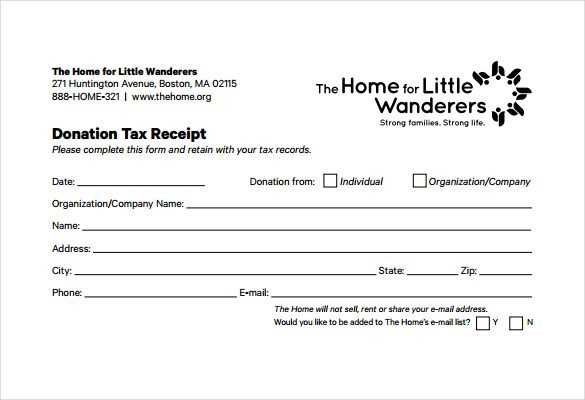

To create a donation receipt letter for tax purposes, begin with a clear header identifying the organization’s name, address, and contact information. This makes it easy for both the donor and the tax authorities to verify the legitimacy of the donation. Always include the date of the donation and the amount or value of the contribution.

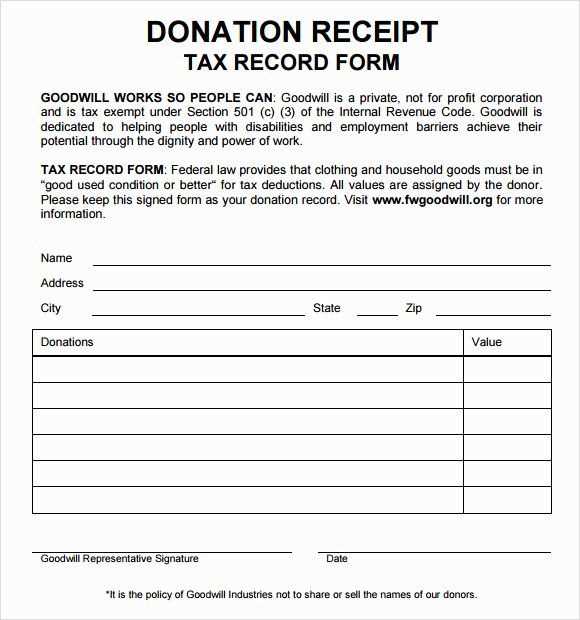

Next, detail the nature of the donation. If it’s cash, state the amount clearly. For non-cash donations, provide a description of the items donated along with an estimate of their value. If the donor received any goods or services in exchange for the donation, include this information as well. Be specific about the value of those goods or services to ensure the donor knows the appropriate amount they can claim.

Make sure the letter includes a statement affirming the donor did not receive any goods or services in exchange for the donation, unless they did. This ensures the letter is valid for tax deductions. Close the letter with a thank you note and a reminder of the tax year, which helps the donor file their tax return correctly.

Here’s the revised version, minimizing repetitions:

To create a tax receipt donation letter, make sure to clearly outline the donor’s contribution while following IRS guidelines. Include specific details such as the donation amount, whether it was in cash or goods, and the date it was received. The letter should confirm that no goods or services were exchanged for the donation, as this is a key requirement for tax purposes.

Key Elements to Include:

- Donor’s Information: Full name and address of the donor.

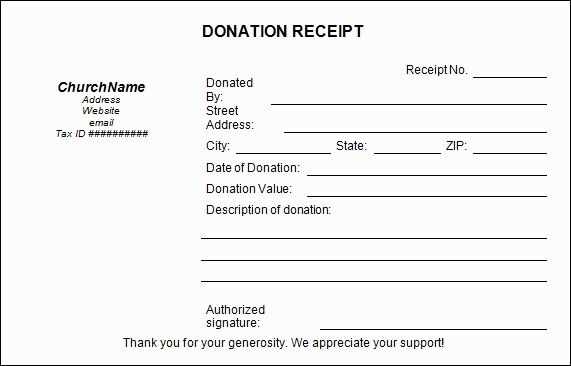

- Organization’s Information: Name, address, and tax identification number of the organization.

- Donation Details: Description of the donation (amount or goods) and the date it was received.

- Non-Exchange Statement: A statement confirming that no goods or services were provided in exchange for the donation.

- Signature: An authorized representative of the organization should sign the letter.

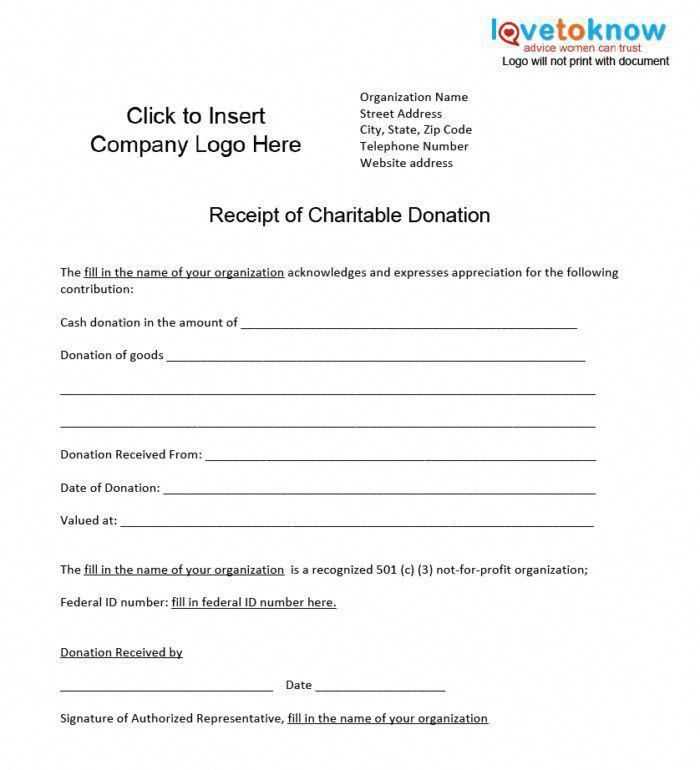

Example Template:

- Donor’s Name: John Doe

- Donation Amount: $500 in cash

- Date: January 15, 2025

- Non-Exchange Clause: “No goods or services were provided in return for this donation.”

This structure ensures the letter meets IRS standards, making it valid for tax purposes. Double-check the accuracy of all information, and ensure the letter is issued promptly to avoid any issues with tax deductions.

- Tax Receipt Donation Letter Template

For a clear and concise donation letter, start by thanking the donor and confirming the gift. Include the following key details:

Key Information to Include

- Donor’s Information: Full name, address, and contact details.

- Organization’s Information: Name, address, and tax-exempt status (IRS or relevant authority).

- Donation Details: Date of donation, donation amount or description of items, and whether the donation was monetary or in-kind.

- Statement of No Goods or Services Provided: A clear statement that no goods or services were exchanged for the donation, if applicable.

- Tax Identification Number (TIN): Include your organization’s TIN to ensure the donor can claim tax deductions.

Sample Template

Dear [Donor’s Name],

On behalf of [Organization Name], I would like to extend our sincere thanks for your generous donation of [description of donation or dollar amount] on [date]. Your contribution will help us [brief description of how the donation will be used].

This letter serves as your tax receipt. No goods or services were exchanged for this donation. Please keep this letter for your tax records. Our Tax Identification Number is [TIN].

We appreciate your support and look forward to keeping you updated on our work. If you have any questions, feel free to contact us at [phone number/email].

Warm regards,

[Your Name]

[Your Title]

[Organization Name]

[Organization Address]

To create an effective donation letter for tax receipts, begin with a clear heading that includes the nonprofit’s name, contact information, and tax ID number. This makes it easier for the donor to identify the organization and use the receipt for tax purposes.

1. Acknowledge the Donation

Immediately thank the donor for their generosity. Specify the amount of the donation and the date it was received. If the donation was in-kind, describe the items donated and their condition.

2. Include Required Legal Information

The letter must state that the organization is a 501(c)(3) nonprofit or another relevant tax-exempt status. This confirms that the donor can claim a deduction. Also, clarify whether any goods or services were provided in exchange for the donation, as this will impact the deductible amount.

3. Specify the Deductible Amount

- If the donation was monetary, list the exact amount contributed.

- If the donation was in-kind, estimate the fair market value of the items donated. Provide a description of the items but avoid placing a dollar value on them unless the donor has already done so.

4. Sign the Letter

End the letter with a signature from the authorized person within the organization, typically the Executive Director or another official. Include their title and the organization’s contact details for any questions.

To ensure tax deduction compliance, provide clear details on the donation. This includes the donor’s full name and address, the charity’s official name and address, and the date of donation. Be specific about the donation amount or fair market value, especially for non-cash donations. Include a description of the donated items if applicable. If the donation exceeds $250, include a statement confirming that no goods or services were provided in exchange, or specify what was received. The letter must also include the charity’s tax-exempt status number for verification purposes.

Make sure to date the donation letter to match the actual donation date, and keep records for your tax filing. If the contribution is above a certain threshold, detailed receipts with additional forms may be required by the IRS. Providing this information will streamline the deduction process and ensure your records are in compliance with tax laws.

Adjust your donation letter to reflect the nature of the gift. For cash donations, emphasize the flexibility of the contribution and express appreciation for their support. Acknowledge how their generosity helps fund specific initiatives or programs.

For in-kind donations, provide detailed information on the item’s value and any specific uses. Be clear about how the donation will directly support your cause or community. Include any relevant tax benefits for donated goods, such as market value for donated property or services.

If the donor contributes stocks or securities, mention the tax advantages of donating these assets. Outline the specific tax deductions available for such donations and confirm how the donor’s contribution is processed for valuation purposes.

For recurring donations, tailor the letter to highlight the ongoing impact of the donor’s commitment. Acknowledge the long-term support and the measurable difference their regular contributions make to your organization.

For corporate donations, recognize the business’s commitment to community involvement and outline the potential corporate social responsibility benefits. Also, mention any partnership opportunities or recognition programs that the donor company can participate in.

Lastly, always customize the tone to align with the donor’s relationship with your organization. Whether the donor is a first-time giver or a long-time supporter, showing sincere recognition of their generosity makes all the difference.

A tax receipt donation letter should clearly outline the specifics of the donation for tax purposes. Ensure that the donor’s name, donation amount, and date are accurately listed. You must also mention whether the donation was monetary or an item, and provide a description if it was in-kind.

Start with the donor’s name, address, and the organization’s contact details. Then, list the specific amount or value of the gift, along with a clear statement confirming no goods or services were provided in exchange for the donation, if applicable. This is key to ensuring the receipt qualifies for tax purposes.

| Element | Description |

|---|---|

| Donor Name | Full name of the donor |

| Donation Date | Date the donation was made |

| Donation Amount | Specific dollar amount of the donation |

| Non-Cash Gifts | If applicable, list a description of the items donated |

| Statement | Confirm that no goods or services were exchanged |

Conclude with a thank you note and include the organization’s tax identification number. Make sure the letter is signed by an authorized person within the organization, to give it authenticity.