To create a tax receipt for donations, include key details that ensure compliance with tax regulations. Start with the donor’s name, the amount donated, and the date of the contribution. It is crucial to also mention whether the donation was monetary or in-kind. For in-kind donations, provide a brief description of the donated items and their estimated value.

Make sure to include your organization’s name and contact details, including a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This confirmation is necessary for tax purposes. Additionally, use a clear, concise format to avoid any confusion during tax filing.

Finally, keep a record of all donations for both the donor’s and your organization’s tax filing purposes. This ensures you remain organized and prepared for audits, should they occur. Consider using digital tools to simplify the process and avoid manual errors. A well-structured tax receipt provides clarity and supports your commitment to transparency and trust with donors.

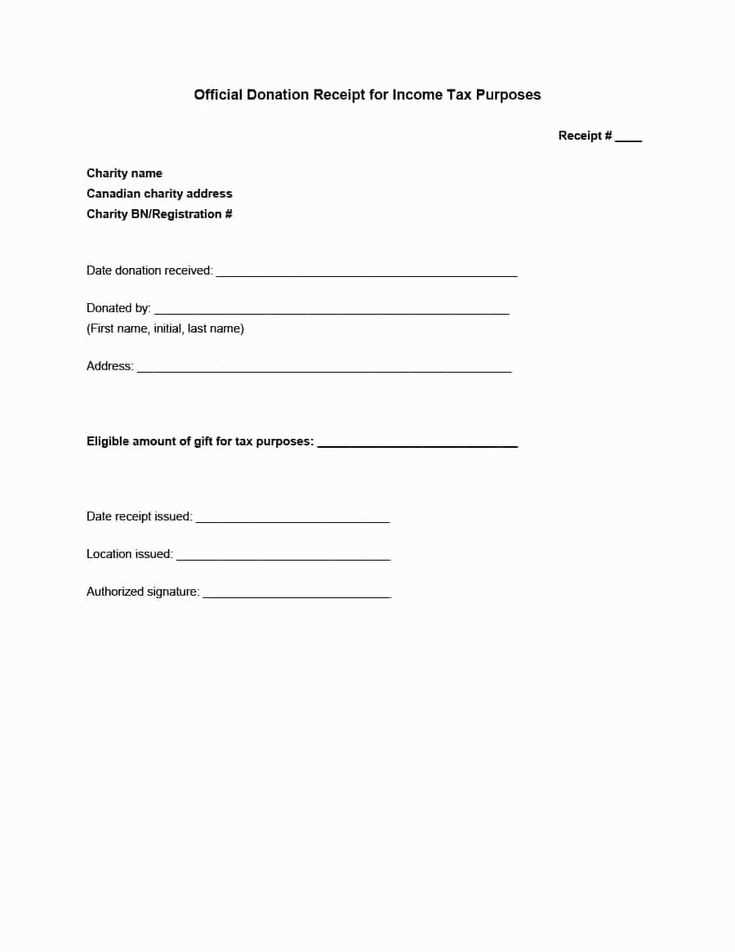

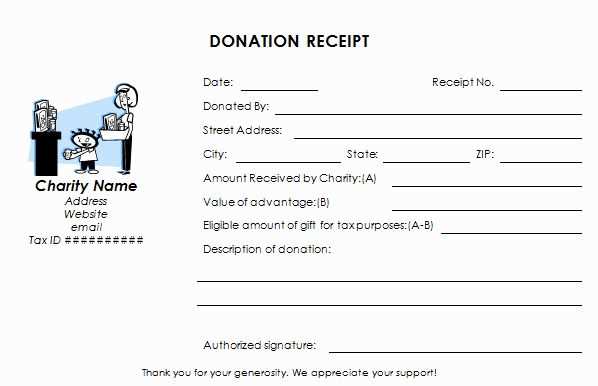

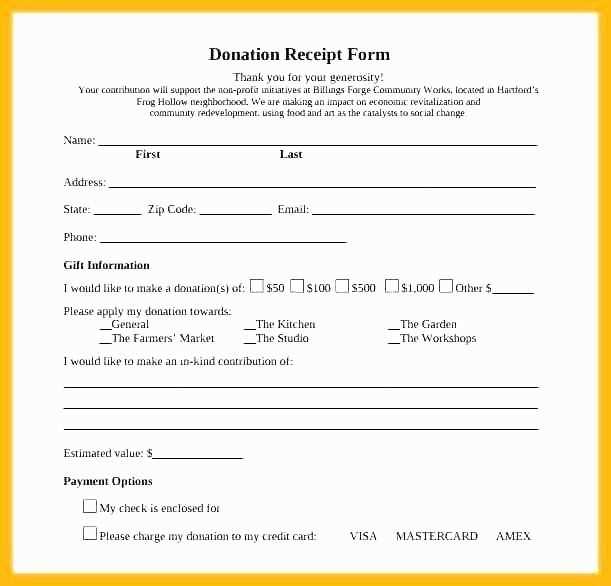

Tax Receipt Donation Template

Ensure the donation receipt template includes the donor’s name, the donation amount, and the date of contribution. Include the name of your organization and its tax-exempt status, as it’s required for tax purposes. Specify whether the donation was monetary or goods, and if goods, describe them clearly.

What to Include

For transparency, provide a clear breakdown of the donation. If it’s a monetary gift, mention the exact sum. If goods were donated, list their value. Include a statement confirming that no goods or services were provided in exchange for the donation, as this impacts the donor’s tax deduction.

Formatting Tips

Make sure the receipt is signed by an authorized person from your organization. The formatting should be clean, with clear sections for each piece of information. You may also want to include a footer with your organization’s contact information or website.

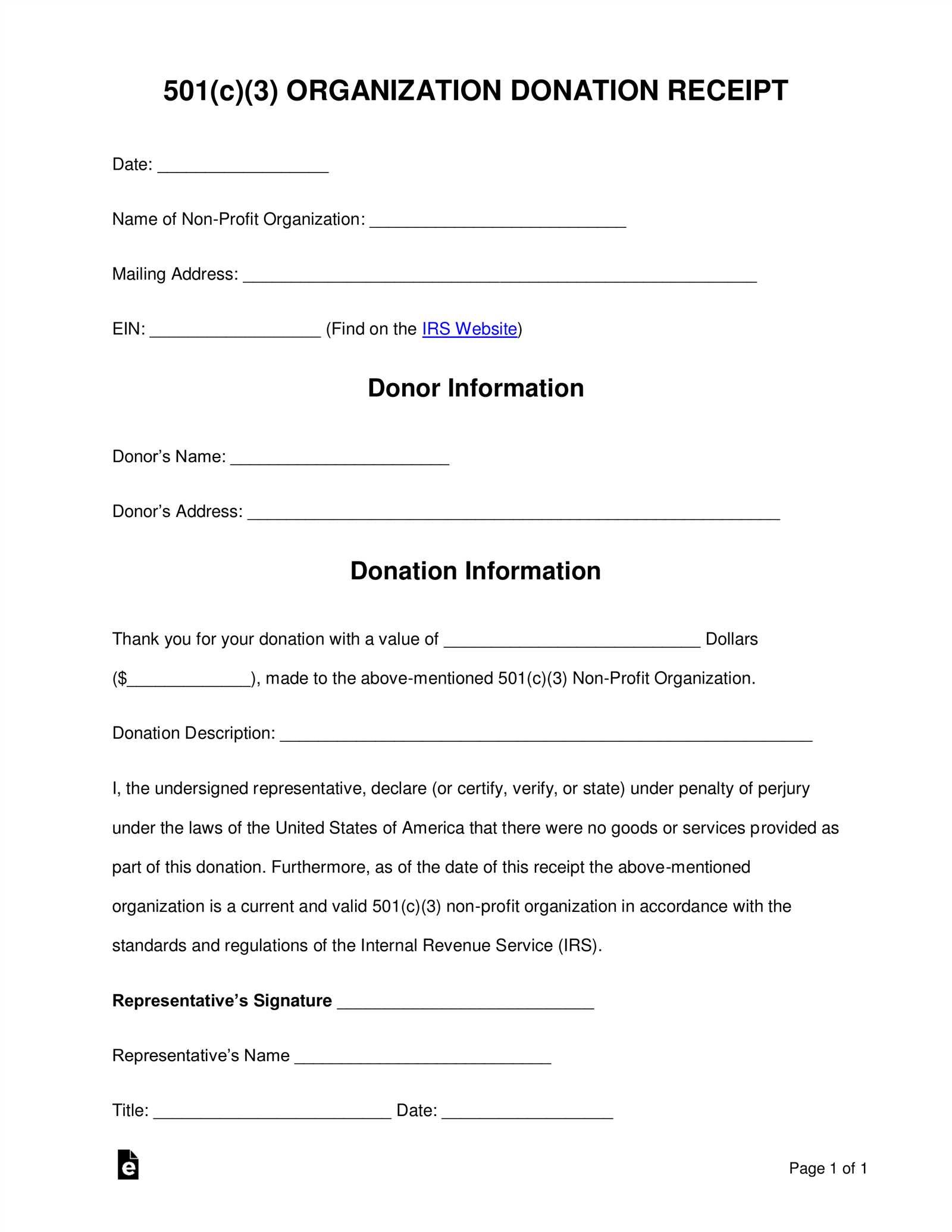

How to Create a Donation Receipt for Tax Purposes

To create a donation receipt for tax purposes, include the donor’s name, the organization’s name, and a clear description of the donated items or funds. Ensure that the date of the donation is specified, along with the value of any goods or services provided in exchange for the donation. If no goods or services were given, state that the donation was fully tax-deductible.

Required Information

Your receipt must list the following details:

- Donor’s name and address

- Organization’s name and address

- Date of the donation

- Description of the donated property or cash amount

- Value of the donation

- Statement of whether the donation was in exchange for goods or services, and if so, the value of those services

- Signature of the authorized person from the nonprofit organization

Tax Deductibility Statement

If no goods or services were received in exchange for the donation, include a statement confirming that the donor’s contribution is tax-deductible. If there were goods or services provided, you must specify the amount that is deductible based on the difference between the donation and the value of the goods or services received.

Key Legal Requirements for Donation Receipts

Donation receipts must meet specific legal criteria to be valid and deductible for tax purposes. Below are the key elements that must be included:

- Organization Information: The receipt must clearly identify the charity or organization receiving the donation. This includes the name, address, and tax identification number (TIN) or employer identification number (EIN).

- Donor Details: The name of the donor should be listed exactly as it appears on their tax records. For businesses, include the legal business name and address.

- Donation Amount or Description: A detailed description of the donation must be provided. For cash donations, the exact amount should be noted. For non-cash donations, a description of the items donated must be included, but an appraisal is not required.

- Statement of No Goods or Services: If the donation is in exchange for goods or services, this must be clearly stated. The value of the goods or services received must be disclosed, and only the remaining portion of the donation is tax-deductible.

- Date of Donation: The date on which the donation was made should be clearly indicated on the receipt.

- Receipt Issuance: Charities must issue a receipt for donations exceeding a certain amount, often $250, to claim the deduction. For donations under this threshold, a simple acknowledgment can suffice, but it may not be enough for tax deduction purposes without proof of the amount.

- Federal Tax Status Statement: A statement affirming the organization’s tax-exempt status under section 501(c)(3) of the Internal Revenue Code is required. This ensures the donor can claim the tax benefits associated with the donation.

Ensuring these requirements are met helps prevent any delays or issues when claiming tax deductions. Make sure to provide donors with accurate and thorough receipts to maintain compliance and transparency.

Common Mistakes to Avoid When Issuing Tax Receipts

One of the most common mistakes is failing to include all required donor information. Always make sure you clearly list the donor’s full name and address on the receipt. Missing details may invalidate the receipt in case of an audit.

Incorrect Donation Amount

Verify the donation amount before issuing the receipt. Double-check whether the donation is in cash, property, or services, as different types require different treatments. It’s crucial to state the precise value of non-cash donations, as estimated values can lead to confusion or disputes later.

Not Including the Tax-Exempt Status

Do not forget to include your organization’s tax-exempt number. This is a key detail for the donor to claim a deduction. Without this information, the tax receipt is incomplete, which can prevent donors from receiving the intended benefits.

Another mistake is failing to sign the receipt. A signature from an authorized person within your organization adds credibility to the document, confirming its authenticity. Make sure it is present on every issued receipt.

Finally, ensure that the date of donation is accurate. Mistakes here could lead to discrepancies in the donor’s records, affecting their tax filings.