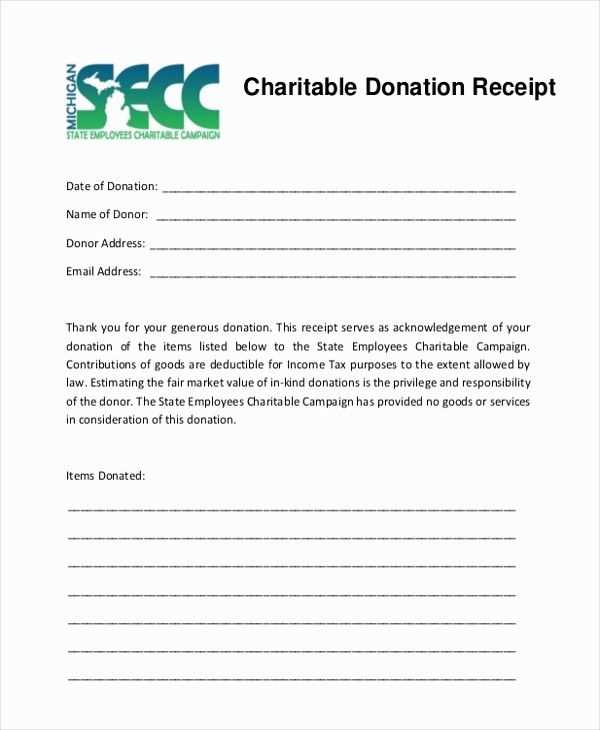

Creating a tax receipt for charitable donations can simplify the process of claiming deductions. Use a clear and concise template that includes key details about the donation. Make sure to include the donor’s name, donation amount, and the charity’s registered tax number. This will help both the donor and charity maintain accurate records for tax purposes.

Accurate Recordkeeping is essential when handling donations. Specify whether the donation was monetary or an in-kind gift. Include the date of the donation and a brief description of the gift, especially if it’s non-cash, as this will impact the deduction process. Ensure that both the charity and donor have identical records to prevent discrepancies during tax filing.

Another key element to include in the receipt is a statement confirming that the charity is a registered organization eligible for tax deductions. A simple acknowledgment of this, paired with the charity’s registration number, will fulfill the legal requirements and clarify the tax status of the donation.

By following this template, you can streamline the process and avoid confusion during tax time. Make sure the receipt is issued promptly, and both parties keep a copy for their records. This ensures transparency and ensures that the donation can be easily accounted for during tax preparation.

Here’s the revised version:

Ensure your tax receipt includes the following key information:

- Donor’s full name and address

- Organization’s name, address, and tax-exempt status

- Date of the donation

- Description of the donated items or cash amount

- Value of the donation (if applicable)

- Statement confirming no goods or services were provided in exchange

If the donation is in-kind (non-cash), include a brief description of the item(s) and an estimated value if the donor did not assign one. For cash donations, state the exact amount given.

Always ensure the donor’s information is accurate and clear to avoid any discrepancies during tax filing. This will simplify the process for both you and the recipient.

- Tax Receipt for Charitable Contributions Template

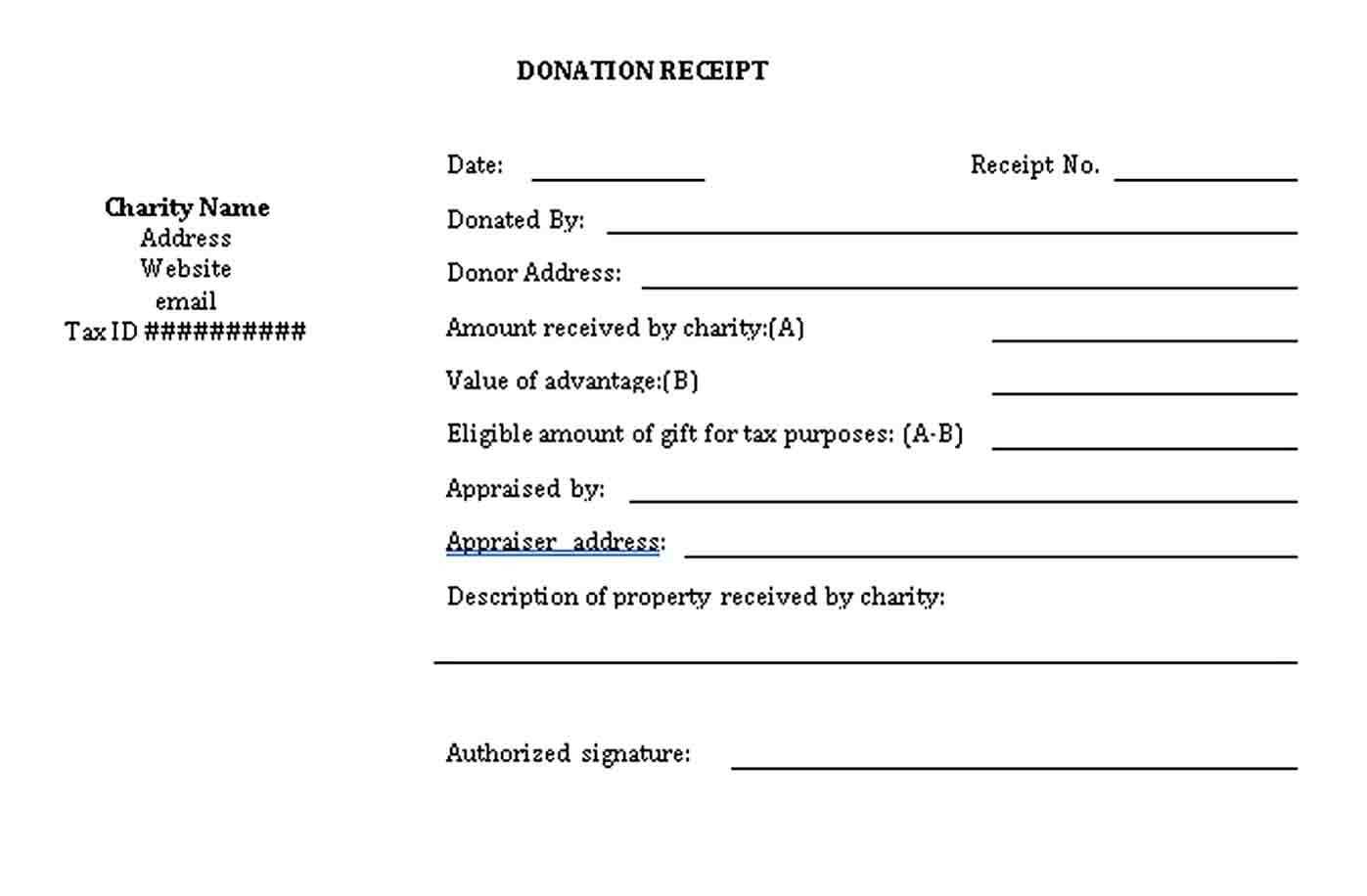

A well-structured tax receipt is key for donors to claim their charitable contributions during tax season. The receipt should include specific details that are required by tax authorities to ensure eligibility for deductions. Here’s a clear template to follow:

- Organization’s Name and Address: Clearly state the official name, address, and contact details of the charitable organization.

- Donor Information: Include the name and address of the donor. If applicable, include their donor identification number or membership number.

- Date of Donation: The exact date when the contribution was received.

- Amount Donated: List the total monetary amount or the value of the non-cash donation. If applicable, specify if the donation is in goods or services.

- Description of the Donation: Provide a detailed description of the item or service donated, including its condition if it is a non-monetary contribution.

- Statement of No Goods or Services Received: A clear statement that the donor did not receive any goods or services in exchange for the donation, or a description of what was received if applicable.

- Tax-Exempt Status Information: A note confirming that the organization is a registered charity and eligible to issue tax-deductible receipts (include the charity registration number).

- Signature and Title: The signature of the authorized representative and their title within the organization, validating the receipt.

This template ensures both the donor and the charity comply with the necessary tax requirements. By maintaining these key elements, you guarantee that the receipt can be used during tax filing without complications.

List the charity’s name, address, and tax identification number at the top of the receipt. Include a clear statement that the donation is tax-deductible, such as “This donation is tax-deductible as allowed by law.”

Record the donor’s name and address for reference. Specify the date and amount of the donation, including whether it was cash, check, or property. If it’s property, describe the item and its value at the time of donation.

Include a note if any goods or services were provided in exchange for the donation. If so, state their estimated value and subtract that from the donation to show the deductible amount.

Close with a thank-you message, acknowledging the donor’s generosity and confirming that no goods or services were provided in exchange for the donation, if applicable.

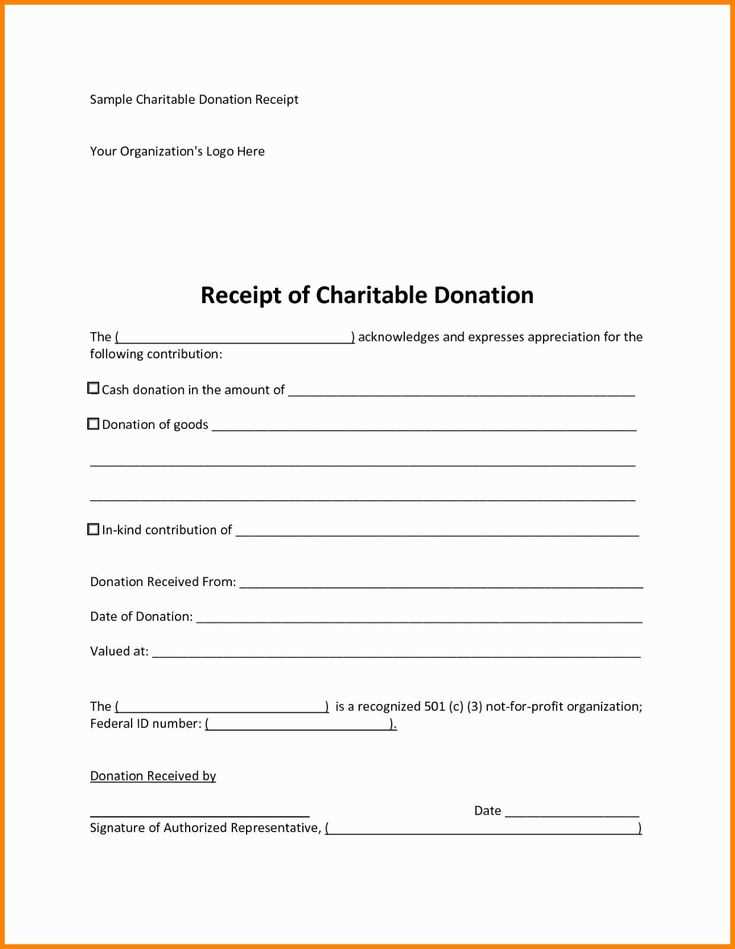

Each charitable contribution receipt should contain specific details to ensure clarity and compliance. These key elements make the document reliable and useful for tax purposes.

1. Donor Information

Clearly include the donor’s full name and address. This helps both the charity and the donor for proper record-keeping.

2. Charity Details

The charity’s name, address, and tax identification number should be listed. This confirms the legitimacy of the organization and enables easy identification by tax authorities.

3. Date of Donation

Accurate recording of the donation date is essential for tax purposes, as it affects the donor’s eligibility for deductions in the correct year.

4. Description of Donation

A clear description of the donated items or the amount given is needed. If the donation is non-cash, include details like the condition or nature of the items, as well as their fair market value if available.

5. No Goods or Services Received

If the donor did not receive any goods or services in exchange for their contribution, the receipt should state this explicitly. This information is crucial for the donor to claim a tax deduction.

6. Charitable Organization’s Declaration

The charity must declare that it is a tax-exempt organization. This affirms that the donation is eligible for tax deductions under the relevant laws.

| Information | Details |

|---|---|

| Donor Name and Address | Include full legal name and mailing address |

| Charity Name and Address | Include name, address, and tax ID number |

| Donation Date | Ensure the donation date is correctly noted |

| Description of Donation | Item description and fair market value for non-cash gifts |

| Goods or Services | Statement confirming no goods or services received |

Donation receipts must contain specific details to be legally valid. Include the organization’s name, address, and tax identification number (TIN). Clearly state the amount or description of the donation. If the donation is non-monetary, provide a detailed description and the approximate value. The receipt should also specify that no goods or services were provided in exchange for the donation, unless applicable.

For cash donations, include the date of the donation and the amount. For property or goods, state the date of donation and a description. If the value exceeds a certain threshold, the donor might need to provide additional documentation. Nonprofits should issue receipts within a reasonable time frame to comply with tax regulations.

Ensure receipts comply with the local regulations, as requirements may vary by jurisdiction. Consult legal professionals or tax experts to ensure that the receipts are in line with tax laws and meet the expectations of donors and authorities.

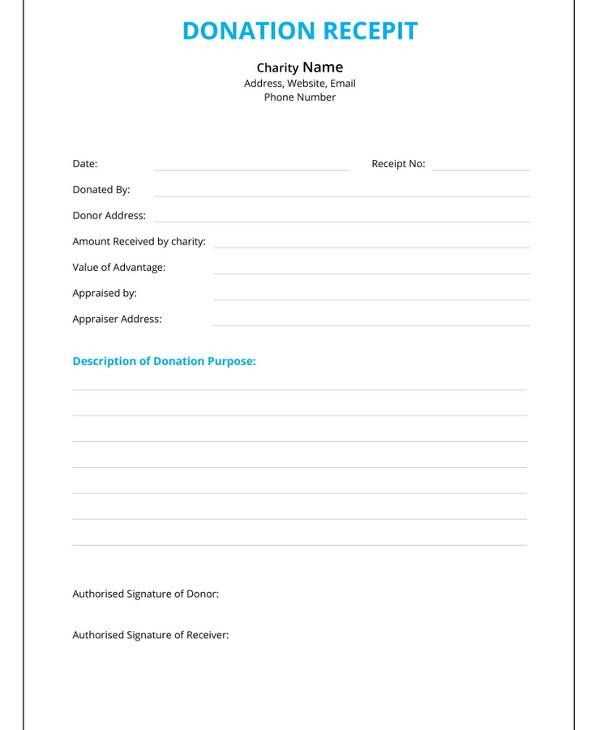

Tailor your tax receipt template to reflect the specifics of different types of donations. For monetary gifts, ensure the template includes the exact amount donated and the method of payment, such as cash, check, or credit card. Be clear about the date of the contribution and confirm the non-refundable status of the donation, if applicable.

Non-Monetary Contributions

For non-monetary donations like goods or services, describe the items in detail, including their condition, estimated value, and the date received. It’s helpful to provide a brief statement on how the valuation was determined, which can help with transparency. Note that some contributions may not have a fair market value and must be handled differently.

Recurring Donations

For recurring donations, specify the frequency (e.g., monthly or annually) and the amount donated for each period. Include any automatic payment details, ensuring the donor is aware of their ongoing commitment. This will help streamline the process for both parties and offer clarity on donation cycles.

For in-kind donations, tax receipts must include a detailed description of the items donated, as well as their fair market value. This ensures transparency and meets the necessary requirements for donors to claim a deduction. The fair market value should reflect the price a willing buyer would pay and a willing seller would accept for the donated items, in their current condition.

Include a Detailed Description of the Donation

Clearly state the type of goods or services donated, including any brand names or specific items. For example, if a donor contributes a piece of furniture, list the type of furniture (e.g., “antique oak dining table”) and any relevant specifications (e.g., “in good condition”). The more details provided, the more credible the valuation will be.

Valuing In-Kind Donations

It’s important to note that donors are responsible for determining the fair market value of their in-kind donations. As a recipient organization, you may offer guidance on valuation, but it is the donor’s responsibility to substantiate the value with proper documentation, such as receipts for similar items or an appraisal for high-value donations.

Example: For donations like artwork, an independent appraisal may be necessary. For less expensive items, referencing a local secondhand store or online market prices could be sufficient.

Distribute receipts promptly after each donation to maintain good relationships and ensure tax compliance. You can choose from several methods, including email, postal mail, or through your organization’s donor portal.

Email Distribution

For quick and eco-friendly distribution, send receipts via email. Ensure the subject line clearly states the purpose (e.g., “Donation Receipt for [Organization Name]”). Include all required details, such as the donor’s name, donation amount, and date. Attach a PDF version of the receipt for clarity and easy record-keeping.

Postal Mail Distribution

If a donor prefers physical documentation, mail receipts promptly. Include a personalized note of thanks and consider using printed receipts with your organization’s branding. For large donations or when required by local tax laws, you may want to include additional documentation, such as a formal acknowledgment letter.

Always make sure your method of distribution complies with relevant tax laws, and track sent receipts for efficient follow-up in case of any issues.

Tax Receipt for Charitable Donations Template

To create a tax receipt for charitable donations, ensure the following key details are included in the template:

- Organization Information: Include the charity’s name, address, and official registration number.

- Donor Information: List the donor’s name, address, and contact information for proper identification.

- Donation Details: Clearly specify the date of the donation, the amount or value of the contribution, and whether it was cash or non-cash.

- Receipt Number: Assign a unique receipt number for record-keeping and tracking purposes.

- Statement of Tax-Exempt Status: Include a statement confirming the organization is a registered charity and the donation qualifies for tax purposes.

- Signature: The receipt should be signed by an authorized representative of the charity to validate the document.

This structure will ensure the tax receipt is both legally compliant and useful for donors when filing their tax returns.