Providing a well-structured charitable donation receipt is a key step in acknowledging contributions. A clear, concise receipt ensures transparency and builds trust with donors. It is important to include all required details that support tax deductions for the donor and fulfill legal requirements for your nonprofit.

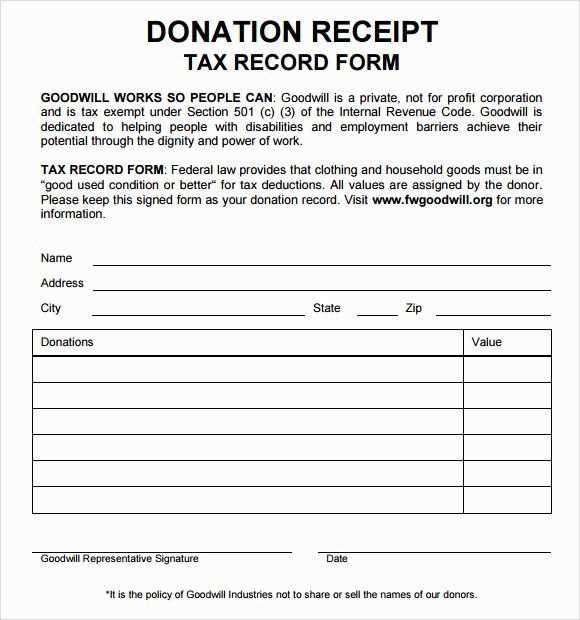

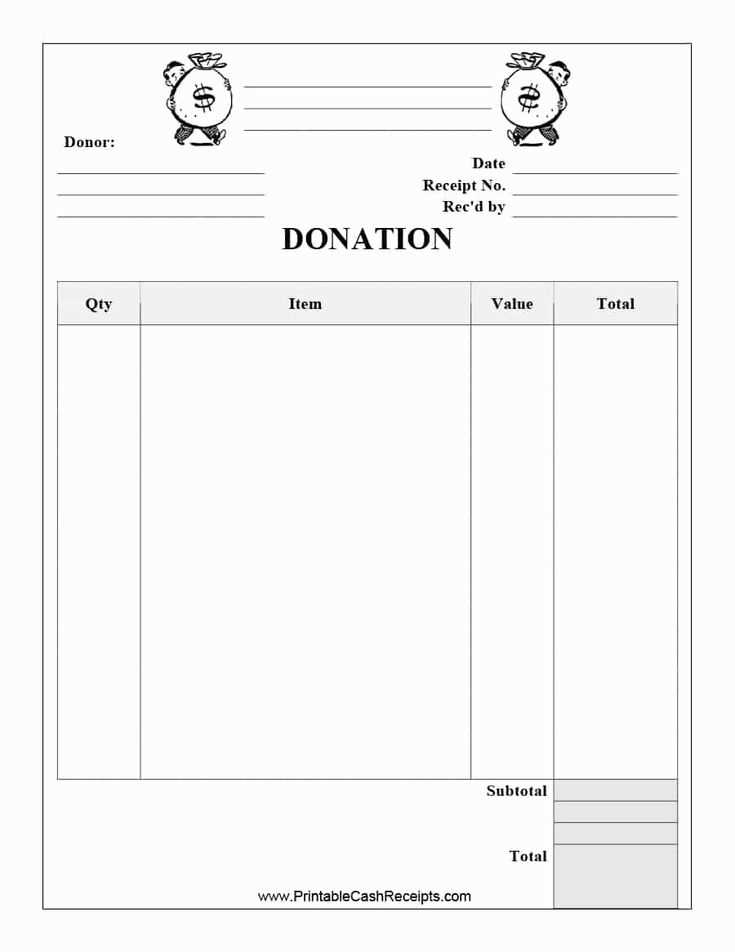

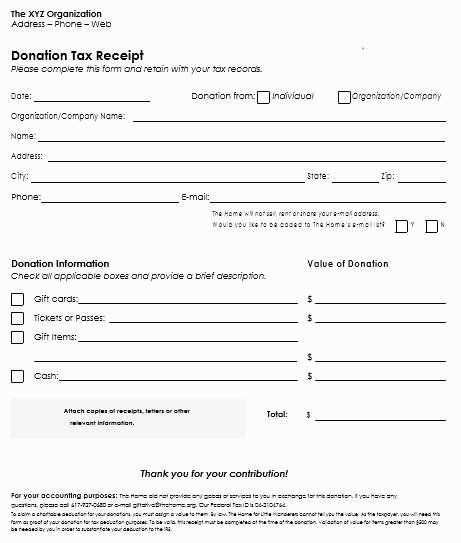

The receipt template should feature specific fields such as the donor’s name, donation amount, date of contribution, and the organization’s tax-exempt status. In addition, always ensure the organization’s contact information is visible. The inclusion of a unique transaction reference number can also help in organizing and tracking donations efficiently.

Always specify whether the donation was monetary or in-kind, and if applicable, the estimated fair market value of non-cash gifts. For in-kind donations, be sure to include a description of the donated items, ensuring the donor is aware they should keep their own records for any valuation purposes.

Lastly, keep your receipts professional yet simple. A clean, standardized design helps maintain consistency and enhances the overall donor experience. Customizing the receipt to fit your organization’s branding can also add a personal touch to the acknowledgment process.

Here is the corrected version:

Ensure the receipt includes the donor’s name, address, and the date of the donation. Specify the donation amount and clarify whether it was a monetary or non-monetary contribution. If it was a non-monetary gift, describe the item or service donated with an estimated value.

State the organization’s name, address, and tax identification number (TIN) to verify its legitimacy. For monetary donations, note whether the contribution was tax-deductible, and include a statement confirming that no goods or services were exchanged for the donation.

If applicable, include specific statements like “The donor did not receive any goods or services in exchange for the donation” to ensure clarity regarding tax-deductible eligibility. Always issue a receipt promptly after the donation to keep records accurate and up to date.

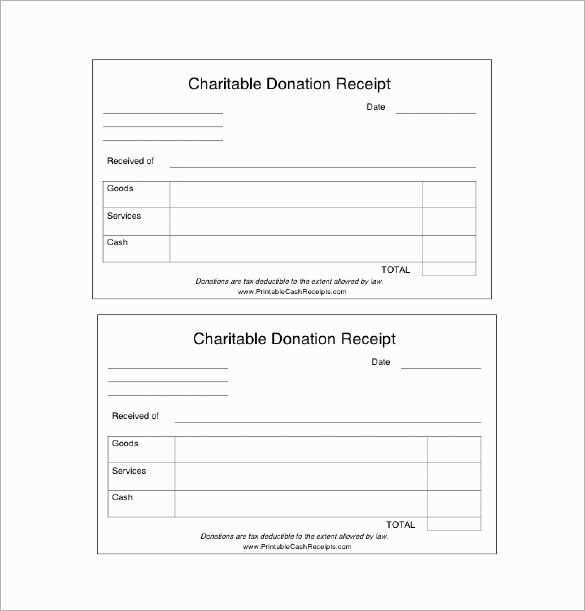

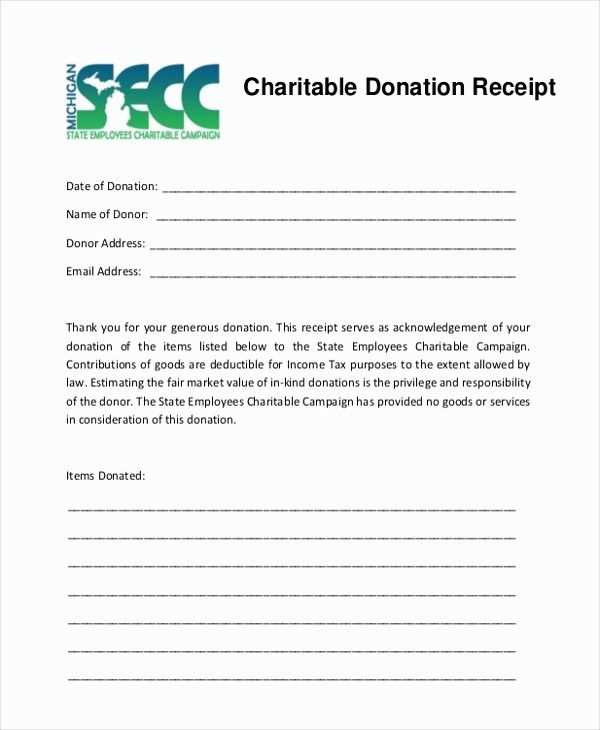

Template for Charitable Donation Receipt

Begin with a clear heading: “Charitable Donation Receipt” or something similar. Include the name of your organization and its contact information. Make sure to specify the date of the donation and include the donor’s name, address, and amount donated. If the donation is in kind, provide a brief description of the donated items or services.

Include a statement indicating whether the donation is tax-deductible. For example, “Your donation is tax-deductible to the extent permitted by law.” This statement is necessary to meet IRS requirements in many jurisdictions. Also, make sure to thank the donor for their generosity and support.

How to Structure a Donation Receipt

Use a simple structure to maintain clarity. Start with your organization’s details at the top, followed by the donor’s name and donation details. It’s important to include the total amount donated, as well as whether the donation was cash, check, or goods. For non-cash donations, provide an estimated value of the items donated.

Ensure the receipt is signed by an authorized person from your organization, and include their title. This adds legitimacy and accountability to the document. You may also want to include a reference number or unique identifier for each donation for tracking purposes.

Key Legal Requirements for Receipts

For donations over a certain amount (typically $250 or more), you must provide a detailed receipt with a written acknowledgment of the donation. This includes the amount donated and a description of any non-cash contributions. Additionally, if the donor receives any goods or services in exchange for their donation, you need to provide an estimate of their value.

Failure to meet these legal requirements can result in penalties for your organization or disallowance of the donor’s tax deduction. Ensure that receipts are provided in a timely manner and meet all necessary legal criteria.

Common Mistakes to Avoid in Receipts

One of the most common mistakes is failing to provide the receipt within a reasonable time frame. Donors should receive their receipts promptly to ensure they can use them for tax purposes. Another common error is not properly acknowledging non-cash donations. Ensure that any goods or services donated are described in sufficient detail.

Avoid vague language in the acknowledgment statement. For example, instead of saying “a generous donation,” specify the exact amount or value of the donation. Also, double-check for any clerical errors in the donor’s name or donation amount, as these can invalidate the receipt.