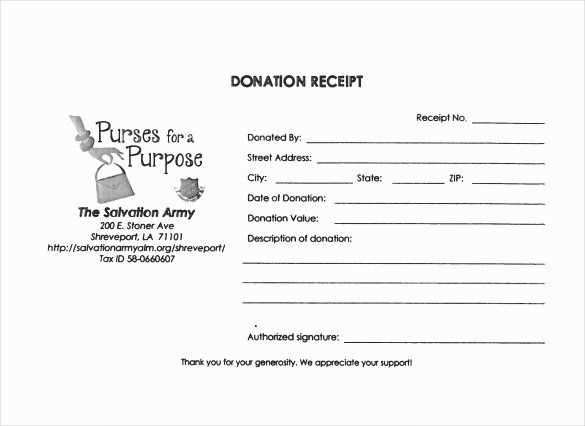

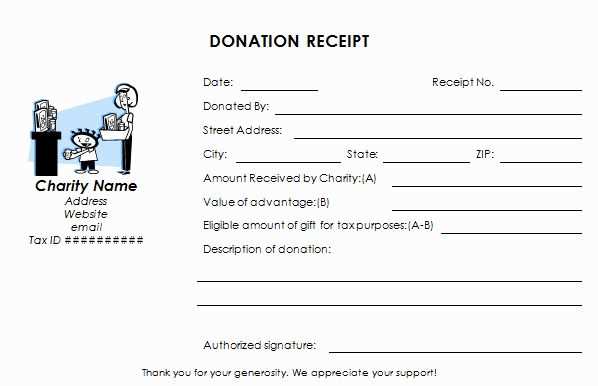

To create a receipt for donations, clearly outline the details of the transaction, including the donor’s name, donation amount, date, and the purpose of the donation. This ensures transparency and helps both parties maintain accurate records.

Include a statement confirming that the donation is tax-deductible, if applicable. This can provide added value for the donor, as it ensures they have the necessary documentation for tax reporting. Mention your organization’s tax-exempt status, if relevant.

Make sure the receipt includes the name and contact information of your organization, so the donor can reach out if needed. It’s also helpful to include a unique transaction or receipt number for easy reference in case of follow-up or audit.

End with a polite thank you message to express appreciation for the donor’s support. This strengthens the relationship and shows that their contribution is meaningful to your cause.

How to Structure Donation Receipt Information

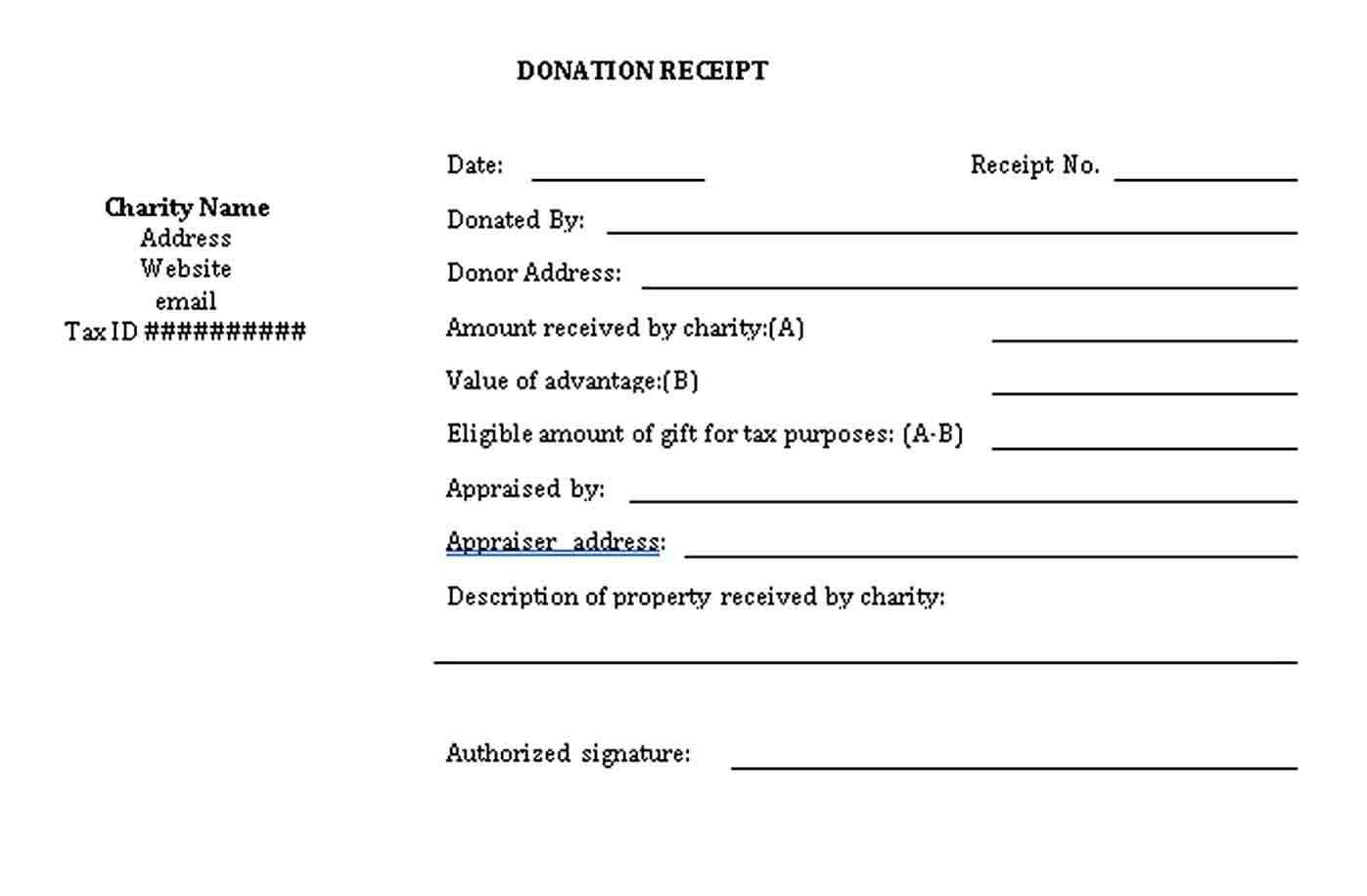

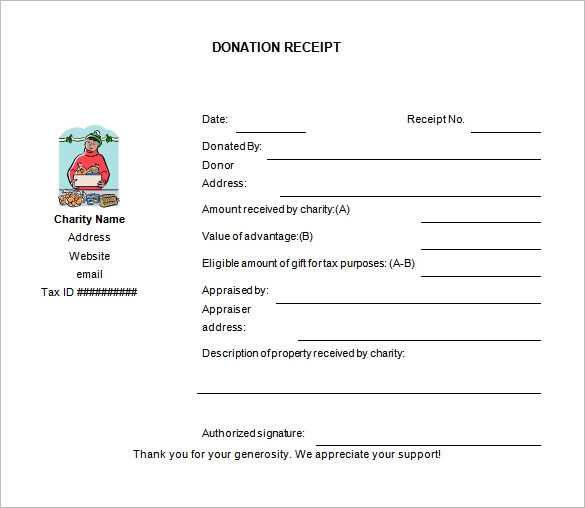

Include the name of the organization, its address, and the tax-exempt status if applicable. This ensures the receipt is valid for tax purposes.

Clearly state the donor’s name and address. If it’s a group donation, list all contributors. Keep this information accurate for proper record-keeping.

Record the donation amount in both words and numbers. For non-monetary donations, provide a description of the items or services donated. For large donations, include a fair market value assessment.

Provide the date of the donation and the receipt number. These details help the organization track donations for accounting purposes.

For cash donations, include a statement confirming that no goods or services were provided in exchange, if true. This is a key requirement for tax-exempt organizations.

Finally, add a thank-you note to acknowledge the donor’s contribution. It shows appreciation and helps maintain a positive relationship for future giving.

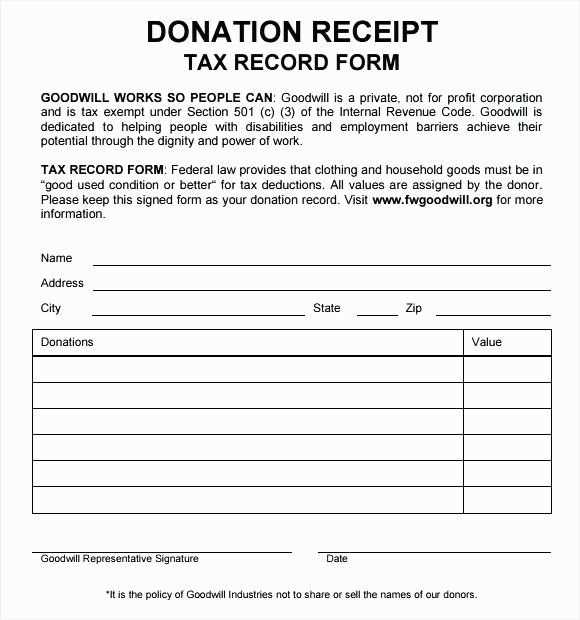

Legal Requirements for Donation Receipts

Donation receipts must include specific details to comply with tax regulations. They should clearly state the donor’s name, the donation amount, and the date of the contribution. The organization must provide a statement confirming that no goods or services were exchanged for the donation unless applicable. If goods or services were provided, their value must be disclosed.

In many jurisdictions, non-profit organizations are required to include their tax identification number (TIN) or similar registration details on the receipt. This helps establish the legitimacy of the organization and ensures that the donor can claim tax deductions for the contribution.

The receipt must also include a statement about the donor’s eligibility to claim tax deductions. Some tax authorities require a specific format for this declaration, which should be followed precisely. Make sure to provide receipts on time, typically within a reasonable period after receiving the donation.

Customizing the Template for Different Donation Types

Adjust your receipt template based on the type of donation received. For monetary gifts, include fields for the donation amount, date, and donor details. For in-kind contributions, list the items received with descriptions and estimated value. Ensure that the donor’s name and the date of the donation are prominently displayed on each template version.

Monetary Donations

For cash or online donations, provide a clear breakdown of the amount, payment method, and transaction reference. If applicable, include tax-deductible information specific to the donor’s region. This ensures that the donor has all the details needed for their records or tax reporting.

In-Kind Donations

For goods or services, itemize what was donated, including quantities, condition, and estimated value. Make sure to specify that the donor is responsible for determining the fair market value. If the donor offers multiple items, group them by category for easy reference.