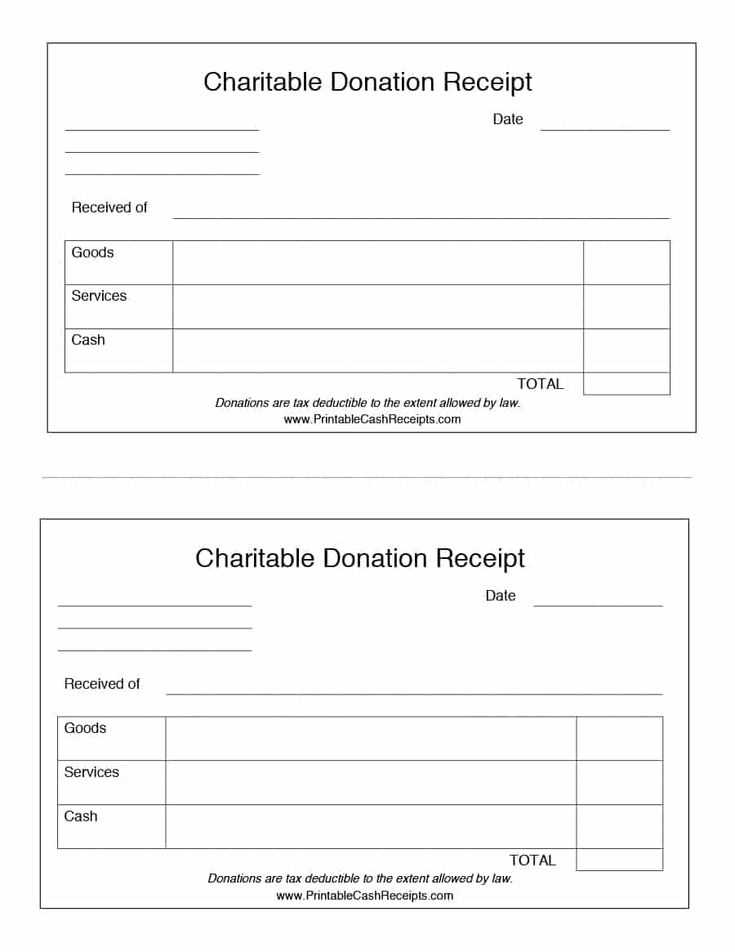

Use the following template to create a clear and concise charitable donation receipt. This ensures transparency for both the donor and the organization, complying with tax reporting requirements.

Receipt Information

- Donor’s Name: Full name of the individual or entity donating.

- Organization Name: The name of the charity receiving the donation.

- Donation Date: The exact date the donation was received.

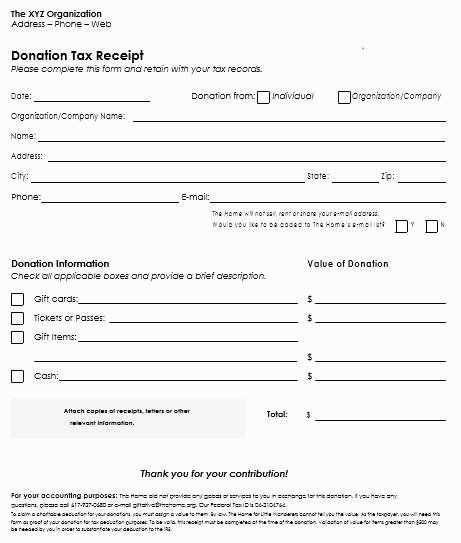

- Donation Amount: Specify the amount donated, along with the currency if needed.

- Item Description: If the donation is in-kind (e.g., goods), describe the items and their estimated value.

- Tax-Exempt Status: A statement confirming that the organization is registered as tax-exempt.

- Signature: Authorized person’s signature from the organization.

Additional Notes

- Non-Cash Donations: For non-cash donations, provide a description of the items donated and their estimated value. If applicable, remind the donor to consult with a tax professional for valuation.

- Services: If the donation is in the form of services, clarify that services are not tax-deductible.

- Donor Acknowledgment: Include a line acknowledging the donor’s support and appreciation for their contribution.

Sample Donation Receipt

Receipt for Charitable Donation

Donor’s Name: John Doe

Organization Name: Helping Hands Charity

Donation Date: February 5, 2025

Donation Amount: $200.00

Thank you for your generous contribution. Your donation will support our community outreach programs.

This receipt serves as documentation for your tax purposes. Please retain it for your records.

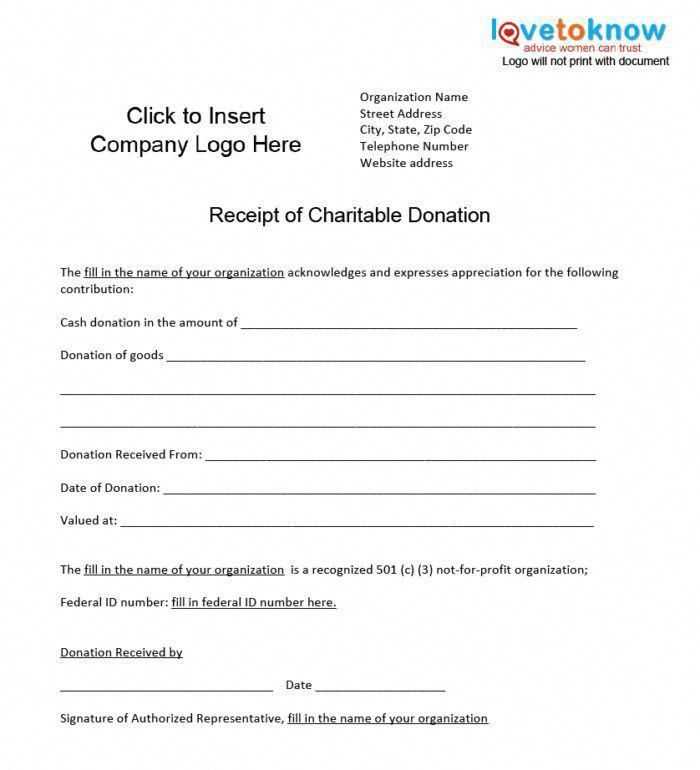

Template for Donation Receipt

Customizing Receipt Header for Donor Recognition

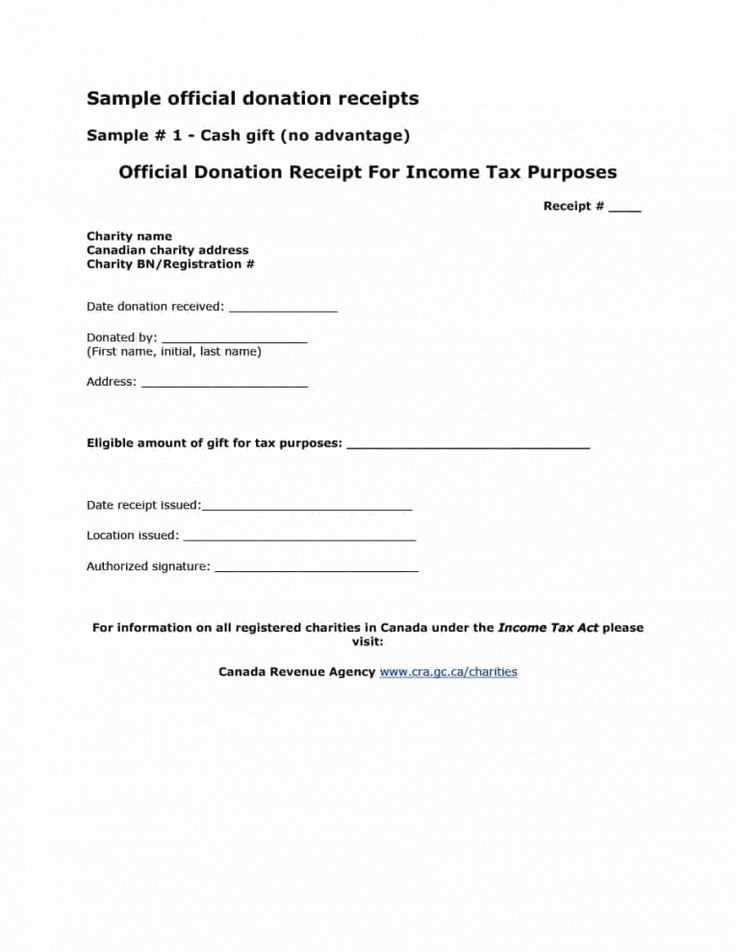

Including Legal Disclaimers and Tax Details

Creating a Clear and Detailed Description Section for Donations

Choosing the Right Format for Print or Digital Use

Ensuring Compliance with Tax Regulations

Tracking and Storing Receipts for Audits and Reports

Customize the receipt header with your organization’s name and logo to provide clear identification. Add a “Thank You” message to acknowledge the donor’s contribution. Include the donation date and receipt number for better tracking.

Ensure the legal disclaimer is concise and covers the non-profit status and any applicable tax benefits. Clearly state that the donor received no goods or services in exchange for their donation to ensure compliance with IRS regulations.

Detail the donation’s purpose and amount in a section that is easy to read. If possible, describe how the funds will be used, helping the donor see the direct impact of their contribution. This transparency builds trust and encourages future donations.

Select a format that suits your organization’s needs–either printable or digital. For print, ensure the layout is printer-friendly with proper spacing. For digital receipts, include a PDF option to make it easy for donors to save and share their records.

Verify that all the information in the receipt complies with tax regulations. This includes specifying the donation amount, the organization’s tax-exempt status, and any legal disclaimers required for tax purposes. Review IRS guidelines to confirm you’ve met all requirements.

Implement a tracking system for receipts. This will help keep records organized and easily accessible for both audits and reporting. Use a secure database to store digital receipts and ensure physical receipts are properly filed for future reference.