To create a charity donation receipt, include the donor’s full name, donation amount, and the date of the contribution. Clearly state that the donation is tax-deductible, if applicable, and provide the charity’s name, address, and contact details. This ensures transparency and gives the donor the necessary information for their records.

Include the following key elements:

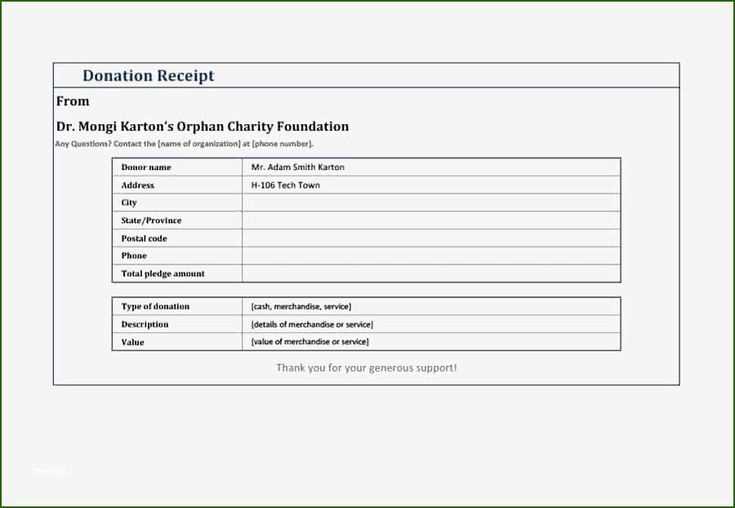

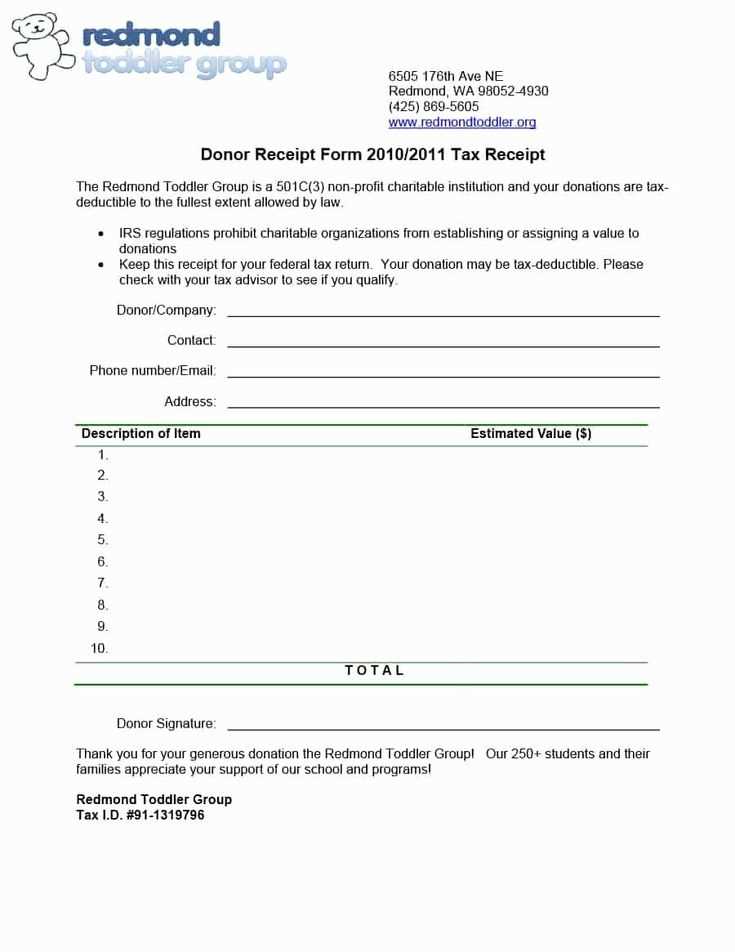

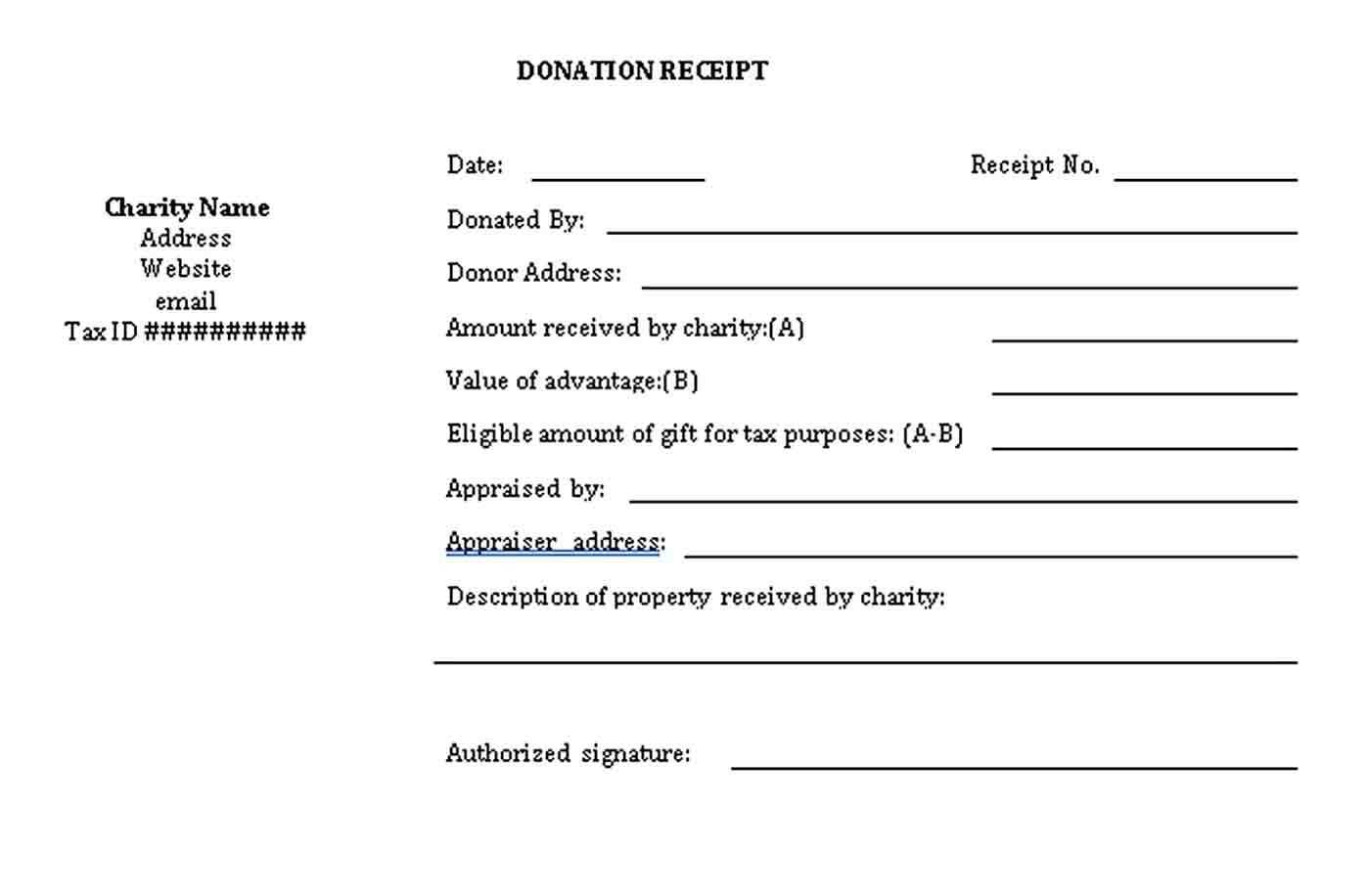

1. Donor’s Information: Full name of the donor and their contact information, such as email or address.

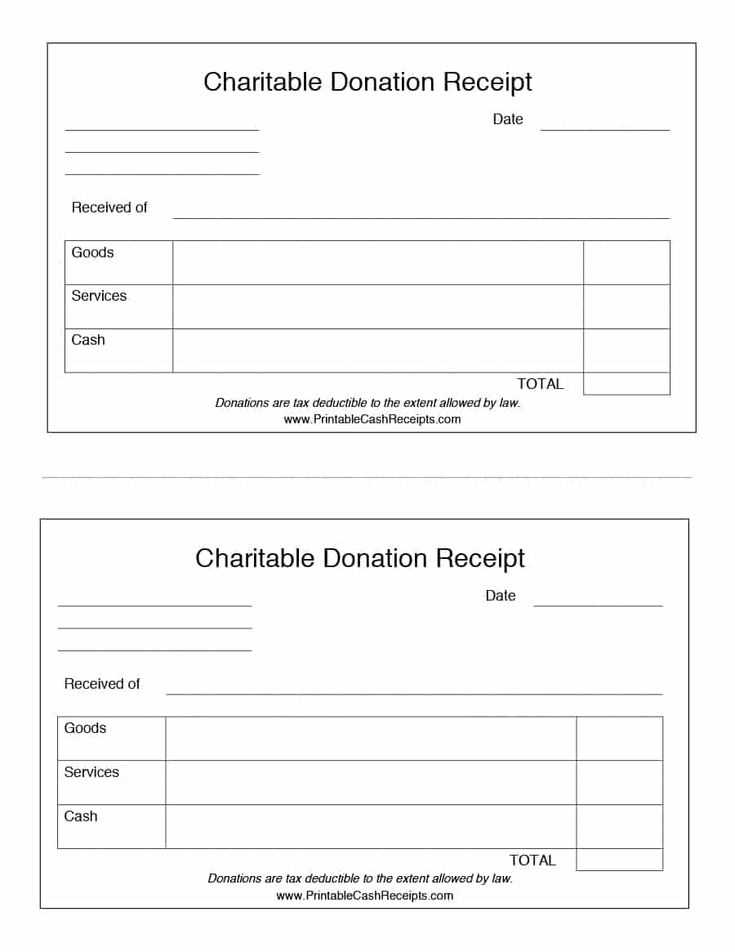

2. Donation Details: The exact amount of the donation, whether it was in cash, check, or any other form. If the donation is in kind, describe the item(s) and their estimated value.

3. Charity’s Details: Name, address, and contact information of the charity receiving the donation.

4. Date: The date the donation was received.

For tax purposes, include a clear statement that no goods or services were provided in exchange for the donation unless it was a quid pro quo donation. If goods or services were provided, list the value of those items separately to avoid confusion during tax filing.

Using this template ensures both parties have accurate documentation for their records and minimizes any ambiguity during tax reporting. A well-organized receipt builds trust and keeps donors informed about how their contributions are being utilized.

Here’s an improved version with reduced repetition of words:

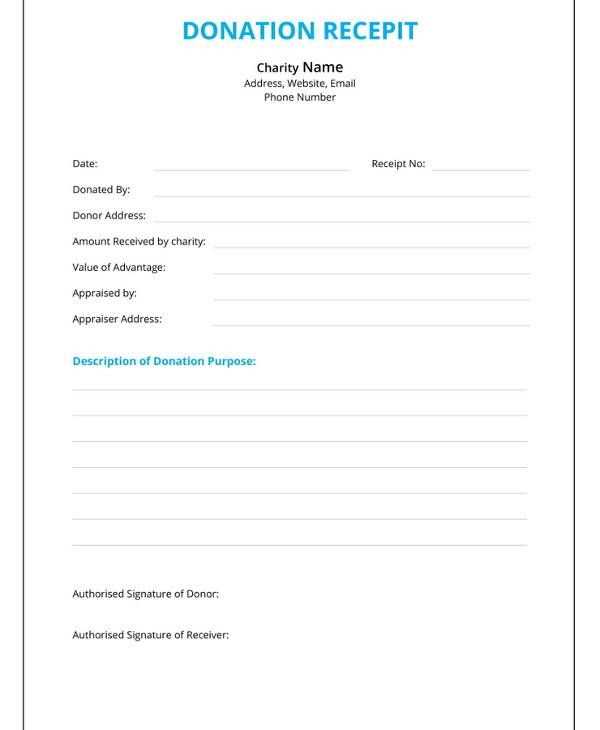

To create a concise and clear charity donation receipt template, focus on simplicity. Clearly state the donor’s name, address, and donation amount. Include the organization’s name and a brief description of its mission. Specify the date of the donation and confirm the tax-exempt status of the organization.

Key Components to Include

Start with the organization’s contact information. Follow with the donor’s details and the transaction specifics. Ensure the receipt states whether the donation was monetary or in-kind. For in-kind donations, describe the item and estimate its fair market value.

Formatting Tips

Keep the layout clean and professional. Avoid excessive use of colors and fonts, sticking to a simple format. Include a statement like “No goods or services were provided in exchange for this donation” if applicable. This ensures transparency and makes the receipt tax-compliant.

HTML structure for the article “Template for Charity Donation Receipt” with 3 practical and focused headings:

Start by structuring the charity donation receipt template with clear and straightforward sections to ensure transparency and compliance. First, include donor details, then proceed with donation specifics, and finally, confirm receipt acknowledgment.

Donor Information

Place the donor’s name, address, and contact information prominently at the top of the receipt. This ensures that the donor’s contribution is properly attributed. You can use labels such as “Donor Name” and “Address” in clear, bold text for easy readability.

Donation Details

Under donation specifics, list the amount donated, the donation method (e.g., cash, check, or credit card), and the date of donation. A simple format with placeholders like “Amount Donated” and “Donation Date” will make the receipt easy to read and fill out.

Receipt Acknowledgment

End the template with a confirmation section that includes a statement acknowledging the donation’s receipt. This may include a phrase like “Thank you for your generous donation,” followed by the charity’s contact information and tax-exempt status, if applicable.

- Creating a Clear and Compliant Acknowledgment of Donations

Ensure that each donation receipt contains specific information that aligns with tax regulations and donor expectations. This includes the following:

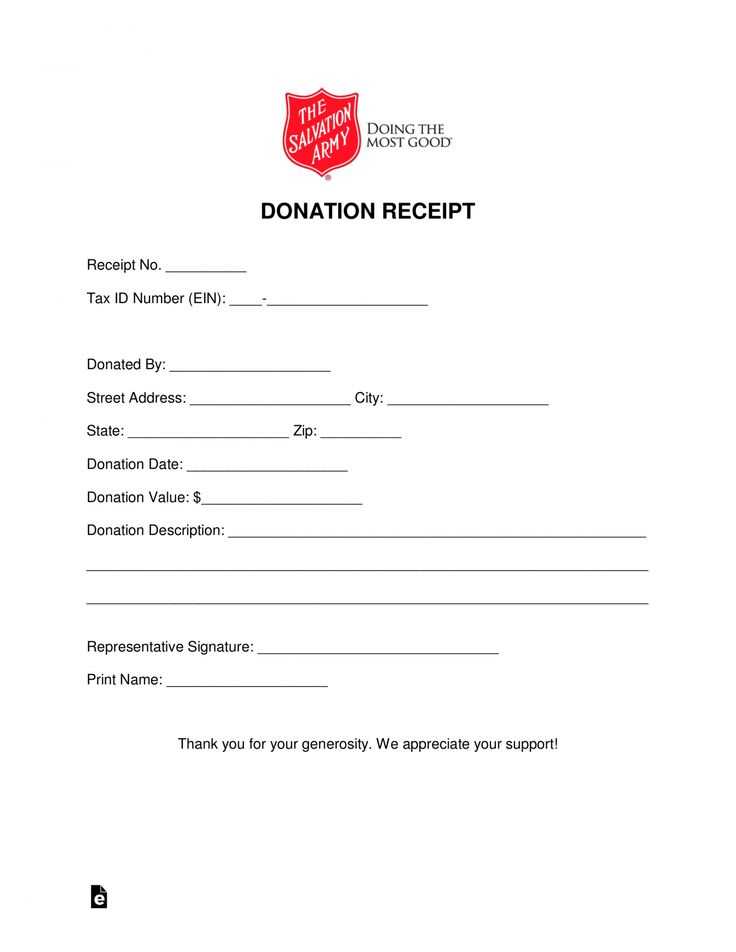

- The name of the charity or organization receiving the donation.

- The donor’s name and, where applicable, their contact information.

- The donation amount or the description of goods/services donated.

- A statement confirming whether the charity provided any goods or services in exchange for the donation, and if so, a description and fair market value of those goods/services.

- The date the donation was made.

- A clear declaration that no goods or services were provided in exchange for the donation, if applicable.

Review IRS requirements or local tax laws to ensure compliance. Keep receipts simple but complete, making sure they convey all necessary details without excess information. Avoid ambiguous language and confirm the specifics of the donation, including the type and value, if applicable.

- For monetary donations: provide the exact dollar amount.

- For non-cash donations: describe the item(s) and estimate their fair market value.

Lastly, confirm that the receipt clearly states that it serves as acknowledgment of the donor’s contribution for tax purposes. This provides clarity and ensures donors have a valid record for their filings.

Ensure the donation receipt is clear and easy to understand. Begin by listing the donor’s full name and contact details at the top. This provides clarity on who made the donation and ensures the receipt is personalized.

Donation Information

Clearly state the amount donated, the date of donation, and the method of payment. Include any applicable transaction references or check numbers, which will help track the donation for both the donor and the organization.

Non-Profit Organization Details

Include the organization’s name, address, and tax ID number. This establishes credibility and helps the donor use the receipt for tax purposes. Ensure the organization’s mission or purpose is briefly mentioned to reinforce the cause.

Provide a clear statement of whether the donation is tax-deductible and include any additional information relevant to the tax status of the gift, if necessary.

Include the name, address, and phone number of your organization at the top of the receipt. This allows donors to easily verify the source of their donation for any future reference. Clearly display the tax-exempt status of your organization, if applicable, and provide the relevant tax identification number (TIN). This assures the donor that their contribution is eligible for tax deductions.

Provide concise instructions about the donor’s ability to claim deductions. For example, include a statement that the donation is tax-deductible to the extent allowed by law. Also, remind donors to consult with their tax advisor for specific guidance on how to report donations. Offering this information directly on the receipt helps ensure transparency and fosters trust with your contributors.

Donors will appreciate having all necessary details included for both immediate acknowledgment and long-term record-keeping, especially during tax season. Keep the contact information accessible and the tax language clear to minimize any confusion regarding future tax filings.

Keep the structure of your charity donation receipt clear and straightforward. List all necessary details in a table for easy reference. The donor’s name, donation amount, and the date should be included in the top section. Below, add any additional information such as the donation method (e.g., cash, check, online payment) and the purpose of the donation if applicable.

| Donor Name | Donation Amount | Date | Payment Method | Donation Purpose |

|---|---|---|---|---|

| John Doe | $100 | 02/12/2025 | Online | General Fund |

Be sure to include your organization’s details such as name, address, and tax identification number (TIN) at the bottom for verification purposes. A signature or representative’s name could also be added to verify the authenticity of the receipt.