When acknowledging a donation, a well-crafted receipt is key to maintaining transparency and trust. Begin by clearly stating the donor’s name and the exact amount of the donation. This provides both a formal record and a helpful reference for the donor’s tax purposes.

Next, include a statement confirming whether any goods or services were provided in exchange for the donation. If applicable, note the value of those services or goods, ensuring the donor understands the tax-deductible portion of their gift.

End the receipt with a sincere thank you for the donor’s contribution. A personal message can strengthen the relationship and demonstrate the impact of their support. Providing an itemized list of the donation or specific projects funded is another excellent way to showcase how the funds will be used.

Here’s a detailed plan for an informational article on the topic “Template for Donation Letter Receipt” in HTML format with specific headings, as requested:

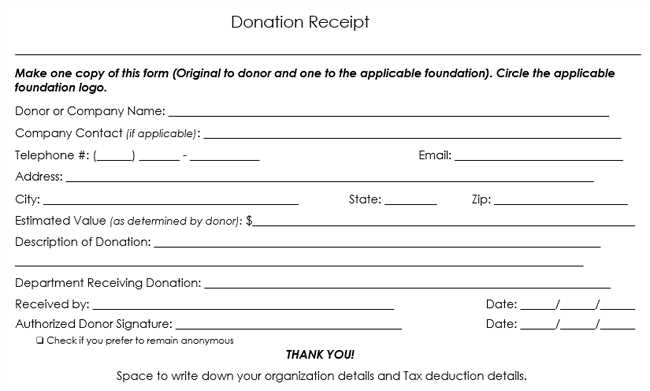

Create a clear and concise structure for the donation letter receipt. Include key details like the donor’s name, the date of the donation, and the amount donated. Ensure the tone is formal yet warm, acknowledging the donor’s generosity.

1. Introduction to Donation Letter Receipt

Provide an overview of the purpose of a donation receipt. Clarify its legal importance for both the donor and the organization, highlighting its role in tax deduction claims.

2. Essential Elements of a Donation Letter Receipt

List the key components that every receipt should include:

- Donor’s name and contact information

- Donation amount (or description of donated items)

- Organization’s name and contact information

- Date of donation

- Statement of no goods or services provided in exchange for the donation (if applicable)

3. Formatting the Receipt Template

Suggest an easy-to-read layout that ensures all information is clearly presented. The donor’s details should be at the top, followed by the donation information, and a concluding thank-you note. Provide a sample template in HTML format for visual reference.

4. Legal Considerations for Donation Receipts

Outline the legal requirements for donation receipts, especially for tax-exempt organizations. Mention any necessary disclaimers or special notes that need to be included for certain types of donations (e.g., items vs. cash donations).

5. Thanking the Donor

Include a personalized thank-you note at the end of the receipt. This is an opportunity to show gratitude and strengthen the relationship with the donor.

6. Example Template

Provide a clean and simple HTML template. Make sure it’s easy for users to copy and adjust for their needs. Here’s a brief sample:

<div class="donation-receipt">

<p>Dear [Donor Name],</p>

<p>Thank you for your generous donation of $[Amount] on [Date].</p>

<p>No goods or services were provided in exchange for this donation.</p>

<p>Sincerely,<br>[Organization Name]</p>

</div>

7. Customization Tips

Provide suggestions for adjusting the template to fit different types of donations or organizational needs. Discuss how to make the tone more formal or informal, depending on the relationship with the donor.

8. Conclusion

Wrap up with a final reminder about the importance of accurate and respectful donation receipts. Encourage organizations to tailor their templates based on the needs of the donor and their specific policies.

- Template for Donation Letter Receipt

A donation letter receipt should clearly provide all necessary details for both the donor and the organization. It ensures transparency and records the charitable contribution accurately. Below is a simple template for creating a donation letter receipt:

Donation Receipt Template

Organization Name: [Your Organization Name]

Organization Address: [Your Organization Address]

Organization Phone Number: [Your Organization Phone Number]

Date of Donation: [Date]

Donor’s Name: [Donor’s Full Name]

Donor’s Address: [Donor’s Address]

Donation Details:

- Amount Donated: [Donation Amount]

- Method of Donation: [Cash, Check, Credit Card, etc.]

- Purpose of Donation: [General Support, Specific Program, etc.]

Additional Information:

- Non-cash Donation (if applicable): [Description of the donated item(s)]

- Estimated Value of Non-cash Donation: [Value]

Receipt Confirmation

Thank you for your generous donation! Your support helps us further our mission of [organization’s mission or goals]. We are a registered non-profit, and no goods or services were exchanged for this donation.

Signature: [Authorized Signature]

Title: [Organization Representative Title]

Date: [Date of Signature]

Begin by addressing the donor personally. Include their name and specific details of the donation to make the letter feel personal and appreciative. Clearly state the amount or value of the donation and describe how it will be used. This lets the donor know their contribution has been recognized and will make a tangible impact.

Ensure that your letter expresses sincere gratitude. Be genuine in your appreciation and convey how their support helps the cause. This is an opportunity to reinforce the donor’s role in achieving the mission and goals of your organization.

Incorporate any legal or tax-related information necessary for the donor. Include a statement confirming the donation was made without any goods or services received in return, if applicable. This helps the donor when claiming tax deductions and ensures compliance with tax laws.

Close the letter with a warm, friendly tone. Reaffirm your appreciation and offer any additional information the donor may find helpful, such as upcoming events or updates about the use of their donation. Always sign off with a personal touch, ideally with the name of a specific person from your organization to establish a more personal connection.

Ensure that your donation acknowledgment includes these key details to maintain transparency and build trust with your donors.

- Donor’s Full Name: Clearly state the name of the donor as it appears on the donation records. This ensures the acknowledgment is properly addressed.

- Donation Amount or Description: Specify the monetary value or provide a detailed description of the donated goods or services. If the donation is in kind, clearly mention what was donated.

- Date of Donation: Include the exact date on which the donation was received to avoid any confusion about when the contribution occurred.

- Charitable Organization Information: Provide the name and contact information of your organization, including tax ID number, to help the donor verify their contribution for tax purposes.

- Statement of Non-Exchange: Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This is essential for tax deductions.

Formatting the Acknowledgment Letter

Be concise but clear in presenting the information. Ensure that the letter is structured professionally, with the donor’s information at the top, followed by donation details, and your organization’s statement. This will help the donor easily access the necessary data for tax filing and future reference.

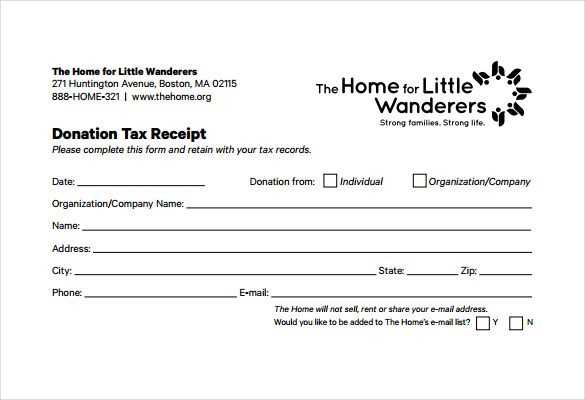

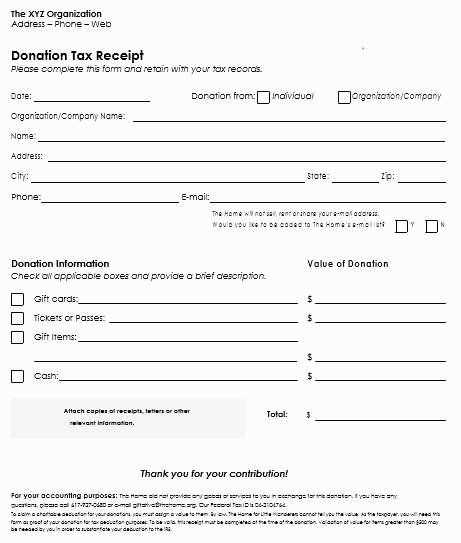

Designing a Clear and Concise Receipt Format

Ensure the receipt clearly presents all the necessary details. Include the donation amount, date, and donor’s name at the top, followed by the organization’s information. Use legible fonts and an organized layout to guide the reader’s eye through the essential elements. Make sure there is adequate spacing between sections to avoid a cluttered appearance.

Key Elements to Include

Start with a clear heading like “Donation Receipt” to establish the document’s purpose. Add a receipt number for tracking and include a thank you message. Follow up with the donor’s full name and the donation amount. Specify whether the donation was monetary or in-kind, and detail any specific items if applicable. Finish with your organization’s tax ID for donor records.

Simplicity and Readability

Keep the language straightforward, without jargon, and use bold or italics sparingly to highlight the most critical information. Avoid overwhelming the recipient with unnecessary details. The goal is to provide a document that’s both easy to read and accurate.

To ensure compliance with tax laws and avoid any misunderstandings, it is crucial to address legal and tax matters when acknowledging donations. Here are key points to keep in mind:

Tax-Deductible Donations

- Confirm that the recipient organization is a registered charity or nonprofit that qualifies for tax-deductible contributions.

- Provide a statement of the donor’s gift that includes the amount donated, the date, and the organization’s details for tax purposes.

- State whether any goods or services were provided in exchange for the donation. If so, the donor must be informed of the fair market value of those items, as this affects the deductible amount.

Donation Receipts

- Ensure the receipt includes the nonprofit’s tax identification number (TIN) or employer identification number (EIN) to support the donation’s tax status.

- Include clear language specifying that the donor did not receive any goods or services in exchange for the donation, if applicable, to ensure the full amount is tax-deductible.

- Issue receipts for donations of $250 or more. These receipts must be sent in a timely manner to meet IRS guidelines.

By adhering to these requirements, both donors and organizations can maintain proper documentation for tax reporting purposes and ensure all parties comply with legal standards.

When creating a donation acknowledgment letter, it’s vital to keep the tone genuine and clear. Below are a few examples of how to structure your acknowledgment for various situations:

1. Standard Donation Acknowledgment

Dear [Donor’s Name],

Thank you for your generous donation of $[Amount] made on [Date]. Your support helps us continue our efforts to [brief description of your cause]. We appreciate your commitment to our mission, and your contribution will make a significant impact.

Sincerely,

[Your Organization Name]

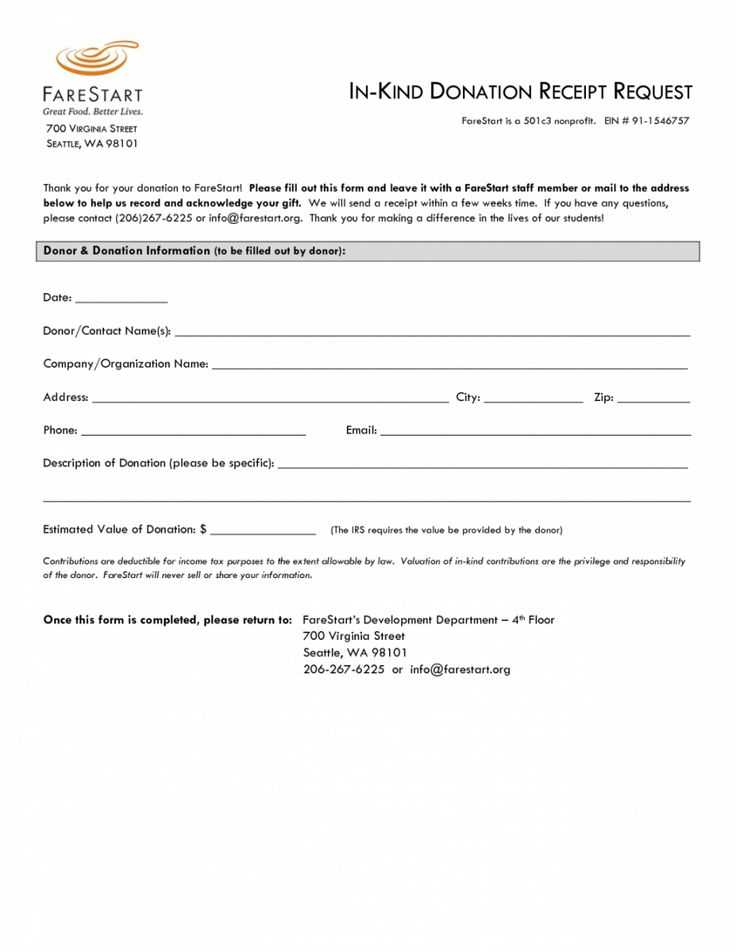

2. Donation Acknowledgment for In-Kind Gifts

Dear [Donor’s Name],

Thank you for your generous in-kind donation of [Item Description] received on [Date]. Your support enables us to [describe how the item will be used]. We are grateful for your contribution to our cause.

Sincerely,

[Your Organization Name]

3. Donation Acknowledgment with Tax Information

Dear [Donor’s Name],

We are grateful for your donation of $[Amount] made on [Date]. This letter serves as your official acknowledgment for tax purposes. Please retain it for your records. Our tax-exempt status under [Organization’s Tax Exemption Number] allows you to claim this donation as a charitable contribution on your tax return.

Sincerely,

[Your Organization Name]

Begin by identifying the key elements that should appear on the receipt. These include the donor’s name, the date of donation, the amount given, and a description of the donation. This information helps ensure transparency and provides a clear record for tax purposes.

1. Add Your Organization’s Branding

Incorporate your organization’s logo and name prominently at the top of the receipt. This not only strengthens your organization’s identity but also assures donors that they are supporting a legitimate cause. If possible, use your organization’s brand colors and fonts to create a consistent and professional look.

2. Include Tax Information

Clearly state whether the donation is tax-deductible. Include the organization’s tax identification number (TIN or EIN), which is necessary for the donor’s tax reporting. Ensure that the receipt states if the donation was for goods or services in exchange, as this can affect the deductibility.

3. Specify the Donation Amount

Be clear about the donation amount, specifying whether the donor contributed a monetary sum, goods, or services. If the donation involves items, include a brief description of those items, as well as their estimated fair market value. For cash donations, simply list the total amount given.

4. Detail the Donation Date

The date of the donation should be clearly listed. This helps donors keep track of their contributions for year-end tax filing and ensures there is a record for future reference. If the donation is in installments, document the payment schedule.

5. Provide Acknowledgement of Gifts in Kind

If the donation consists of non-cash items, ensure that the receipt reflects the nature and approximate value of the goods. While organizations can’t provide exact valuations for donations in kind, offer a good faith estimate based on comparable items.

6. Make it Easy to Read

Ensure the receipt is easy to read and free from clutter. Use a clean layout with clear fonts, and organize the information into sections. Include contact information for your organization so donors can reach out with any questions.

7. Add a Thank You Note

Including a short, sincere thank-you message on the receipt not only expresses gratitude but also reinforces the relationship between your organization and the donor. Personalize the note when possible to make donors feel appreciated for their specific contribution.

8. Consider Using a Template

If you send receipts in bulk, use an online template or software that allows you to customize receipts quickly. Many donation management platforms offer pre-designed receipt templates that can be personalized with your organization’s logo and tax information.

Sample Donation Receipt Template

| Donation Date | Donor Name | Amount Donated | Tax-Deductible | Thank You Note |

|---|---|---|---|---|

| February 5, 2025 | John Doe | $100 | Yes | Thank you for your generous donation to our cause! |

| February 6, 2025 | Jane Smith | 2 used laptops | Yes | Thank you for your in-kind donation! Your support makes a difference. |

To make the donation letter receipt easy to read and clear, include a bullet-point list to highlight key details. This simple format makes it easier for the donor to verify the information at a glance.

- Donor Name: Include the full name of the donor to ensure proper identification.

- Donation Amount: Clearly state the amount donated, along with the currency.

- Date of Donation: Specify the exact date the donation was received.

- Purpose of Donation: Mention the purpose for which the donation is being used, if applicable.

- Receipt Number: Provide a unique receipt number for reference and record-keeping.

Using a bullet-point format helps in presenting information in a digestible way, reducing the chances of errors and providing a professional touch. It also adds to the overall transparency of your donation process.