A proper in-kind donation receipt must include key details to ensure compliance with tax regulations and provide transparency for both donors and recipients. Clearly list the donor’s name, the organization’s details, a description of the donated items, and the date of receipt. Avoid assigning a monetary value to the items–this responsibility lies with the donor or a qualified appraiser.

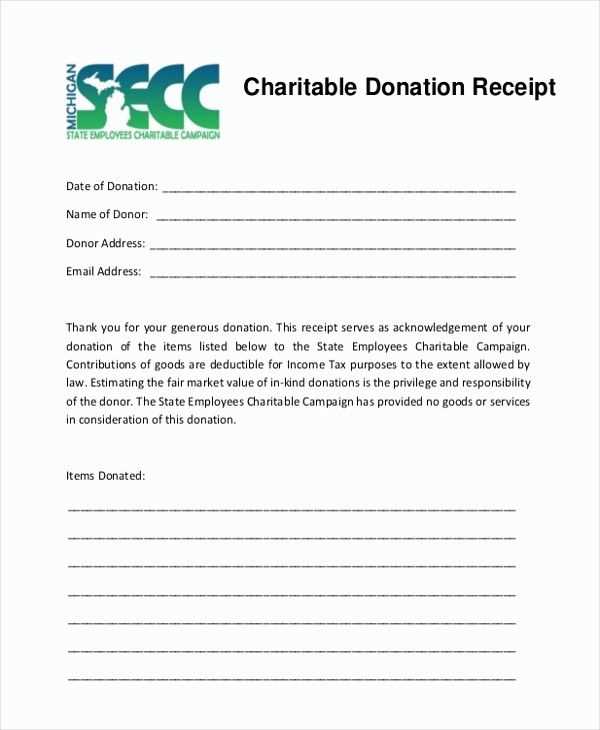

Ensure the receipt includes a statement of no goods or services exchanged. If the organization provided anything in return, such as event tickets or promotional items, specify the fair market value of these benefits. Without this clarification, donors may face difficulties when claiming deductions.

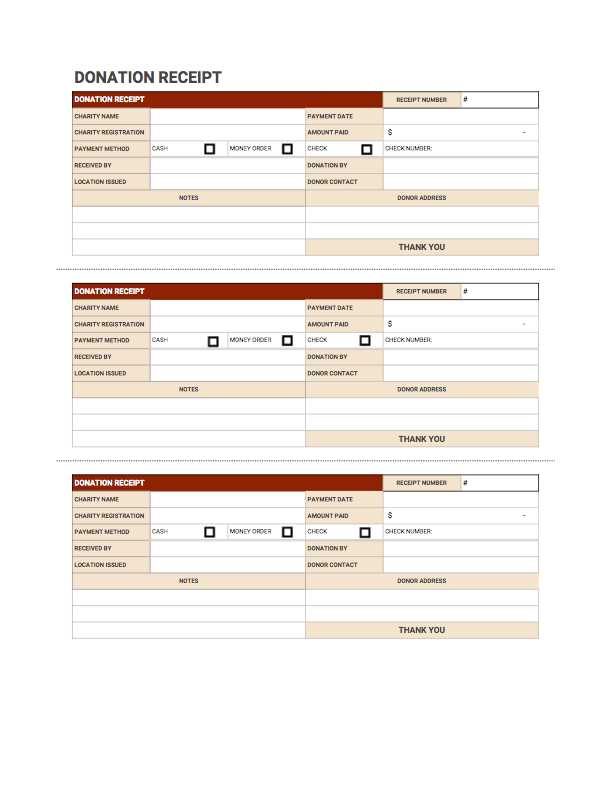

For consistency and record-keeping, use a structured format. Include the organization’s tax-exempt status and a unique reference number for tracking. Electronic receipts are acceptable, provided they meet record retention requirements. A well-prepared receipt simplifies reporting and strengthens donor confidence.

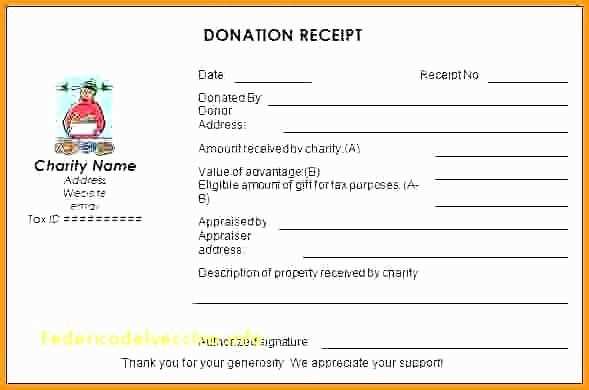

Template for In-Kind Donation Receipt

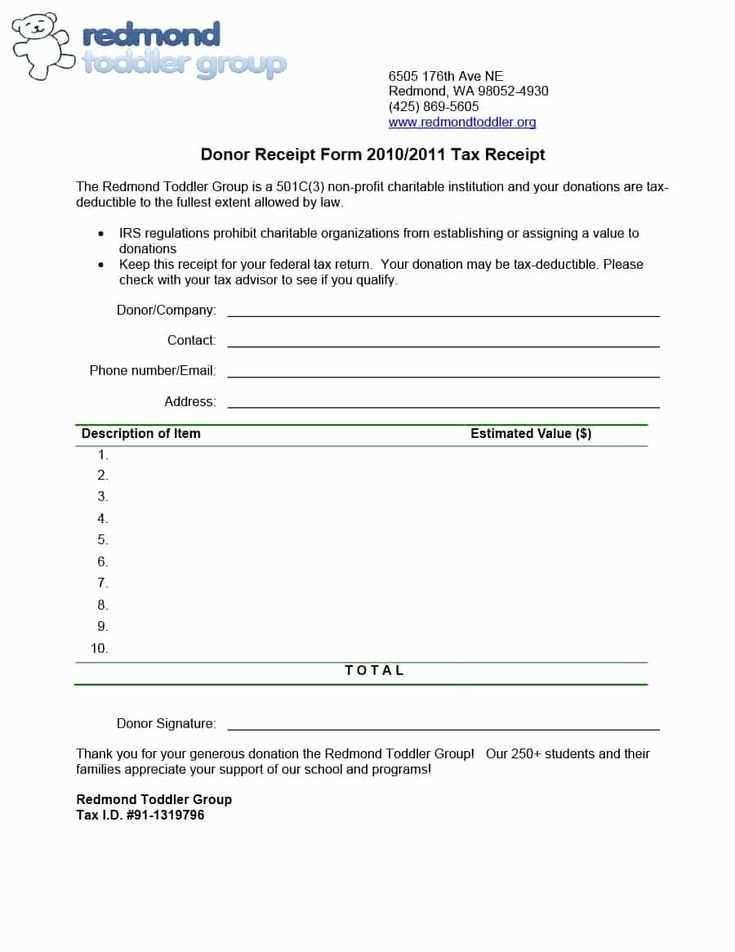

Ensure the receipt includes key details to comply with tax regulations and provide clarity for both the donor and recipient. List the donated items with descriptions and estimated values but avoid assigning a specific dollar amount unless legally required.

Essential Elements

- Organization Information: Name, address, and tax-exempt status.

- Donor Details: Full name and contact information.

- Donation Description: Itemized list with accurate descriptions.

- Receipt Date: The date the donation was received.

- Statement of No Goods or Services: A declaration that no compensation was provided in return.

Suggested Format

- Header with the organization’s name and logo.

- A formal statement confirming receipt of the contribution.

- Clear section listing donated items.

- Signature line for an authorized representative.

Provide receipts in both digital and printed formats for convenience. Maintain copies for record-keeping and ensure compliance with legal requirements.

Key Elements to Include in a Receipt

Include the donor’s full name and contact details, along with the organization’s official name, address, and tax identification number. These details ensure the receipt is valid for record-keeping and tax purposes.

Description of the Contribution

Provide a clear description of the donated items or services. Avoid assigning a monetary value unless legally required, as donors typically determine the fair market value for tax deductions. If the donation is monetary, specify the exact amount.

Date and Acknowledgment

List the date the contribution was received. Include a statement confirming that no goods or services were provided in exchange, or specify what was given if applicable. This confirmation is necessary for tax documentation.

Legal Considerations and Compliance

Provide a detailed receipt that includes the donor’s name, a clear description of the donated items, and the date of the contribution. Omit any valuation of non-cash donations, as tax regulations require donors to determine the fair market value themselves.

Ensure that the receipt explicitly states whether any goods or services were exchanged in return. If none were provided, include a declaration that confirms this. When partial benefits are received, specify the estimated value of those benefits separately.

For compliance with tax requirements, maintain accurate records and store copies of issued receipts. Organizations should verify local regulations to confirm reporting obligations and required disclosures.

| Required Receipt Elements | Description |

|---|---|

| Donor Information | Full name or organization name of the contributor |

| Donation Details | Clear description of the items or services donated |

| Contribution Date | The specific date when the donation was made |

| Fair Market Value | To be determined by the donor, not the recipient |

| Goods or Services Provided | Indicate if any compensation was given in return |

Regularly review documentation practices to align with updated tax laws. Consult a professional for verification if needed, ensuring all issued receipts meet current legal standards.

Formatting Guidelines for Clear Documentation

Use a consistent font and size for readability. Standard choices include Arial or Times New Roman in 12-point size. Maintain uniform margins, typically one inch on all sides, to ensure a clean layout.

Align text to the left for clarity, and use bold or italics sparingly to highlight key details. Avoid excessive capitalization, as it can reduce legibility.

Structure the content with clear headings and subheadings. Lists improve readability, so use bullet points or numbering when outlining key points.

Ensure all sections are concise and logically ordered. Place donor and recipient information at the top, followed by contribution details and any necessary legal disclaimers.

Use simple language and avoid jargon. Short sentences enhance comprehension. Double-check for errors before finalizing to maintain professionalism.

Common Mistakes to Avoid in Receipts

Omitting a clear description of the donated items creates confusion and may lead to compliance issues. Always specify quantities, conditions, and estimated values where applicable.

Leaving out the recipient organization’s details makes verification difficult. Include the full legal name, address, and tax identification number to ensure legitimacy.

Failing to state whether the donor received goods or services in exchange can cause tax complications. Explicitly confirm if nothing was received or describe the benefit provided.

Using vague wording weakens the document’s validity. Phrases like “various items” or “miscellaneous goods” lack precision. Instead, list each item distinctly.

Forgetting the date of donation can make the receipt unusable for tax purposes. Always include the exact date to establish when the contribution occurred.

Neglecting a signature or authorized statement can raise doubts about authenticity. Even if not required, a signed declaration from the organization strengthens credibility.

Handling Non-Monetary Contributions from Different Sources

Verify the nature and condition of each donated item before acceptance. Establish clear criteria for what can be received to prevent storage issues or regulatory concerns. If necessary, request supporting documents, such as appraisal reports or itemized lists.

Maintain detailed records for tax and accounting purposes. Include donor information, item descriptions, estimated values, and dates of receipt. For high-value contributions, consider professional valuation to ensure accurate reporting.

Coordinate logistics for collection or delivery. Large or perishable donations may require special handling, so communicate expectations with donors in advance. If possible, provide receipts immediately to streamline documentation for both parties.

Examples and Customization Tips for Various Organizations

Each organization can adapt the template for in-kind donation receipts to reflect their unique mission, values, and needs. Tailoring the document ensures it aligns with the type of donations they receive and the purpose of those contributions.

Nonprofit Organizations

For nonprofits, it’s useful to include a section highlighting the intended use of the donation. For instance, “This donation will help fund our local food bank initiatives.” This ensures transparency for donors and adds a personal touch. Additionally, consider adding space for tax exemption status or IRS-required language to assist donors with tax deductions.

Educational Institutions

Schools and universities should include specific details regarding educational equipment, supplies, or scholarships received. Customize the receipt to reflect the academic mission and the specific items or services provided by the donor. A line such as “Donation for STEM Lab Supplies” helps clarify the impact of the contribution.

For organizations accepting both monetary and in-kind donations, including a clear description of the donated items, their condition, and approximate value ensures accountability. Customize the receipt template to accommodate various donation types by adding specific categories for different goods like books, furniture, or technology.