A clear and professional donation receipt ensures transparency and compliance with tax regulations. It should include the donor’s name, the donation amount, the date of the contribution, and the recipient organization’s details. If the donation is non-monetary, describe the item and its estimated value. Always specify whether any goods or services were provided in return.

Essential Details: List your organization’s legal name, address, and tax identification number. A brief statement confirming tax-deductibility strengthens credibility. For recurring donations, mention the frequency and total sum contributed within the year.

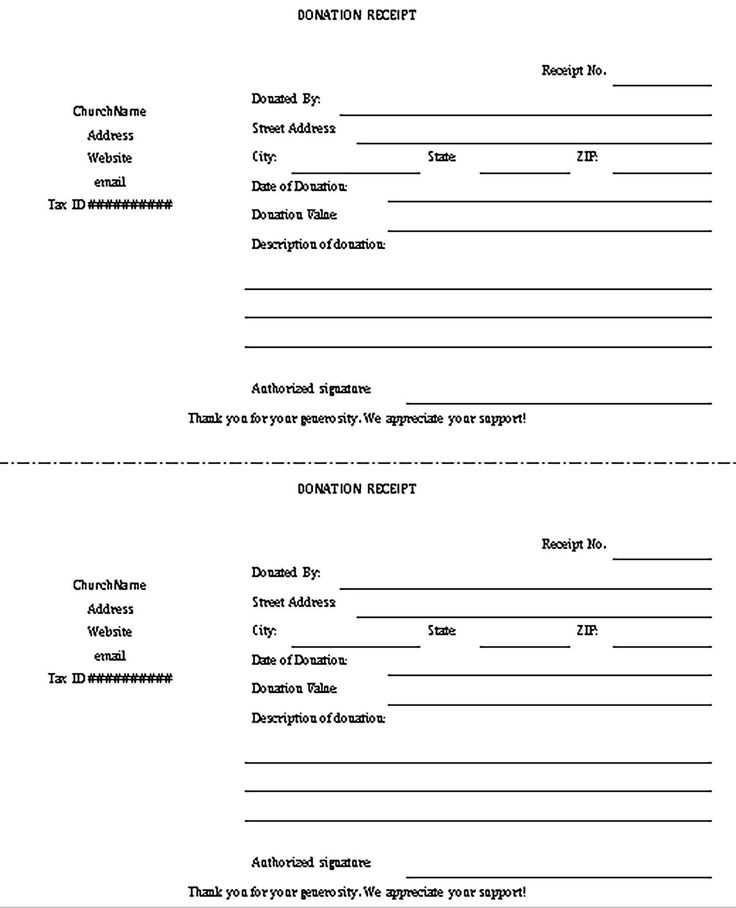

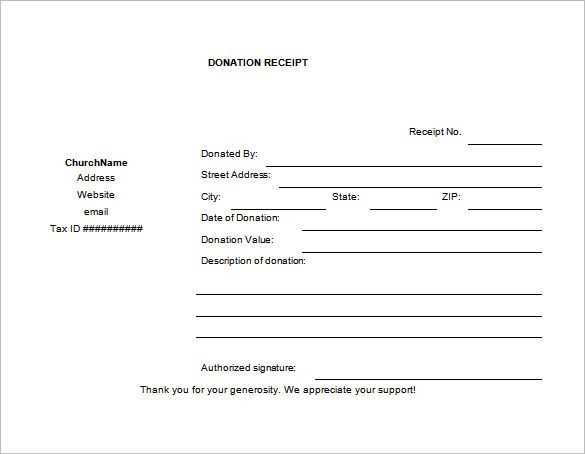

Formatting for Clarity: Use a structured layout with distinct sections for donor and organization details. Digital receipts should be in PDF format for easy record-keeping, while printed versions should use official letterhead. A thank-you message adds a personal touch and encourages future support.

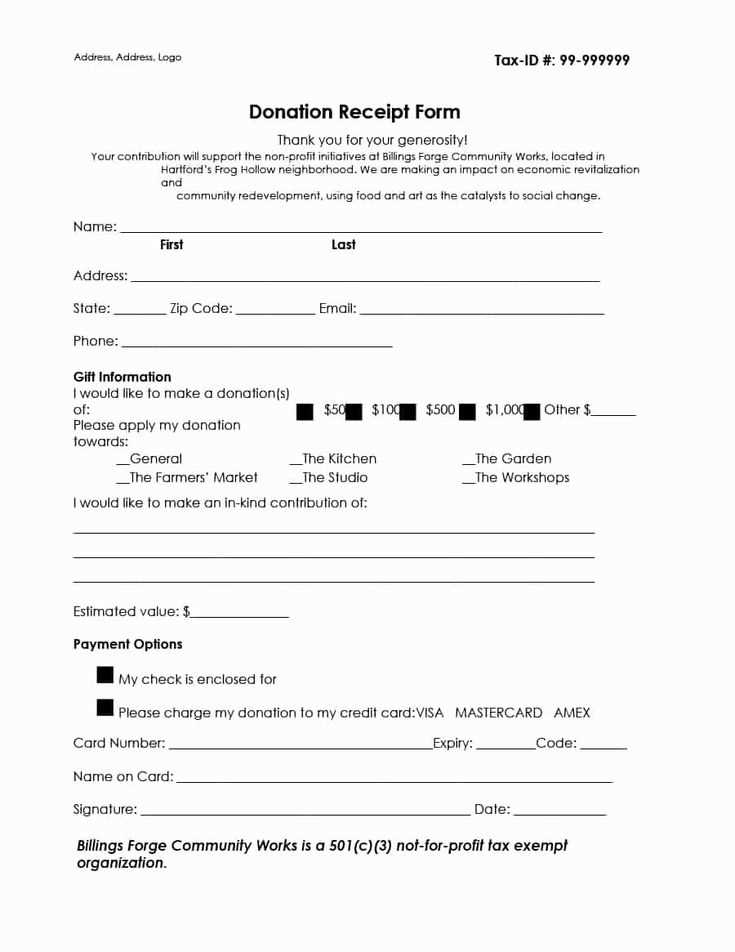

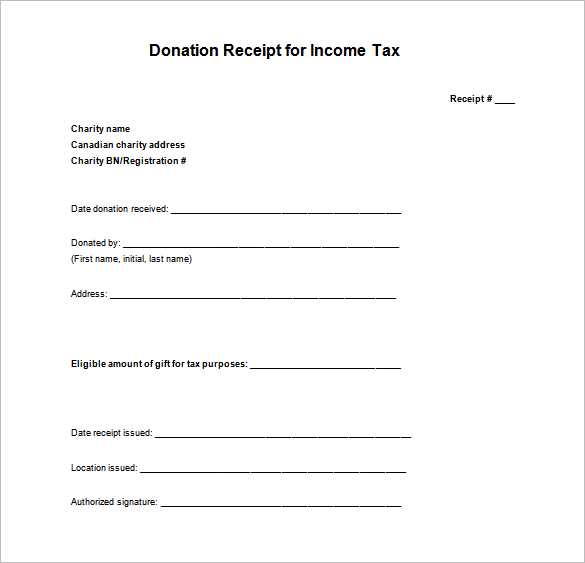

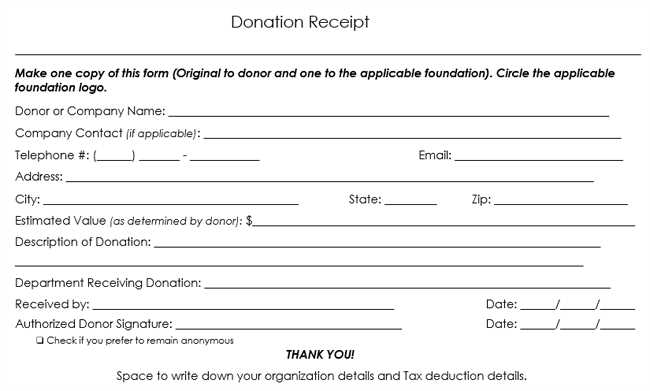

Template Receipt for Donation

Include the donor’s full name, address, and contact details to ensure proper documentation. List the donation amount or describe the donated items with their estimated value. Clearly state the donation date and the recipient organization’s legal name and tax identification number.

Add a statement confirming whether the donor received any goods or services in return. If the donation is fully tax-deductible, include a note saying, “No goods or services were provided in exchange for this contribution.” For partial deductions, specify the estimated value of any benefits received.

Provide a signature or an authorized representative’s name for authenticity. Use clear language and a professional format to make the receipt easy to use for tax reporting.

Key Elements to Include in a Donation Receipt

Ensure the receipt contains all necessary details to comply with tax regulations and provide clarity for donors. Missing information can create issues during tax filing, so include the following:

- Donor’s Name and Address – Accurately record the name and contact details of the donor to establish proof of contribution.

- Organization’s Name and EIN – Clearly state the official name of the nonprofit and its Employer Identification Number (EIN) to confirm tax-exempt status.

- Date of Donation – Specify the exact date to determine the applicable tax year.

- Donation Amount or Description – Provide the monetary value of cash donations or a detailed description of non-cash contributions.

- Statement of No Goods or Services – Include a declaration that no goods or services were provided in exchange for the donation unless there was an exception.

- Signature of an Authorized Representative – Though not always required, a signed receipt adds authenticity.

Nonprofits issuing receipts with these key details help donors meet tax requirements and maintain transparency in financial records.

Legal Requirements and Tax Compliance

Ensure that donation receipts meet federal and state regulations by including the donor’s name, contribution amount, and organization details. For tax-deductible donations, clearly state whether goods or services were provided in exchange and specify their estimated value if applicable.

Nonprofit organizations must comply with IRS rules, including maintaining records for all donations and issuing receipts for contributions over $250. Receipts should be issued promptly and contain a statement confirming the organization’s tax-exempt status under section 501(c)(3).

Electronic receipts are acceptable but must be securely stored for audit purposes. Organizations operating internationally should verify compliance with both local and foreign tax laws to prevent legal issues.

Customizing a Donation Receipt for Different Organizations

Tailor donation receipts by including details relevant to the organization’s structure and donor expectations. For nonprofits focusing on humanitarian aid, highlight the impact of each contribution by specifying how funds are allocated. For educational institutions, mention scholarship programs or facility improvements supported by donations.

Key Elements for Different Sectors

Religious organizations benefit from including a statement of faith-based mission, while environmental groups should emphasize sustainability efforts. Political campaigns must comply with disclosure regulations, listing contributor details and legal disclaimers.

Formatting and Delivery

Adjust receipt format based on the donor base. Large institutions may prefer digital receipts with QR codes for tracking, whereas smaller community groups often use printed acknowledgments with personal messages. Ensure compliance with tax regulations by incorporating necessary legal language specific to the organization’s jurisdiction.