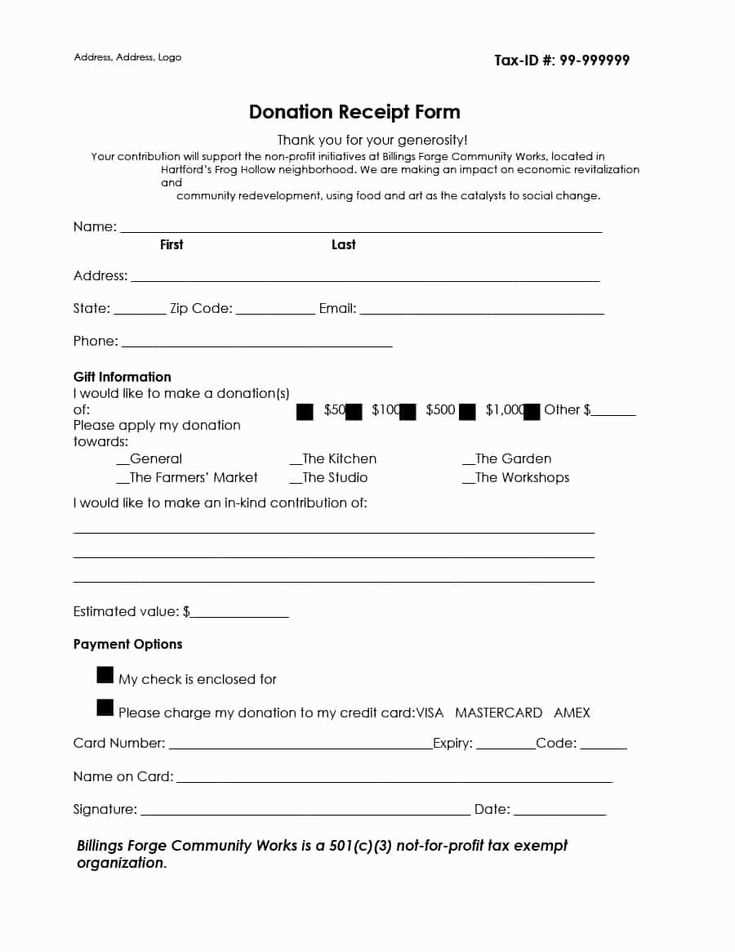

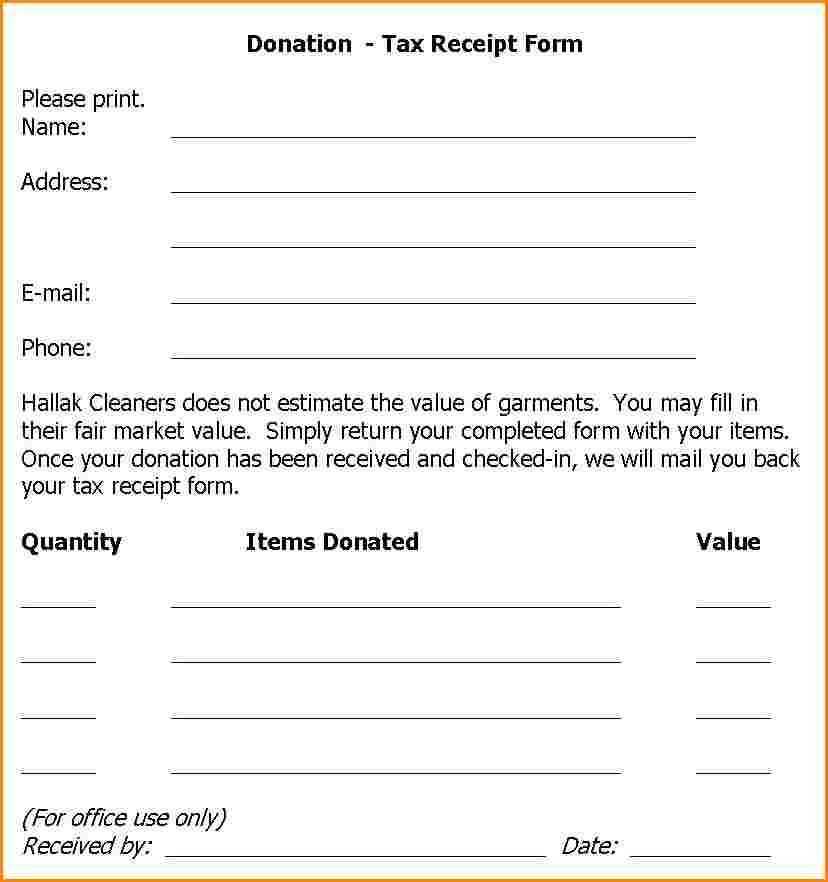

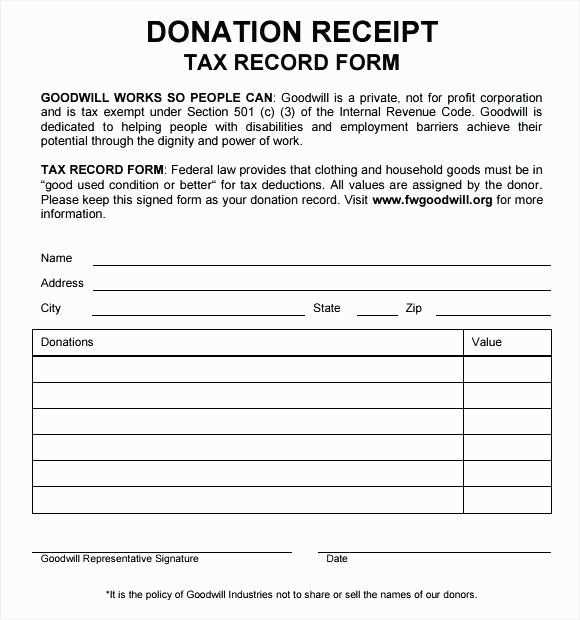

Use a donation receipt template to ensure your records are accurate and meet the requirements for tax deductions. A well-structured template simplifies the process for both the donor and the organization receiving the contribution.

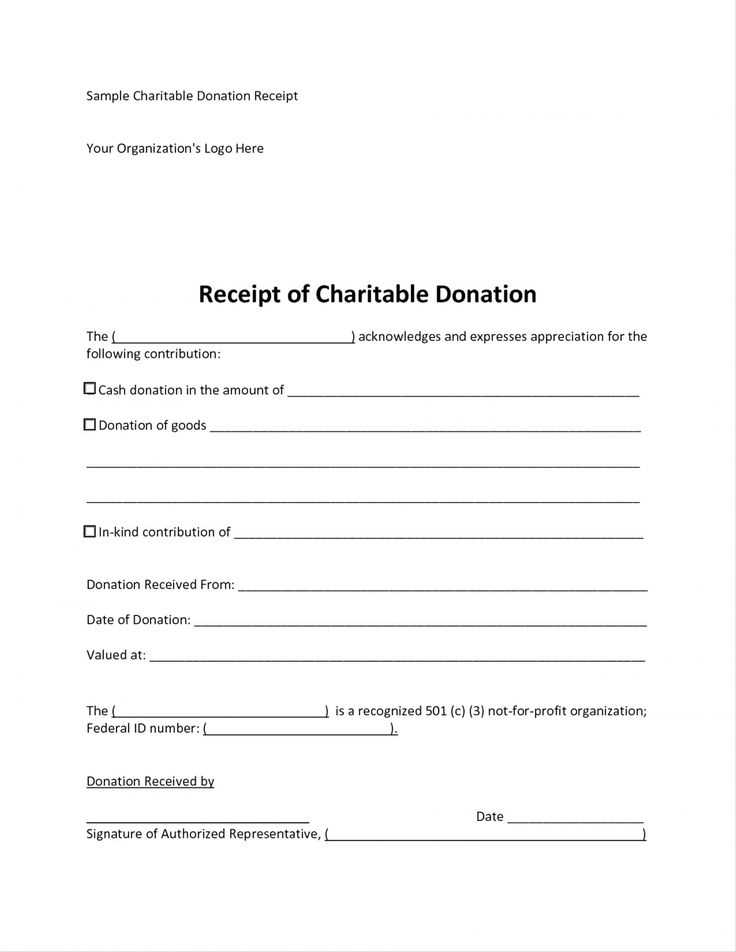

The receipt should clearly list the donor’s name, address, and the amount or description of the donated items. Make sure to include the organization’s name, address, and tax-exempt status to confirm the legitimacy of the donation. Also, specify the date of the donation to avoid any confusion during tax filing.

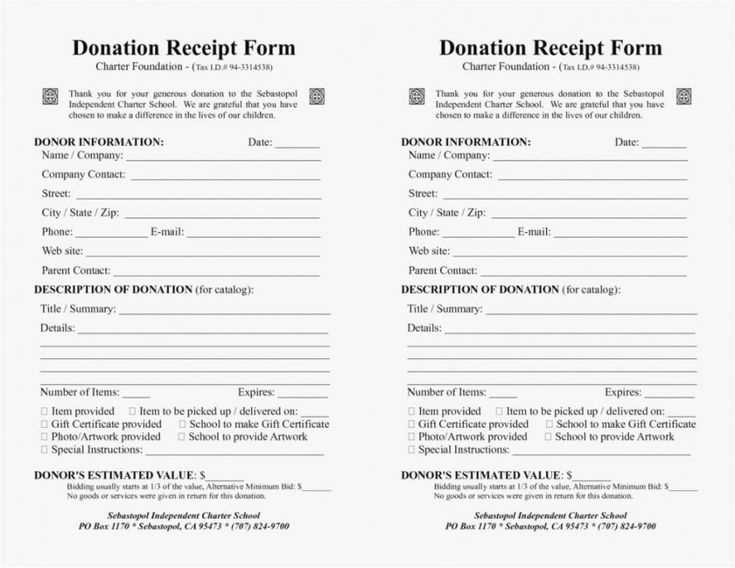

When creating a tax receipt, remember to state whether the donation was monetary or non-monetary. If it involves property, provide a detailed description of the items, along with their estimated value, if applicable. For monetary donations, ensure the exact amount is stated, and if the donor receives any goods or services in return, mention the fair market value of those benefits to ensure transparency.

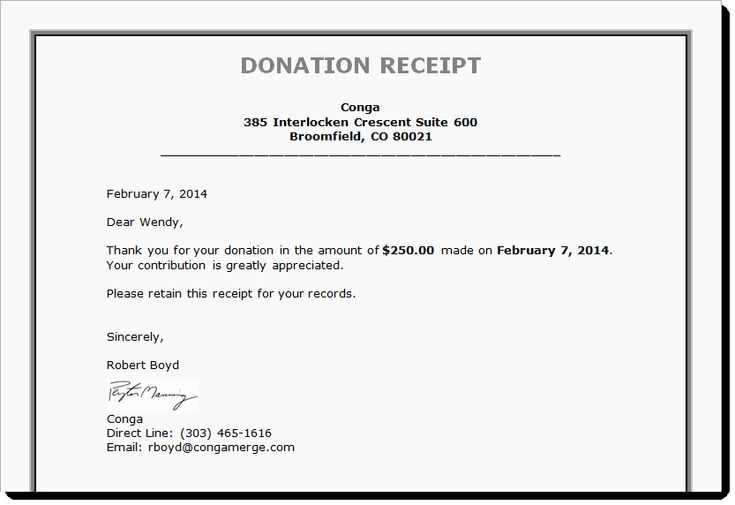

It’s advisable to include a thank-you note or acknowledgment, which strengthens donor relations. Consider using a standard template to ensure consistency in your receipts, making sure that it aligns with the local tax regulations.

Here are the corrected lines:

Ensure that the donation amount is clearly stated. For example, specify the exact contribution, such as “Amount donated: $100”. This prevents ambiguity in case of a dispute or inquiry.

Donation Date

Include the exact date of the donation. A common format is “Date of donation: January 15, 2025”. This helps both parties keep accurate records.

Donor Information

Make sure to include the donor’s name and contact details, such as their email address or mailing address. This is necessary for tax filing purposes and for issuing receipts.

If your organization has a Tax Identification Number (TIN) or Employer Identification Number (EIN), add it clearly on the receipt. This ensures the donation is recognized for tax purposes.

- Template Tax Receipt for Donation

Provide a clear and professional tax receipt for each donation. This document should confirm the donation amount, the donor’s details, and your organization’s information. Ensure that the receipt includes these key components:

- Organization’s Name and Contact Information: Display your charity’s legal name, address, and tax ID number.

- Donor’s Information: List the donor’s full name and address for their tax records.

- Donation Amount: Include the exact amount donated, and specify if the donation was in cash, goods, or services.

- Date of Donation: Clearly state the date the donation was made to confirm the timeline.

- Declaration of Non-Compensation: Add a statement confirming no goods or services were provided in exchange for the donation.

- Receipt Number: Assign a unique reference number for tracking purposes.

- Tax Deductibility Statement: Include a statement that the donation is tax-deductible under applicable laws.

Customize the template for each donation type, ensuring clarity and accuracy for tax filing purposes.

Begin by including your organization’s name and contact details at the top of the template. This should include the official name, address, phone number, and email address, so the recipient can easily reach you if needed.

Next, provide a unique receipt number. This helps track donations and ensures proper record-keeping for both the donor and your organization. It’s recommended to use a simple numerical sequence or a combination of letters and numbers to avoid duplication.

Donation Information

List the date of the donation. This is critical for tax purposes, as it determines the applicable tax year for the donor. Specify the donation type (e.g., cash, check, or property) and include the amount or value of the gift. For property donations, include a brief description and estimated value.

Tax-Exempt Status and Legal Information

Clearly state your organization’s tax-exempt status, referencing your IRS determination letter or other relevant documentation. This assures the donor that the donation is eligible for tax deduction. Include a statement such as, “This donation is tax-deductible to the extent allowed by law.”

Finally, provide a statement indicating that no goods or services were provided in exchange for the donation, if applicable. If any goods or services were exchanged, mention their fair market value to help the donor understand what portion of their contribution is tax-deductible.

Include the donor’s full name and address. This ensures the receipt is tied to the correct individual for tax records. Clearly state the organization’s name, address, and tax-exempt status (e.g., 501(c)(3) in the U.S.), confirming that the donation is tax-deductible.

List the exact donation date and specify the amount for cash donations. If the donation consists of goods, describe the items donated and provide an estimated fair market value, while advising the donor to self-assess the value for tax purposes. Do not assign a value to the donation unless it’s a cash gift.

If the donor receives anything in return for the donation, such as event tickets or merchandise, indicate the value of those benefits. This deduction will help clarify the actual amount eligible for a tax deduction.

Clearly state whether the donor received any goods or services in exchange for the contribution. If no goods or services were provided, include a statement confirming that no exchange took place, which helps ensure the donor can claim the full deduction amount.

Donation receipts must meet specific legal requirements to ensure compliance with tax regulations. They must contain certain information, including the donor’s details, the donation amount, and a statement on whether the donation was in cash or non-cash form. These details help both the donor and the recipient organization manage their tax obligations accurately.

For charitable organizations, ensuring the proper issuance of receipts is critical. The IRS, for example, has strict guidelines for what must appear on receipts for tax-deductible donations. Receipts should include the organization’s name, address, and tax-exempt status, confirming that no goods or services were provided in exchange for the donation, unless specified otherwise.

| Required Information | Explanation |

|---|---|

| Organization’s Name and Address | Clearly identify the charity making the receipt. |

| Donation Amount | For cash donations, the exact dollar amount must be listed. |

| Tax-Exempt Status | Include the tax-exempt number or a statement that the organization is a tax-exempt charity. |

| Description of Non-Cash Donations | For non-cash donations, provide a description of the items, without estimating their value. |

| Statement of No Goods or Services | Confirm if the donor received anything in return for their gift. |

Failure to comply with these requirements may result in the donation not being eligible for a tax deduction. To avoid this, both the donor and the charity must ensure that the donation receipt is complete and accurate before submission to tax authorities.

Adjust your receipt template to match the specific nature of the donation. For monetary contributions, include the exact donation amount, payment method (cash, check, or credit card), and the date of the donation. If it’s an in-kind donation, describe the items donated with as much detail as possible, noting the fair market value of the goods. For recurring donations, specify the frequency (monthly, quarterly) and the amount, ensuring the donor understands the terms of the commitment.

Monetary Donations

Clearly indicate the total amount donated, including the currency. Specify the method of payment to distinguish between cash, check, and online payment systems. If applicable, add a reference number or transaction ID for tracking purposes. This ensures transparency and helps the donor keep a clear record for tax filing.

In-Kind Donations

For goods or services, list each item with its description and estimated value. Be sure to state that the donor is responsible for determining the value of their contribution. If you offer any estimation or appraisal service, indicate that as well. This clarity prevents any confusion for the donor when filing taxes.

Ensure the receipt includes the donation amount, date, and purpose. This clarity helps both donors and organizations maintain accurate records.

- Include a unique receipt number: This ensures each donation is easily traceable and prevents duplication.

- Specify the type of donation: Whether the donation is monetary or in-kind, this should be clear for tax purposes.

- List the organization’s name and contact information: Donors should know who received the donation and how to reach out for any questions or issues.

- State whether goods or services were provided: If a donor received something in exchange for their contribution, make this clear to avoid confusion during tax filing.

- Ensure compliance with tax regulations: Confirm that all required legal information is included, such as the organization’s tax-exempt status.

- Provide a thank-you message: A brief message of appreciation fosters a positive relationship and encourages continued support.

Regularly review your processes to ensure your receipts meet all requirements and maintain accuracy. Donors will appreciate a straightforward, transparent approach to giving and receiving recognition for their contributions.

Store receipts in a dedicated folder, either physical or digital, categorized by year and type of donation. For physical receipts, use labeled envelopes or file folders to keep them organized. For digital receipts, create folders on your computer or cloud storage, naming them according to the donation year and organization.

Ensure that digital copies are clear and legible. Scan or take high-quality photos of receipts and save them as PDF or image files. Avoid using formats that may become outdated or inaccessible over time.

Regularly back up your digital files to a separate hard drive or cloud service to prevent data loss. Consider using a tax preparation tool or app that allows you to upload receipts directly, streamlining the organization process.

If you receive a receipt with an unclear or missing amount, contact the organization promptly to get a replacement. Keep track of any missing receipts by noting the donation details in a spreadsheet, including the date, amount, and organization.

Review your receipts before tax season. Organize them into a spreadsheet or use tax software to track total donations. This will simplify your filing and ensure accurate reporting for deductions.

Template Tax Receipt for Donation

Ensure the tax receipt clearly indicates the donation amount, the date, and the organization name. Include the donation purpose and specify whether it is monetary or material. Mention the receipt number for tracking purposes.

Each donation should be acknowledged with an official receipt. This helps the donor claim tax benefits accurately. Avoid using ambiguous terms; keep the wording precise.

Keep the donation records organized and available for the donor. The receipt should include both the donor and charity’s contact details, ensuring the information is clear and easily accessible.