For a smooth year-end tax filing, providing a clear and organized donation receipt is a must. A well-structured template helps donors track their charitable contributions, ensuring that they can claim the appropriate tax deductions. Make sure to include the donor’s name, the amount donated, the date, and the church’s tax-exempt status. A simple layout can go a long way in making your church’s financial records transparent and easy to review.

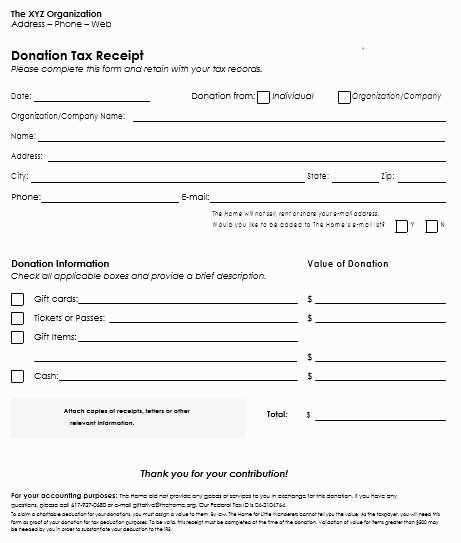

Details to Include: Be specific when listing the donation details. The donor’s information should be correct, with no ambiguity. Clearly specify whether the donation was cash or property. For non-cash donations, include an estimate of the item’s value or a reference to the appraised value to help the donor’s tax claim.

Tax Exemption Statement: Make sure to add a statement confirming the church’s tax-exempt status. This lets the donor know the donation qualifies for tax deduction. You can also mention that the donor did not receive any goods or services in return for the contribution, which is crucial for their tax reporting.

Keep the format simple and direct, ensuring that the donor can easily find the necessary information for their tax return. A straightforward template will save time and minimize confusion during tax season.

Here’s a version with reduced repetition while maintaining clarity and correctness:

Use a straightforward structure for your church donation tax receipt. Include key details like the donor’s name, address, and donation amount. Specify the date of the donation and a clear statement of whether it was a cash or in-kind donation.

Donation Details

List the donation type–whether it’s money, goods, or services–and the exact value. If it’s a non-monetary donation, provide an estimate of its fair market value and a description of the items or services.

Tax Information

Ensure the receipt contains your church’s tax-exempt status and an acknowledgment that no goods or services were exchanged for the donation (if applicable). This clarifies that the donation qualifies for a tax deduction.

Finally, end with a thank you note to show appreciation for the donor’s generosity.

- Year-End Church Donation Tax Receipt Template

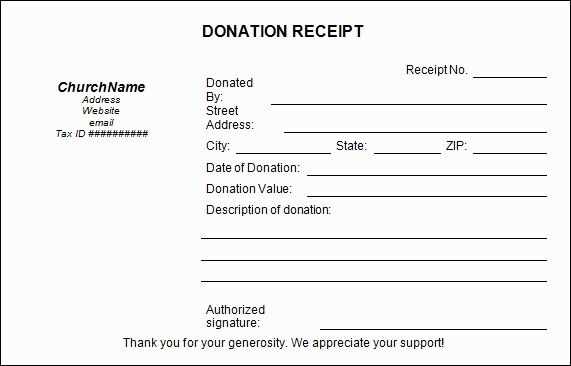

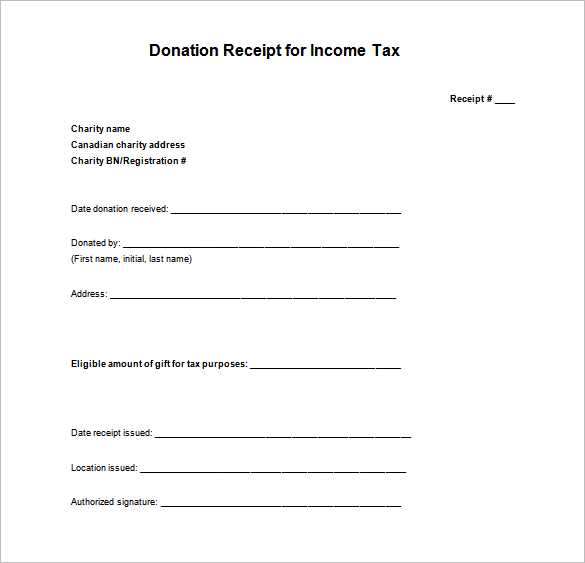

A year-end church donation tax receipt should clearly display the donor’s information, donation details, and the church’s recognition of the contribution. Here’s a simple template structure to follow:

Receipt Header

Include the church’s full name, address, and contact information at the top. This ensures the recipient knows where the receipt is from. Example:

Church Name

123 Church Street

City, State, ZIP Code

Phone: (123) 456-7890

Donor Information

Clearly state the donor’s name, address, and any relevant identification number (if applicable). Example:

Donor Name: John Doe

Address: 456 Donor Avenue, City, State, ZIP Code

Donation Details

Detail the donation amount, date, and description. For non-cash donations, include a brief description of the items donated. Example:

Donation Amount: $500

Date of Donation: December 31, 2024

Description of Items Donated: 3 boxes of clothing, 5 bags of canned food

Tax-Exempt Status Statement

Make sure to mention the church’s tax-exempt status. This statement is necessary for tax purposes:

Tax-Exempt Status: [Church Name] is a 501(c)(3) tax-exempt organization. Donations are tax-deductible under IRS regulations.

Closing and Signature

End with a signature from an authorized church representative and a thank you message. Example:

Signature: [Authorized Representative Name]

Title: Church Treasurer

Thank you for your generous contribution!

Begin with the church’s name, address, and contact details at the top of the receipt. This ensures that the donor can easily identify the organization issuing the receipt. Following that, include the date of the donation. This will help establish the timing for tax purposes.

Include a Clear Donation Description

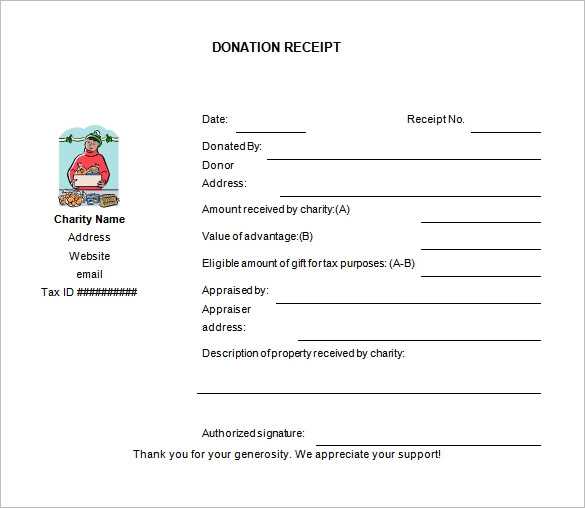

State the amount donated, specifying whether it is cash or property. If the donation is non-cash (e.g., goods or services), describe the donated items clearly. If possible, provide an estimated fair market value for non-cash donations to help the donor with tax filing.

Tax Exemption Confirmation

Clearly indicate that the church is a registered charity with tax-exempt status. This assures the donor that the contribution qualifies for tax deductions. Use a simple statement like, “This donation is tax-deductible under IRS Section 501(c)(3) regulations” for U.S.-based churches.

Include a statement confirming that no goods or services were provided in exchange for the donation. If the donor received goods or services, mention their estimated value to comply with IRS rules.

Finally, add a thank-you note to express appreciation for the donation. A simple, heartfelt acknowledgment adds a personal touch and strengthens donor relations.

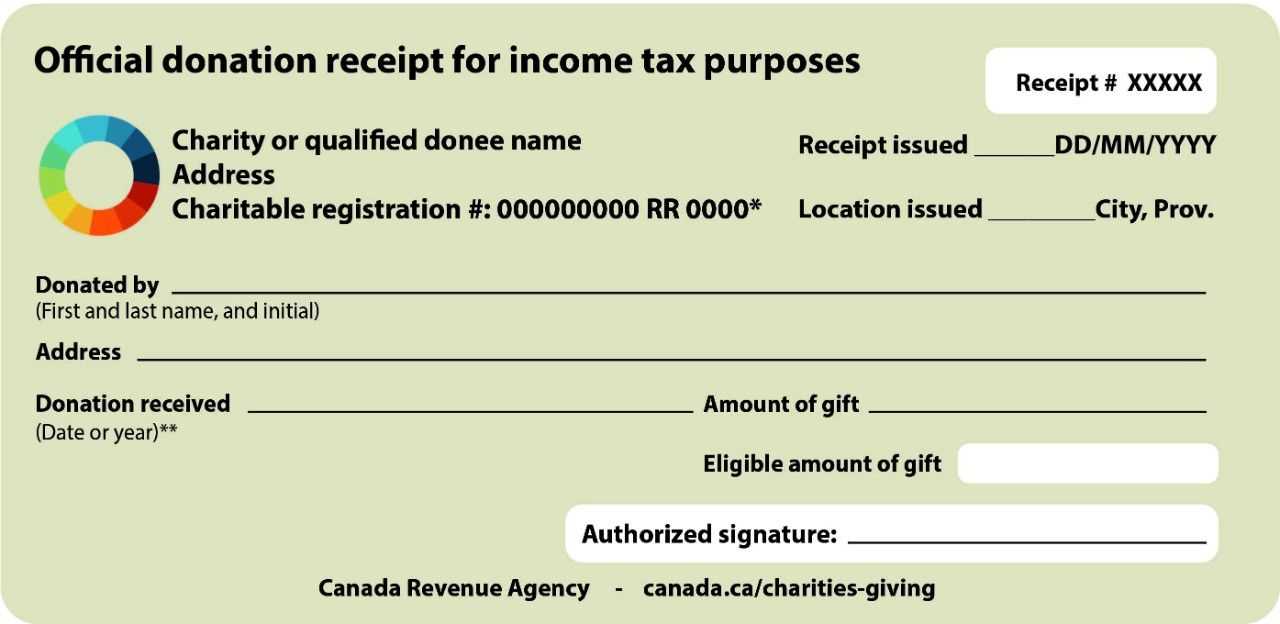

Include the donor’s full name and address at the top of the receipt. This ensures that both the donor and the church are properly identified for tax reporting purposes. Follow this by the church’s name, address, and tax identification number (TIN) for official records.

Clearly state the date of the donation and the amount received. For cash donations, specify the total amount; for non-cash donations, describe the items donated and provide a reasonable estimate of their value. Ensure the receipt mentions whether goods or services were provided in exchange for the donation. If so, specify their fair market value.

| Information | Details |

|---|---|

| Donor’s Name | Full name of the donor |

| Donor’s Address | Full address for verification |

| Church Information | Name, address, and TIN |

| Date of Donation | Exact date of receipt |

| Donation Amount | Exact donation or estimated value |

| Goods/Services Provided | Specify any exchange or benefits |

Finally, provide a statement confirming that no goods or services were exchanged in return for the donation if applicable. The signature of an authorized church representative should be included for authenticity and to meet tax requirements.

Donation receipts must meet certain legal criteria to be valid for tax purposes. To ensure compliance, include the following key details on each receipt:

- Charity’s Name and Address: The full legal name and physical address of the church or charity.

- Tax-Exempt Status: The organization’s tax-exempt status number, such as the EIN (Employer Identification Number) in the U.S.

- Donation Date: The exact date the donation was made. This is crucial for proper tax reporting.

- Donation Amount or Description: For monetary donations, the exact amount must be listed. For non-monetary gifts, a description of the item must be provided.

- Statement of No Goods or Services Provided: Include a statement confirming that no goods or services were provided in exchange for the donation, or a description of any goods/services provided with a fair market value.

- Signature: A signature or electronic equivalent of an authorized representative of the charity or church.

Additional Requirements for Larger Donations

If a donation exceeds $250, additional documentation is required, such as a written acknowledgment of the donation. The receipt should clearly state whether any goods or services were provided in exchange for the donation, along with their estimated value.

State-Specific Regulations

Be aware of specific state or regional rules regarding donation receipts. Certain jurisdictions may have additional requirements, such as specific wording or formats. Always check local laws to ensure full compliance.

Adjust your tax receipt template based on the donation type to ensure clarity and accuracy. Different donation categories require specific information, and customizing the template can streamline this process.

Monetary Donations

For monetary donations, include the exact amount given, the date of the donation, and the method of payment (e.g., cash, cheque, credit card). It’s important to specify if the donation was made online or in-person, as this helps in verifying the donation record for both the donor and your organization.

Non-Monetary Donations

Non-monetary donations, such as goods or services, should be clearly described. Provide an estimated value of the donation based on current market prices or appraisals, if applicable. Ensure that the donor understands the method of valuation used, as this will help them during tax filing.

Recurring Donations

For recurring donations, detail the frequency (monthly, quarterly, etc.), the total amount donated during the year, and any changes in the donation amounts over time. It’s helpful to provide a summary of all transactions for the year in a clear, organized format.

Event-Based Donations

If donations are made during a specific event, indicate the event name, date, and the amount donated. Make it clear if the donation is for a specific cause or project tied to the event, as this may affect how the donor claims their deduction.

By customizing the template for each donation type, you ensure accuracy and ease of use for both the donor and your accounting team. This also helps meet specific tax reporting requirements.

How to Distribute Year-End Receipts to Donors

Distribute year-end receipts to donors promptly after the donation has been processed. Use email for quick delivery and ensure all necessary details are clearly listed. If your church has a secure online system for donations, this could be a good place to send receipts automatically after each donation is made.

Email Distribution

Send receipts as PDF attachments via email to maintain a professional appearance. Include all donation details, such as the amount, the date, and the church’s tax-exempt status. Personalize the email with a thank-you note to show appreciation for the donor’s contribution.

Physical Receipts

If your church prefers to send physical receipts, ensure they are printed with clear and legible information. Address envelopes to the donor’s home address and mail the receipts early in January to give ample time for tax filing. Track the mailing to avoid issues with lost mail.

Ensure that all the necessary details are correctly included. Common errors often stem from missing or incorrect information. Double-check names, addresses, and donation amounts before finalizing the receipt.

1. Incorrect or Missing Donor Information

- Verify the donor’s name and address. Typos or inaccuracies can lead to complications during tax filing.

- Ensure that the donation amount is correct and matches the donor’s records. Even small errors can cause issues.

2. Failure to Provide a Proper Donation Description

- Describe the nature of the donation. For non-cash contributions, be clear about the items or services donated.

- Specify whether the donation was restricted or unrestricted to avoid confusion for tax purposes.

3. Missing Charity Identification Details

- Include the charity’s full legal name and registered address.

- Make sure the charity’s tax identification number (TIN) is listed on the receipt.

4. Incomplete or Inaccurate Donation Amount

- If the donation includes both monetary and non-monetary items, break down the total into clear categories.

- Don’t forget to include any tax-deductible amounts, as per the IRS or local tax guidelines.

5. Lack of a Clear Acknowledgment Statement

- Include a statement that confirms no goods or services were provided in exchange for the donation, if applicable. This is crucial for tax deductions.

- Ensure the wording of this acknowledgment is in line with the regulations for tax purposes.

Ensure the year-end church donation tax receipt template includes key details for clarity. Include the donor’s full name, address, and donation amount. Provide the church’s legal name, address, and tax identification number (TIN) for verification. Clearly state the donation date and a brief description of the gift. If the donation is non-cash, describe the item and its fair market value.

Double-check the format and accuracy of each section. If the donor receives anything in exchange for the donation, note its value and mention it to ensure transparency in tax reporting.

Incorporate a statement confirming that no goods or services were exchanged for the donation, unless applicable. This section helps ensure the receipt meets IRS standards and supports the donor’s tax claims.

Ensure all information is clear, concise, and free of errors. Provide contact details for inquiries to support donors with any potential issues or questions.