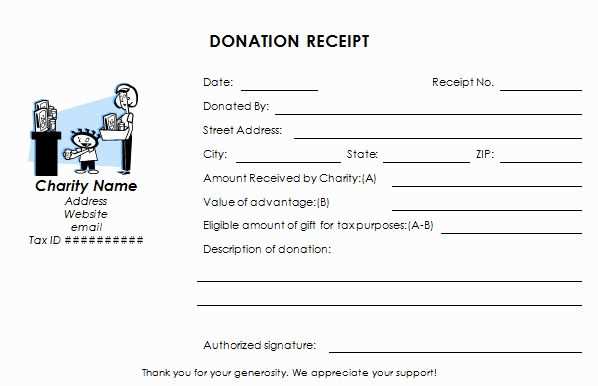

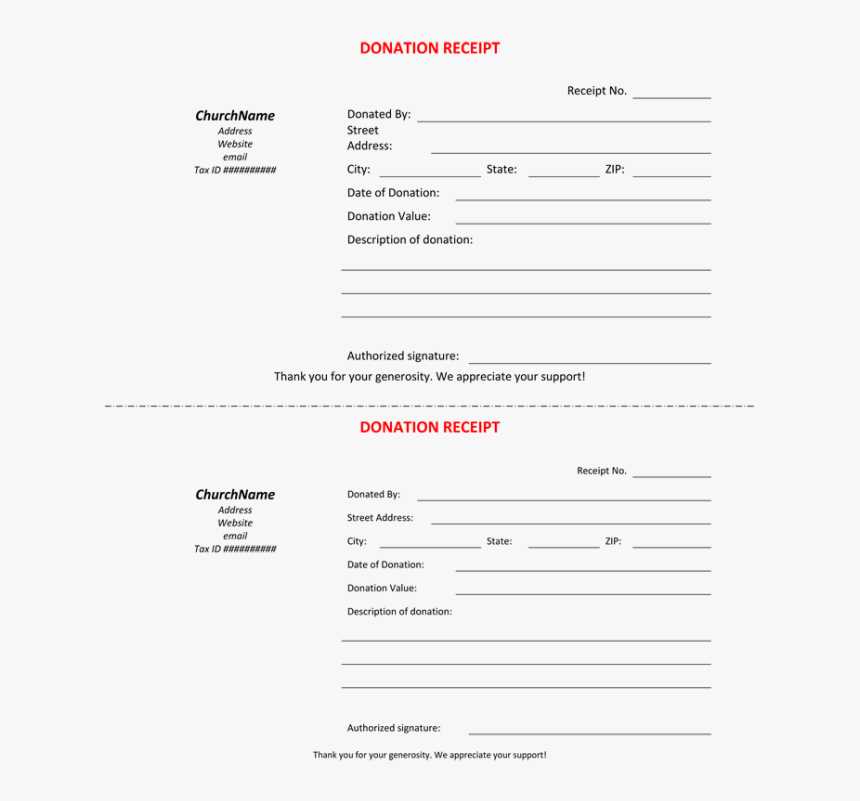

Creating a year-end donation receipt is a straightforward way to acknowledge contributions and help donors claim tax deductions. A clear and concise receipt ensures that both parties meet legal requirements and avoid confusion during tax season. Below is a template that you can customize for your nonprofit or charitable organization.

Date of Donation: The receipt should clearly list the donation date. This helps verify the contribution for tax purposes. If the donation is made via check or another payment method, include the payment date as well.

Donor Information: Include the donor’s full name and address. This allows the IRS to verify the donation and ensures proper recordkeeping for both the organization and the donor.

Donation Amount: Clearly state the donation amount, or the fair market value if the contribution is in-kind. If the donation is a non-cash gift, provide a description and estimate of the value.

Tax-Exempt Status: A statement confirming your organization’s tax-exempt status is necessary. It should specify your IRS tax-exempt number and confirm that no goods or services were exchanged in return for the donation.

Organization Information: Provide the name, address, and contact information of your organization, along with your EIN (Employer Identification Number). This allows donors to easily verify that the receipt came from a legitimate nonprofit.

Signature: While not required, including a signature can make the receipt feel more official. It also adds a personal touch to show appreciation for the donor’s support.

Here is the corrected version:

Begin your year-end donation receipt by clearly stating the organization’s name, address, and tax identification number (TIN). This information verifies the legitimacy of the donation and ensures compliance with tax regulations. Next, specify the donor’s name, address, and donation date. It’s also helpful to include the amount donated, whether it was cash, property, or goods, and if applicable, the fair market value of non-cash contributions.

Indicate whether any goods or services were provided in exchange for the donation. If so, list these items and their estimated value. This helps avoid misunderstandings and gives clarity for the donor’s tax filing. Include a statement that no goods or services were given in return if this applies. Be sure to also include the signature of an authorized representative from the organization for authenticity.

Close with a brief thank you note, expressing gratitude for the donor’s support. This maintains a positive relationship with the donor while ensuring that the receipt remains professional and transparent. Keep the language simple and direct for easy understanding.

- Year-End Donation Receipt Template Guide

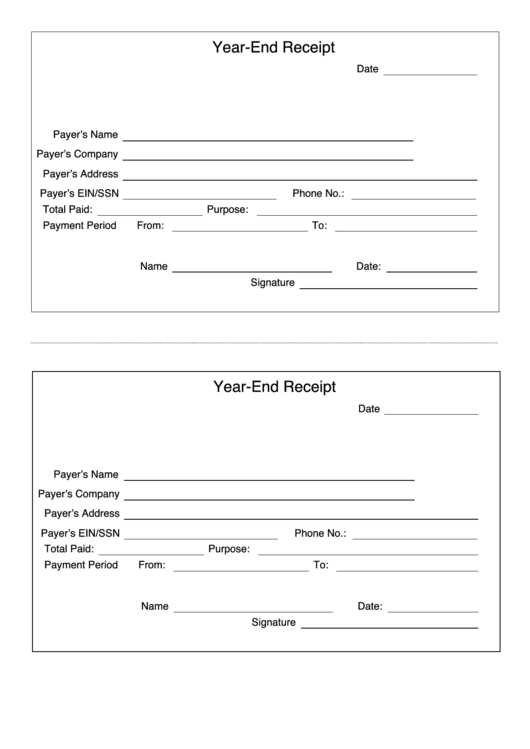

Creating a clear, accurate year-end donation receipt ensures your donors have the documentation they need for tax purposes. The receipt should contain specific information to meet legal requirements and support your donors’ charitable deductions. Below is a straightforward guide to building a donation receipt template for the end of the year.

Ensure your template includes these key details:

| Section | Required Information |

|---|---|

| Organization Name | The full legal name of your nonprofit organization. |

| Donation Date | The exact date the donation was received. |

| Donor Name | The full name of the individual or entity making the donation. |

| Donation Amount | The dollar amount of the donation or a description of non-cash donations (e.g., clothing, property, etc.). |

| Non-Cash Contributions | If applicable, a description of the donated items or services. |

| Statement of No Goods or Services | A statement confirming that no goods or services were provided in exchange for the donation, unless applicable (e.g., a benefit received for a donation over $75). |

| Tax-Exempt Status | Your organization’s tax-exempt status (e.g., IRS 501(c)(3) recognition). |

| Contact Information | Include a contact phone number and email address for questions or further clarification. |

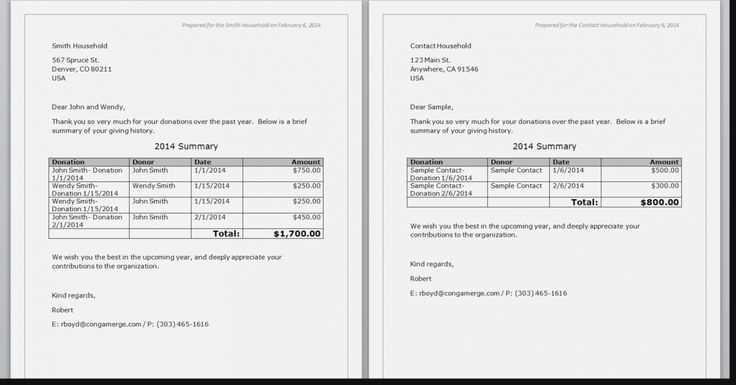

Incorporate the donation’s fair market value (FMV) for non-cash contributions, if applicable. The IRS requires nonprofits to provide a good faith estimate of this value for donations of goods or property. If the donor does not receive goods or services in exchange, you can state that in the receipt. For donations where goods or services are exchanged, you must provide an acknowledgment of the value of those benefits provided.

Ensure that your donation receipts are issued promptly, ideally before January 31st, to help donors prepare for tax season. Save records of all donations to comply with audit requirements and provide a transparent record of transactions for your organization.

Include the full name and address of the donor, the date of donation, and the donation amount or a detailed description of non-cash items donated. For non-cash donations, include an estimated fair market value of the items to help the donor with tax deductions.

State the name, address, and IRS tax-exempt status of your organization, including the EIN (Employer Identification Number). This helps the donor claim tax benefits.

If the donation exceeds $250, note whether the donor received any goods or services in return. If so, include a description and value of those items, subtracting them from the donation value to determine the deductible amount. If no goods or services were received, state this clearly on the receipt.

Ensure that the receipt includes the signature of an authorized representative of your organization. This adds credibility to the receipt and makes it valid for tax filing purposes.

For donations under $250, a simple acknowledgment is enough, but a more detailed receipt is required for larger donations to ensure compliance with IRS rules.

Begin with a clear statement that acknowledges the donor’s contribution. Specify the amount donated, the date it was received, and the organization’s name. This information assures the donor that their gift was recorded properly.

Provide a description of the donation. If the donor contributed a non-monetary item, explain what was donated and its fair market value, if applicable. This helps the donor for tax purposes and clarifies how the gift was used.

If the gift is eligible for tax deduction, include a statement confirming that no goods or services were exchanged for the donation, or if they were, explain the value of those goods or services. This ensures the donor understands their tax benefits.

Ensure to mention the fiscal year for which the donation is being recorded. For instance, if the donation was made in December, but for a specific year-end campaign, clearly state that it is being applied to the campaign or year specified.

End with a personal touch, such as thanking the donor for their support and reinforcing the impact of their gift. A heartfelt message strengthens the donor’s relationship with the organization and encourages continued support.

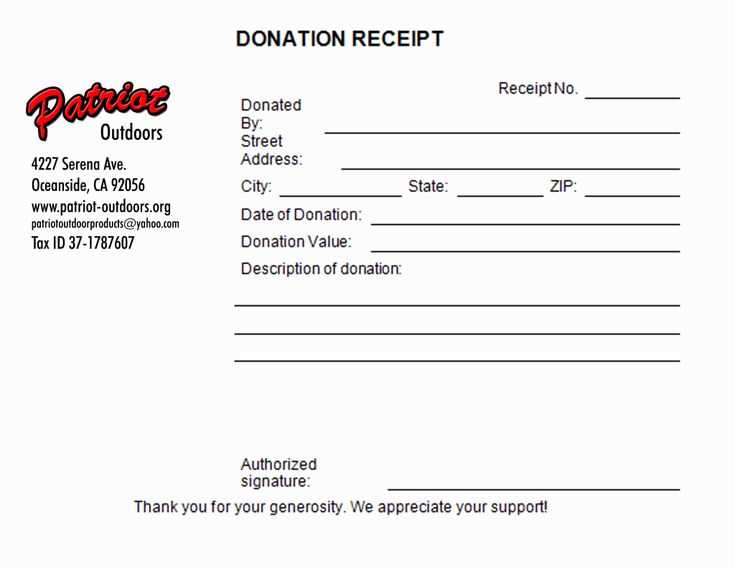

Begin by including your organization’s logo and contact details at the top of the receipt. This establishes trust and makes the document easily recognizable. Use a clean, professional layout for these elements, with the logo prominently placed.

Ensure the donation details are clear. List the donor’s name, the amount donated, and the date of the contribution. If applicable, include specific instructions for recurring donations, such as the frequency and next payment date.

Customize the message of gratitude to reflect your organization’s tone. A warm, personalized thank you note adds a personal touch and shows appreciation for the donor’s support. Make sure this is placed in a visible spot on the receipt, ideally beneath the donation details.

For tax-deductible donations, include a statement confirming that the donation is tax-exempt under your organization’s nonprofit status. If there are any restrictions on the donation, such as a specific use or project, mention those clearly.

Include a donation reference number or receipt ID for tracking purposes. This helps both the donor and your organization maintain records efficiently.

To make it easy for future reference, ensure the receipt is formatted to fit easily into filing systems, whether physical or digital. Consider offering an electronic version that can be downloaded directly from your website.

Lastly, make sure to review local regulations and compliance requirements to ensure that the receipt includes all necessary legal information. This might include specific disclaimers or registration details, depending on your location.

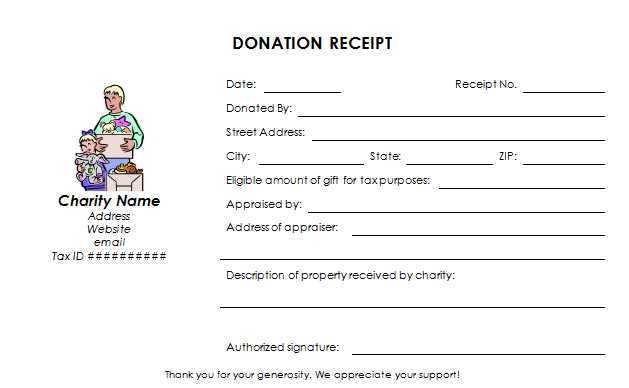

Year-End Donation Receipt Template

Make your year-end donation receipts clear and easy to understand by following these key points.

- Donor Information: Include the donor’s full name and address. Ensure the spelling is correct to prevent any confusion for tax purposes.

- Donation Details: Specify the donation amount and whether it was in cash, check, or goods. For non-cash donations, include a description and an estimated value if possible.

- Organization Information: Clearly list your organization’s name, address, and tax-exempt status. This allows the donor to confirm that your nonprofit is recognized by the IRS.

- Date of Donation: Always include the exact date the donation was made. This is critical for tax records.

- Thank You Message: A brief but sincere thank-you message shows appreciation and strengthens your relationship with the donor.

- Tax Deductibility Statement: Include a statement confirming whether the donation is tax-deductible, as required by law.

Additional Tips

- Be sure to send the receipts within a reasonable time frame, ideally by the end of the year.

- If the donation exceeds a certain amount, consider including additional documentation (such as an appraisal for non-cash gifts).

- Ensure all receipts are stored properly for your own records and available for future reference.