A donation receipt letter serves as an official record of contributions made to your non-profit. It is important to provide this document by the end of the year to ensure donors can claim their charitable contributions for tax deductions. A well-structured letter can increase trust and encourage future giving.

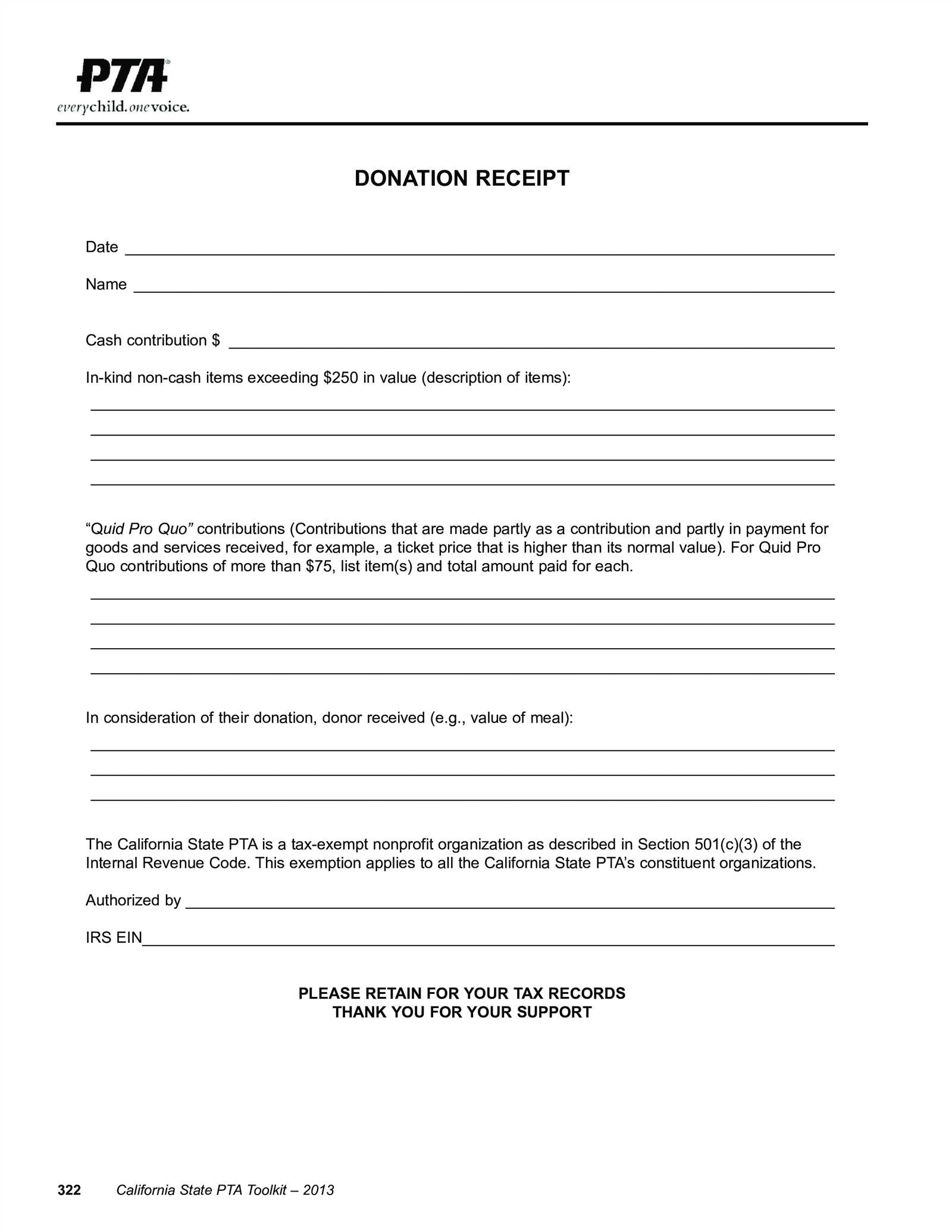

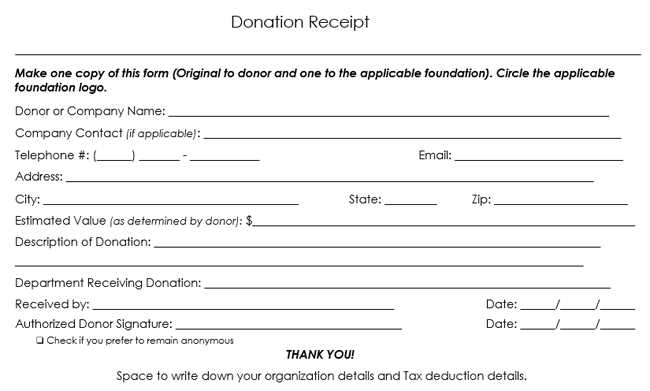

The letter should include key information: donor’s name, donation amount, and the non-profit’s tax-exempt status. For cash donations, specify the amount given. For non-cash donations, describe the items received. This ensures both clarity and accuracy for the donor’s records.

Don’t forget to include a statement of no goods or services provided in exchange for the donation. This confirms the donation is fully deductible. If the donor received something of value, clearly state the fair market value of that item, so they know what portion is tax-deductible.

To save time, consider creating a template with placeholders that can be quickly customized for each donor. Include a personal thank you message, reinforcing the impact their support has made. This personal touch strengthens relationships and builds donor loyalty.

Year-End Non-Profit Donation Receipt Letter Template

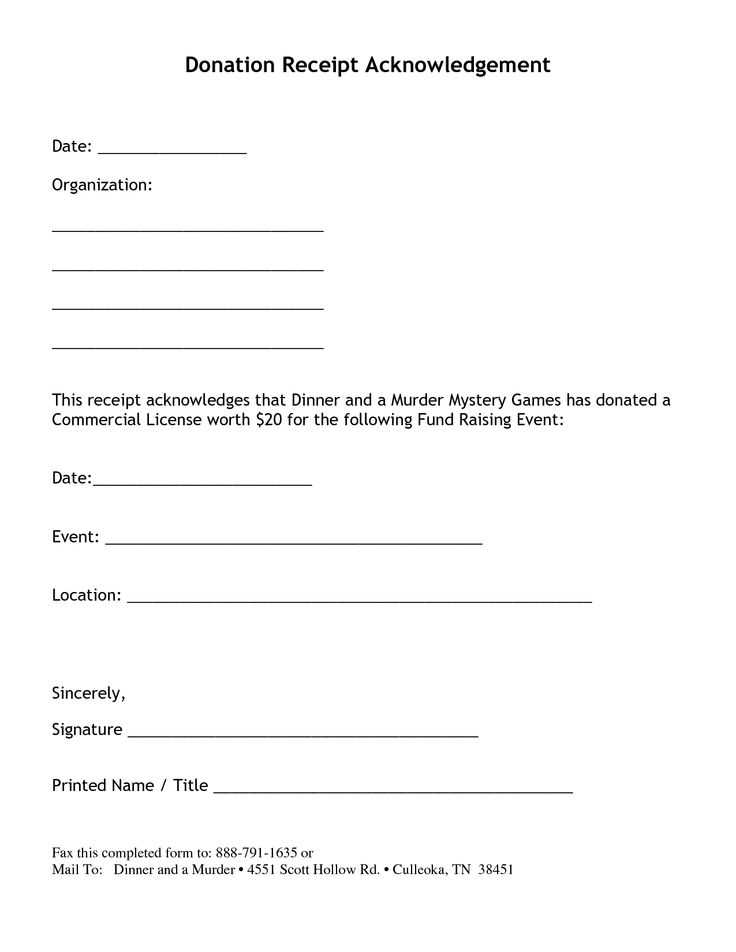

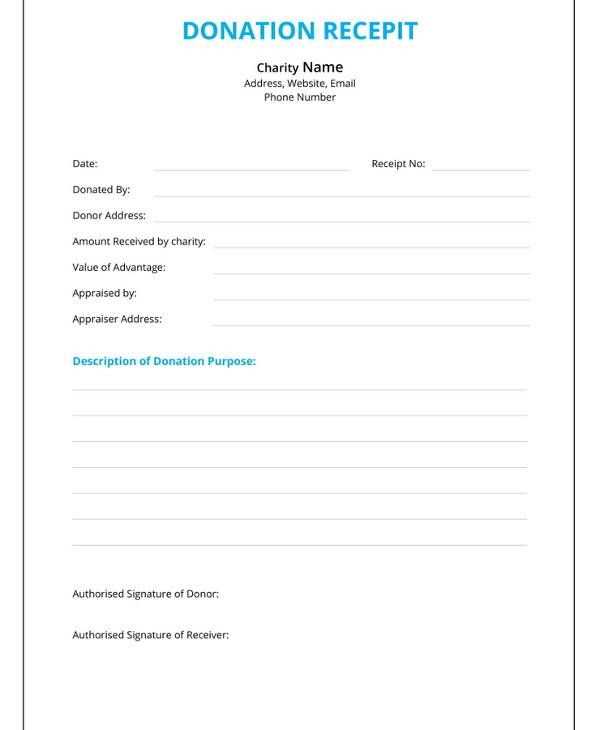

Craft a clear and concise donation receipt letter for year-end contributions to maintain transparency and compliance. Include the following key details: donor’s name, donation date, amount or description of the donation, and a statement confirming the non-profit status of your organization. Ensure the letter is signed by an authorized representative for authenticity.

Key Elements to Include

Start by clearly stating the non-profit’s name, address, and tax ID number at the top of the letter. Acknowledge the donor’s contribution in detail, specifying the donation type–whether cash, goods, or services–and its value. If the donation includes non-cash items, describe them accurately. Finish with a closing statement indicating the donor received no goods or services in exchange for the gift, as per IRS guidelines.

Formatting Tips

Use professional, easy-to-read fonts and format the letter in a way that stands out for the donor. Keep the tone polite and appreciative, but make sure to provide the necessary tax information clearly. Sending these letters promptly after each donation fosters trust and ensures donors can use their receipts for tax purposes before the year ends.

Creating a Clear Acknowledgment for Donors

Provide clear and concise information to your donors in the acknowledgment letter. Start by confirming the donation amount and the date received. This ensures accuracy and transparency for both parties.

Detail the Donation Type

Specify whether the donation was monetary or an in-kind contribution. If the donation includes goods or services, describe the items in detail to avoid any confusion.

Include Your Organization’s Information

Clearly state your nonprofit’s name, contact details, and tax identification number. This will help donors maintain accurate records and can be useful for tax purposes.

- Nonprofit Name

- Tax ID Number

- Address and Contact Information

End the letter with a warm expression of gratitude. A simple “thank you” goes a long way in maintaining a strong relationship with your supporters.

Structuring Tax-Deductible Information Properly

Ensure that your donation receipt clearly outlines the donor’s contribution and the tax-deductible amount. Provide specific figures rather than general statements to avoid confusion. Detail the exact value of non-cash contributions and mention if the donor received any goods or services in return for their donation. If so, the fair market value of those goods or services should be subtracted from the total donation to reflect the true tax-deductible amount.

Detailed Contribution Breakdown

List all donations separately, specifying whether they are monetary or non-monetary. For non-monetary gifts, describe the item(s) donated and their estimated value. Include any appraisals or valuations if applicable. For monetary donations, ensure that the receipt reflects the exact amount given, with no ambiguity regarding the sum.

Clarify Goods and Services Received

If a donor received anything in return for their contribution, outline the fair market value of those goods or services. This step is necessary for ensuring that the donor claims the correct tax deduction amount. Always note the value separately so that the donor knows what portion of their gift is tax-deductible.

Personalizing the Letter for Impactful Communication

Use the donor’s name at the beginning of the letter to establish a personal connection. Reference their specific contribution, whether it’s a dollar amount or the project they supported. Highlight the impact their donation made, connecting it to tangible outcomes such as programs funded, people helped, or resources provided. Tailoring the content to their previous involvement with your organization makes the letter more meaningful. Add a brief note on how their support aligns with the mission, creating a direct link between their contribution and the cause. Acknowledge the donor’s continued commitment to your work if they have given before, strengthening the relationship. Close the letter with a heartfelt thank-you and a reminder of their lasting influence on your organization’s success. This level of personalization makes the communication memorable and shows genuine appreciation.