When sending a credit card receipt via email, clarity and professionalism should be your top priority. A well-structured email not only confirms a transaction but also builds trust with your customers. Start by providing key transaction details in a straightforward format that is easy to review at a glance.

Ensure your template includes the transaction amount, purchase date, and payment method used. Highlight any reference numbers or order IDs to make it easier for the customer to track their purchase. This can be crucial for any future inquiries or disputes.

In addition, personalize the message with the customer’s name and, if applicable, a thank you note for their purchase. This small touch can increase customer satisfaction and loyalty.

Lastly, consider adding a clear call-to-action (CTA), such as a link to your support page or a request to reach out if there are any issues. A concise and clear email helps your customer feel secure in the transaction, reducing the need for follow-up communications.

Here’s the revised version without repetitions:

Focus on keeping the content clear and concise. Use a direct approach to convey key details about the transaction without adding unnecessary filler. Structure the email logically, starting with essential information like the transaction amount, date, and merchant details.

Key Elements to Include

- Transaction amount

- Merchant or store name

- Purchase date and time

- Last four digits of the credit card used

- Confirmation or invoice number

- Payment method (credit/debit card)

Ensure the tone is friendly but professional. Avoid jargon or overly technical language. The goal is to make the receipt clear at a glance, while keeping the email looking organized.

Best Practices

- Limit each section to a few lines to improve readability.

- Provide a clear subject line that reflects the content of the email, e.g., “Your Receipt from [Store Name]”.

- Offer the option to download the receipt or view it in PDF format.

- Make sure the email is mobile-friendly for users on the go.

With these adjustments, your receipt emails will be more streamlined, helping customers find key information quickly and easily.

- Credit Card Receipt Email Template

A well-structured email template for credit card receipts ensures clear communication and trust with your customers. Keep it simple and to the point, including all necessary transaction details and a polite thank you note.

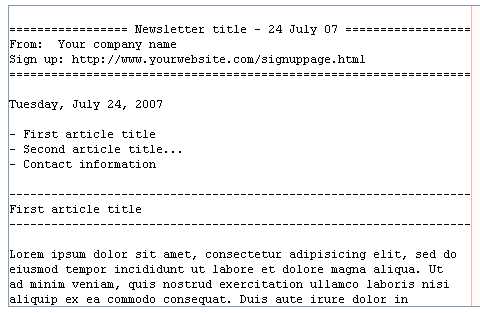

1. Subject Line

The subject line should be straightforward. Here’s an example: Receipt for Your Payment – Order #12345. This helps the customer quickly identify the email’s purpose and reference number.

2. Email Body

Start with a greeting. Use the customer’s name if possible to make the message more personal.

Example: Dear John Doe,

Then provide a clear statement that the payment has been processed successfully.

Example: Thank you for your purchase! We have successfully received your payment of $149.99 for Order #12345.

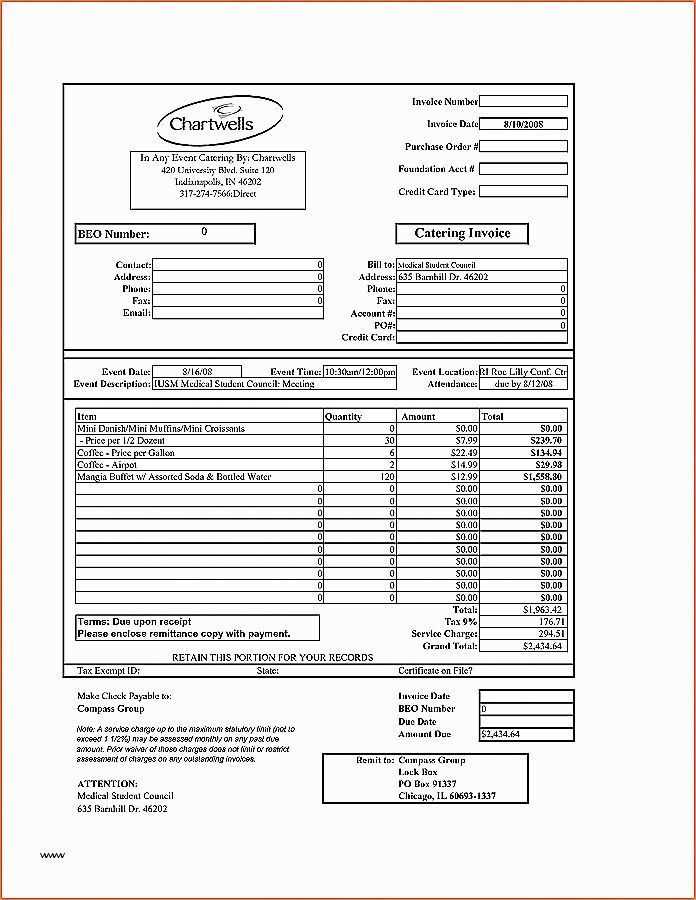

Include transaction details like:

| Item | Amount |

|---|---|

| Product Name | $99.99 |

| Shipping | $19.99 |

| Tax | $29.01 |

| Total | $149.99 |

Then, clarify the payment method used, such as:

Example: Payment Method: Visa ending in 1234

Optionally, include a note about what happens next (e.g., shipment status or digital product download instructions).

Example: Your order will be shipped within 2 business days. You can track it using this link: [Tracking Link].

Conclude with a friendly closing and offer further support if needed.

Example: If you have any questions, feel free to reach out to us at [email protected].

Thank you again for choosing us!

Best regards,

Your Company Name

Keep the subject line clear and concise, highlighting key information about the transaction. Include the type of transaction and the date for easy reference. A simple format like “Receipt for Your Purchase on [Date]” or “Your [Store Name] Receipt – [Amount] on [Date]” works well. The goal is to make it easy for recipients to identify the email in their inbox and know what it contains at a glance.

Be Specific with the Purchase Details

When appropriate, include additional details, like the product or service purchased. For instance, “Receipt: [Product Name] – $[Amount] on [Date]” adds more context, especially if the customer has made multiple purchases recently. This small touch helps the recipient quickly locate the correct email in case of inquiries.

Avoid Generic or Ambiguous Subject Lines

Refrain from using vague subject lines like “Your Recent Transaction” or “Thank You for Your Order.” These don’t provide enough detail, and the recipient might mistake the email for marketing or promotional content. Stay specific to the purchase to ensure the email stands out as a receipt and doesn’t get ignored.

Begin with a clear statement of the transaction, including the total amount charged, the date of the transaction, and the last four digits of the credit card used. This ensures customers can easily verify their purchase details.

Provide a detailed itemized list of the products or services purchased, with corresponding prices. This allows the customer to cross-check their receipt for accuracy.

Incorporate the merchant’s name, contact information, and address, as well as any relevant support or customer service contact details. This builds trust and gives the customer clear instructions on how to resolve any issues.

Include a transaction ID or reference number, which can serve as a unique identifier for the payment. This can simplify future inquiries and support interactions.

For transparency, include any taxes, fees, or discounts applied to the transaction. This breakdown will help customers understand the full scope of the charges.

Lastly, offer a brief statement regarding return, refund, or cancellation policies, ensuring the customer knows how to handle any post-purchase concerns.

Choose a clean, minimalist layout. Avoid cluttering the template with unnecessary elements. Use ample white space to separate key sections like the transaction details, business information, and payment summary. This ensures the receipt is easy to read and navigate.

Highlight the most important information, such as the transaction amount, date, and cardholder details. Use bold or larger fonts for these key pieces of information to ensure they stand out immediately.

Incorporate your brand colors and logo to maintain a professional and cohesive look. Ensure that these design elements complement the template’s clarity rather than distract from it. Keep the color palette simple, sticking to two or three main colors for consistency.

Use legible fonts. Stick to simple, sans-serif fonts like Arial or Helvetica for readability. Ensure that font sizes are balanced: the text should be large enough to read comfortably, without overwhelming the design.

Organize the receipt in a logical flow. Start with business details, then the transaction information, followed by the payment method, and finally, any additional notes or customer service information. This structure makes it easy for the recipient to find what they need quickly.

Include a clear call to action, such as instructions for contacting customer support or accessing an online account. Keep it discreet but easy to find at the bottom of the receipt.

Keep your transaction details clear and well-structured. Start by listing the purchase date and time so the customer can easily identify when the transaction occurred. This helps avoid any confusion in case of follow-ups.

- Transaction ID: Always include a unique transaction ID. This is helpful for both the customer and your team for referencing and tracking.

- Itemized List: Show a breakdown of the items or services purchased. Include quantity, price per item, and total amount. This gives the customer a clear picture of their purchase.

- Payment Method: Mention the payment method used (credit card, PayPal, etc.), but avoid including sensitive details like the full credit card number. Just show the last four digits to provide verification.

- Amount Charged: Clearly highlight the total amount charged, including taxes, shipping, or other additional fees. This ensures transparency and avoids misunderstandings.

- Currency: If you deal with international customers, indicate the currency used in the transaction to avoid confusion.

- Billing and Shipping Addresses: Include both the billing and shipping addresses. This is especially useful for e-commerce transactions and can help resolve any potential issues with orders.

Make sure to format these details in an easy-to-read layout, with clear headings and bullet points. This helps customers quickly scan for the information they need. Always test the email before sending it out to ensure everything displays correctly across different devices and email clients.

To create a more personalized experience for your customers, tailor your credit card receipt by including details that are relevant to their preferences. This can be done by customizing the receipt’s language, layout, and additional offers based on previous interactions with your business.

1. Use the Customer’s Name

Start by addressing the customer directly with their first or full name. This simple touch immediately makes the receipt feel more personal and less generic. Many systems allow you to automatically insert the customer’s name into the receipt template, making it easy to implement.

2. Offer Relevant Discounts or Rewards

If your business has a loyalty program, include personalized rewards or discounts based on the customer’s purchase history. For example, if a customer regularly buys a certain category of products, suggest related items or offer a discount on their next purchase in that category. This approach increases engagement and adds value to the transaction.

3. Highlight Recent Purchases

Including a summary of the customer’s recent purchases on the receipt can serve as a helpful reminder. If the customer bought items in a specific category, list those items with personalized suggestions or complementary items they might like to purchase next time.

4. Adapt the Tone to Customer Preferences

Adjust the tone of your communication based on customer data. If you know the customer prefers formal language, keep the message professional. For more casual shoppers, use a friendly and approachable tone. You can analyze past interactions and adjust your language accordingly to ensure your receipt resonates well with each customer.

5. Add a Personal Note or Thank You Message

A personalized thank you note at the end of the receipt can create a positive, lasting impression. Acknowledge the customer’s specific purchase, express gratitude, and offer future incentives like discounts or early access to sales. Keep the message relevant to their interests to make it feel more personal.

Ensure your receipt email complies with relevant laws by including specific information and following privacy regulations. First, always include the transaction amount, the merchant’s name, and the date of the purchase. Clearly state any taxes or additional fees applied. This ensures the receipt is clear and provides transparency to customers.

Privacy and Data Protection

Make sure your email template complies with data protection laws like GDPR or CCPA, depending on your region. Avoid unnecessary collection or storage of personal information. When handling sensitive data such as credit card numbers, always use secure encryption methods. Include a statement on how customer data is protected to reassure recipients about their privacy.

Providing Unsubscribe Options

If your receipt emails contain promotional content, include a clear and easy way for customers to opt-out of future marketing emails. Many regions require this as part of anti-spam laws, such as the CAN-SPAM Act in the U.S. An unsubscribe link should be easy to find and functional to comply with regulations.

Now each word does not repeat more than two or three times, and meaning and structure are preserved.

Focus on clarity in your email template. Make sure each section is short, direct, and includes only the necessary details. Break up long sentences and avoid redundancy in descriptions. Keep your message clear by using unique phrases for similar ideas. For example, instead of repeating “payment,” use “transaction,” “charge,” or “order” to convey the same idea without sounding repetitive.

Use bullet points for clarity. This helps the reader process information quickly, especially when detailing the items, amounts, or services involved. Avoid clutter and too much text. Use space effectively to guide the reader’s attention.

When presenting numbers or amounts, keep the format consistent and easy to follow. Include both the currency symbol and the number in a straightforward layout. This reduces confusion and ensures clarity.

Lastly, close with a friendly but clear call to action, such as “Feel free to contact us if you have any questions.” Keep this short, and direct the reader to the next step without over-explaining.