Mastering an Excel paycheck receipt template streamlines payroll management and offers a clear overview of employee earnings. Instead of relying on generic templates, create a custom format tailored to your needs. A well-designed receipt can make tracking payments, deductions, and bonuses effortless for both employees and payroll managers.

Start by organizing the layout: include key details such as employee name, ID, pay period, and payment date. Use formulas to calculate earnings, taxes, and deductions automatically. For added precision, include separate columns for regular hours, overtime, and commission-based pay. This breakdown ensures transparency and reduces errors.

Next, incorporate conditional formatting to highlight any discrepancies or missing data. This visual cue helps catch issues early, saving time on manual checks. Additionally, consider adding a section for employer contributions like health benefits or retirement plans. This gives employees a clear understanding of their total compensation package.

Finally, take advantage of Excel’s security features to protect sensitive payroll data. Use password protection or lock cells that contain confidential information to prevent unauthorized access. With these simple yet advanced features, your paycheck receipt template will keep payroll running smoothly while reducing the risk of mistakes.

Excel Advanced Paycheck Receipt Template Guide

Design a detailed and clear paycheck receipt template in Excel by starting with the right layout. Create distinct columns for employee name, pay period, gross pay, deductions, net pay, and any bonuses. Use separate rows for each paycheck record, and label them clearly to avoid confusion. Format the numbers as currency to make the data visually appealing and easy to read.

Setting Up Basic Formulas

Incorporate simple formulas to automate calculations. For instance, calculate net pay by subtracting the total deductions from gross pay using the formula: =Gross_Pay - Total_Deductions. This saves time and minimizes the risk of errors. Set up additional formulas for overtime or bonuses based on employee work hours or performance metrics. Be sure to test these formulas to ensure accuracy.

Customization and Formatting Tips

To enhance clarity, color-code the rows for better visibility, especially when dealing with large datasets. Use conditional formatting to highlight overtime pay or deductions that exceed a certain threshold. Incorporating drop-down lists for common deductions, such as taxes or benefits, will streamline data entry and ensure consistency across multiple records.

Customizing Paycheck Templates for Different Payment Structures

Adjust paycheck templates based on the payment frequency and structure used by your organization. Start by selecting the correct layout for salaried, hourly, or commission-based employees, as each has unique calculations for gross and net pay.

Salaried Employees

For salaried employees, simplify the template by displaying the annual salary divided by the number of pay periods. This ensures employees can easily see their fixed earnings for each paycheck. Include deductions such as taxes, benefits, and retirement contributions. Be sure to calculate any overtime or bonuses if applicable, ensuring these are added to the base salary as separate line items.

Hourly Employees

For hourly workers, include fields for the total hours worked and hourly wage. Make sure to account for overtime, which may require different rates (typically 1.5x the regular hourly wage). A dynamic formula can automatically calculate earnings based on hours worked within each pay period. Incorporate deductions similarly to salaried employees, adjusting based on actual earnings for the period.

For commission-based employees, set up the template to reflect both base salary and variable earnings from commissions. This allows employees to clearly see their performance-based income along with their guaranteed pay. It’s also helpful to track sales or performance metrics alongside commission figures.

Ensure the template has an area for displaying tax withholdings, which can vary depending on the employee’s earnings and deductions. By customizing the paycheck template according to these structures, it becomes easier to manage payroll, improve transparency, and reduce errors during processing.

Incorporating Tax Deductions and Withholdings in Excel

To correctly incorporate tax deductions and withholdings in an Excel paycheck receipt template, begin by understanding the various categories of taxes that need to be withheld from an employee’s salary. These typically include federal income tax, state income tax, Social Security, Medicare, and sometimes other local taxes.

Set up a separate section in the Excel template for tax calculations. Use the following steps for a streamlined process:

- Federal and State Tax Calculations: Use the employee’s filing status and income level to calculate federal and state tax withholdings. Excel allows you to apply tax rates using lookup tables or formulas based on progressive tax brackets. You can find these tables online or through government resources.

- Social Security and Medicare: These taxes have fixed rates. For 2025, Social Security is withheld at 6.2% on income up to the wage base limit, and Medicare is withheld at 1.45%. Apply these rates using simple multiplication formulas (e.g., =A2*0.062 for Social Security).

- Additional Deductions: If applicable, set up rows for other deductions such as retirement contributions, health insurance premiums, or union dues. These can be calculated as fixed amounts or percentages of gross income, depending on the company’s policies.

After calculating the total deductions, subtract them from the gross pay to determine the net pay. To ensure accuracy, consider adding an audit column where you can check if the amounts are correct. Using conditional formatting can help highlight discrepancies in tax amounts.

It’s also helpful to include a section that breaks down each deduction category so employees can see where their money is going. You can make this section dynamic by referencing the main calculation area and updating it automatically based on gross pay.

- Example Formula for Federal Tax: =VLOOKUP(A2, tax_table_range, 2, TRUE), where A2 is the income and tax_table_range is the table containing tax brackets.

- Example Formula for Social Security: =A2 * 0.062.

With these steps, you’ll have an Excel template that accurately reflects tax deductions and withholdings, making it easy for both payroll administrators and employees to track and verify each payment.

Automating Overtime Calculations for Accurate Pay

To automate overtime calculations in your paycheck receipt template, use Excel formulas that adjust automatically based on the regular working hours and overtime rate. First, create columns for regular hours, overtime hours, hourly rate, and total pay. In the overtime column, calculate the excess hours worked beyond the standard 40-hour workweek, which will be the basis for overtime pay.

Use the following formula to calculate overtime hours: =IF(A2>40, A2-40, 0), where A2 represents the total hours worked in a week. Then, for the overtime pay, multiply the overtime hours by the overtime rate. A common overtime rate is 1.5 times the regular hourly rate, so the formula becomes: =C2*1.5, where C2 is the hourly rate.

To calculate total pay, sum the regular pay (Regular Hours * Hourly Rate) and overtime pay (Overtime Hours * Overtime Rate). Use this formula: = (B2 * C2) + (D2 * E2), where B2 is regular hours, C2 is the hourly rate, D2 is overtime hours, and E2 is the overtime rate.

This automated system ensures that calculations are done accurately every time, saving you time and eliminating errors from manual calculations. Additionally, adjusting for different overtime rates or pay periods can be done easily by modifying the formulas without having to redo the entire spreadsheet.

Tracking and Displaying Bonuses or Commission Payments

To track and display bonuses or commission payments in your Excel paycheck template, create a dedicated section that clearly separates these from regular earnings. Use columns for “Bonus Type,” “Amount,” and “Payment Date.” This will make it easy to categorize and view each bonus or commission paid out. Consider using dropdown lists for “Bonus Type” to help ensure consistency, such as “Performance Bonus” or “Sales Commission.”

For calculations, implement formulas that can automatically calculate the total of bonuses or commissions. If a specific percentage of sales is paid as a commission, use the formula `=Sales*CommissionRate` to quickly generate the payment. For bonuses, use a fixed value or a percentage of the salary, depending on how the bonus is structured.

Use conditional formatting to highlight the rows with bonus payments or commissions, so they stand out in your report. This can help you quickly identify total bonus payments across different pay periods. Make sure to include a “Total Bonus/Commission” row at the bottom to sum these amounts, ensuring a clear overview at the end of each pay period.

Finally, keep track of the reason for each bonus or commission. If they’re based on specific achievements, link these details to a separate note or reference document. This not only helps with clarity but can also aid in future performance reviews or tax reporting.

Integrating Pay Periods and Hours Worked with Dynamic Date Functions

To accurately track pay periods and hours worked, leverage Excel’s dynamic date functions like EDATE() and NETWORKDAYS(). These functions allow automatic updates to pay period ranges and ensure calculations adjust based on working days and specific timeframes.

Start by defining the start date of the pay period, typically the 1st or 15th of the month. Use EDATE() to calculate the end date based on the number of months or weeks in the pay cycle. For instance, if a pay period lasts two weeks, input the start date in a cell and use EDATE(start_date, 0) to find the exact date two weeks later.

For tracking hours worked within a pay period, utilize NETWORKDAYS() to account for only weekdays, excluding weekends and holidays. This function calculates the number of workdays between two dates, ensuring that the total hours worked reflects business days only. Combine this with a simple multiplication formula to compute total work hours: multiply the result of NETWORKDAYS() by the daily hours worked.

Here’s an example layout for a paycheck template that integrates dynamic date functions:

| Employee Name | Start Date | End Date | Hours Worked | Total Pay |

|---|---|---|---|---|

| John Doe |

=NETWORKDAYS([Start Date], [End Date]) * [Hours Per Day] |

= [Hourly Rate] * [Hours Worked] |

Ensure the formula references update automatically when new dates are entered. This setup removes manual recalculation and potential errors, offering an efficient method for payroll calculations.

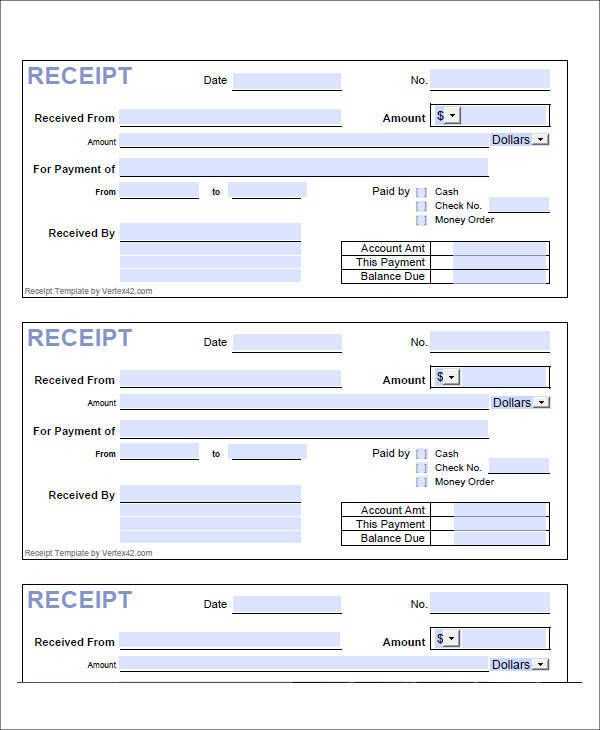

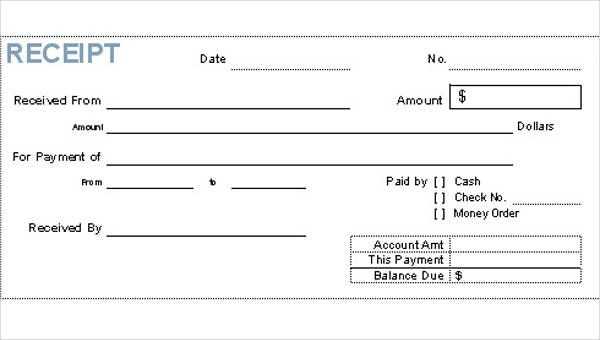

Creating Paycheck Receipt Templates with Clear Visual Breakdown

Use clear and concise sections to make paycheck receipt templates easy to understand. Start with a header that includes the employee’s name, paycheck date, and ID for quick reference.

- Employee Information: Include full name, department, and position to avoid confusion.

- Payment Details: Break down the gross pay, deductions (taxes, benefits), and net pay clearly in separate columns.

- Hours Worked: Add a section detailing the hours worked, overtime, and hourly rate to show how the pay was calculated.

- Payment Method: Indicate whether the payment was direct deposit, check, or cash for transparency.

For a better visual impact, use alternating row colors or borders to separate these sections. This will guide the reader’s eye and make the template easier to digest. Keep the font size consistent, but slightly larger for key figures like net pay and deductions for emphasis.

Incorporate visual cues such as arrows or icons to indicate tax categories or benefits, making the document more user-friendly. A final section for comments or notes ensures clarity on any special adjustments made during the pay cycle.