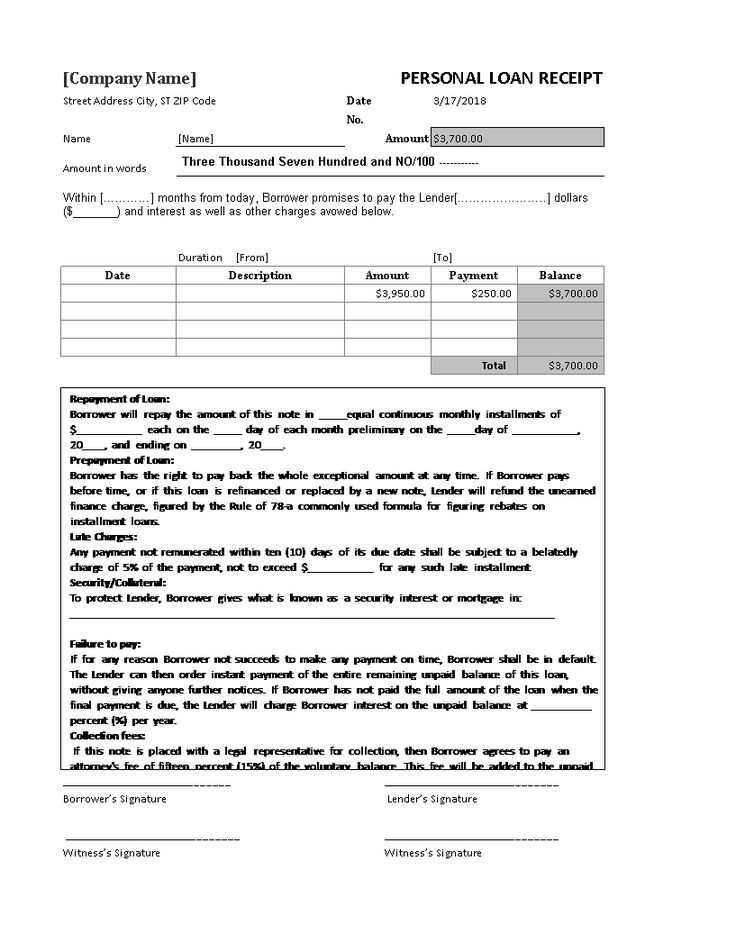

If you’re looking to keep track of loan receipts in an organized and straightforward way, an Excel template can save you time and effort. It helps you systematically record key details such as the borrower’s name, loan amount, repayment schedule, and outstanding balance.

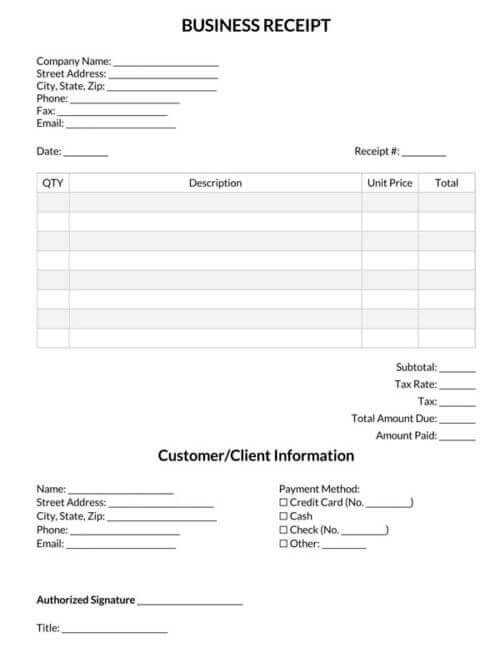

Using a well-structured template allows for clear, easy-to-read records. You can customize the template to include additional fields like interest rate or loan terms based on your specific needs. This reduces the chances of errors and ensures everything is in one place.

With Excel’s built-in features, like conditional formatting, you can highlight overdue payments or track payments that have been made. This functionality helps you stay on top of loan management without manual updates or complex calculations.

Sure! Here’s the revised version with minimal repetition of words:

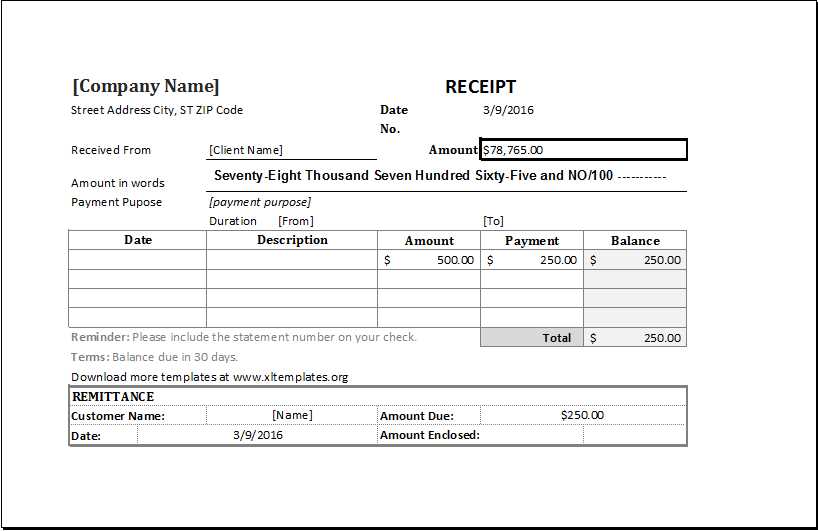

Creating a loan receipt record in Excel is simple and can help you keep track of loans efficiently. Begin by setting up columns for the borrower’s name, loan amount, loan date, interest rate, repayment schedule, and outstanding balance. This structure will ensure all necessary information is captured and easy to reference.

Loan Details

In the first column, list the borrower’s full name. In the second column, include the total loan amount. The third column should display the date the loan was issued. You can use a date format (e.g., MM/DD/YYYY) to maintain consistency.

Repayment Information

Include columns to track the interest rate, due dates for each repayment, and the amount repaid. To calculate the outstanding balance, create a formula that subtracts each payment from the loan balance, making sure to update the sheet as repayments are made.

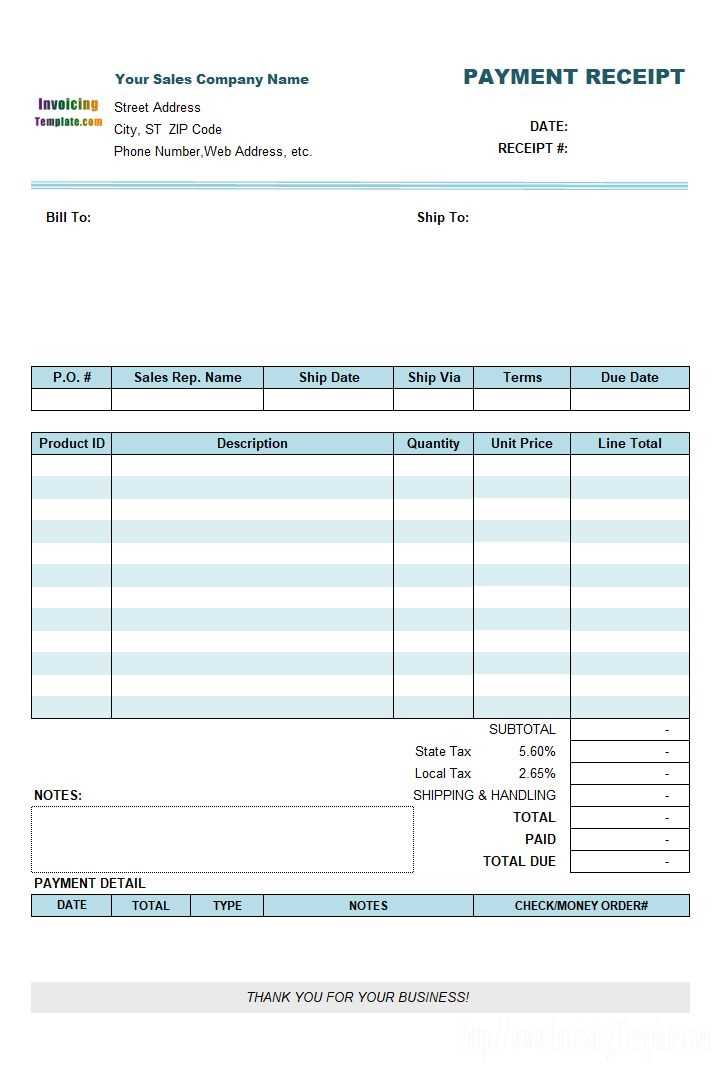

Loan Receipt Record Template Excel

Creating a loan receipt template in Excel helps track loan payments clearly and efficiently. Start by setting up columns for essential details: borrower name, loan amount, interest rate, payment date, and balance. Include a column for each payment installment to ensure each transaction is recorded accurately. Ensure that you use proper formatting and formulas to calculate the balance and total payments over time.

Customizing the Excel Template to Track Repayment Schedules

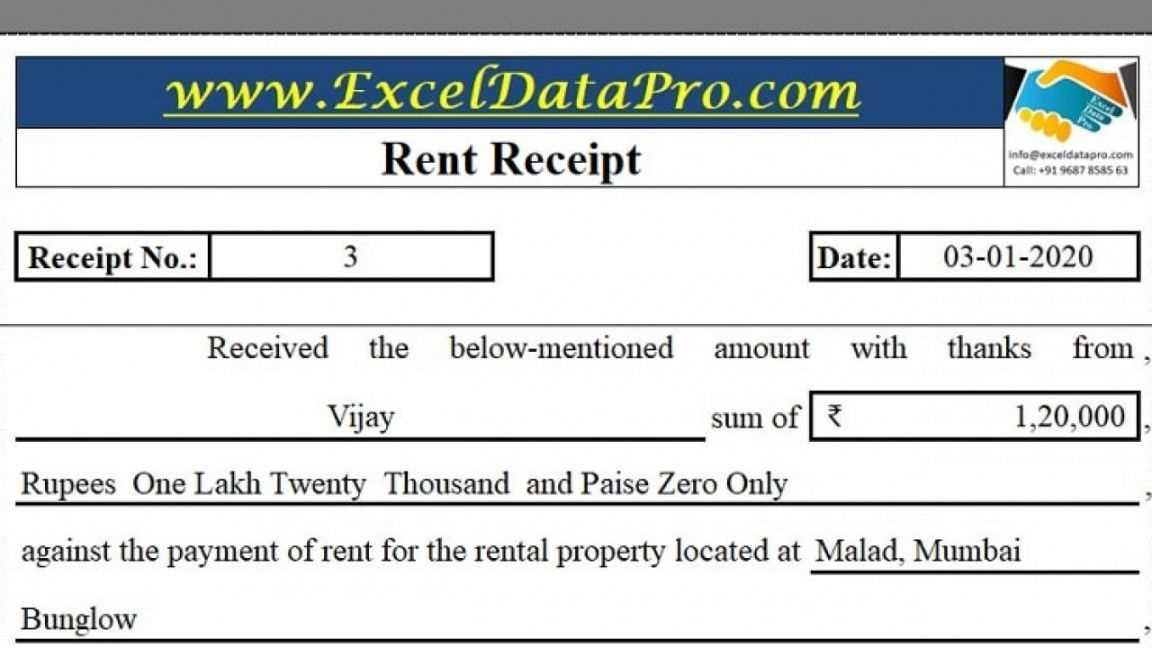

Customize your template to handle various repayment schedules. Create separate columns for different payment frequencies such as weekly, bi-weekly, monthly, or annually. For each frequency, adjust the formula for payment amounts based on the interest rate and loan terms. This approach will help you easily track due dates and balances for each loan payment period.

How to Automate Calculations and Updates in a Loan Record Sheet

Automate the loan record sheet by applying Excel’s built-in functions. Use the PMT function to calculate regular payments based on the loan’s interest rate and term. Set up conditional formatting to highlight overdue payments or payments made. Also, utilize data validation to ensure all entries are accurate, preventing errors in loan tracking and simplifying updates. These automated processes will save time and reduce manual errors in managing loan receipts.