Creating a paid receipt in Excel is a practical way to manage payments efficiently. A paid receipt template allows you to track transactions clearly and professionally. Whether you’re running a small business or managing personal finances, using an Excel template streamlines the process.

Customize your receipt template by adding details such as payment amount, payer information, date of payment, and services provided. A well-organized template eliminates confusion, making it easier to monitor payments and prevent errors in accounting.

Use formulas within the template to automate calculations, like adding up totals or applying taxes. This reduces manual work and minimizes the risk of mistakes. Once you set up your template, it becomes a reusable tool for any future transactions.

Stay consistent with a structured layout. Ensure the template includes clear headings and sections for all relevant information. This not only improves clarity for both parties but also enhances the professional look of the receipt.

Excel templates offer flexibility for customization, so adjust them based on your needs. With a little setup, you can have a highly functional receipt system at your fingertips, making record-keeping easier and more reliable.

Here’s the revised version with minimal repetition:

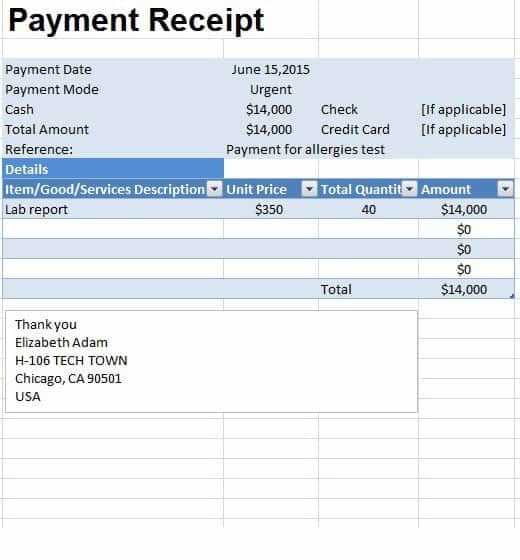

When designing a paid receipt Excel template, prioritize simplicity and clarity. Include columns for item descriptions, quantities, rates, and total amounts to provide an organized view of the transaction. Create formulas for automatic calculations to reduce manual errors. Set up the template with predefined date and receipt number fields for easy tracking. Add a space for the buyer’s and seller’s information, making it simple to input names and addresses.

Key Elements to Include

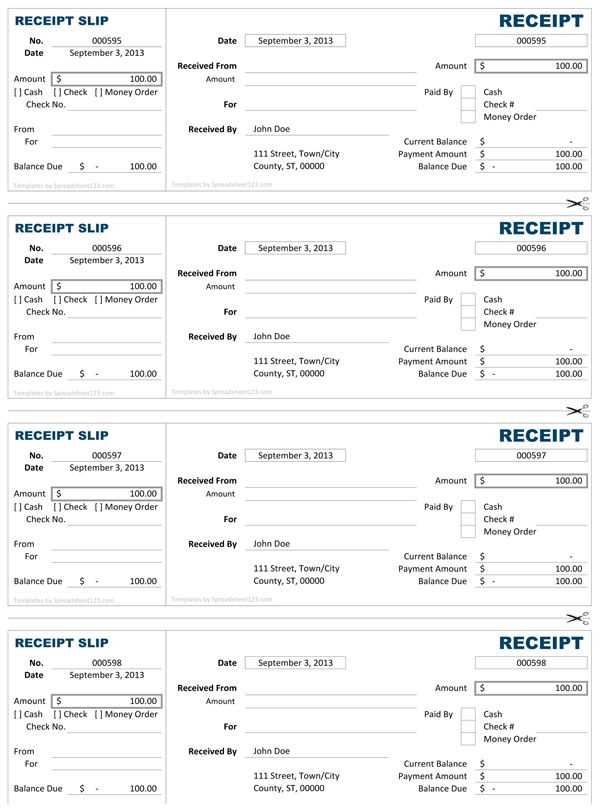

- Date and Receipt Number: Ensure every receipt has a unique identifier and a date field for easy reference.

- Item Details: Each product or service should have a dedicated row with clear descriptions, quantities, and pricing.

- Total Calculation: Use formulas to automatically calculate totals and taxes based on input data.

- Payment Method: Add a section for indicating how payment was made, whether by cash, credit card, or another method.

Tips for Streamlining Your Template

- Use dropdown menus for common entries like payment methods to speed up the process.

- Color-code sections for better visual appeal and easy navigation.

- Save the template with cell protections to prevent accidental editing of formulas.

Here is a detailed HTML outline for an article on “Paid Receipt Excel Template,” with specific, practical subtopics:

1. Introduction to Paid Receipt Templates

Paid receipt templates in Excel provide an easy and customizable method for tracking payments. Using this format simplifies accounting, ensuring both the payer and recipient have a clear record of transactions. It’s an excellent tool for businesses and freelancers alike to maintain organized financial documentation.

2. Key Elements of a Paid Receipt

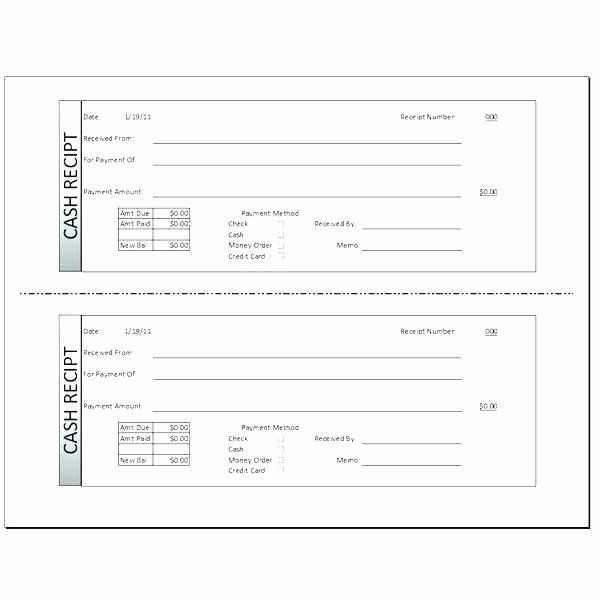

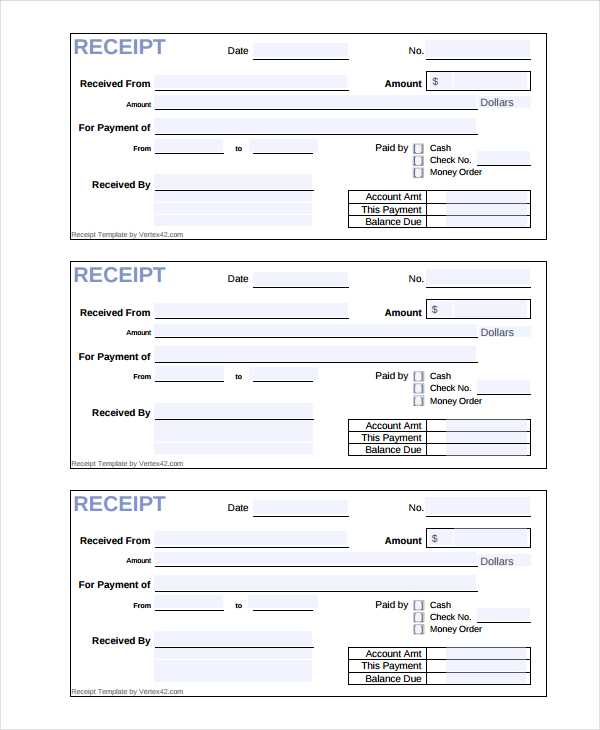

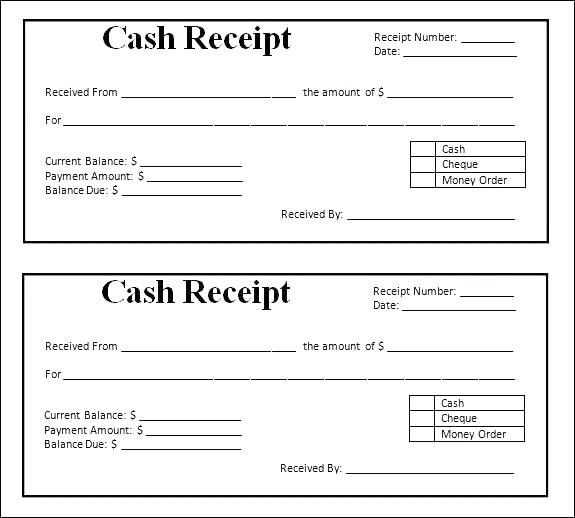

A good paid receipt template should include the following fields: payment date, payer’s name, recipient’s name, payment method (e.g., cash, check, or credit card), amount paid, description of the transaction, and a unique receipt number. Customizing these fields according to business needs makes the receipt more specific.

3. Why Use an Excel Template for Receipts?

Excel provides an intuitive interface for creating and storing paid receipts. Users can easily modify the template for different transaction types, apply formulas for calculating totals, and use Excel’s data management features for efficient record-keeping. Excel’s flexibility helps in adapting to various business requirements without the need for additional software.

4. Steps to Create a Paid Receipt Template in Excel

To create your own paid receipt template, follow these steps:

- Create a new Excel file and label the first row with the necessary fields: Receipt Number, Payer Name, Date, Payment Method, Amount, and Description.

- Format the columns to ensure all text fits appropriately, and use borders for a neat layout.

- Consider adding a formula to automatically calculate totals or apply tax rates if needed.

- Save the file as a template for future use, ensuring it is easy to fill out for each transaction.

5. Customizing the Template for Your Needs

Customize the template by adjusting column widths, changing fonts, or adding a logo. You can also add drop-down menus for fields like payment method to make the form more user-friendly. Excel’s conditional formatting can be applied to highlight overdue payments or track payment status.

6. Tips for Managing Paid Receipts in Excel

When using Excel for receipts, create a dedicated sheet for each month or year. This makes it easier to track historical payments and analyze trends. You can also filter the data by date or payer, which helps streamline the retrieval of specific receipts when needed.

7. How to Save and Share Your Paid Receipt Template

After customizing the template, save it as an Excel template file (.xltx) for easy reuse. You can share it with others by emailing the template or storing it in a shared cloud folder. If you want to prevent editing, save it as a PDF before sending it to clients or customers.

8. Conclusion

Paid receipt Excel templates are an efficient way to manage and document payments. With the right fields and customization, these templates can be tailored to fit any business’s needs while maintaining organized and accessible records. Excel’s versatility ensures that businesses can adapt the template for their specific financial processes.

Paid Receipt Excel Template: A Practical Guide

How to Customize a Paid Receipt Template for Your Business

Key Features to Include in Your Receipt Template

How to Track Payments and Create Summaries in Excel

Best Practices for Formatting Your Paid Receipt

How to Automate Calculations in Your Template

Tips for Ensuring Accurate Data Entry in Your Excel Receipt

Start by creating a template that suits your business style. Include your company name, logo, and contact information at the top. This keeps your receipts professional and personalized. Ensure the receipt fields are organized, such as customer name, date of payment, itemized list of purchased items or services, payment amount, and method of payment. You can format the item list with rows and columns for clear separation.

Key Features to Include in Your Receipt Template

Your receipt template should have key fields like receipt number, invoice reference, and tax information. These ensure clarity and help with future referencing. Incorporate fields for payment type (cash, card, check) and the paid amount. Also, include space for a “thank you” or a note of appreciation to enhance customer experience.

How to Track Payments and Create Summaries in Excel

Track payments by creating separate sheets for each month or client. Use Excel’s built-in SUM function to calculate total payments per month or per client. This helps you keep an organized record of all transactions. You can also create a summary sheet to monitor overall sales and unpaid invoices, making accounting simpler.

To automate calculations, set up formulas for taxes, discounts, or totals. This saves time and reduces errors. For example, use a formula like =A2*B2 to calculate totals based on quantity and unit price, and then apply tax calculations using =C2*10% for tax at 10%. This automation streamlines the process.

Finally, ensure data accuracy by validating entries. Use drop-down lists for fields like payment type to avoid errors. You can also use conditional formatting to highlight missing data or discrepancies, which prevents mistakes from slipping through the cracks.

This version reduces word repetition while keeping the meaning intact.

Opt for concise phrasing to maintain clarity and readability. By using synonyms or restructuring sentences, you can avoid unnecessary repetition. For example, instead of repeatedly using the word “template,” substitute with “form” or “spreadsheet” when appropriate. This keeps the content fresh and dynamic.

Focus on active voice for better flow. Rather than saying “the template was created,” try “we created the template.” This approach eliminates extra words while making the sentence more direct and engaging.

Also, group similar ideas together to avoid restating the same point in different sections. If you’ve already explained a concept, there’s no need to revisit it unless you’re adding new information. This method maintains the reader’s interest and ensures that the writing remains sharp and to the point.