If you’re looking for a straightforward, customizable receipt template in Excel for UK businesses, you’re in the right place. Using a receipt template can save time and ensure that all necessary details are captured in a clear and professional format. An Excel receipt template is ideal for small businesses, freelancers, or anyone needing a simple yet effective way to issue receipts.

The template should include key elements such as the date of the transaction, the item description, the amount paid, and the payer’s details. You can also incorporate VAT breakdowns, if applicable, ensuring compliance with UK tax regulations. A well-designed template will allow you to easily modify details for each transaction and store them securely in your records.

By setting up your own receipt template in Excel, you can make sure that you’re providing all required information in a format that’s both professional and easy for your clients to understand. With Excel’s built-in features, you can even automate calculations for totals and tax, streamlining your workflow even further.

Here is the corrected version of the text based on your request:

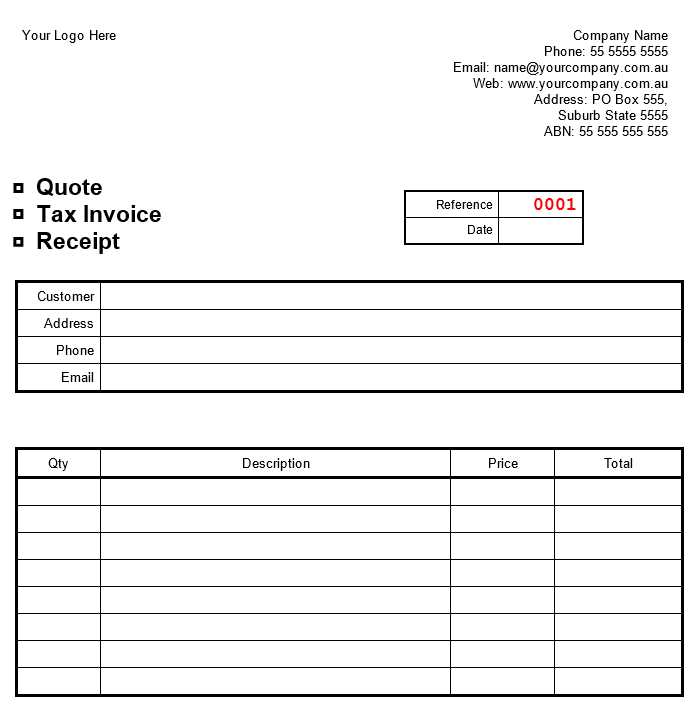

If you’re looking to create a professional and user-friendly receipt template in Excel for the UK, focus on the essentials: clear item descriptions, accurate totals, and the correct VAT rates. First, set up a header with your company name, address, and contact details. Then, add a section for the buyer’s information. This ensures both parties have the necessary details on file.

Next, include a table with columns for item names, quantities, unit prices, and total amounts. Calculate subtotals automatically using Excel formulas. Below the item list, make space for VAT calculations. The standard VAT rate in the UK is 20%, but remember to include options for different rates if needed. A row for the total cost after VAT should be at the bottom of the table.

Finally, add a footer with the payment method, date of issue, and any relevant terms and conditions. This section can also include a thank you note for the customer. By structuring your receipt template this way, you’ll ensure it’s not only functional but also aligned with UK standards for business transactions.

Sure! Here’s a detailed plan for an article titled “Receipt Template Excel UK” with 6 practical and specific headings in HTML format:

1. Key Features of a UK Receipt Template in Excel

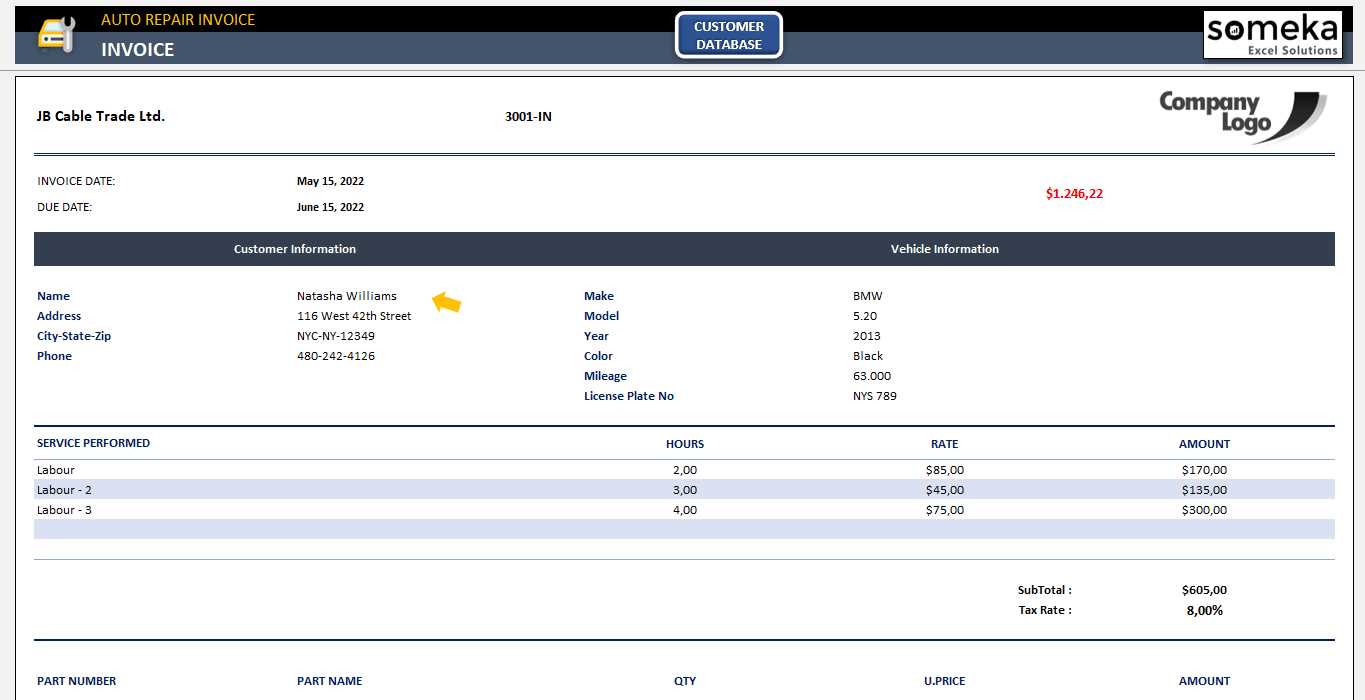

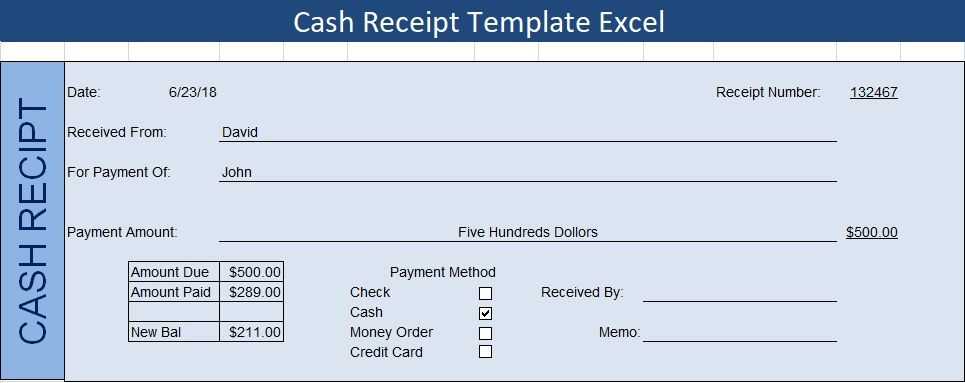

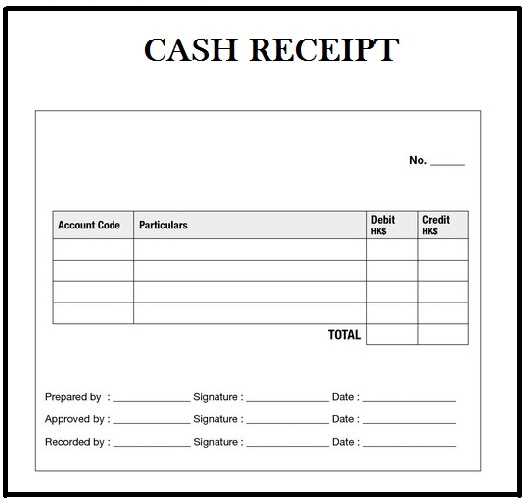

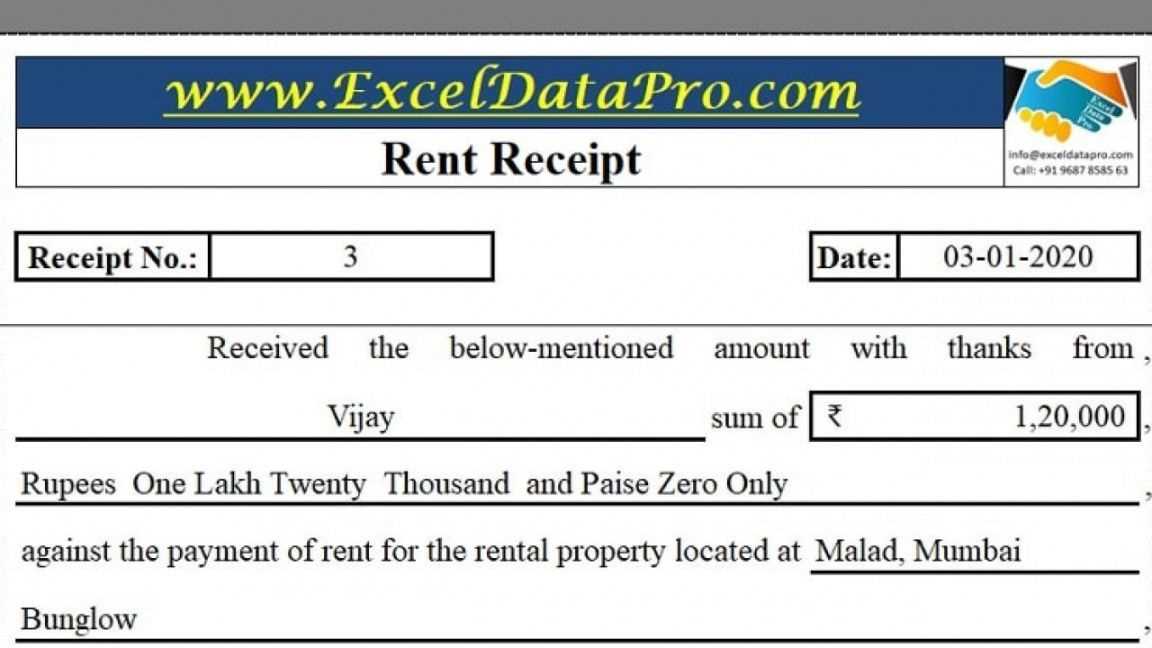

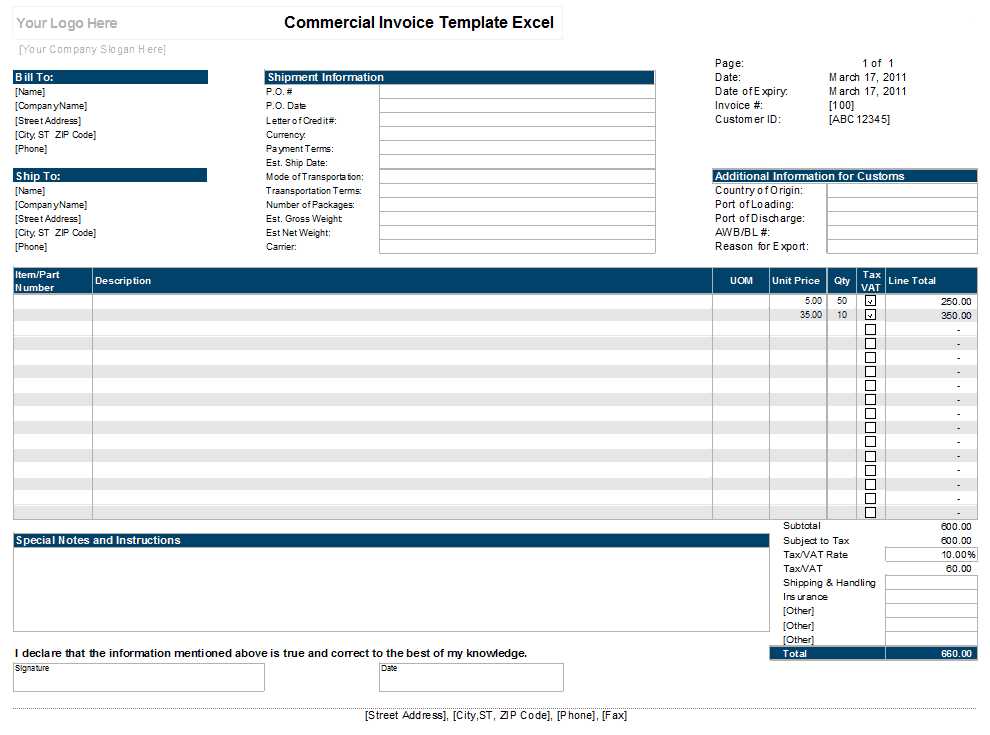

A UK receipt template in Excel should include specific components such as the recipient’s details, transaction date, itemized list of products or services, individual prices, total amount, and VAT (if applicable). Customizing it to include payment methods (cash, credit card, etc.) and unique identifiers such as invoice numbers ensures that the template suits various business needs.

2. How to Create a Receipt Template in Excel

To create a receipt template in Excel, start by setting up columns for the date, item description, quantity, price per item, total for each item, and any applicable tax. Use Excel functions like SUM for automatic calculations. Add your business logo or branding to personalize the template. Ensure that all rows and columns are clearly labeled and the total is easily identifiable.

3. Customizing Your Receipt for UK Regulations

When designing a UK receipt, consider including elements that comply with local regulations. This includes VAT rates and specific business registration numbers if required. Customize your template to show both the gross and net amounts to ensure transparency in compliance with HMRC standards.

4. How to Automate Calculations Using Excel Formulas

Excel formulas streamline the process. Use the SUM function to calculate totals, VAT, and item subtotals automatically. The IF function can be used to adjust VAT depending on the item category or location. Using drop-down menus for payment methods and automatic invoice numbering will also save time.

5. Saving and Sharing Your Receipt Template

Once your receipt template is ready, save it in a format compatible with your needs, such as .xlsx or .csv. Sharing the template is simple: email it directly or upload it to cloud storage services. Always keep a backup of your receipts for record-keeping purposes.

6. Using Pre-Made UK Receipt Templates

If creating a template from scratch is not your preference, you can use pre-made templates available online. These templates can be easily adapted to your specific needs. Look for templates that are designed for UK businesses to ensure that they meet local tax and VAT requirements.

| Component | Details |

|---|---|

| Transaction Date | Include the exact date of the transaction. |

| Item Description | List all items or services with detailed descriptions. |

| Unit Price | Enter the price per item/service. |

| Quantity | Indicate the number of items or hours. |

| Total Amount | Calculate the total price including VAT. |

| VAT | Show applicable VAT, if relevant. |

| Payment Method | Include options like cash, card, etc. |

- How to Create a Basic Receipt Template in Excel for UK Transactions

Creating a basic receipt template in Excel for UK transactions involves a few simple steps. This template will help you track payments and provide clear records for your customers. Follow these steps to get started:

Step 1: Set up Your Excel Sheet

Start by opening a new Excel worksheet. In the first row, create headings for all the necessary receipt information: Receipt Number, Date, Seller’s Information, Buyer’s Information, Item/Service Description, Quantity, Price, VAT (if applicable), and Total Amount. You can bold these headers for easy identification.

Step 2: Add Formulas for Calculations

Use Excel’s built-in formulas to automatically calculate values. For instance, to calculate the total price, multiply the quantity by the price of the item. If you’re including VAT, use the formula to add the VAT percentage to the total. In the case of UK transactions, ensure the VAT is calculated at the correct rate, typically 20% unless otherwise stated.

To calculate VAT, you can use the formula: =Price * Quantity * VAT Rate. Then, add the VAT to the total by using: =Total + VAT.

Step 3: Include Business Details

In the section for Seller’s Information, include your business name, address, VAT registration number (if applicable), and contact details. For the Buyer’s Information, include the customer’s name, address, and contact details. This makes the receipt more professional and complete.

Step 4: Add Styling and Formatting

Once the basic information is in place, you can format the sheet to make it clearer. Use borders for each section, highlight important fields, and apply bold text for headings. You can also add a logo or change the font to match your branding.

Step 5: Save as Template

Once you’ve filled in the basic structure, save the file as an Excel template (.xltx). This way, you can reuse it for future transactions, simply by opening the template and filling in the new details.

By following these steps, you’ll have a functional and professional receipt template tailored to UK transactions. This ensures all relevant details are included and calculations are automated, making the process easier and more efficient.

Set the tax rates and VAT fields in your template according to current UK tax regulations. Begin by updating the VAT rate section to reflect the standard 20%, or the reduced rate of 5%, depending on the type of goods or services you provide.

Adding VAT Fields

- In Excel, insert columns for VAT-exclusive prices and VAT-inclusive totals.

- Use simple formulas like

=A2*20%to calculate VAT for individual items, where A2 is the price before VAT. - For items eligible for reduced VAT, apply the 5% rate by adjusting the formula to

=A2*5%.

Handling VAT Exemptions

- If your business is VAT exempt, you can remove the VAT columns entirely or adjust them to show ‘N/A’.

- Ensure the total amount at the bottom reflects the correct VAT status, using formulas like

=IF(B2="Exempt", A2, A2*1.2)to account for tax-free items.

Adjust these fields based on the products and services you offer, ensuring all tax rates are applied accurately and in compliance with UK regulations. This customisation helps in keeping your receipts clear and transparent for your customers.

To incorporate branding into your Excel receipt template, begin by adjusting the header area. Open the template, select the top row, and merge the cells to create space for your brand’s name or logo. Input your company name using a bold, clear font, such as Arial or Calibri, at an appropriate size for visibility.

Next, add your logo by inserting an image. Go to the “Insert” tab, select “Pictures,” and choose your logo file. Resize it to fit the header without overpowering the text. Align the logo to the left, right, or center, based on your design preference.

For consistency with your branding, customize the color scheme. Highlight key cells, such as those for totals or item names, and change the fill color to match your company’s palette. Use the “Format Cells” option to adjust the font color and background for a cohesive look.

Add a footer with contact details or a slogan to reinforce your brand identity. Insert a row at the bottom, and input your phone number, website, or social media handles. Style the text using the same font and colors as the header to maintain uniformity across the template.

Finally, make sure all text is legible by adjusting the font size and cell padding. Consider adding borders or lines to separate different sections of the receipt for a polished, professional appearance. This will help your branding shine while ensuring the receipt remains user-friendly.

Including Payment Methods and Transaction Details on a UK Receipt

To ensure clarity and meet legal requirements, always include payment methods and transaction details on a UK receipt. The transaction information should cover the following:

| Details | Description |

|---|---|

| Payment Method | Clearly state the method of payment used, such as credit card, debit card, cash, or bank transfer. If multiple methods were used, list each one separately. |

| Transaction Amount | Show the total amount paid, ensuring it aligns with the breakdown of goods or services purchased. Include any VAT or taxes applied. |

| Transaction Date | Include the exact date the transaction took place to avoid confusion in case of refunds or disputes. |

| Reference Number | Include a unique transaction or reference number for easy tracking of the payment. |

| Card Details (if applicable) | For card payments, display the last four digits of the card number and the card type (Visa, MasterCard, etc.), while ensuring sensitive information remains protected. |

Including these details makes receipts clear and helps customers verify their purchases. Ensure all information is accurate and easy to read for smooth transactions.

Automatically Calculating Totals and VAT on Your Receipt Template

To streamline your receipt process, it’s vital to set up automatic calculations for totals and VAT. Excel offers straightforward formulas to achieve this, saving time and reducing errors.

Step 1: Set Up Item Prices

List all items and their prices in your receipt template. Place the prices in separate cells under the “Price” column. For example, if the item price is in cell B2, input the price directly into this cell.

Step 2: Calculate Subtotal

To calculate the subtotal (the sum of all items before VAT), use the formula:

=SUM(B2:B10)

This will add up all the values from B2 to B10, which should represent your item prices. Adjust the cell range based on the number of items on your receipt.

Step 3: VAT Calculation

VAT in the UK is typically 20%, but ensure to check for any updates in the rate. To calculate VAT, multiply the subtotal by 0.20:

=Subtotal*0.20

This formula will give you the VAT amount. You can place it in a separate cell for clarity.

Step 4: Calculate Total

The total is simply the sum of the subtotal and VAT. Use this formula:

=Subtotal+VAT

Replace “Subtotal” and “VAT” with the actual cell references. This gives you the final total to charge the customer.

Step 5: Formatting and Error Checking

Ensure your cells are formatted as currency to make the receipt clearer. Check for any possible errors in your formulas and test them with sample data to confirm the accuracy of your calculations.

To save your Excel receipt template, click on “File” in the top left corner, then select “Save As.” Choose the location on your device where you’d like to store the file. For ease of access, save it in a folder you frequently use, such as “Documents” or “Desktop.” Be sure to select the correct file format (Excel Workbook) before clicking “Save.” This ensures your template remains editable for future use.

Sharing Your Template

Sharing the template is simple. Go to “File” again, and select “Share.” If you want to email it, choose “Send a Copy” and pick your preferred email service. Alternatively, for cloud sharing, upload it to OneDrive or Google Drive. Once uploaded, click on the “Share” button to generate a link, which you can send directly to the recipient. Make sure you adjust the permission settings to allow the receiver to edit or view as needed.

Printing Your Template

To print your receipt template, select “File” and then “Print.” You’ll be presented with a print preview, allowing you to adjust settings such as paper size and orientation. If the layout doesn’t fit well, click on “Page Layout” and tweak the margins or scale to ensure everything fits neatly on the page. Once everything looks good, select “Print” to get a physical copy of your template.

Receipt Template in Excel (UK)

Ensure the receipt template is clear and concise for easy use and understanding. By structuring it correctly, you can avoid unnecessary confusion and ensure users easily input required details. Start by organizing the layout with sections that are easy to read.

- Heading: The receipt’s title should be displayed clearly at the top, such as “Receipt” or “Sales Invoice”. This section ensures immediate identification of the document’s purpose.

- Seller Details: Include the seller’s business name, address, contact information, and VAT registration number, if applicable. This ensures all necessary information is captured.

- Customer Information: A section for the customer’s name, address, and contact details is essential. This guarantees the transaction is tied to the correct individual or business.

- Date and Invoice Number: Record the transaction date and a unique invoice number for reference. This is crucial for tracking and organization purposes.

- Items or Services: List each product or service, along with its price, quantity, and total cost. This section should be laid out clearly with space for any additional notes on the transaction.

- Total Amount: Include the total amount due, as well as any applicable taxes or discounts. This helps the customer verify the charges.

- Payment Method: Specify the method of payment (e.g., cash, credit card, bank transfer). This ensures both parties have a clear understanding of the transaction method.

Ensure the template is flexible to accommodate various transaction types while maintaining a professional appearance. This layout maximizes efficiency and reduces errors during data entry.