Steps to Create a Tax Receipt Template

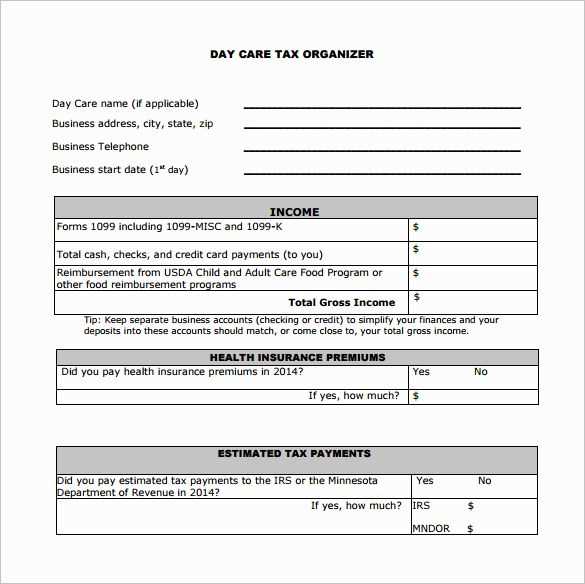

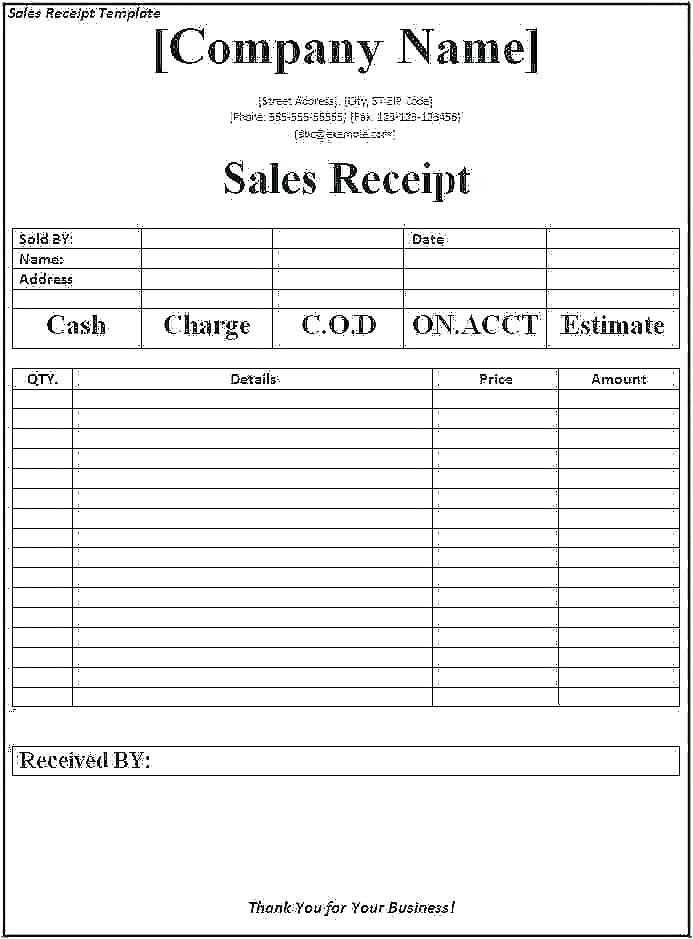

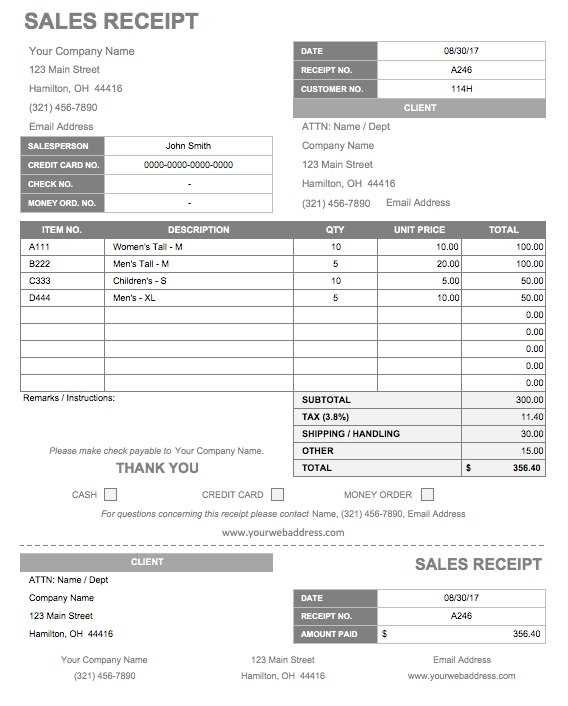

Begin by setting up a spreadsheet with columns for essential details. Include sections for the date of transaction, payer’s name, amount, tax rate, total amount (including tax), and payment method. Use formulas to calculate totals automatically, saving time on manual calculations.

Customizing the Template for Your Needs

- Consider adding columns for item descriptions or service details if you need to issue receipts for specific products or services.

- Label each column clearly to avoid confusion when entering data. Use simple, direct language.

- Incorporate dropdown menus for payment methods, like “Cash,” “Credit Card,” or “Bank Transfer,” to speed up data entry.

Adding Formulas for Automation

In the “Total Amount” column, use the formula: =Amount * (1 + Tax Rate). This will calculate the total, including tax, without needing manual input. Adjust the formula to reflect different tax rates if applicable.

Keeping the Template Organized

For better organization, group receipts by date or transaction type. Use colors or bold text to separate different categories or months. Sorting your entries by these criteria makes it easier to track and review your transactions quickly.

Additional Features to Include

- Set up a separate sheet for monthly totals, using the SUM function to calculate all transactions over a specific period.

- Insert a summary section to automatically tally your taxable income, taxes owed, and total revenue.

Saving and Sharing the Template

Save the template as an Excel file, and back it up regularly. You can also share it with your accountant or clients via email or cloud storage, ensuring secure access to updated financial records.

Tax Receipt Excel Template: A Practical Guide

Creating a Basic Receipt Layout

Incorporating Details and Rates

How to Add Client Information

Using Formulas for Automatic Calculations

Formatting for Clear and Professional Output

Customizing the Template for Various Requirements

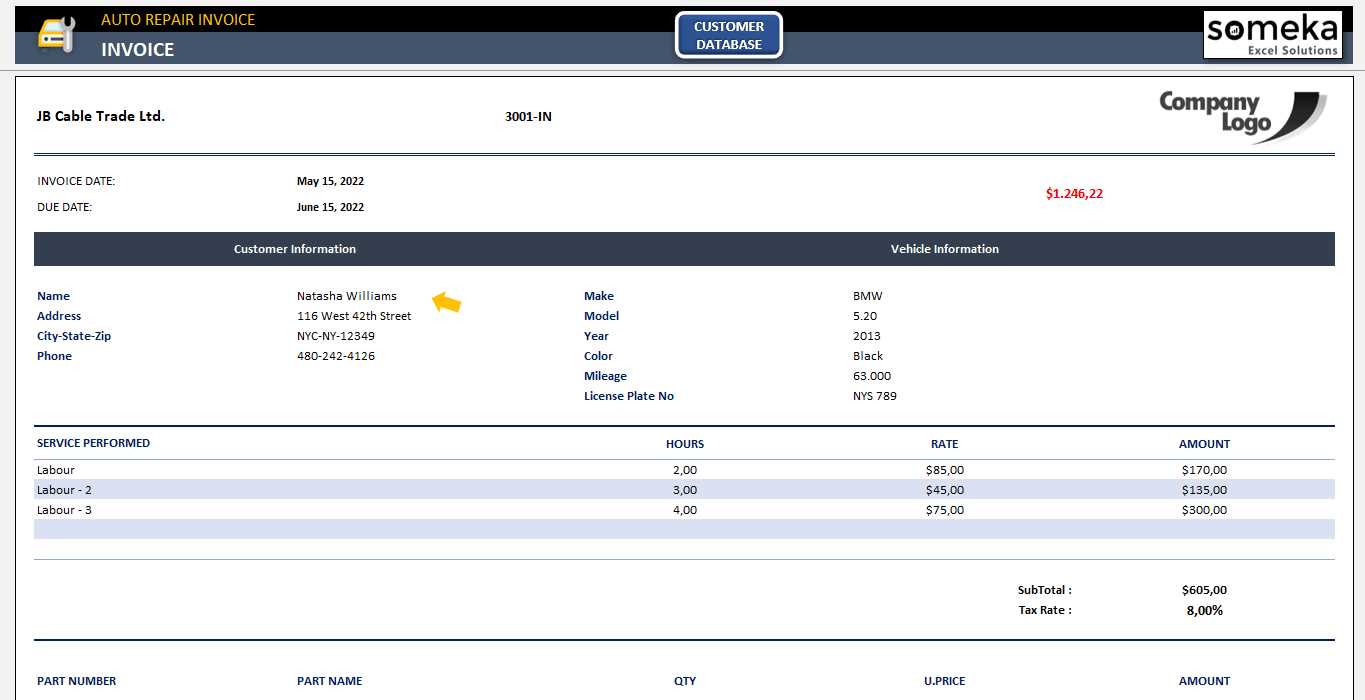

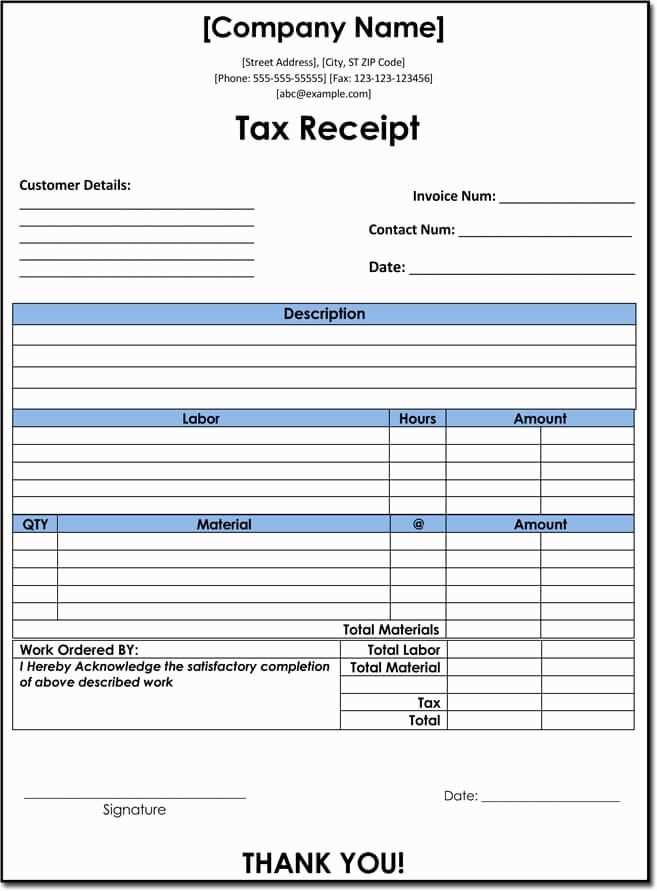

Start by designing a clean layout with distinct sections: title, transaction details, client information, and cost breakdown. Place the title at the top in a bold font for clarity. Create separate rows for the date, item description, quantity, unit price, and total. Use columns to structure the information neatly.

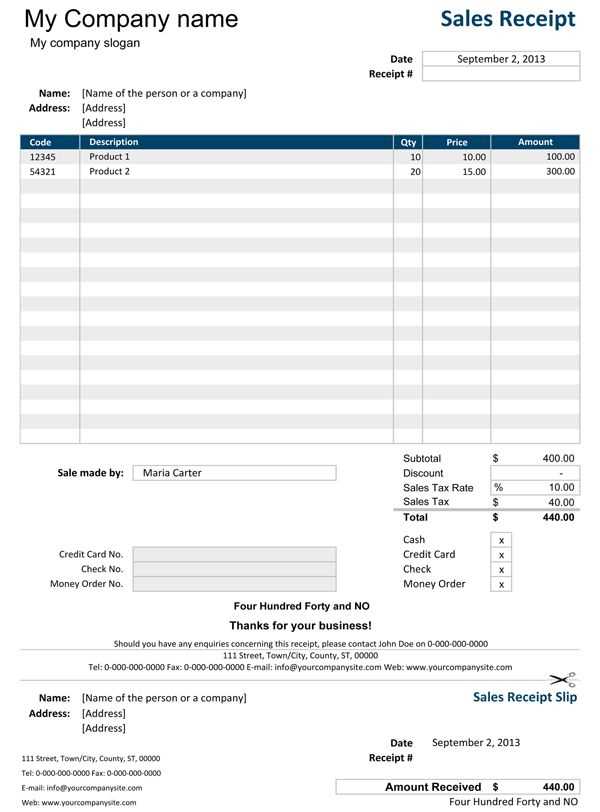

Incorporating Details and Rates: Clearly list the products or services provided, along with their respective prices. Make sure to add any applicable tax rates. Consider adding a separate row to display the subtotal before taxes, the tax amount, and the final total. This layout helps ensure clients can quickly see the breakdown of charges.

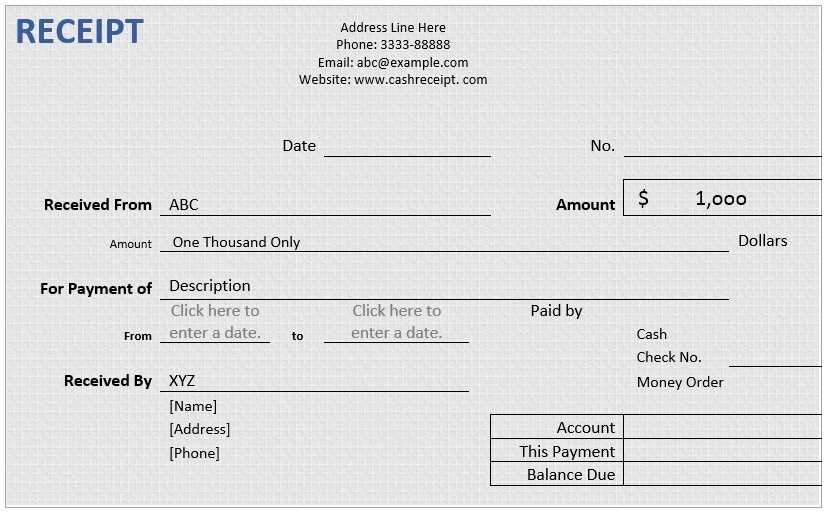

How to Add Client Information: Include fields for client name, address, and contact details. For a personalized experience, set these sections to be easily editable. The top of the template should have space for the receipt number for better tracking.

Using Formulas for Automatic Calculations: Automate the calculations for total costs and taxes. Use the SUM function to calculate the total price per item, and the multiplication formula to determine item cost based on quantity. For tax calculations, apply a simple percentage formula to calculate the tax amount based on the subtotal.

Formatting for Clear and Professional Output: Keep the formatting consistent. Bold headers for each section and ensure the data is aligned properly. Use borders to separate sections, and shade alternating rows for readability. Highlight totals and taxes using a different color to make them stand out.

Customizing the Template for Various Requirements: Tailor the template based on the business needs. If different tax rates apply depending on the location, add fields to adjust the tax rate dynamically. If discounts are given, include a row to enter discount percentages and automatically adjust the final price.