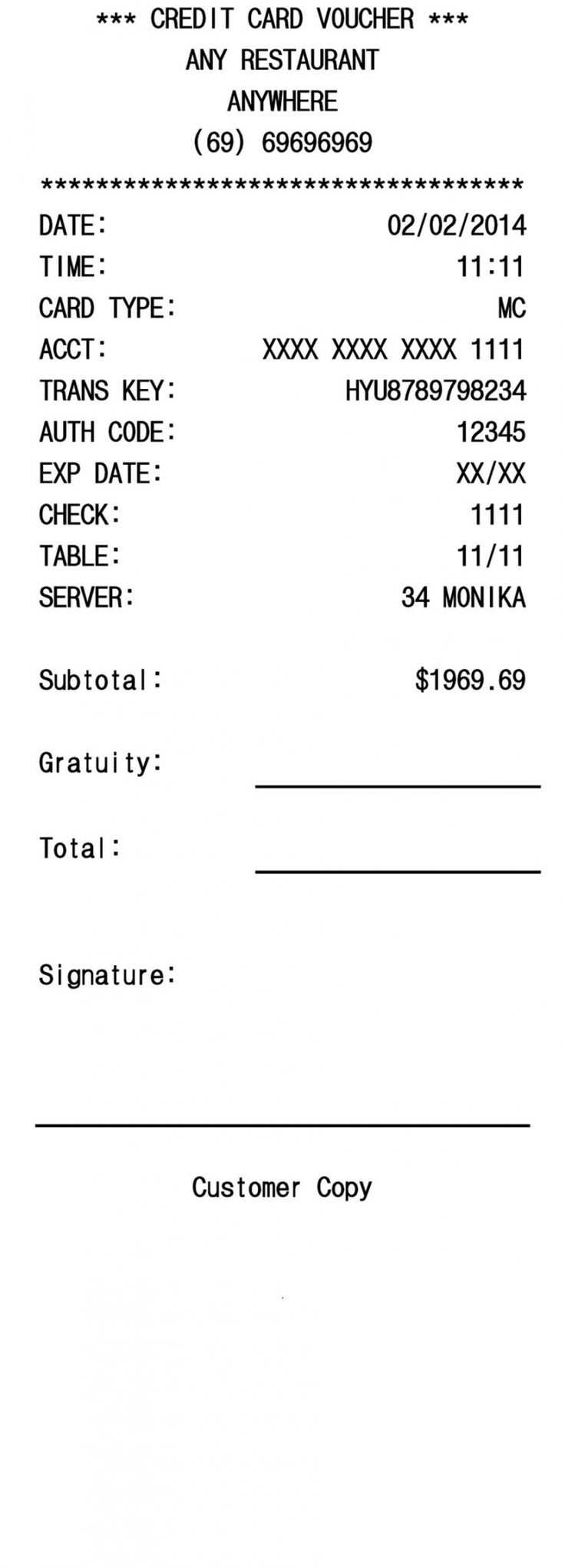

A credit card receipt form is a key document for both businesses and customers to track payments made via credit card. It outlines the transaction details, ensuring transparency and security. To streamline this process, using a template can save time and reduce errors in recording essential payment information.

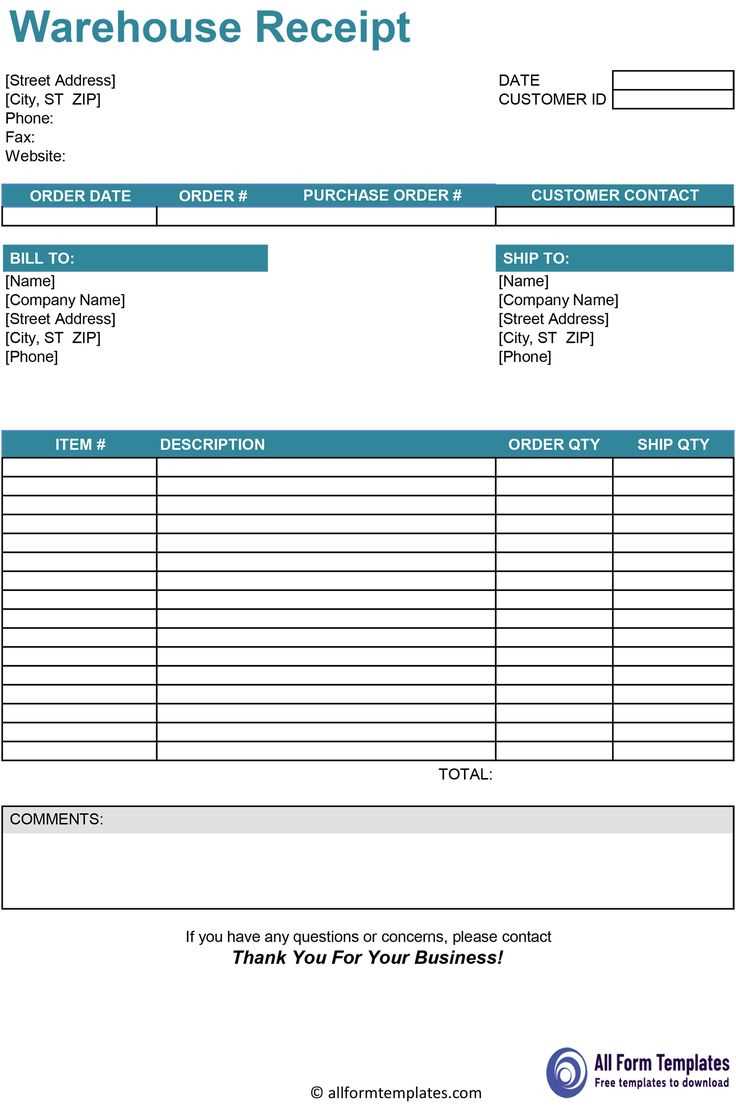

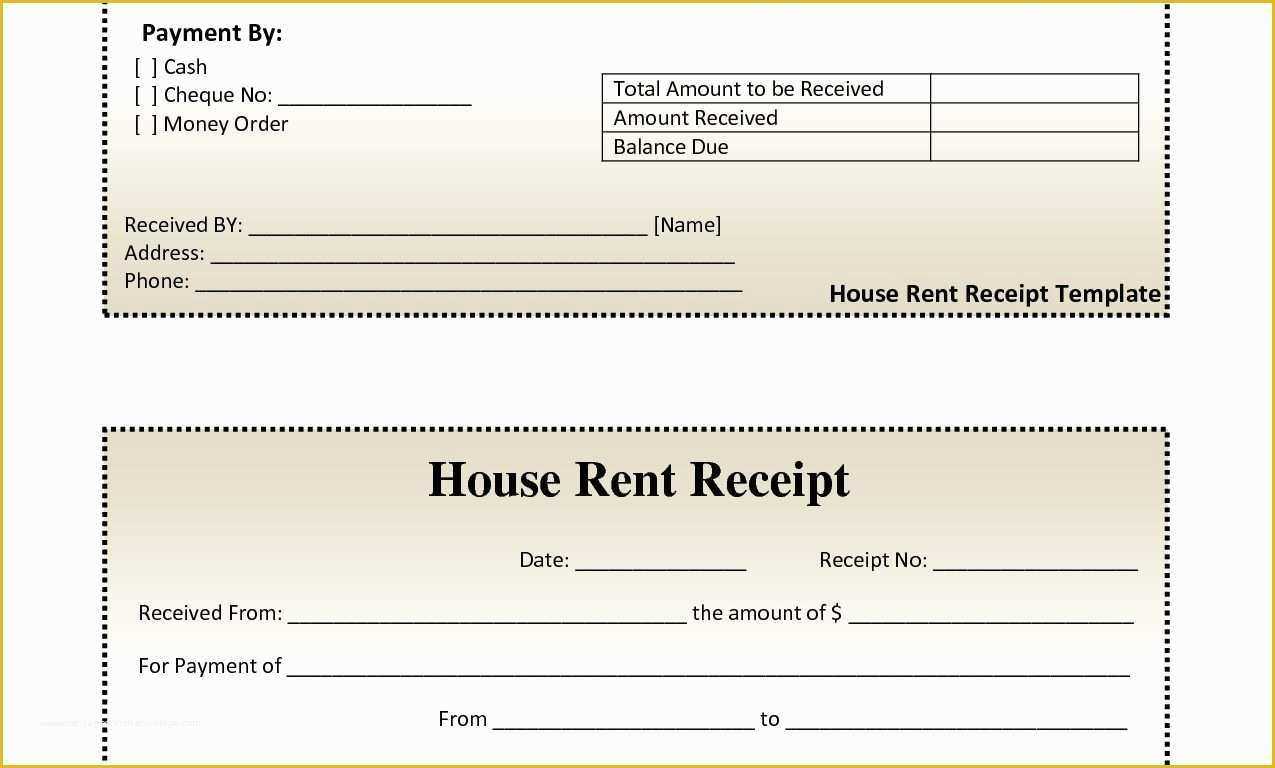

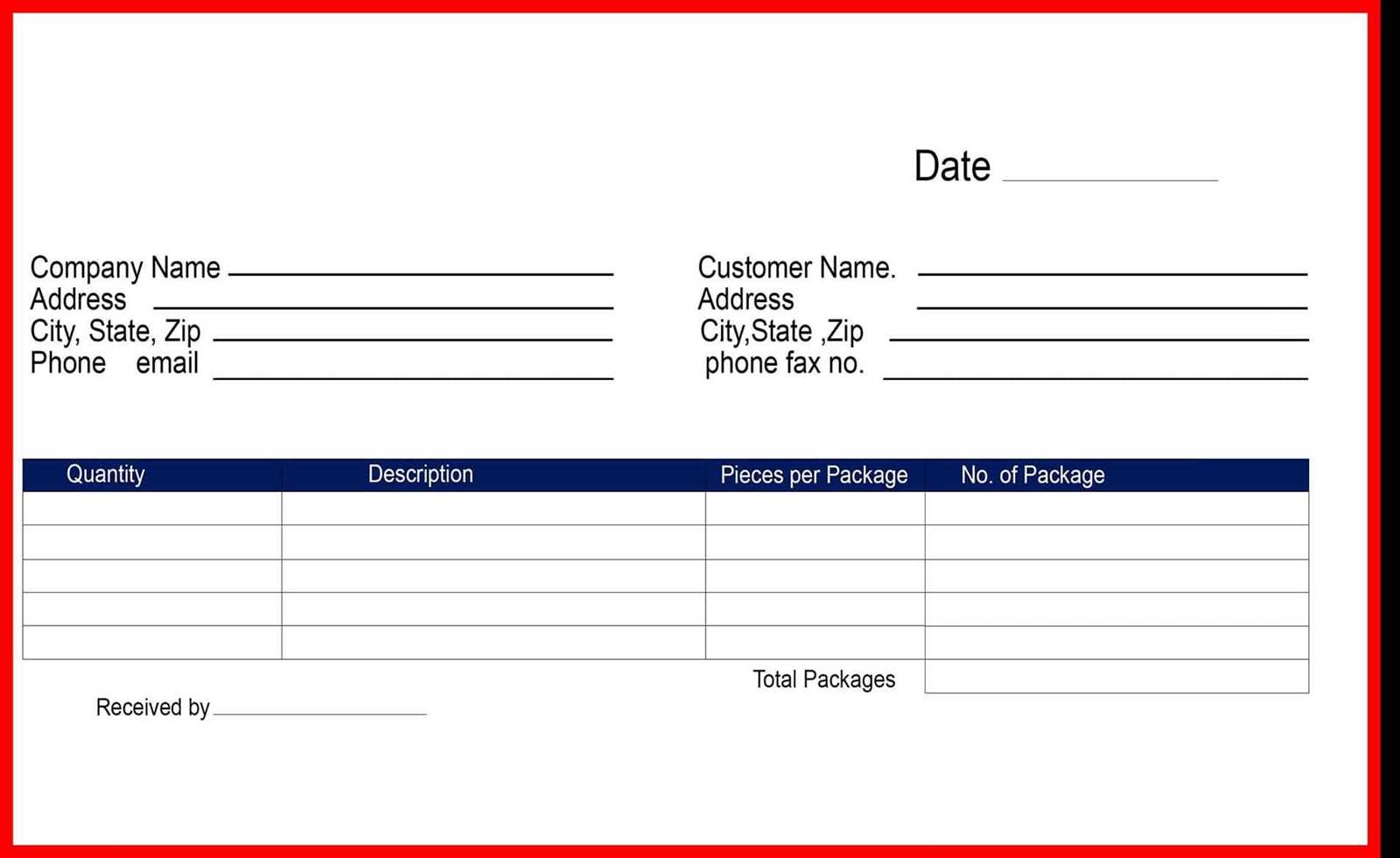

The template should include fields for the transaction date, cardholder’s name, card type, and the total amount paid. It’s also useful to have spaces for the merchant’s contact information, transaction ID, and the items or services purchased. This makes the receipt both a record and proof of purchase for the customer.

Make sure the template adheres to relevant standards to meet legal and business requirements. By including all necessary details, you help maintain organized records, which is especially helpful during audits or when resolving disputes. Consider using a digital version that automatically fills in details from your point of sale system for greater efficiency.

Here is the revised version:

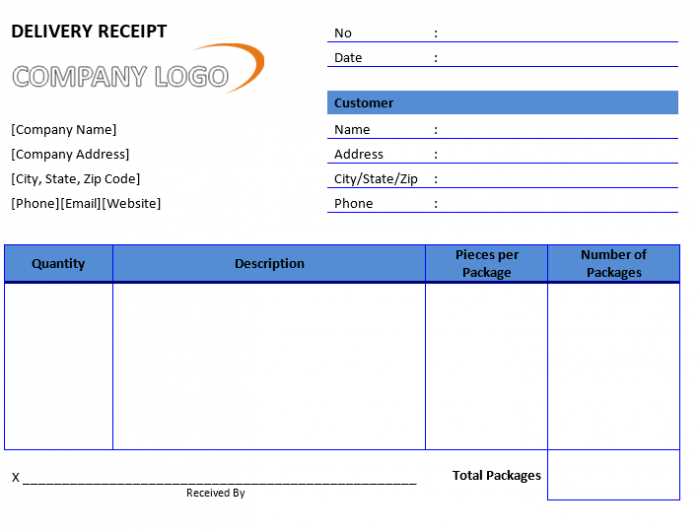

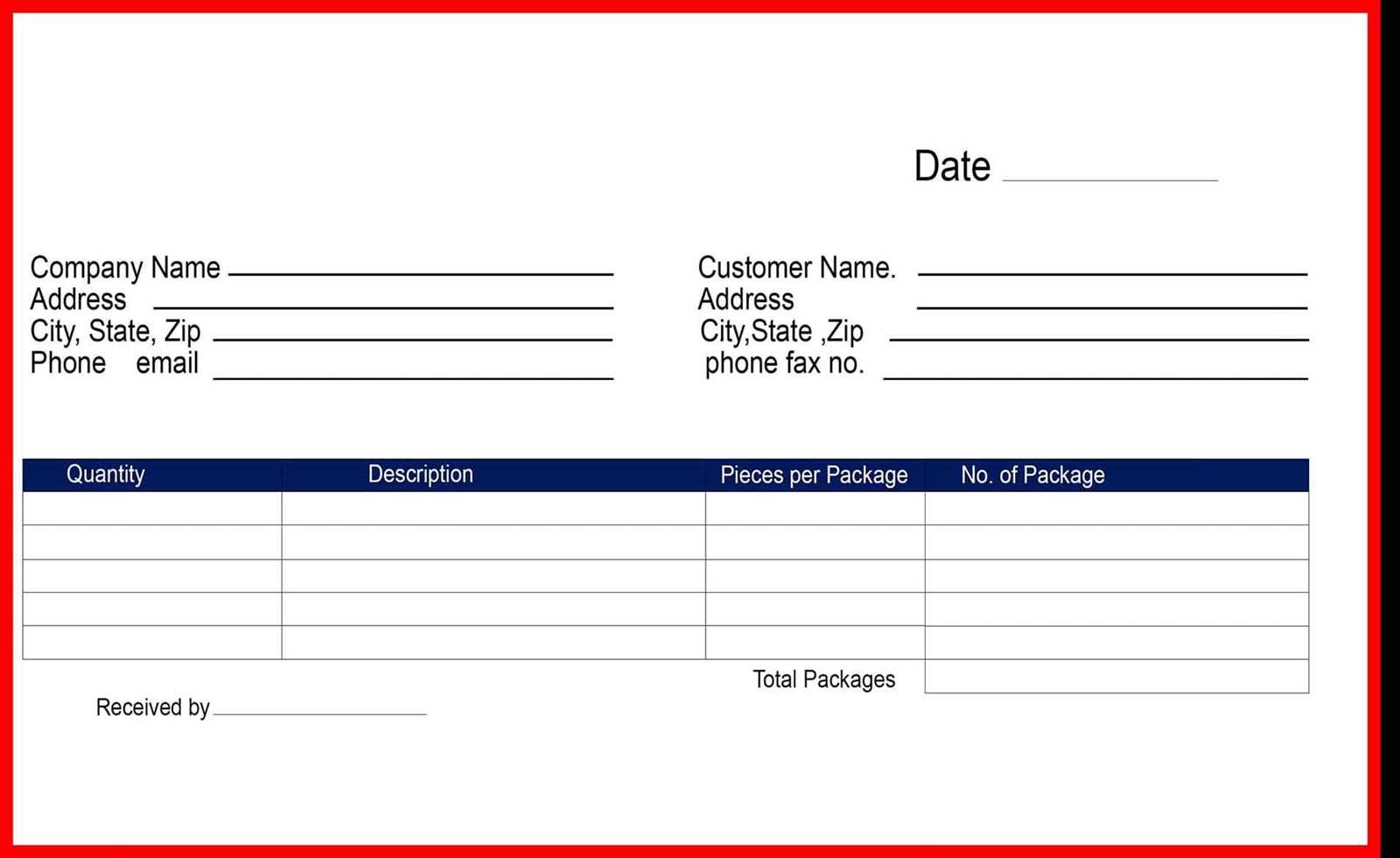

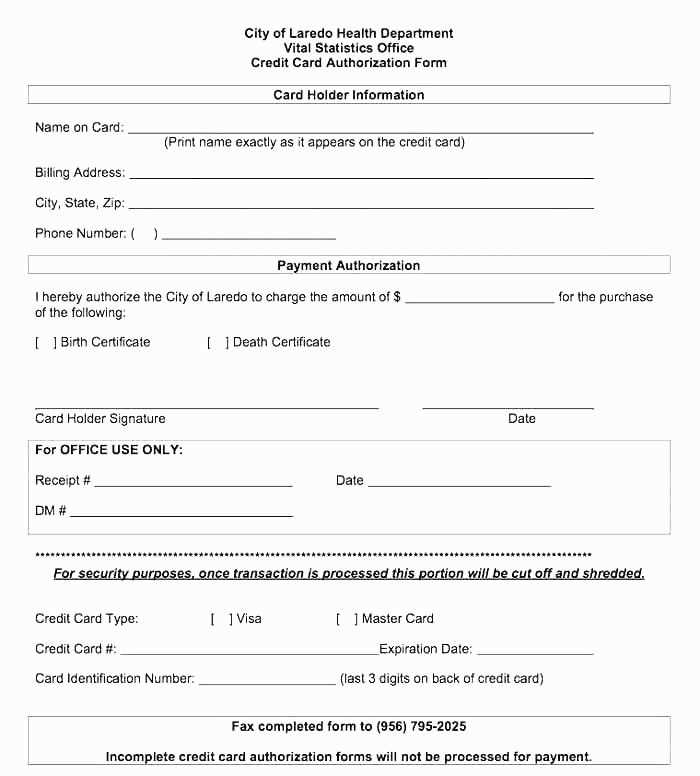

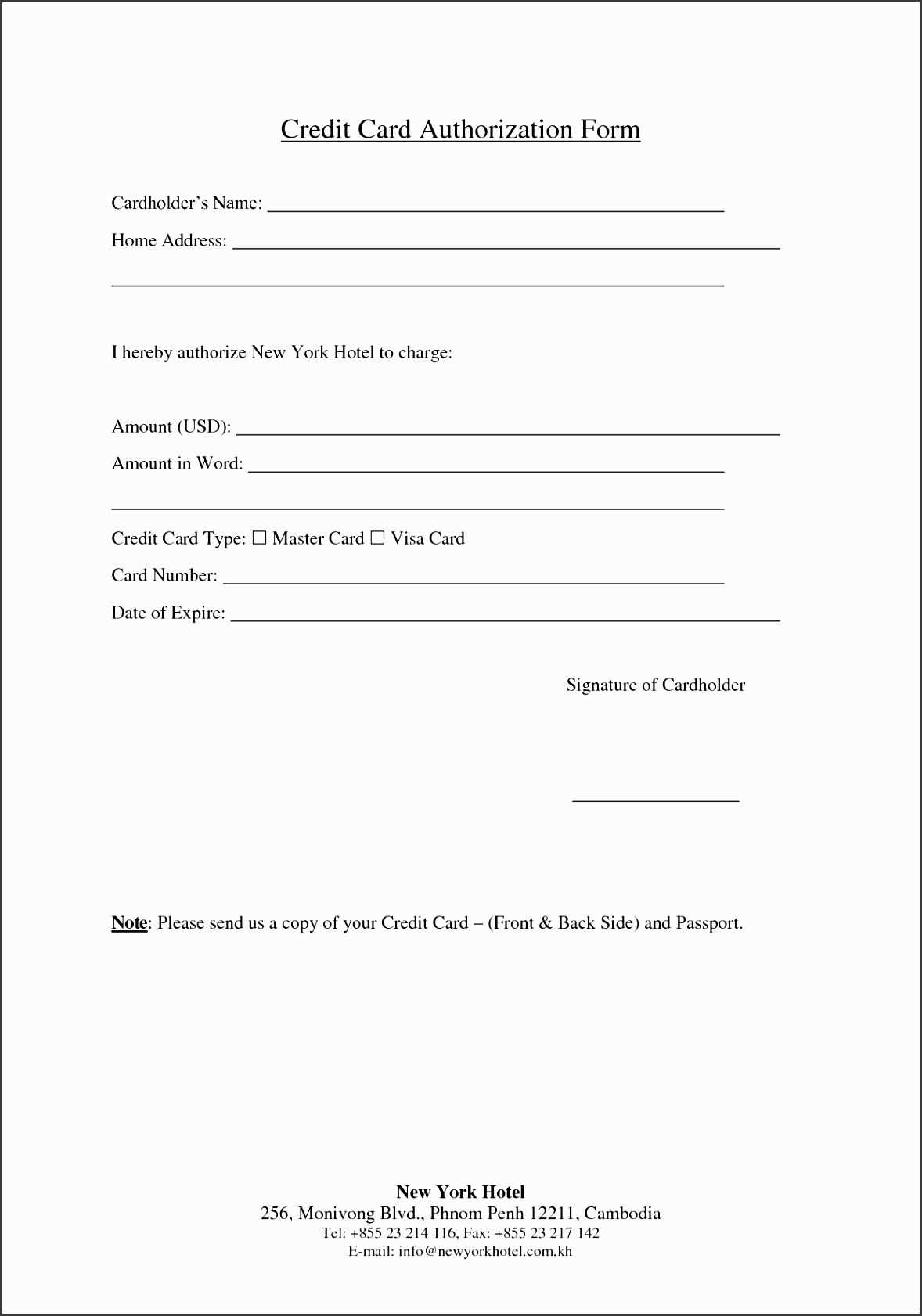

To create a credit card receipt form, begin by ensuring that the form contains the necessary details to capture transaction information accurately. Start with fields for the cardholder’s name, credit card number (with a masking option), expiration date, and transaction amount. Clearly label each section to reduce confusion. Also, include a space for the merchant’s details, including name, contact number, and address.

Key Components

The form should include a signature line for both the cardholder and merchant. Additionally, a timestamp section ensures the transaction details are logged correctly. A summary section at the bottom can display a quick breakdown of the transaction amount, taxes, and any applied discounts or promotions.

Practical Recommendations

Ensure that the form is user-friendly by organizing the fields logically and using clear, concise labels. Allow for both online and printed versions of the form for flexibility. To enhance security, consider adding a unique receipt number to track each transaction. Keep the layout clean and straightforward, avoiding unnecessary details that could distract from the main information.

- Credit Card Receipt Form Template

A credit card receipt form should clearly display transaction details, ensuring both the merchant and the customer have accurate records. A good template will include sections for the cardholder’s name, card number (last four digits), transaction amount, date, and merchant details. It is important to leave room for signatures for both parties. The receipt should also contain a clear statement about the type of transaction (purchase, refund, etc.) and any applicable tax information.

Key Fields in the Template

Cardholder’s Name: Always include the name as it appears on the credit card to prevent confusion and verify the identity of the payer.

Card Number: Only the last four digits of the card number should be displayed for security and privacy reasons. This helps identify the card while maintaining confidentiality.

Transaction Details: A breakdown of the transaction, including the total amount charged, taxes, and any discounts applied. Ensure the total is clearly visible at the bottom of the form.

Merchant Information: Include the merchant’s business name, address, and contact details to provide a clear point of reference if the customer needs to follow up on the transaction.

Design Tips for a Functional Template

The layout should be simple, with bold headers for each section to make the receipt easy to read. Use a professional font and ensure that all information is legible, even when printed in small size. Avoid cluttering the form with unnecessary text or images. The template should be formatted to fit on standard receipt paper for easy printing and distribution.

Design your receipt to reflect your business’s identity. Include your logo, business name, and contact details clearly at the top. Make sure your customers know exactly where they made the purchase. If your business operates in multiple locations, specify the store or branch where the transaction occurred.

Key Information to Include

Include the date and time of the transaction to ensure transparency. Itemize the products or services purchased, with clear descriptions and prices for each. Add any applicable taxes, discounts, or promotions that apply to the transaction, making sure all calculations are accurate and visible.

Optional Enhancements

Consider adding a section for return or exchange policies, along with contact information for customer service. This can increase customer trust and provide clear instructions in case of issues. Including a QR code for online reviews or future promotions can also encourage repeat business.

Clearly list the transaction date. This provides clarity on when the payment took place, which is essential for both the customer and the merchant for record-keeping.

Show the merchant’s name and contact information. This helps customers quickly identify where the transaction occurred and provides an easy way to contact the business if needed.

Display the credit card type used (Visa, MasterCard, etc.). It gives clarity about the payment method chosen, especially when multiple options are available.

Include the last four digits of the credit card number. This serves as a unique identifier for the transaction while maintaining cardholder privacy.

List the total amount charged. This includes any applicable taxes and fees, giving customers a clear view of the final price paid.

Show a breakdown of the purchased items or services. Include the name, quantity, and price of each item, if applicable. This level of detail ensures transparency in the transaction.

Include a transaction ID or reference number. This is essential for tracking or resolving any issues related to the transaction later.

| Item Description | Quantity | Price |

|---|---|---|

| Item 1 | 1 | $50.00 |

| Item 2 | 2 | $20.00 |

| Tax | $5.00 | |

| Total | $95.00 |

Indicate whether the transaction was approved or declined. This helps both the merchant and the customer confirm the outcome of the payment.

Provide the return or refund policy. This allows customers to know their options for exchanges or refunds if needed.

Ensure that all fields are clearly filled in. Missing or unclear information can create confusion and lead to disputes. Double-check the amounts, dates, and transaction numbers for accuracy.

- Incomplete Payment Details: Never leave payment method or transaction ID blank. These details are critical for tracking the payment.

- Incorrect Amounts: Verify that the amount listed matches the payment made. Even small discrepancies can create problems for both parties.

- Missing Date or Time: Always include the exact date and time of the transaction to avoid confusion later on.

- Unclear Terms or Descriptions: Make sure the description of goods or services is clear and concise. Vague language may lead to misunderstandings.

- Failure to Include Business Information: Include your business name, address, and contact details. This makes the receipt more professional and easier to reference.

By paying attention to these details, you help ensure a smooth transaction and reduce the chance of any misunderstandings down the line.

To create a clean and professional credit card receipt form, include the following key components:

1. Header Section

Ensure the header clearly states “Credit Card Receipt” at the top, followed by your business name and logo. The header should also include the transaction date and a unique receipt number for easy reference.

2. Cardholder Details

Include the cardholder’s name, billing address, and card type (Visa, MasterCard, etc.) to confirm their identity and card used for the transaction. This helps in keeping the form clear and organized.

3. Transaction Information

List the purchased items with corresponding prices, taxes, and totals. Provide a breakdown of the transaction, ensuring that all charges are easy to follow. Also, include the method of payment (credit card) and approval code.

4. Contact Information

Offer a section for customer service or business contact details in case of inquiries or disputes. Include phone numbers and emails to make it easy for customers to reach out if needed.

5. Terms & Conditions

Clearly outline any terms regarding refunds, returns, or warranties, if applicable. Keep this section concise but informative, offering customers a transparent overview of their rights and obligations.