Accurate documentation ensures smooth transactions and legal clarity. The NYS State Distribution Receipt and Release Form serves as a critical record for confirming the receipt and release of distributed assets. Whether handling financial disbursements, estate settlements, or legal transfers, this form provides structured acknowledgment between parties.

Each section of the template serves a distinct purpose. It typically includes details about the recipient, a description of distributed assets, and a statement confirming the release of any further claims. Clear and precise language prevents disputes and ensures all involved parties understand their obligations.

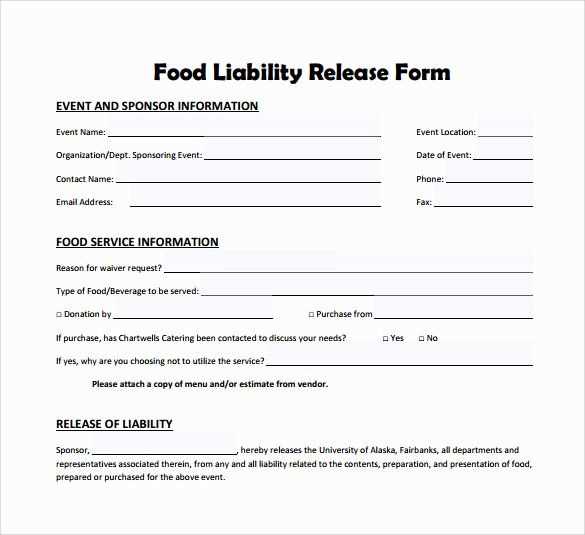

Customization is often necessary to align with specific legal or financial requirements. Fields for additional terms, notary acknowledgment, or witness signatures may be included depending on the context. Reviewing state regulations and seeking legal advice when modifying the form helps maintain compliance.

Consistent record-keeping is key. Retaining signed copies safeguards against future misunderstandings and supports transparency in asset distribution. Digital storage solutions can further enhance accessibility and security for these essential documents.

Here’s the revised version without redundant word repetition:

Ensure clarity by using precise language. Avoid unnecessary phrases that do not contribute to the message. Instead of repeating the same terms, substitute with synonyms or restructure sentences. For example, use “receipt” and “release” separately, depending on the context, to maintain specificity. Reducing redundancy keeps the form concise and user-friendly, which is crucial for clear communication. Always focus on delivering the information with simplicity, making it easy for anyone to understand.

Focus on key terms: Select words that are most relevant and remove those that may confuse or clutter the form. For instance, eliminate filler phrases like “as stated earlier” or “in the context of,” as these add no value. Every sentence should provide necessary details with precision, ensuring the form serves its purpose without excess wording.

Reviewing the content: After creating the form, go through it again to identify any redundancies. Simplify language where possible, cutting out repetitive expressions. This process will ensure the form remains effective, efficient, and easy to follow.

- NYS State Distribution Receipt & Release Template

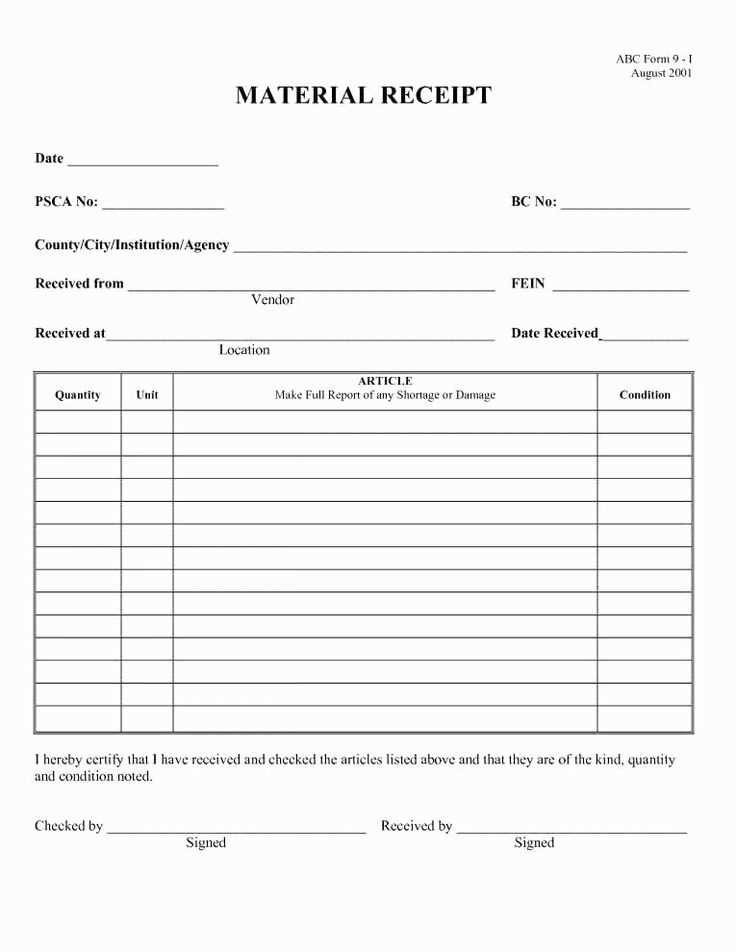

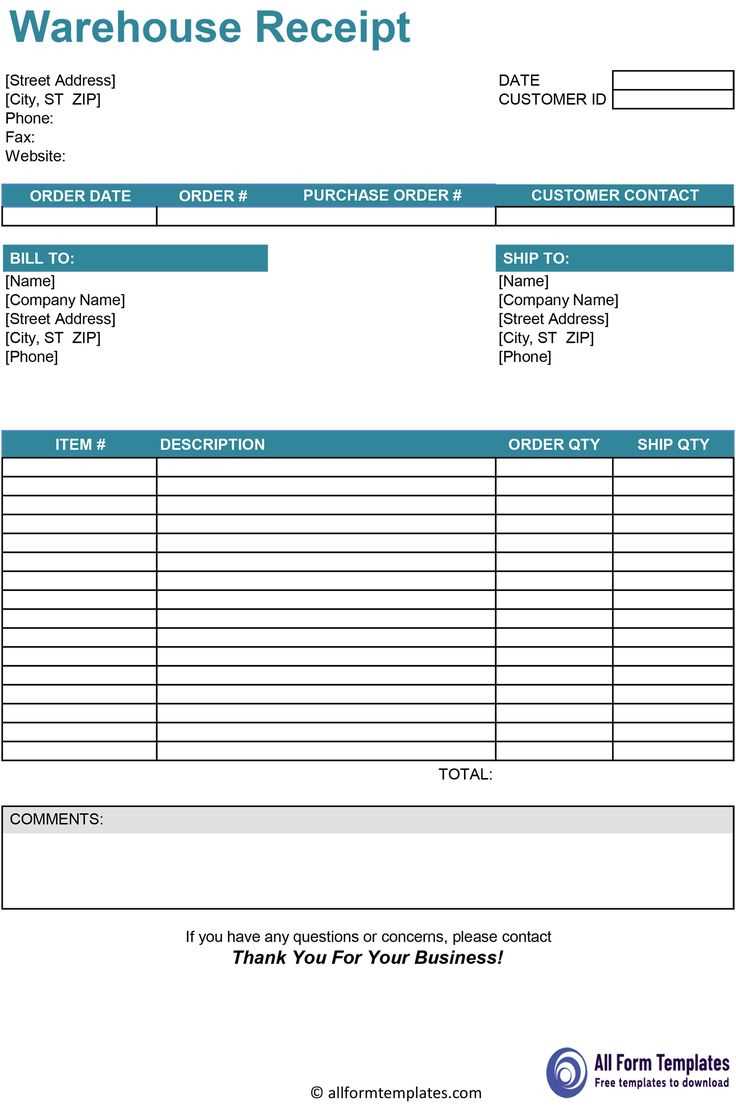

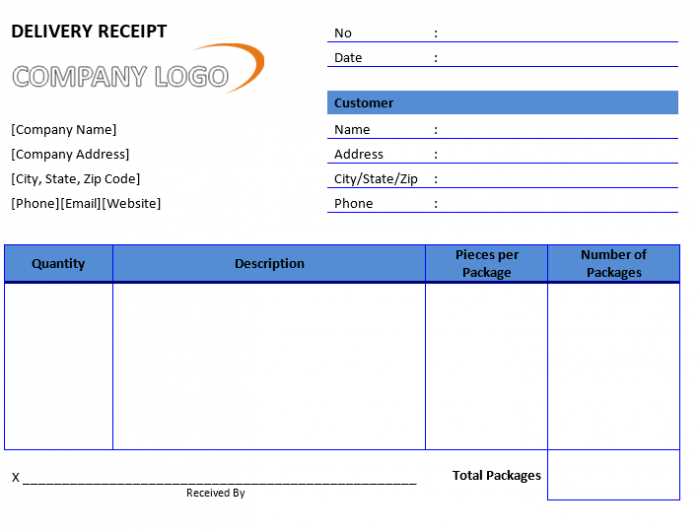

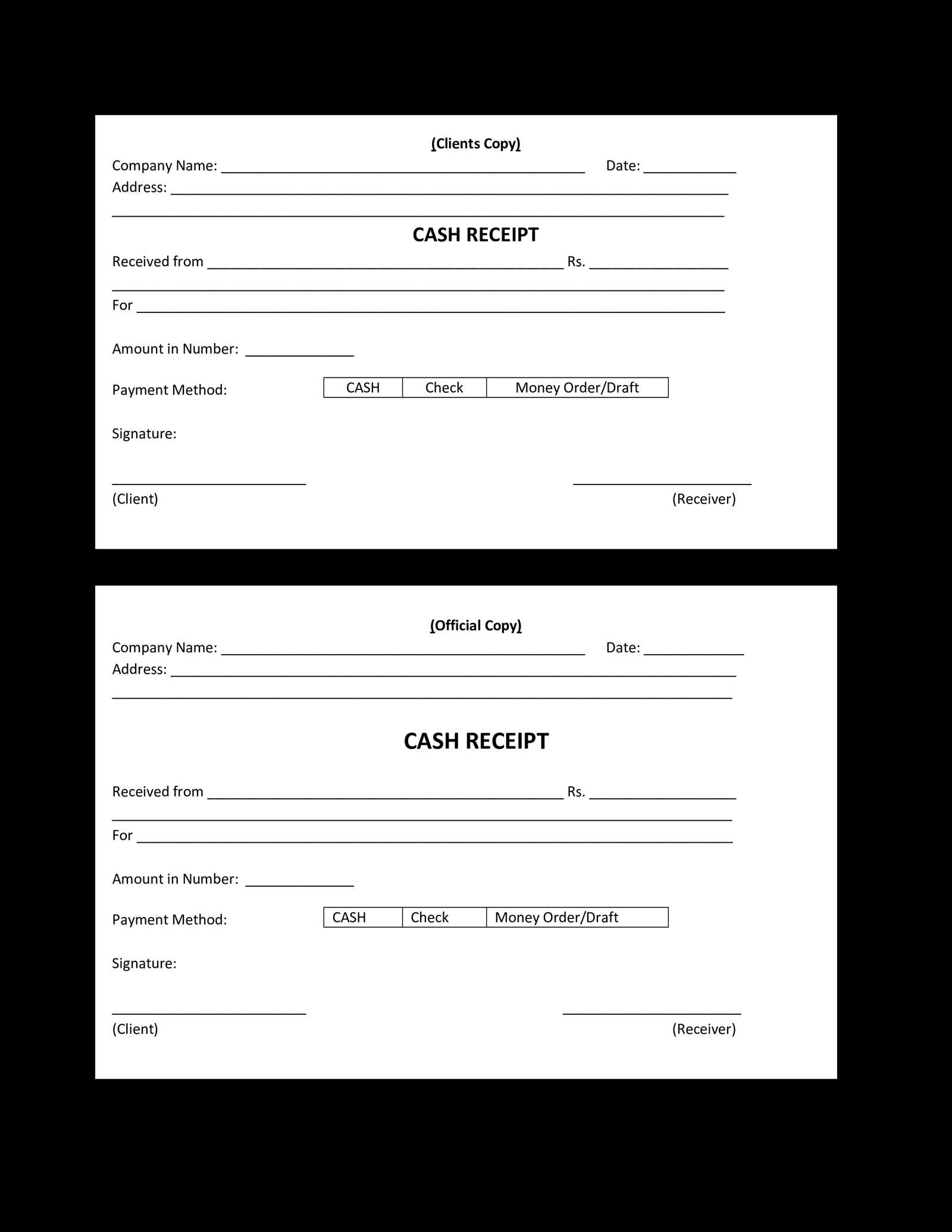

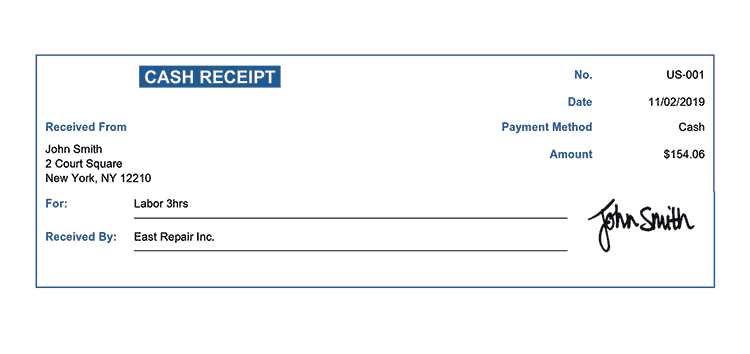

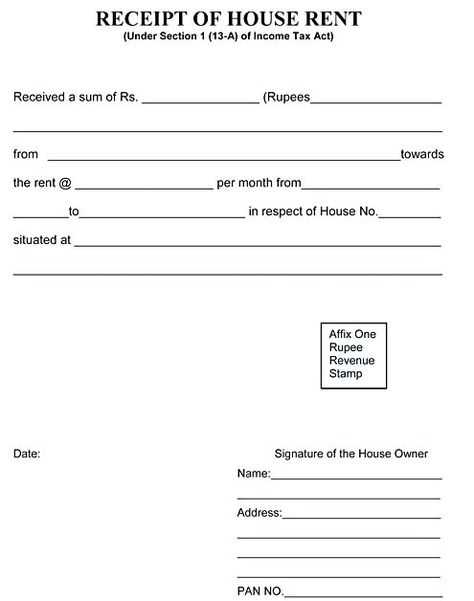

Ensure that all necessary fields are included in the NYS State Distribution Receipt & Release form to document the transfer of items accurately. Start by listing the name of the distributing party and the recipient’s details, including their contact information and address. Clearly state the items or funds being released, specifying quantities, descriptions, and any applicable reference numbers. Include space for both parties to sign and date the form to validate the transaction. It’s also recommended to include a brief statement that confirms the recipient acknowledges the receipt and agrees to the terms outlined in the document.

For better tracking, assign a unique reference or receipt number to each transaction. This will help maintain organized records and facilitate any future inquiries. Finally, ensure the template aligns with any specific state regulations regarding distribution and release forms. Always consult legal guidelines to ensure compliance with state laws, as requirements may vary across jurisdictions.

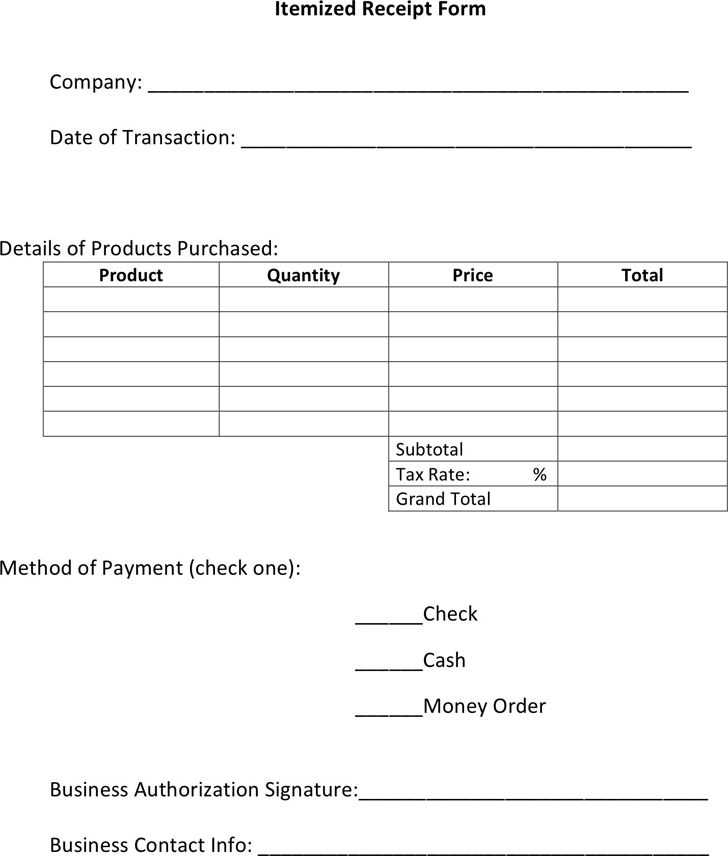

Complete and accurate submission of the Nys State Distribution Receipt and Release form requires specific details to ensure proper processing. Missing information may delay approval. The following fields are mandatory:

- Full Name: Include the legal name of the individual or entity requesting the distribution.

- Contact Information: Provide up-to-date phone numbers and email addresses for communication purposes.

- Taxpayer Identification Number (TIN): This is necessary to verify identity and avoid delays in processing.

- Address: Specify both mailing and physical addresses where applicable.

- Distribution Amount: Clearly state the exact amount being requested or released.

- Signature: An official signature confirms consent and acknowledgment of the terms.

Additional Considerations

Double-check that all required fields are filled in with accurate and legible information to prevent any issues. Missing signatures or incomplete data may result in processing delays or rejection of the form.

Tips for Accuracy

- Verify the information with official documents like tax records or previous correspondence.

- Ensure all fields are legible, especially handwritten entries.

To ensure proper handling of a Nys state distribution receipt and release form, the section for authorized signatures must be completed with accuracy. This confirms the legitimacy of the transaction and verifies that all parties involved are in agreement.

Follow these steps to make sure your signatures are properly validated:

- Each authorized individual must sign in the designated space to indicate their approval of the form’s contents.

- Ensure that the signatures are legible and match the official records of the signatories.

- Verification can be done by a witness or notary, depending on the requirements stated on the form.

- If multiple signatures are required, confirm that each signer is authorized to act on behalf of their organization or entity.

- Check that any necessary dates and titles are also filled out next to the signatures for further validation.

After gathering all authorized signatures, ensure that the verification process is complete. This includes checking the legitimacy of each signer’s authority and the validity of their signature to prevent any future disputes.

Always organize your documents before submission. Group related forms together and ensure each section is clearly marked. Use labeled folders or digital categories for easy access and retrieval.

Physical Filing Tips

When filing paper documents, use sturdy file folders. Ensure each folder contains a clearly written label with the document’s title, date, and any relevant reference numbers. Store the files in a cool, dry place to avoid damage.

Digital Filing Tips

For digital records, save files in a well-structured directory system. Name each file with a clear and consistent naming convention that includes relevant details such as the document type, date, and a reference number. Regularly back up files to avoid data loss.

| Filing Type | Tip |

|---|---|

| Physical | Use labeled folders with clear sections for related documents. |

| Digital | Save files in organized directories with consistent naming conventions. |

Maintain records for at least three years after the date of distribution. This timeframe is mandated by the New York State guidelines for retaining transactional records and related documentation. Keep both physical and digital copies of all receipts and release forms in an organized manner. Ensure that the records are easily accessible in case of future audits or inquiries.

Storage Methods

For digital records, use secure cloud storage or encrypted drives to ensure data protection. For paper records, store them in a safe, secure location, such as a locked file cabinet or a safe, where they cannot be easily damaged or tampered with. Keep the records organized by date and type for quicker retrieval when needed.

Disposal Process

When the retention period ends, dispose of records properly to ensure privacy. Shred physical documents and delete digital files securely. Using a certified disposal service is recommended for compliance with privacy regulations.

One common mistake when handling the Nys state distribution receipt and release form is neglecting to fill out all required fields. Double-check each section before submission to ensure nothing is missing. Pay close attention to signature areas, dates, and the details of transactions.

Incorrect Date Entries

Make sure to enter the correct dates in the designated fields. Incorrect or mismatched dates can lead to confusion or delays. Always cross-check the date of the transaction with your records.

Incomplete Information

Incomplete information can cause rejection of the form. Ensure that all personal and transaction details are clear and fully filled out. Verify that the contact details, such as phone numbers or email addresses, are up-to-date.

To avoid delays or rejection, review the form before submission and consult with relevant authorities or guidelines if unsure about any field. Proactive attention to detail helps prevent common errors.

Ensure the distribution receipt and release form complies with all applicable state and federal regulations. Verify that the form captures all required details, such as the recipient’s name, contact information, and any associated legal disclaimers. These details help protect both parties and provide clarity in case of disputes.

Data Privacy Requirements

Collect only the necessary information, avoiding excessive data collection. Abide by data privacy laws such as the General Data Protection Regulation (GDPR) if applicable. Inform recipients about their rights regarding personal data and how it will be used, stored, and protected.

Signatory Authentication

Ensure that the form includes a field for recipient signatures. It is vital to confirm the signatory’s identity, either through a witness, digital authentication, or other legally acceptable means. This prevents fraudulent claims and ensures legal validity.

| Required Information | Legal Compliance Requirement |

|---|---|

| Recipient’s Full Name | Must match legal documents |

| Date of Receipt | Must reflect actual transaction date |

| Signature | Must be verified and authentic |

Ensure that the receipt and release form is clearly structured with the necessary information, such as the recipient’s name, item description, and any associated identification numbers. Avoid clutter by focusing on the key elements: item name, quantity, and date of release. Include a section for signatures, confirming that both the release and receipt processes are acknowledged. This will help prevent disputes and facilitate easy tracking of the distribution process. Double-check that all fields are correctly filled out before finalizing the document.

Implement simple but effective formatting for readability. Clearly define each section, using bold or underlined headings for easy reference. Make sure the template leaves enough space for all required details, especially when documenting multiple items. Accuracy is paramount–cross-check data for completeness and correctness to avoid mistakes that could complicate future retrievals.

For recurring distributions, set up a reusable template. This will save time and maintain consistency across multiple transactions. Store the completed forms digitally, allowing for quick retrieval if needed. Keep a backup of all distribution records to avoid any loss of crucial information.