For businesses handling transactions, it’s critical to maintain clear and professional receipts that include necessary banking details. A well-designed receipt not only serves as a proof of payment but also provides transparency for both parties involved. Below is a straightforward template to include banking information effectively, ensuring customers have all the required details at hand.

First, always make sure to clearly list the recipient’s banking information. Include the bank name, account number, and IBAN if applicable. This ensures that both the sender and recipient can confirm transaction details without confusion. For added security, you can also include a SWIFT/BIC code for international transfers.

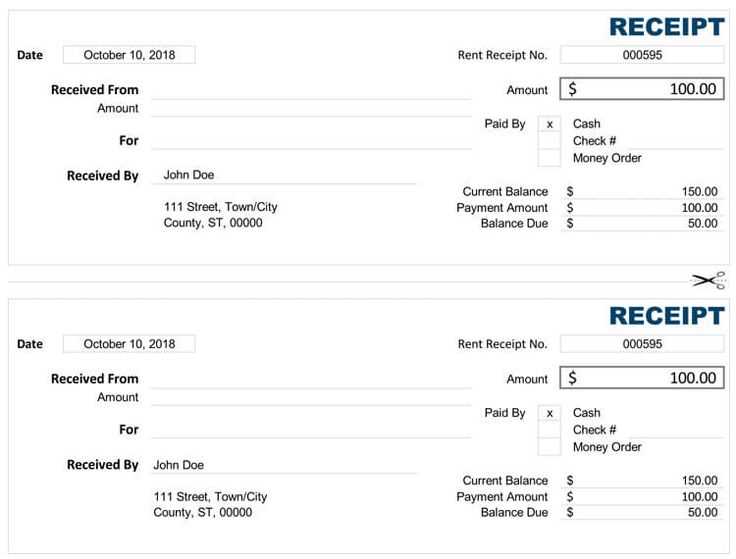

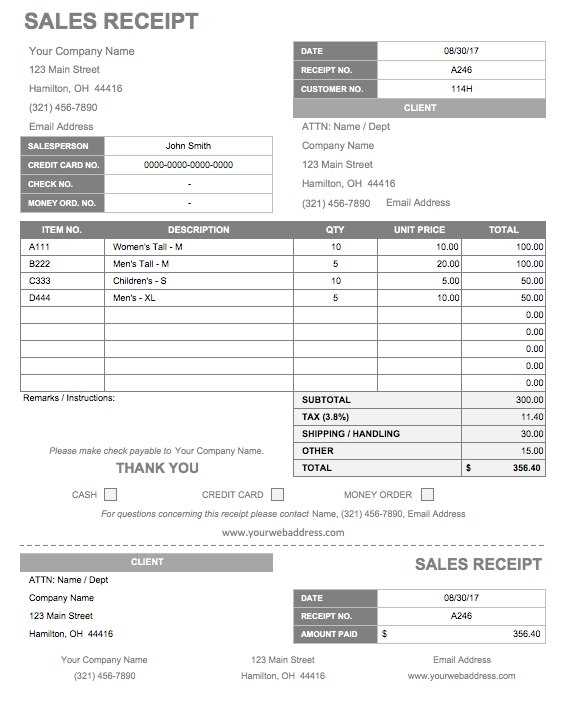

The template should also display the transaction date, amount paid, and any reference or transaction number. This helps maintain accurate records for accounting purposes. Don’t forget to include your contact details for any follow-up inquiries. A simple “Thank you for your payment” at the end creates a more personable receipt.

By using a clear and simple receipt template, you reduce the chances of any misunderstandings and ensure a smooth process for all transactions. Keep the information well-organized and easy to read to avoid unnecessary complications down the line.

Here’s the revised version with minimized repetitions:

To create a streamlined receipt with banking information, focus on the core elements needed for clarity and security. Start with the transaction details, followed by the recipient’s banking information. Make sure to use clear labels for each section and separate the different types of data logically.

Transaction Details

- Date of transaction

- Amount transferred

- Transaction reference number

Banking Information

- Recipient’s bank name

- Account number

- SWIFT/BIC code (if applicable)

- IBAN (if applicable)

Avoid repeating the same information, such as transaction types or additional notes, unless absolutely necessary. Keeping the document simple and focused helps reduce confusion and ensures all key data points are easily found.

- Receipt with Banking Details Template

Include the bank account information clearly at the bottom of your receipt. This should contain the bank name, account number, sort code, IBAN (if applicable), and SWIFT/BIC code. Make sure the text is legible and appropriately spaced to avoid confusion.

Place the payment method and transaction reference above the bank details. This helps the recipient distinguish between payment type and banking information. For example, indicate whether the payment was via bank transfer, credit card, or cheque.

Provide clear instructions if necessary. If the recipient needs to take further steps, such as confirming the transaction or providing additional information, include those instructions near the banking details. Avoid long paragraphs; keep instructions short and direct.

Ensure the format matches standard financial documentation, and align the details neatly for clarity. Consistency in formatting helps with easy reference in future transactions.

List payment details in a clear, consistent manner. Start with the payment method, followed by the transaction ID, the amount, and the date of the transaction.

Payment Method

Indicate the payment method clearly: cash, credit card, debit card, bank transfer, or other. For card payments, include the last four digits of the card number to maintain privacy. For bank transfers, specify the bank name and account number used.

Transaction ID and Amount

Each receipt should include a unique transaction ID for tracking purposes. Below that, display the payment amount, including any taxes or fees.

| Payment Method | Transaction ID | Amount | Date |

|---|---|---|---|

| Credit Card | 123456789 | $150.00 | 2025-02-05 |

| Bank Transfer | 987654321 | $250.00 | 2025-02-05 |

Ensure the format is consistent across all receipts for better readability and professional presentation.

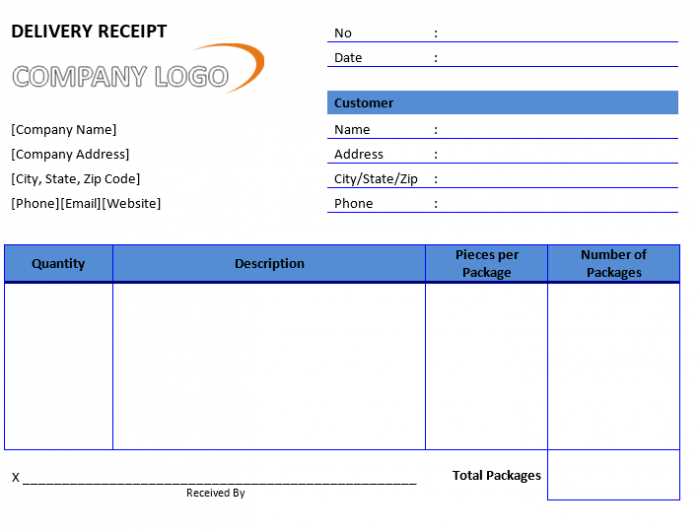

Clearly display the payer’s name and address. This helps confirm the identity of both parties in the transaction.

Provide detailed banking information, including the recipient’s bank name, account number, SWIFT/BIC code, and IBAN (if applicable). This allows for direct and secure transfers.

Include the payment amount and currency. Specify the total due and the currency being used to avoid confusion.

Indicate the payment date or due date. This ensures both parties are aware of the expected timeline for the transaction.

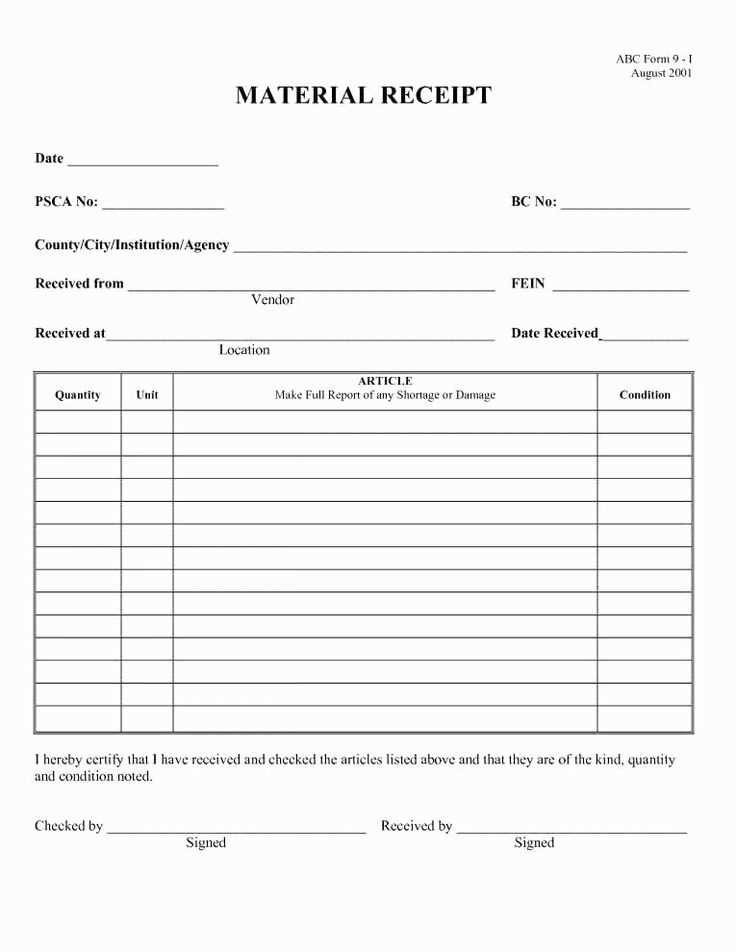

Offer an itemized breakdown of the services or products being paid for. List each item, quantity, and price, so the payer understands exactly what they’re paying for.

Include the invoice or reference number for easy tracking and record-keeping. This makes it simpler for both parties to reference the transaction in case of discrepancies.

If applicable, provide payment terms such as late fees or discounts for early payment. This sets expectations and helps prevent misunderstandings.

Make sure to include contact details for customer support or inquiries. A phone number or email ensures the payer can reach out if they have any questions or issues with the payment.

Include specific banking details on your receipt, such as your business’s bank account number, IBAN, and SWIFT/BIC codes. These details are often required for accurate financial reporting and compliance with international and local financial regulations. Double-check that your bank’s information is accurate to prevent issues with transactions.

Verify the inclusion of tax-related data, like VAT numbers and relevant tax rates. For businesses in regions with VAT, failure to list the correct tax information can result in penalties. Ensure this data is formatted according to your jurisdiction’s legal requirements.

Provide clear details about the transaction, including amounts, payment method, and dates. This is crucial for transparency and audit trails. Make sure to list refunds, exchanges, or partial payments separately to avoid confusion during financial reviews.

Review your receipts to ensure they meet the record-keeping standards required for tax purposes. Some regions mandate keeping receipts for a set number of years, so ensuring your receipt has all the necessary information will make it easier to comply with future audits or reviews.

Lastly, stay updated on local regulations. Laws about financial documentation can change, and staying informed ensures your receipts remain compliant. Consult with a financial expert or legal advisor to ensure your template is always up to date.

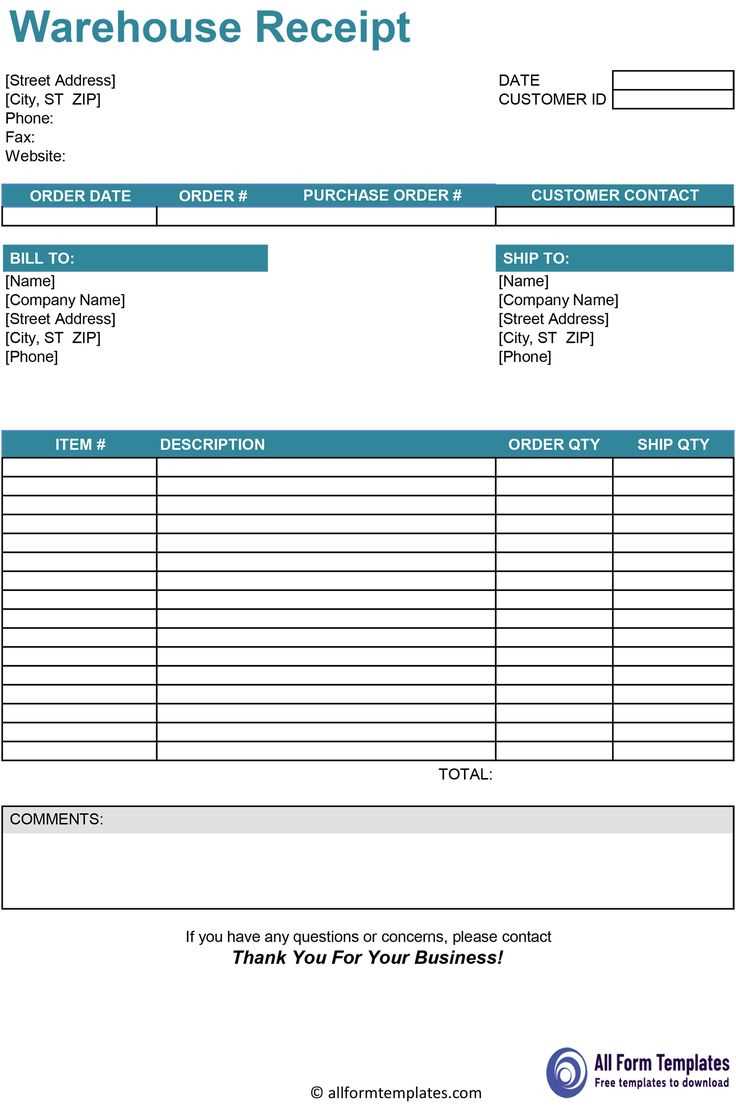

To customize a receipt template, adjust the layout to fit your brand’s identity. Include your company logo at the top, followed by business details such as name, address, phone number, and email. Make sure the text is clear and easy to read, with enough space between sections for clarity.

Incorporate Payment Information

Clearly display payment details like transaction ID, payment method, amount, and any applicable taxes. Align these elements in a way that highlights important data, so customers can quickly find their transaction information.

Add a Personalized Touch

Include a message or a thank-you note at the bottom of the receipt. This small addition helps to create a positive customer experience and strengthens your brand’s presence. Adjust the font and color to match your brand style.

Lastly, ensure that your receipt complies with any local or industry regulations for financial documentation. This can include adding VAT numbers or specific legal disclaimers. Check that all required fields are present and correctly formatted.

Use encryption for all sensitive data. Always encrypt files containing financial information both during transmission and when stored. This adds an extra layer of security to prevent unauthorized access.

- Apply strong passwords and multi-factor authentication. Use long, complex passwords and enable two-factor authentication for systems where financial data is stored or processed.

- Limit access to only authorized personnel. Grant access to sensitive information on a need-to-know basis to reduce the chances of a data breach.

- Regularly update and patch systems. Ensure that all software, especially security tools, is up-to-date to protect against vulnerabilities.

- Monitor access and usage logs. Track who accesses financial data and look for unusual activities that could indicate potential security issues.

- Educate employees on security practices. Provide regular training on how to spot phishing attempts, avoid malware, and handle financial data safely.

By following these practices, you significantly reduce the risk of exposing sensitive financial information and help protect both your business and customers.

Make sure the payment data is clear and accurate. Double-check the transaction amount, currency, and any fees applied. A common mistake is listing incorrect totals, which could cause confusion or lead to disputes. Verify that all the relevant payment information, such as payment method and card details, are properly formatted and up-to-date.

1. Incomplete Banking Information

Ensure that you provide the full banking details, including the account number, sort code, and IBAN, if applicable. Omitting any of these can result in delayed or rejected payments. Be specific and include all necessary identifiers to avoid confusion during transfers.

2. Unclear Date Format

Use a consistent date format to avoid confusion, especially if your receipt might be shared internationally. Choose a format like YYYY-MM-DD, as it eliminates ambiguity that could arise from different regional date conventions.

Pay attention to spelling errors in names or addresses as well. These small mistakes can lead to incorrect transactions and delay processing. Always cross-check the information provided, particularly for clients or vendors with international payment data.

Try to maintain accuracy and meaning while avoiding repetition.

To create a clear and professional receipt with banking information, focus on presenting all necessary details in an organized manner. Include the full name of the payer, the payment method, the transaction amount, and the exact date. Be sure to list the bank’s name, the account number, and routing information in a separate section. Avoid redundancy by presenting this information once and in a straightforward format.

Ensure the payment reference or invoice number is visible, as this is key for tracking transactions. Keep the language direct and simple, limiting unnecessary commentary. When entering banking details, double-check for accuracy to prevent future errors or confusion.

Provide contact information or support channels in case any clarification is needed. A receipt should only contain the necessary data for both parties to confirm the transaction without ambiguity.