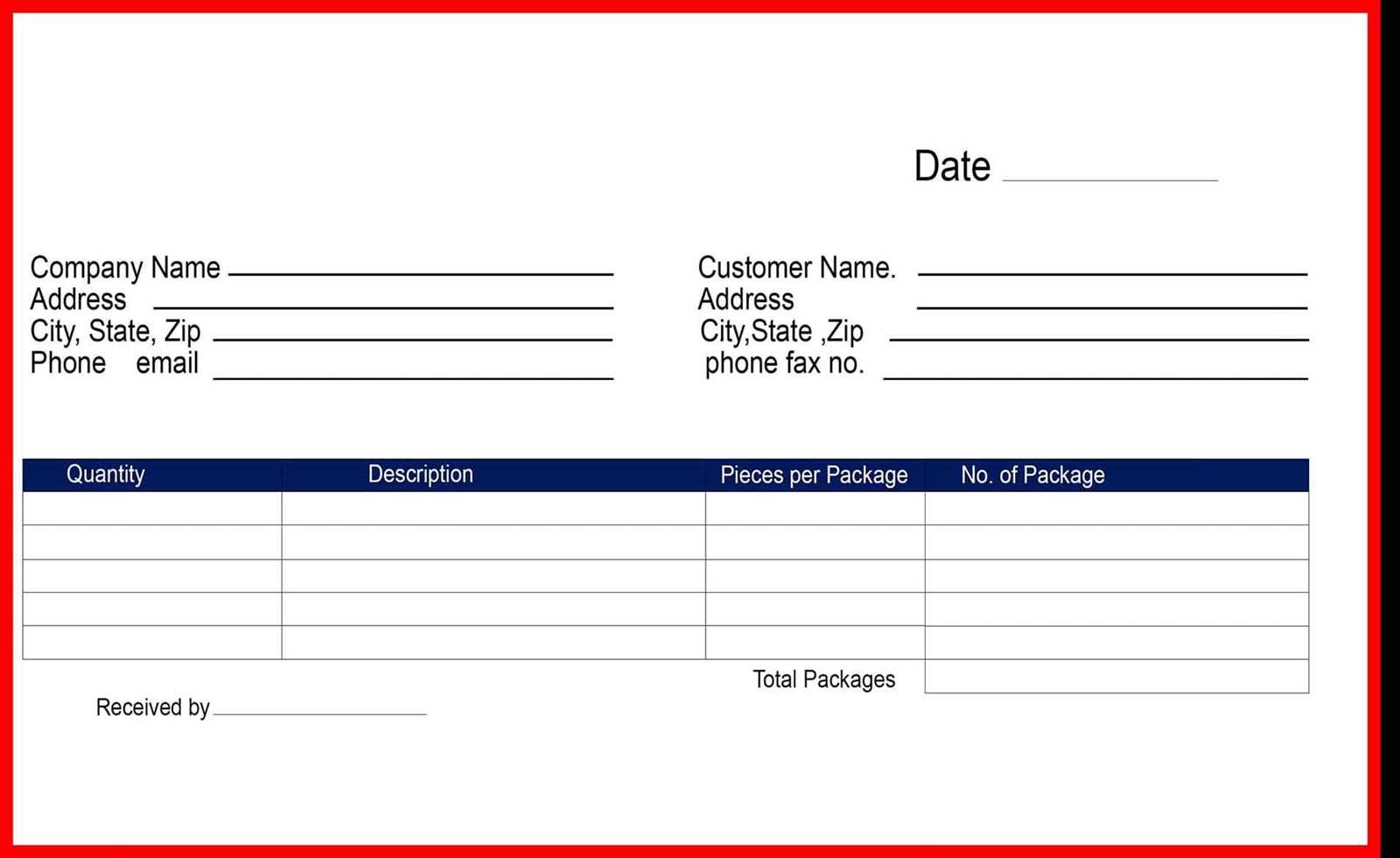

Creating a clear and concise asset purchase receipt is a simple but important step when transferring ownership of goods. A short-form template ensures that both parties have a written record of the transaction, protecting both the buyer and the seller. It captures the essential details of the asset, the terms of the sale, and confirms that the purchase has been completed.

Use this template to outline key information such as the description of the asset, the purchase price, and the date of transfer. Ensure the buyer’s and seller’s details are clearly listed, along with any relevant conditions or warranties that may apply. Having all the relevant data in a structured format helps avoid misunderstandings and provides proof of transaction for future reference.

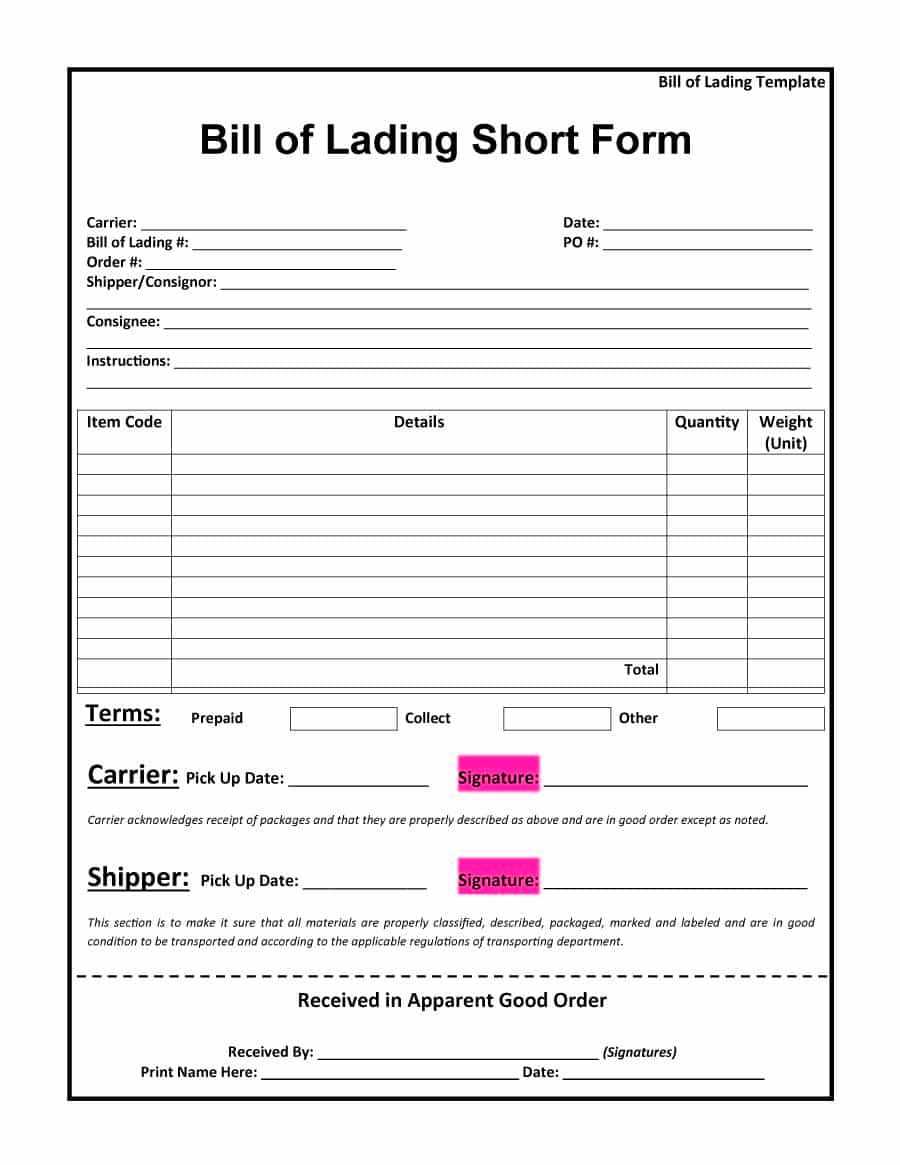

This template also includes space for signatures, making it legally binding and providing an official record of the sale. Both parties should review the document before signing to confirm the accuracy of the details. Keep a copy of the receipt for record-keeping and potential future needs, such as warranty claims or resale of the asset.

Short Form Asset Purchase Receipt Template

A Short Form Asset Purchase Receipt is a straightforward document confirming the transfer of assets between a buyer and a seller. It typically includes key details like the date of transaction, asset description, price, and signatures of both parties. Keep the information concise and clear, while covering all necessary points. Here’s what should be included:

Key Details

The receipt should list the following details:

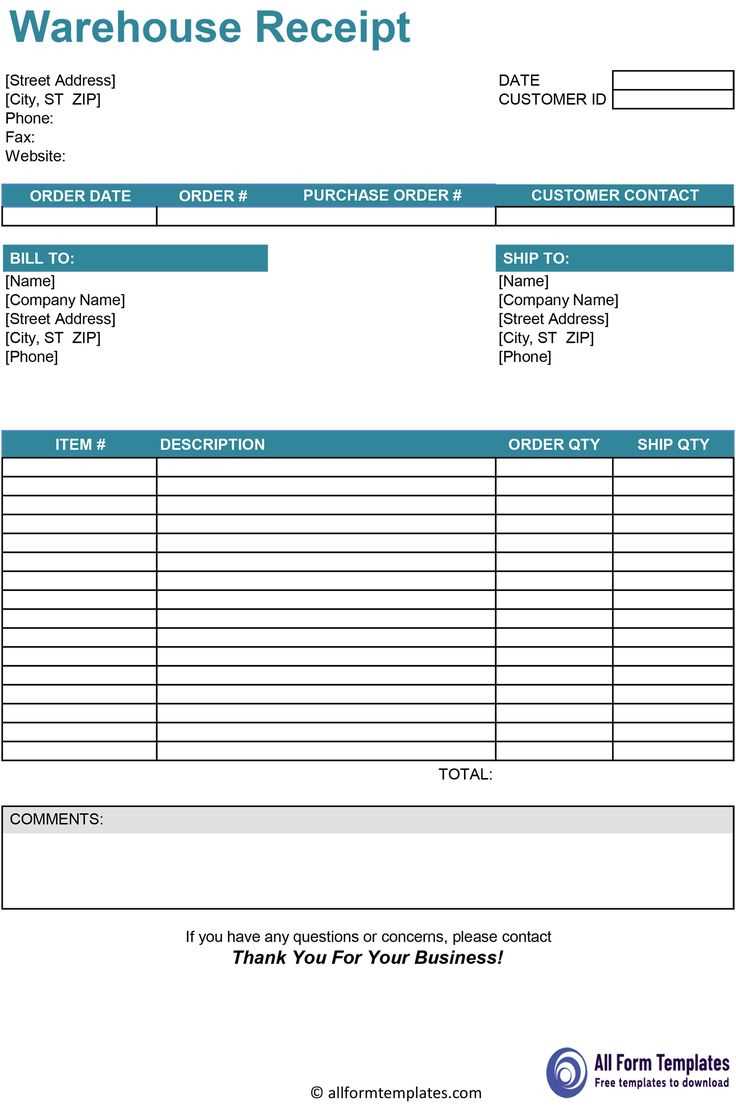

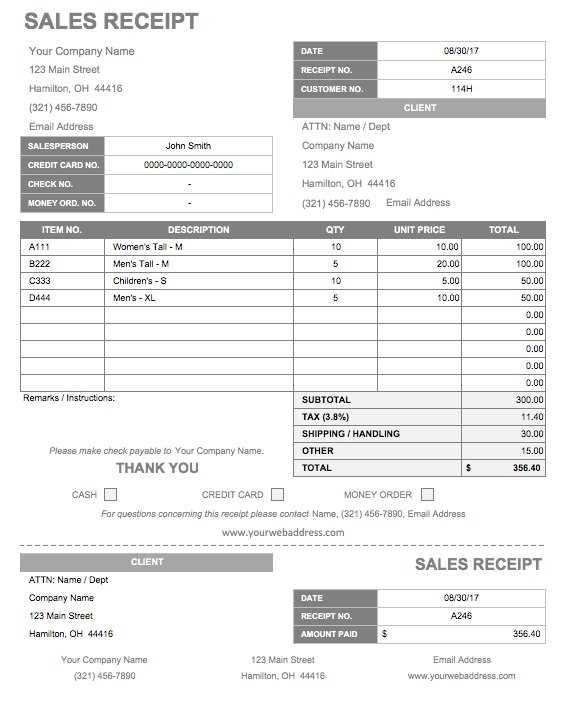

- Buyer and Seller Information: Names and addresses of both parties.

- Transaction Date: The date the asset was purchased.

- Asset Description: A brief but specific description of the asset being transferred.

- Purchase Price: The agreed-upon price for the asset.

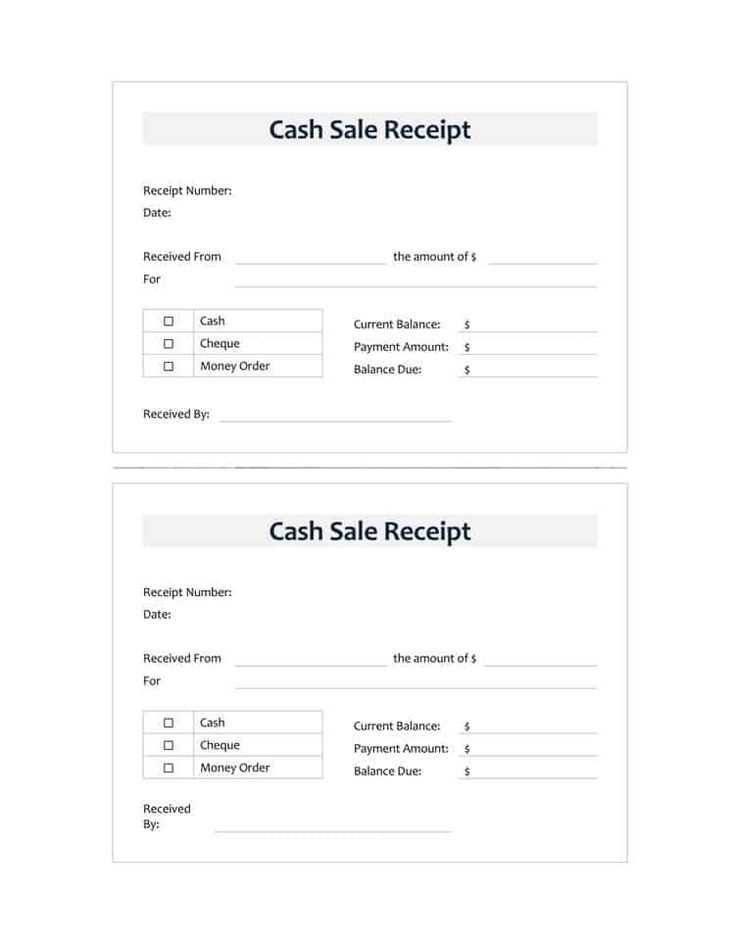

- Payment Method: Indicate whether the payment was made in cash, by check, or via another method.

- Signatures: Both buyer and seller should sign the document, verifying the transaction.

Additional Tips

To ensure clarity, avoid unnecessary legal jargon. Provide enough detail to avoid misunderstandings, but keep the document short and to the point. If you are including multiple assets, list each item separately with its corresponding price. This approach prevents any confusion in the future.

How to Create a Short Form Asset Purchase Receipt

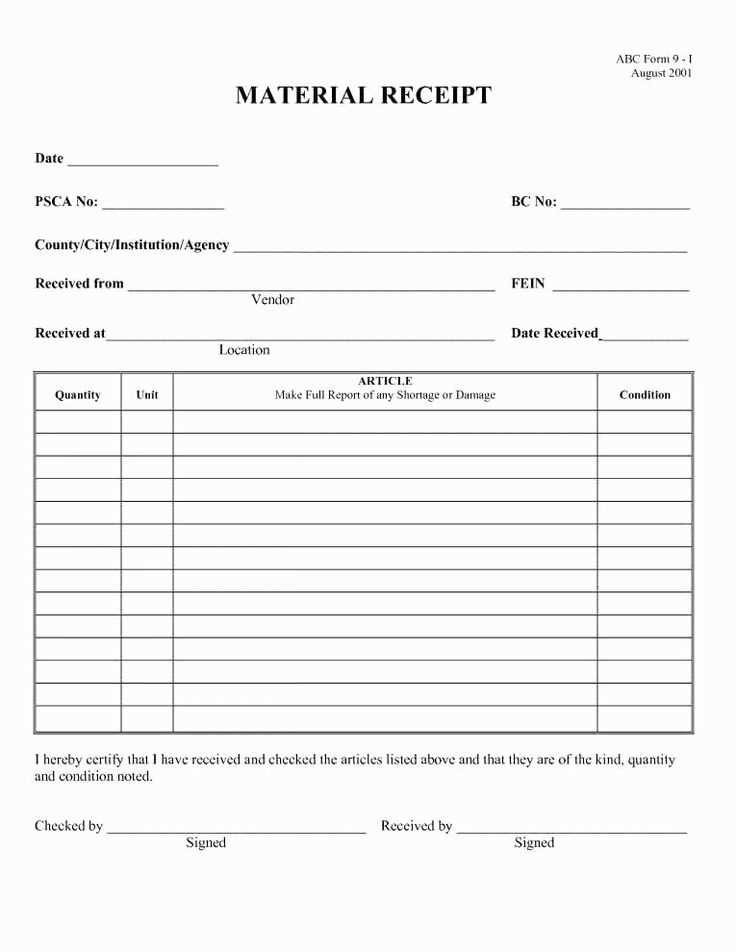

To create a short form asset purchase receipt, follow these steps for a clean and straightforward document:

1. Include Buyer and Seller Details

- Buyer’s name, address, and contact details.

- Seller’s name, address, and contact details.

2. List the Asset Details

- Provide a clear description of the asset being purchased.

- Include any relevant serial numbers, model numbers, or identification marks.

- State the condition of the asset at the time of sale.

3. Specify the Purchase Price

- State the total amount paid for the asset.

- Include any applicable taxes or additional charges.

4. Include Payment Method and Date

- Note how payment was made (e.g., cash, check, wire transfer).

- Specify the date payment was made and any reference numbers if applicable.

5. Provide a Statement of Transfer

- Clearly state that ownership of the asset has been transferred to the buyer.

- Confirm the date of transfer.

6. Signatures

- Have both parties sign the receipt to confirm the agreement.

- Include spaces for their printed names and the date of signing.

Key Legal Considerations for Asset Purchase Receipts

Ensure that the asset purchase receipt clearly identifies the specific assets being transferred. Avoid ambiguity in the description of the assets, specifying details such as serial numbers, models, or any other distinguishing features. This helps prevent disputes over what was included in the transaction.

Title Transfer and Ownership

The transfer of ownership must be explicitly stated in the receipt. Make sure the seller confirms they have full rights to transfer the assets and that there are no outstanding encumbrances, such as liens or claims. A clear declaration of title transfer protects both parties in case of future ownership disputes.

Payment Terms and Conditions

State the agreed payment terms in detail, including the total amount, payment method, and schedule. Specify if any deposits, installments, or deferred payments are involved. Be clear about any penalties or interest charges for late payments to avoid future disagreements.

Include a clause that confirms whether the receipt serves as a full settlement or if there are any remaining obligations. Clarify any contingencies, such as inspection or regulatory approvals, that might affect the finality of the transaction.

Common Mistakes to Avoid When Using a Short Form Receipt

One of the most frequent mistakes is leaving out important details like the payment method or transaction date. Always include these to ensure clarity and avoid confusion later.

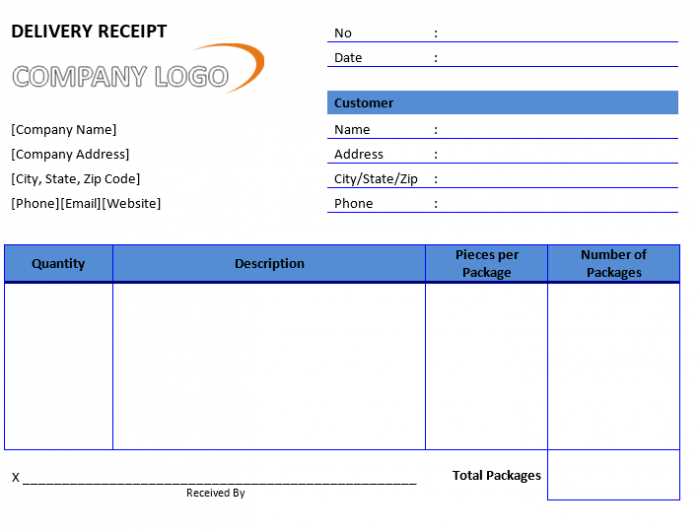

Not Including Seller and Buyer Information

Failing to list the full names and addresses of both parties can lead to misunderstandings. Ensure both the buyer and seller are clearly identified, with accurate contact details.

Vague or Incomplete Item Descriptions

Be specific when describing the items sold. A vague description can create problems if a dispute arises. Include product names, quantities, and condition, even if it’s a short form receipt.

Another issue is neglecting to specify the agreed price or total amount clearly. Make sure the price is visible, and there is no ambiguity about what the buyer is paying.

Lastly, don’t forget to provide space for signatures. A receipt is not official without both parties’ acknowledgment. Leaving this out can make the document legally questionable.