Need a free Australian tax receipt template? Download a professionally designed template that meets ATO requirements and simplifies record-keeping for your business. Whether you’re issuing receipts for sales, donations, or services, a well-structured template ensures compliance and saves time.

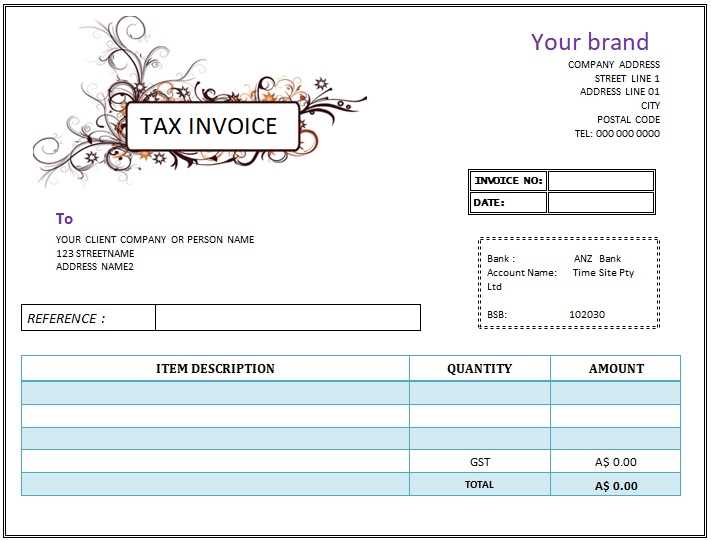

A proper tax receipt should include essential details such as the business name, ABN, date, transaction amount, and a clear description of goods or services provided. If your business is registered for GST, the receipt must also show the GST amount and include the phrase “Tax Invoice” if applicable. For non-GST businesses, a standard receipt without GST breakdown is sufficient.

Using a template eliminates errors and ensures consistency. Choose between printable PDF formats for quick manual entry or editable Excel and Word versions for easy customization. Digital-friendly templates also allow seamless integration with accounting software, helping you streamline financial reporting.

Download your free Australian tax receipt template now and make tax reporting stress-free!

Here’s the revised version without unnecessary repetition:

For a clean, concise Australian tax receipt template, include the following details:

Basic Information

Start with the company name, address, and ABN (Australian Business Number). Make sure these details are prominent at the top of the receipt for easy identification.

Transaction Details

Clearly list the products or services provided, along with the date and amount paid. Include any applicable taxes such as GST, if relevant to the transaction. The total amount should be easy to spot, ensuring transparency for both parties.

Lastly, include a space for the customer’s name and contact details if necessary. This provides clarity and keeps your records organized.

- Free Australian Tax Receipt Template

Use a free Australian tax receipt template to simplify the process of issuing receipts for donations, services, or goods sold. These templates can help ensure compliance with Australian tax laws and make your transactions more transparent.

What to Include in the Template

- Business Details: Include your business name, address, and ABN (Australian Business Number).

- Date of Transaction: Specify the date when the transaction took place.

- Amount Paid: Clearly state the total amount paid, including any taxes.

- Payment Method: Mention how the payment was made (e.g., cash, card, bank transfer).

- Description of Goods or Services: Provide a brief description of what was sold or provided.

- GST (if applicable): If you’re registered for GST, ensure you indicate the GST amount.

- Receipt Number: Include a unique reference number for each receipt issued.

How to Access Free Templates

- Search online for reputable sites offering downloadable Australian tax receipt templates.

- Check government websites or business resources for templates that are free and compliant with the latest tax regulations.

- Download templates in formats such as Word, Excel, or PDF for easy customization.

By using a template, you can ensure consistency, reduce errors, and save time, all while keeping records that meet tax requirements.

Free templates for Australian tax receipts can be found on a variety of reliable platforms. Here are some of the best sources:

1. Government Websites

Check official government resources like the Australian Taxation Office (ATO) website for free templates and guides. The ATO offers various tools that help in generating tax receipts in line with Australian tax laws.

2. Online Template Platforms

Several online platforms provide free downloadable tax receipt templates specifically designed for Australian businesses. Some of the popular sites include:

- Canva – Offers customizable tax receipt templates that can be easily adapted to your needs.

- Template.net – Features a wide range of free tax receipt templates for Australian businesses.

- Vertex42 – Known for high-quality Excel templates that can help with tax receipt generation.

3. Accounting Software Tools

Some free accounting software options, like Wave or Zoho Books, come with tax receipt templates that are pre-designed to meet Australian standards. These tools allow for quick generation and customization of receipts.

Use these resources to find a suitable template that meets your needs and ensures your tax receipts are both professional and compliant.

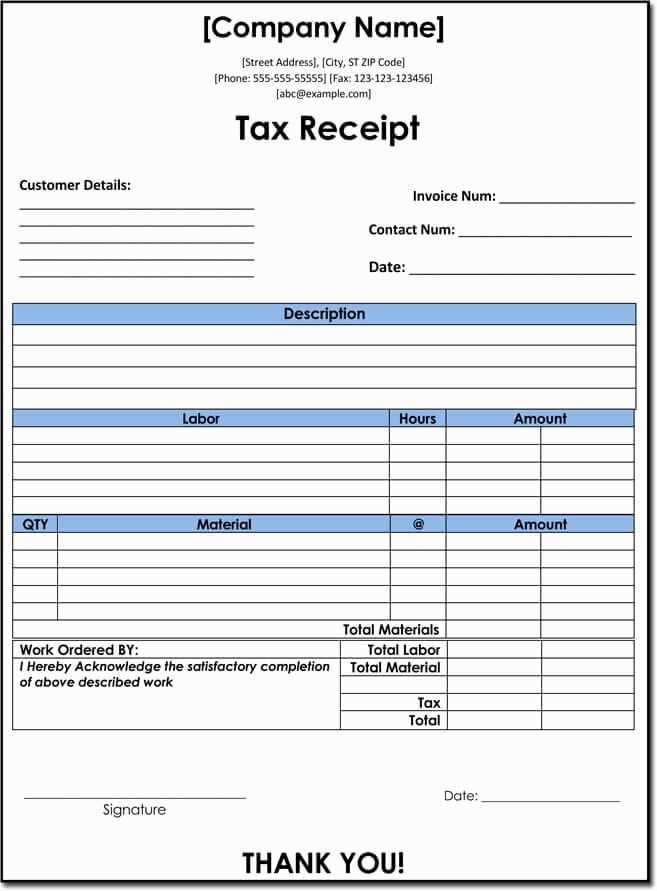

Ensure your Australian tax receipt includes the following details to meet legal and financial requirements. These elements are necessary for both personal and business record-keeping.

1. Issuer’s Information: The receipt must include the full name, business name (if applicable), and Australian Business Number (ABN) of the entity issuing the receipt. This identifies the party responsible for the transaction.

2. Date of Issue: Clearly state the date the receipt is issued. This helps establish the timing of the transaction and is required for tax purposes.

3. Transaction Description: Provide a clear description of the goods or services purchased. Include relevant details, such as quantities or services rendered, to ensure transparency in the transaction.

4. Amount Paid: Specify the total amount paid, including the breakdown of GST (Goods and Services Tax) if applicable. This should match the final price the customer paid.

5. GST Amount: If your business is GST-registered, itemize the GST amount separately. This allows the recipient to claim GST credits if they are eligible.

6. Payment Method: Indicate the method of payment used, such as cash, credit card, or bank transfer. This helps in verifying the payment process.

7. Receipt Number: Assign a unique receipt number to track the transaction. This number is helpful for both auditing and future reference.

8. Refund Policy: If applicable, include a note about your refund policy. This provides transparency and helps customers understand the terms under which returns or exchanges are accepted.

By including these key elements in your Australian tax receipts, you ensure both compliance and clarity for your customers.

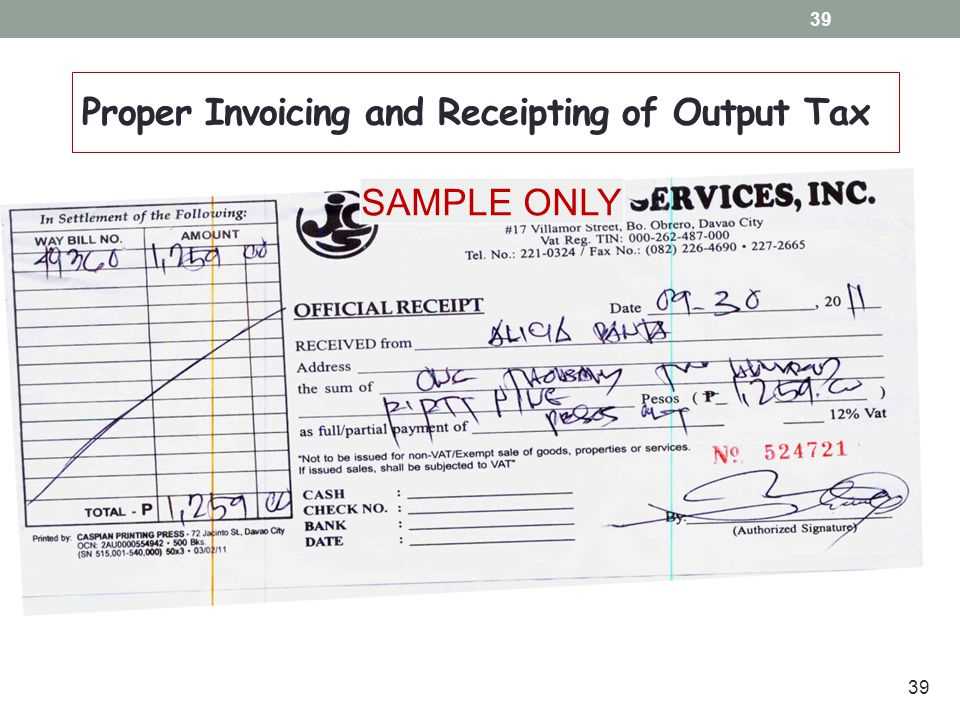

In Australia, receipts must adhere to specific guidelines set by the Australian Taxation Office (ATO). Businesses must provide a receipt for any transaction over $82.50 (including GST) unless the customer requests otherwise. Receipts must clearly display the total amount paid, including GST where applicable, the date of the transaction, and the seller’s details, including name and ABN (Australian Business Number).

Tax Invoice Requirements: For transactions involving GST, a tax invoice is required. This must include the seller’s ABN, a description of the goods or services, the GST amount charged, and the date of the transaction. A tax invoice is not mandatory for transactions under $82.50 unless requested by the customer.

Digital Receipts: If offering receipts electronically, businesses should ensure that the information remains accessible and clear. These receipts are legally valid if they meet the same requirements as paper receipts. Businesses should maintain proper records of all receipts for a minimum of five years, as required by the ATO for audit purposes.

Non-compliance with these requirements may result in penalties or difficulties for customers claiming tax credits. Ensure all transactions are documented accurately and in accordance with ATO guidelines to avoid legal complications.

Modify the template to reflect your business identity by including your logo, brand colors, and custom fonts. Ensure the layout aligns with your company’s style and is easy for customers to read. Position your contact information, such as your website, phone number, and address, in a clear section that is easy to find.

Next, adjust the tax breakdown fields to match your pricing model. If you include multiple tax categories, label them clearly and display the relevant rates. You can also add any discounts or special offers that apply to your transactions.

Include a section for notes or special instructions. This can help clarify details for customers, such as delivery information or specific terms and conditions related to your products or services. Ensure the wording is professional and concise.

Finally, test your customized template by generating a few receipts. This will allow you to see how the information is presented and make any necessary adjustments before using it in real transactions.

The most popular and reliable file formats for tax receipt templates in Australia are PDF, Excel (XLSX), and Word (DOCX). Each of these formats has specific benefits depending on your needs.

PDF is the go-to format for creating professional, universally accessible tax receipts. It ensures the template’s integrity remains intact across all devices and platforms. This format is ideal for both personal and business use, especially if you’re distributing receipts to clients. PDFs are easily printable and cannot be easily edited, providing a higher level of security for your receipts.

Excel (XLSX) is useful when you need to handle multiple receipts or integrate data into accounting software. The flexibility of spreadsheets makes it easy to track and organize receipts, but it’s best used for internal purposes or when the receipt requires specific calculations. It’s also great for customizing templates with formulas to automatically calculate totals, taxes, and other variables.

Word (DOCX) is a simple choice when you need a straightforward, editable template. It’s perfect for smaller businesses or personal use when customization is needed. Word allows easy text formatting and is ideal for creating receipts that require detailed descriptions or specific layouts. However, unlike PDF, Word documents can be edited more easily, so they may not be the best choice when security is a concern.

Choosing the right file format depends on your workflow, but PDF is the best choice for secure, professional-grade receipts, while Excel and Word provide flexibility for customization and ease of use.

Issue receipts clearly, including details like the transaction date, amount, description of goods or services, and both the buyer’s and seller’s contact details. Ensure that each receipt is uniquely numbered for easy identification. This prevents confusion when reviewing records and supports organization for future reference.

Issuing Receipts

Provide receipts immediately after a transaction is completed. For digital transactions, use automated systems to generate receipts, which ensures consistency and accuracy. For paper receipts, make sure the printed copy is clear, legible, and free from errors. In the case of refunds or adjustments, always issue an updated receipt to reflect the change in the transaction.

Storing Receipts

Store receipts in a manner that allows easy access when needed. Digital receipts should be saved in a secure file format, such as PDF, and organized in clearly labeled folders. For physical receipts, use filing cabinets or secure storage boxes, categorized by month or transaction type. Regularly back up digital receipts to protect against data loss.

Australian Tax Receipt Template

Use an Australian tax receipt template to ensure your receipts meet the required standards for both business and personal tax purposes. The template must include specific details like the date of the transaction, business name, address, and an itemized list of goods or services with corresponding prices.

Key Elements for a Valid Tax Receipt

Ensure your template has these fields for a valid tax receipt:

| Field | Required Information |

|---|---|

| Date of Transaction | Exact date when the transaction occurred. |

| Business Name | The registered name of the business providing goods or services. |

| ABN (Australian Business Number) | Unique number identifying the business for tax purposes. |

| Description of Items or Services | A detailed list of what was purchased, including quantities and prices. |

| Total Amount Paid | Summation of all item prices, including taxes. |

This format guarantees your receipt meets legal standards for tax reporting. Using a template helps minimize errors and ensures the right information is consistently included.

Where to Find Free Templates

Search for free Australian tax receipt templates from trusted websites that specialize in small business resources or tax-related tools. These templates are usually available in editable formats like Word or PDF, allowing you to customize them as needed for your specific transactions.