If you’re looking for a simple and practical solution to manage your cash receipts, downloading a free cash receipt template in PDF format is a great choice. This template streamlines the process of documenting payments received in cash, ensuring clear records for both businesses and individuals. With the template, you can easily fill in necessary details such as the date, amount, payer’s name, and description of the transaction.

Opting for a free PDF template saves time and effort compared to creating one from scratch. Many templates come pre-designed, allowing you to instantly use them without needing any special software. Whether you need a receipt for a small business transaction or personal use, this tool simplifies the process and helps you maintain accurate financial documentation.

Downloading and using the cash receipt template is simple. All you need is a PDF reader, and you can begin filling out the details. Templates are customizable, so you can tailor them to meet specific needs, such as adding a logo or adjusting the layout to suit your preferences.

Here are the corrected lines with minimal repetition:

To ensure clarity and efficiency, remove any unnecessary phrases and focus on key details when creating a cash receipt template. The format should be simple yet clear, offering all necessary information without overwhelming the user.

Receipt Information Breakdown

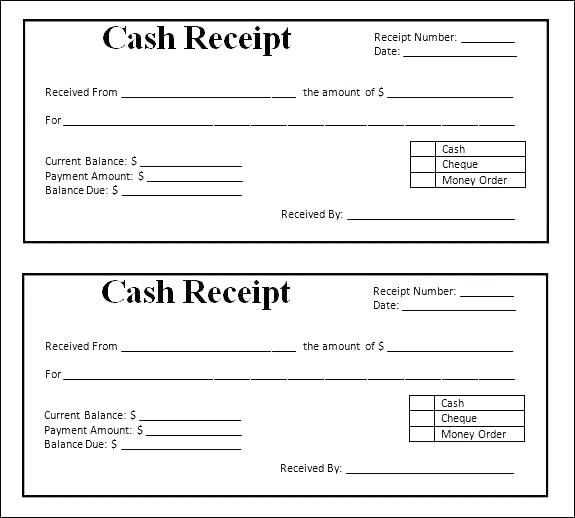

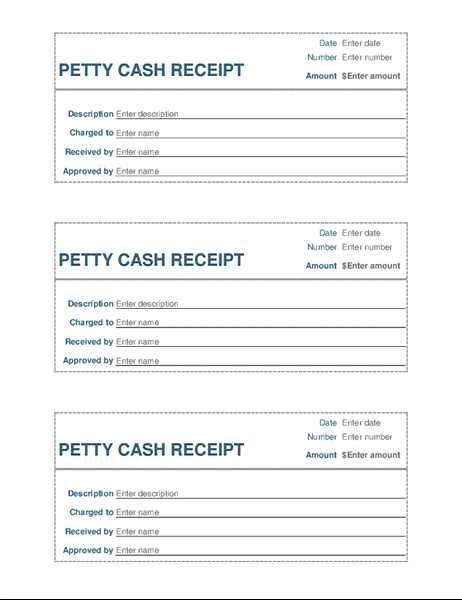

Each receipt should include the following: date, amount received, payer’s name, payment method, and a unique receipt number. These fields are the foundation of a well-structured cash receipt template.

Practical Tips

Focus on consistency in how information is presented. Avoid redundant details like repeated payment methods or redundant address fields. Limit repetition of the payer’s name or address unless absolutely necessary. This keeps the receipt concise and professional.

- Cash Receipt Template Free Download in PDF

For businesses or individuals who need a simple and organized way to document payments, using a free cash receipt template in PDF format is a practical solution. These templates are easy to customize and provide clear details for both the payer and payee. Downloading a PDF template allows for easy printing and sharing. Here’s a quick guide on how to use these templates effectively:

| Template Feature | Description |

|---|---|

| Fields Included | Most cash receipt templates include fields for the date, payer’s name, payee’s name, amount paid, payment method, and a brief description of the transaction. |

| Customizable Sections | You can easily edit fields to suit specific business needs, including adding your logo, changing fonts, or adjusting the layout. |

| PDF Advantages | PDF files preserve formatting across devices, ensuring your receipt looks the same when printed or viewed on a screen. They are also secure and non-editable once saved. |

| Where to Find | You can find free downloadable templates from trusted business websites or template providers. Make sure to check that the templates are aligned with your specific needs. |

| Usage Tips | Fill out all fields accurately and ensure the transaction details are clear to avoid confusion. Keep a copy for your records and give a printed version to the payer. |

By using a free downloadable PDF template, you ensure that your receipts are professional and easy to manage, streamlining financial record-keeping for your business.

To find a free receipt template in PDF format, begin by searching trusted websites offering customizable documents. Many platforms provide templates specifically designed for various purposes, including sales, donations, and services. These templates are usually ready to download and can be modified to suit your needs.

Where to Search

Websites such as Template.net, Vertex42, and FreePrintableReceipt.com host a variety of receipt templates in PDF format. Simply go to the “Receipts” section, choose a template that fits your requirements, and select the PDF download option. Some sites may ask for a brief registration, but many offer free templates with no strings attached.

Customization Tips

Once you’ve downloaded the template, open it in a PDF editor or use tools like Adobe Acrobat to fill in your specific details. Make sure to add information like the recipient’s name, transaction amount, date, and description of the item or service. This step ensures that your receipt is both accurate and professional.

Customize your receipt template by adding specific fields for different payment methods to ensure clarity. Include payment method indicators like “Cash,” “Credit Card,” or “Bank Transfer” to match the transaction type. This will help both the buyer and seller to clearly identify how the payment was made.

Customizing for Cash Payments

- Include a line to confirm the amount of cash received.

- Optionally, add a section to record any change provided, especially for larger transactions.

- Note the time and date of payment, ensuring full transaction transparency.

Customizing for Card Payments

- Include fields for the card type (Visa, MasterCard, etc.) and the last four digits of the card number for reference.

- State whether the transaction was authorized through a terminal or online payment gateway.

- Provide space for transaction approval codes and signatures where applicable.

For online payments or wire transfers, make sure to leave room for transaction IDs and reference numbers. This ensures that both parties have the necessary details to track and confirm payments. Customize your template for each payment method to maintain clear and accurate records of every transaction.

Accurate organization of cash receipts is key to maintaining financial integrity. First, ensure every transaction is documented immediately with a detailed receipt. This practice reduces the risk of missing or inaccurate data, especially for cash transactions where details are more likely to be forgotten.

Store and Categorize Receipts

After creating a receipt, categorize it based on the nature of the transaction (sales, services, refunds, etc.). This allows for easy access when needed for tax filing or audits. Use separate files or folders for different categories, either physical or digital.

Record Receipts in Real-Time

Input receipt data into your accounting system as soon as it’s created. Avoid waiting to log multiple receipts at once to prevent errors or miscalculations. Each record should contain essential details such as the amount, date, payer information, and description of the transaction.

- Amount received

- Date of transaction

- Source of payment (cash, check, card)

- Transaction description (product/service)

These fields help track your cash flow and ensure the accuracy of financial statements.

Secure Receipts for Auditing

Properly archived receipts serve as a reliable source for audits. For physical receipts, store them in a safe, organized location, such as a locked filing cabinet. For digital receipts, back them up in secure cloud storage or an encrypted drive. Always ensure you have a clear system to retrieve receipts quickly when required.

Use a cash receipt template in PDF format to streamline your transactions. Choose a template that includes fields for the transaction date, payer’s name, amount, and payment method. This ensures you capture all the necessary information without confusion. Fill out the fields accurately to avoid discrepancies later. Once filled out, save or print the receipt for your records.

Tip: Look for templates that allow easy customization to fit your specific needs, such as adding your business logo or adjusting the layout. Many free templates can be downloaded online in a few clicks.

Ensure the PDF template is clear and legible. Avoid cluttering the document with excessive text or unnecessary elements. Stick to essential details and maintain a clean, professional design.

Remember: Double-check that the total amount and payment method are correct before finalizing the receipt. This helps prevent future errors or misunderstandings.