A ready-to-use cash receipt template helps businesses, freelancers, and landlords document transactions without extra hassle. Whether you need a simple proof of payment or a detailed breakdown, a well-structured template ensures clarity for both payer and recipient.

UK cash receipt templates typically include date, receipt number, payer and payee details, payment method, itemized list, total amount, and signatures. These elements confirm the transaction and provide a reference for future inquiries.

For a legally valid receipt, use a format that meets HMRC record-keeping requirements. Digital or printed versions should be stored for at least six years. If VAT applies, a separate VAT receipt may be necessary.

Download a free, editable template to streamline your process. Choose from Word, Excel, PDF, or Google Docs formats, depending on your preference. A clear, professional layout ensures easy customization and quick issuance.

Here’s a version without unnecessary repetition:

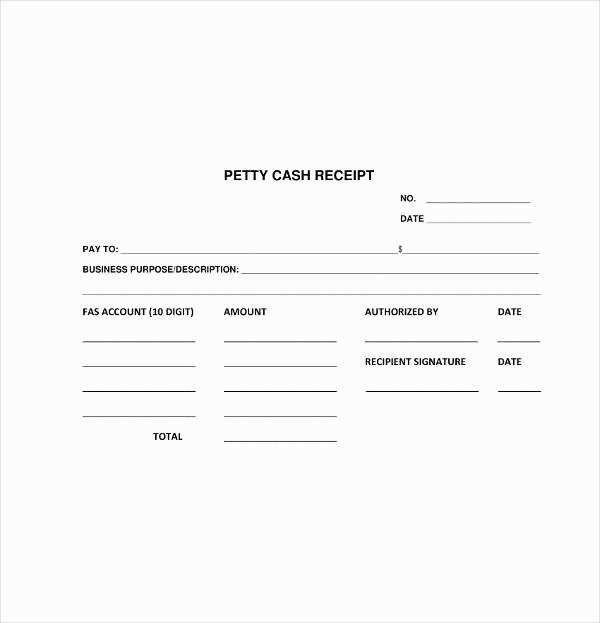

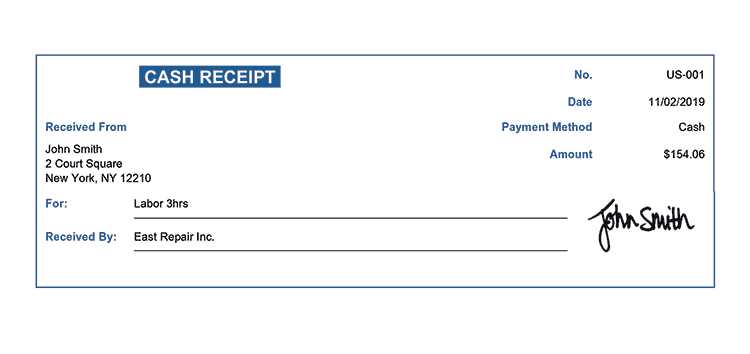

Use a simple and clear template to keep records of cash receipts. This approach avoids unnecessary details while providing all the necessary information for both the payer and payee. Below is a practical example:

- Date: Specify the date of the transaction.

- Receipt Number: Assign a unique number for easy reference.

- Payer’s Name: Include the full name of the individual or entity making the payment.

- Amount Paid: Indicate the exact amount received, including the currency.

- Payment Method: Clarify whether the payment was made in cash, by cheque, or electronically.

- Description: Provide a brief explanation for the payment, such as the purpose of the transaction.

- Signature: Include the signature of the person issuing the receipt.

Following this structure ensures clarity and accuracy without overcomplicating the process. The use of consistent and straightforward templates saves time and reduces errors.

- Free Cash Receipt Template UK

Download a free cash receipt template to keep track of payments made or received. The template includes all the necessary fields, such as the date, amount, payee information, and a description of the transaction. Customise it to suit your needs, ensuring that every payment is documented for easy reference.

Key Features

The template allows you to clearly record the amount received, the payer’s details, and the purpose of the payment. It is designed to be simple and efficient, making it easy to use for personal and business transactions alike. Whether you’re a small business owner or managing personal finances, this template provides a clear and straightforward way to document cash payments.

How to Use

Fill in the required details such as the date, name of the payer, the amount paid, and the purpose. Save the document for your records or print it out for physical copies. This ensures you always have a reliable record of your cash transactions.

Several online platforms offer free receipt templates that comply with UK standards. Here are the best options for easy access:

- Microsoft Office Templates – A variety of receipt templates are available for free. Simply visit their website and search for “receipt” in the template section.

- Google Docs – Google Docs offers customizable receipt templates. You can easily find these templates through the template gallery by searching for “receipt” in the available options.

- Template.net – This site provides a wide range of receipt templates, including ones for UK-based transactions. Download them in different formats like Word or PDF.

- Invoice Simple – Invoice Simple offers free receipt templates that can be quickly customized and downloaded in PDF format. Their website also includes guidance on how to fill out the fields correctly.

- Canva – Canva’s online design tool allows you to create receipts from scratch or use their free templates. You can easily modify the design to fit UK requirements.

Tips for Using Receipt Templates

- Make sure to include all required details like date, seller information, and total amount paid.

- Ensure your template complies with UK tax and business record-keeping regulations.

- Keep a digital copy for your records and offer a printed copy to customers when necessary.

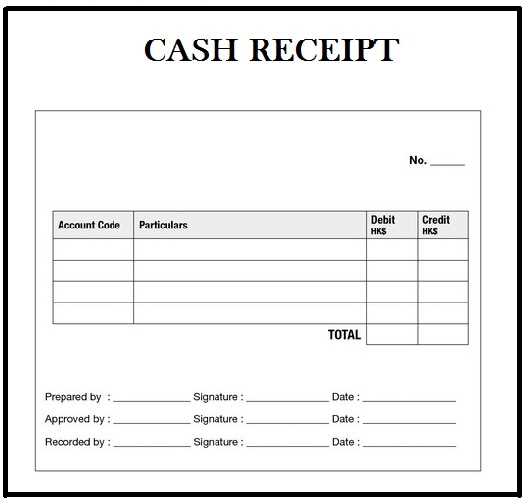

A UK-compliant payment receipt must include specific details to be legally valid and clear. These details ensure both parties have a transparent record of the transaction.

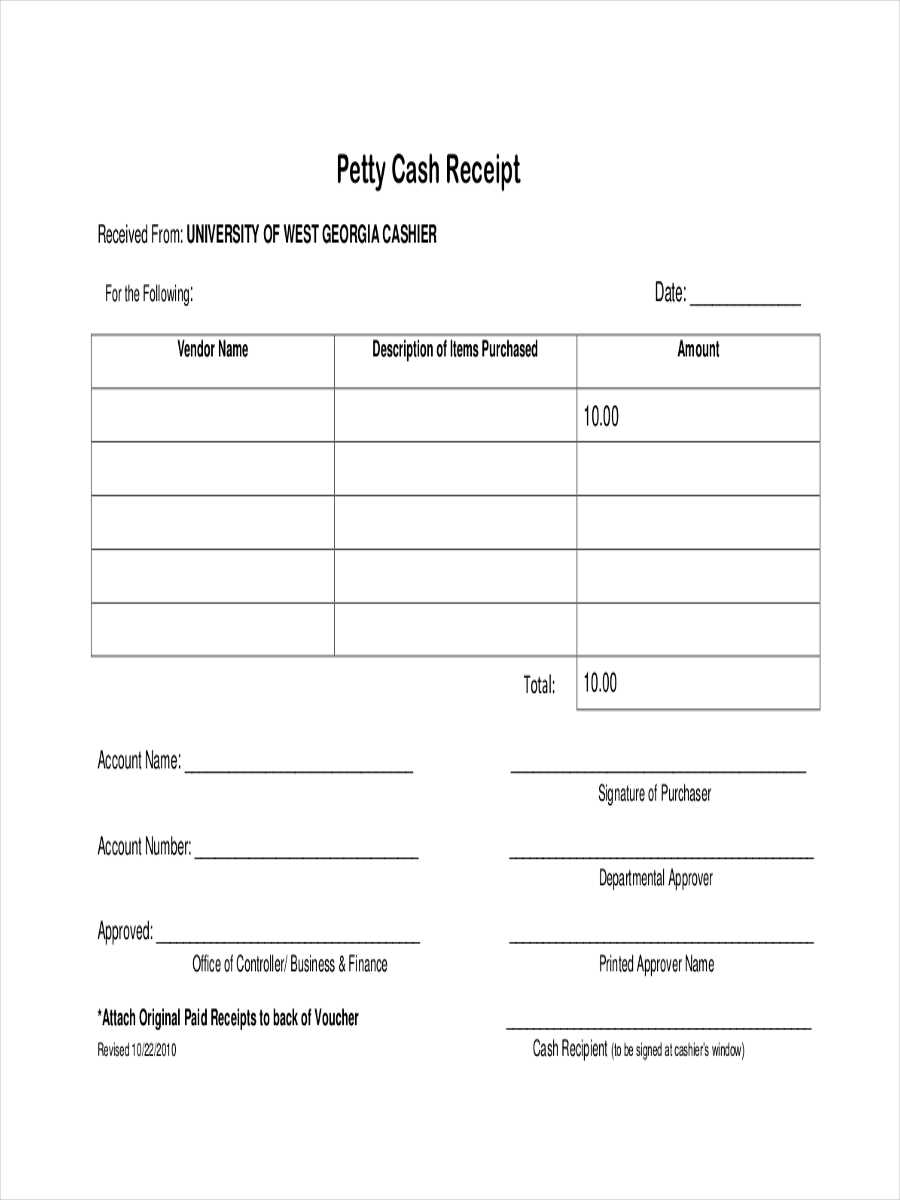

1. Seller’s Information

The receipt should clearly state the seller’s full name or business name, address, and contact details. This allows the buyer to verify the transaction and contact the seller if needed.

2. Buyer’s Information

Including the buyer’s name and, if applicable, their address, is helpful for both record-keeping and resolving any potential disputes.

3. Payment Details

The amount paid, the currency (e.g., GBP), and the payment method (cash, card, bank transfer) must be specified. If a cheque was used, include the cheque number and bank details.

4. Date of Payment

The exact date of the transaction should be recorded. This serves as the proof of when the payment occurred.

5. Description of Goods or Services

A clear description of what was purchased must be included, such as product names, quantities, and any relevant details that specify what was paid for.

6. Invoice Number

An invoice number or unique reference number helps link the payment receipt to the corresponding invoice, especially for businesses. This can also be used for tracking purposes.

7. VAT Information (if applicable)

If VAT applies to the transaction, the VAT number of the seller and the rate applied should be included. This ensures compliance with tax laws.

8. Total Amount

The total amount paid, including any taxes, fees, or discounts, should be clearly displayed at the bottom of the receipt to avoid confusion.

These elements are crucial for creating a transparent, valid payment receipt in the UK. Always ensure the receipt is clear, accurate, and complete.

Fill in the date and time of the transaction at the top of the receipt. This establishes when the exchange took place, which is vital for record-keeping.

Include Buyer and Seller Information

Enter the full name and contact details of both the buyer and seller. For the buyer, include the name, address, and email address, if relevant. For the seller, list the business name, address, and contact information.

List the Items or Services

Provide a detailed description of the items or services provided. Include quantities, unit prices, and the total cost for each item. If applicable, mention any discounts or special terms related to the sale.

Ensure the total amount of the transaction is clearly displayed at the bottom of the receipt, including any taxes or additional fees. This should match the sum of the listed items and services.

Finally, add a payment method section to indicate how the payment was made, whether by cash, card, or another method. If applicable, include a transaction reference number for electronic payments.

In the UK, businesses must issue receipts for payments to customers when requested. While not always mandatory, receipts are necessary for transactions that involve goods or services valued above a certain threshold, typically £250 or more. The receipt should contain specific details to ensure legal compliance.

A receipt must clearly show the date of the transaction, the amount paid, the nature of the goods or services, and the method of payment. It should also include the business’s name, address, and VAT registration number if applicable. This helps both customers and businesses keep accurate records for tax and warranty purposes.

For VAT-registered businesses, a VAT invoice is required when transactions exceed £250. This invoice must include the same details as a receipt, along with the VAT amount, VAT rate, and the business’s VAT number. Keeping these records is vital for tax reporting and may be requested during audits or by HMRC.

Issuing a receipt ensures transparency and protects both the customer and the business. It is advisable for businesses to use a standard receipt template that complies with these legal requirements to avoid any issues down the line.

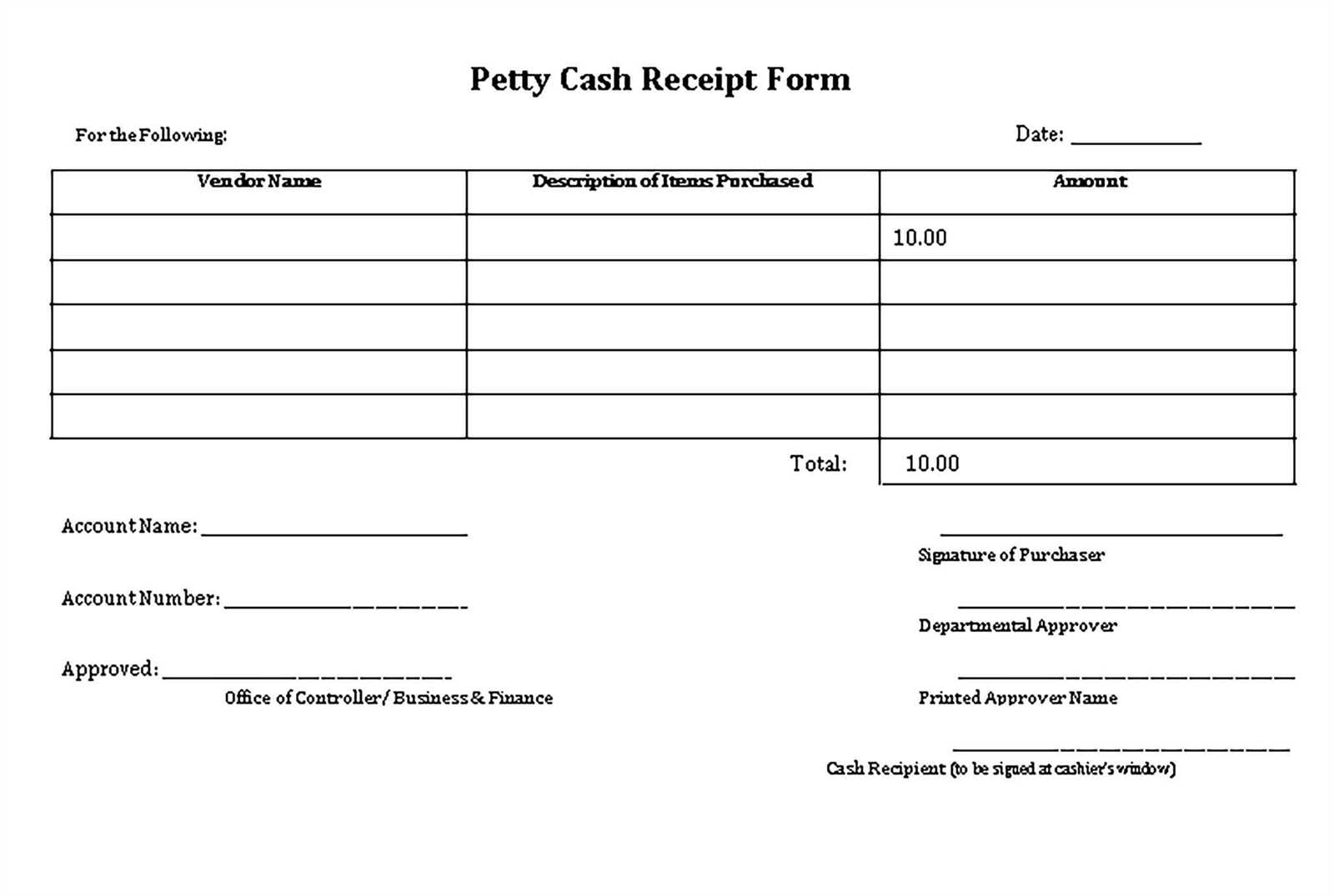

Adjust a receipt template to reflect your brand identity by adding your business logo, color scheme, and contact details. Include the business name, address, and phone number at the top for easy reference. Personalizing these details enhances professionalism and ensures customers can contact you if needed.

Include Relevant Transaction Information

Ensure the receipt includes transaction specifics, such as the date, itemized list of products or services, quantities, prices, and total amount. This information prevents any confusion and can be helpful for both the business and customer during future inquiries.

Incorporate Payment Methods

List the method of payment, whether it’s cash, credit card, or another form. This clarifies how the payment was processed, helping with accounting and reducing discrepancies in financial records.

| Field | Example |

|---|---|

| Transaction ID | 123456 |

| Date | 10-Feb-2025 |

| Item | Product A |

| Price | £50.00 |

| Total | £50.00 |

| Payment Method | Credit Card |

Having a clear and concise receipt helps maintain transparency and builds trust with customers. Customize your template for clarity and brand consistency while ensuring all necessary details are included.

Digital receipts are more convenient for storage and retrieval. They take up no physical space, can be accessed instantly through email or apps, and are easily organized. They also reduce paper waste, supporting eco-friendly initiatives. However, some users find digital receipts harder to track or print when needed, particularly if the email gets lost or the app becomes inaccessible.

Advantages of Paper Receipts

Paper receipts are familiar and tangible. They provide an immediate physical record of the transaction, which can be useful in situations where access to a digital device is unavailable. They also offer a physical backup if the digital receipt system fails. However, paper receipts are prone to fading over time and can clutter physical storage spaces, requiring careful organization.

Digital Receipts Benefits

Digital receipts streamline record-keeping and reduce the need for physical storage. They are easier to search through for tax records, returns, and expense tracking. Additionally, most digital receipt systems integrate with accounting software, making financial management simpler. On the downside, they depend on technology, which may not be as reliable in case of technical issues.

Cash Receipt Template Free UK

Download and customize your cash receipt template for free, specifically designed for use in the UK. This template is ideal for recording cash transactions in a clear and organized way. Fill in details like date, amount, payer, and purpose of the payment to maintain accurate records. Ensure your receipts match UK tax regulations by including all required information.

Template Features

| Field | Description |

|---|---|

| Date | Record the date the transaction occurred. |

| Payer | Enter the name or company of the person making the payment. |

| Amount | Specify the total amount paid in the transaction. |

| Payment Method | Indicate if the payment was made by cash, cheque, or another method. |

| Purpose | State the reason for the payment (e.g., services rendered, goods sold). |

| Receipt Number | Assign a unique number to each receipt for reference and tracking purposes. |

How to Use the Template

Simply download the template, open it in your preferred word processing or spreadsheet software, and fill in the required fields. Save a copy of each receipt for your records. For accurate accounting, ensure the amounts match your business’s cash records and provide a copy to the payer upon receipt.