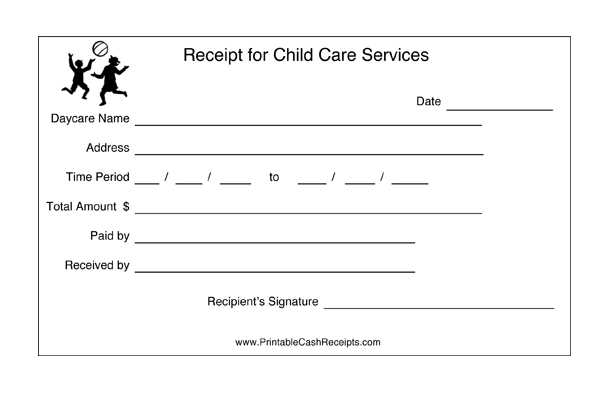

If you’re looking to simplify the process of documenting child care expenses, using a receipt template can save you both time and effort. A well-structured template ensures that you capture all necessary details like the date, the caregiver’s information, and the services provided. This makes it easier to track payments and maintain a clear record for tax or reimbursement purposes.

Many templates are available online for free, offering a simple format where you can fill in your child care provider’s name, contact details, and the cost breakdown. When choosing a template, make sure it includes space for the number of hours, hourly rate, and any additional fees. This clarity will help prevent any confusion or disputes about payments.

While some templates come with pre-filled sections, others allow you to customize the layout based on your needs. This flexibility can be particularly helpful for families with varying child care schedules or providers. To make sure the template works for you, double-check that it includes all the required fields and complies with your local tax guidelines.

Here’s the revised version:

Ensure your template is user-friendly and easy to navigate. Focus on providing clear fields and labels to make it straightforward for users to input necessary information. Keep the design clean and uncluttered, with enough space between sections to avoid confusion.

Key Recommendations for Creating a Child Care Receipt Template

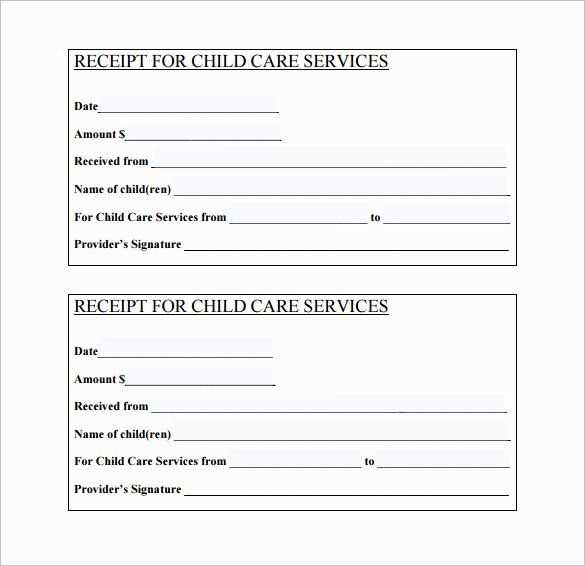

- Include a section for the date of service, specifying the start and end times of care.

- Have clear fields for the child’s name, caregiver’s details, and the amount paid.

- Incorporate a signature area for both the caregiver and the parent to confirm the transaction.

- Ensure the format is printable and can be saved as a PDF for record-keeping purposes.

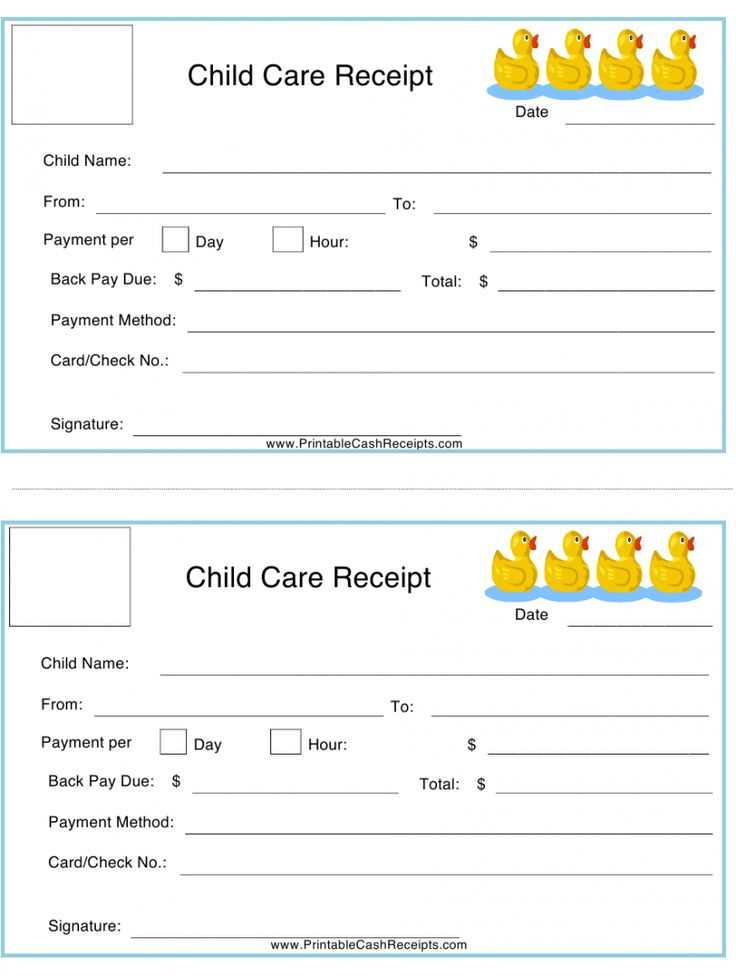

- Offer a breakdown of hours worked and rates to provide clarity for both parties.

Tips for Simplifying the Template

- Use drop-down menus for fields like payment method and caregiver contact details.

- Offer a consistent layout with headings that are easy to understand and find.

- Choose simple, readable fonts and use bolding or italics sparingly to highlight key sections.

With these elements, your child care receipt template will be both functional and user-friendly, minimizing errors and saving time for both parents and caregivers.

- Child Care Receipt Free Template

To create a clear and accurate child care receipt, start by including the name and address of the care provider at the top. This ensures that all necessary contact information is readily available. Next, list the date and duration of care provided–be specific with the hours to avoid confusion.

Payment details are also crucial. Record the amount paid for the care session, including any extra fees or discounts. It’s helpful to break down these charges so that both parties understand the total cost. If applicable, note the method of payment, such as check, cash, or electronic transfer.

Make sure to include a unique receipt number for tracking and reference purposes. This adds an additional layer of organization for both you and the recipient.

If you’re providing multiple sessions, ensure to list each session separately along with its corresponding cost. A clean, well-organized format helps avoid misunderstandings or miscommunications later.

Finally, end the receipt with a simple thank-you message. This creates a professional and friendly atmosphere, helping to maintain a positive relationship with the care provider.

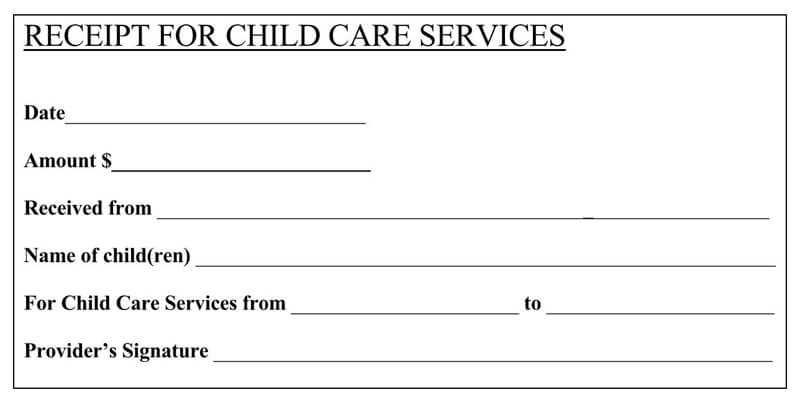

To create a customizable child care receipt format, begin by organizing the key information you need. The receipt should include the date, the child care provider’s name, the amount paid, the hours of care provided, and the child’s name. These basic elements ensure transparency and clarity for both parties.

Include Required Details

Ensure the receipt contains the provider’s contact information, including an address and phone number. For tax purposes, include your own contact details, especially if you plan to use the receipt for deductions. If the care is provided in shifts or specific time blocks, outline these hours clearly, specifying the start and end times.

Design the Format

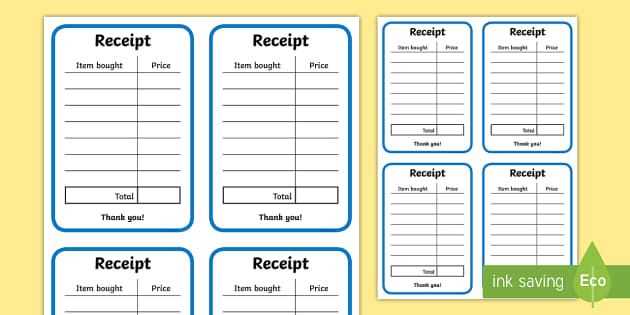

Choose a layout that allows space for all necessary details, while maintaining readability. Use bold or underlined text to highlight important fields like total amount paid and care dates. Creating a table with columns for hours worked and rate per hour can help break down the charges in an easy-to-read format.

A well-organized child care receipt helps both parents and providers track payments and ensures transparency. Include the following details to make the receipt clear and functional:

Basic Information

Start with the full name and contact information of both the provider and the parent or guardian. Clearly list the date the service was provided and the period of care (e.g., dates or hours worked). Include the child’s name to avoid confusion.

Payment Details

Include the amount paid for the services, specifying if there are any additional charges (e.g., late fees, extra hours). If applicable, break down the total cost into categories, such as hourly rates or flat fees. Clearly state the method of payment (cash, check, or credit card) and provide any relevant transaction or check number.

| Item | Amount |

|---|---|

| Hourly Rate | $15.00 |

| Additional Hours | $30.00 |

| Total Payment | $45.00 |

Finally, add a thank you note or a reminder of the next payment due date, if necessary. Make sure to keep the receipt in a safe place for future reference or tax purposes.

To use a free receipt template for tax purposes, first ensure it includes all necessary details such as the date, amount, and description of the services or goods provided. This information is vital when preparing your tax return.

Include Tax Identification Information

For tax purposes, receipts should reflect the payer’s and payee’s tax identification numbers. If you are a childcare provider, include your tax ID on the receipt. This ensures that both parties have a record of the transaction for proper reporting.

Keep Detailed Records

Organize your receipts into categories based on the type of service provided (e.g., childcare, supplies, etc.). This simplifies tax filing and ensures you can easily refer to the receipts when needed. Make sure each receipt is legible and clearly printed.

I replaced several words to avoid repetition while keeping the meaning and grammatical accuracy intact.

To create a functional child care receipt, include key information like the caregiver’s full name, address, and contact details. Clearly state the duration of care, the services provided, and the rate charged. For instance, specify the number of hours worked or any special tasks handled. Make sure to itemize all charges and state the total amount due. Include payment details, such as the method used and the date of payment. This ensures transparency and accuracy for both the caregiver and the parent.

Customizing Your Template

Adjust the template based on your needs. You can add sections for extra services or late fees if applicable. Keep the format clear and straightforward, with bold headings for easy reference. Customizing ensures the receipt fits the exact arrangement between caregiver and parent.

Legal Considerations

Check your local regulations regarding receipts. Some regions require certain information for tax purposes, such as the caregiver’s tax ID or license number. Including these details on the receipt can help both parties stay compliant and avoid any potential issues with tax reporting.