Get a ready-to-use paid receipt template without hidden fees or subscriptions. Whether you’re a freelancer, small business owner, or accountant, having a structured document simplifies record-keeping and ensures compliance with tax regulations.

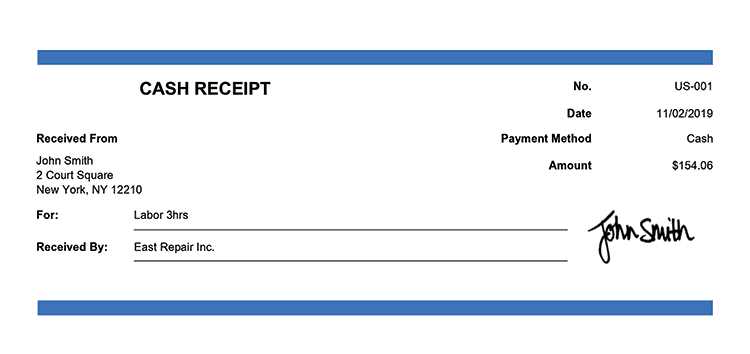

What makes a well-designed receipt? It should include essential details such as the payer’s and recipient’s information, transaction date, itemized list of services or products, total amount, and payment method. A clear layout ensures smooth processing for both parties.

Customizing a template is easy. Add your company’s logo, adjust currency formats, and modify the fields to fit your needs. Many formats are available, including PDF, Word, and Excel, allowing flexibility in editing and storage.

Download a free template today and streamline your financial documentation. A structured receipt not only enhances professionalism but also prevents disputes and simplifies tax filing.

Free Access Paid Receipt Template

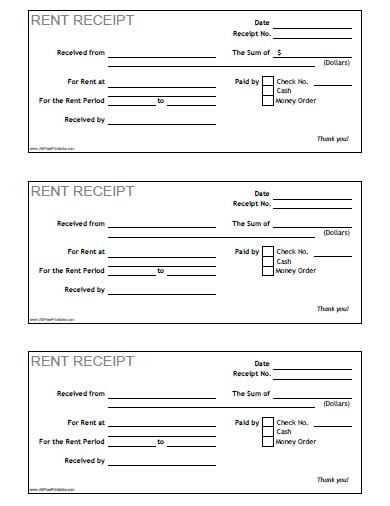

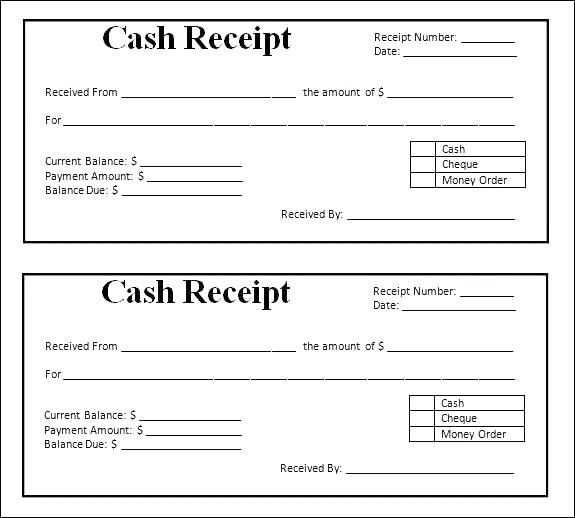

Download a structured template that includes all necessary fields: transaction date, payment method, recipient details, and a unique reference number. Ensure the format aligns with legal and accounting requirements.

Key Elements to Include

- Date and Time: Clearly specify when the transaction took place.

- Payer and Payee Information: Include full names, addresses, and contact details.

- Amount Paid: Display the total sum and currency.

- Payment Method: Indicate whether it was made via card, bank transfer, or cash.

- Reference Number: Assign a unique identifier for easy tracking.

Optimizing the Template for Usability

Use a format that supports easy editing, such as PDF or Excel. Consider adding an automatic calculation feature for tax or discounts. Ensure the layout is clean and professional, making it suitable for both digital and printed use.

Provide a section for signatures if required by regulations. For recurring payments, include a section specifying the billing cycle and next due date.

Key Elements of a Paid Receipt Template

Include Clear Identifiers to ensure quick recognition. The document must display the seller’s name, address, and contact details at the top. Adding a unique receipt number simplifies tracking.

Transaction Details

Specify the payment date and method to provide clarity. Include the total amount paid, currency, and any applicable taxes. If a discount applies, show both the original and adjusted amounts.

Itemized Breakdown

List purchased goods or services with descriptions, quantities, and unit prices. A well-structured table enhances readability and prevents disputes.

Confirmation and Authorization complete the receipt. A closing section should feature the seller’s signature or digital stamp, reinforcing authenticity.

How to Customize a Receipt for Different Transactions

Modify receipt details based on transaction type to ensure clarity and accuracy. Adjust sections to match the nature of the exchange.

- Retail Sales: Include itemized product descriptions, unit prices, and applied discounts. Highlight return policies for transparency.

- Service Payments: Specify provided services, hourly rates, and total labor costs. Add service completion dates if relevant.

- Online Purchases: Incorporate order numbers, shipping details, and estimated delivery dates. Provide a link to return instructions.

- Subscription Fees: Indicate billing cycle, renewal dates, and cancellation policies. List customer support contacts for assistance.

- Rental Agreements: Outline rental duration, security deposit, and late fee terms. Add a section for item condition at return.

Use clear formatting, concise descriptions, and relevant terms to prevent disputes. Always verify calculations before finalizing.

Best File Formats for Easy Editing and Sharing

PDF ensures consistency across devices, making it a solid choice for receipts. While editing can be restrictive, tools like Adobe Acrobat or online converters allow modifications.

DOCX Offers Maximum Flexibility

For seamless text adjustments, DOCX works best. It retains formatting, supports images, and integrates with Microsoft Word and Google Docs. If collaboration matters, cloud-based sharing simplifies real-time edits.

XLSX Handles Calculations Efficiently

Need formulas or automatic totals? XLSX allows dynamic content adjustments. Spreadsheets provide structured layouts, making them practical for itemized receipts with auto-calculating fields.

CSV keeps it simple for bulk data entry. This format removes styling but ensures compatibility with multiple platforms, ideal for importing transaction records into accounting software.

Choosing the right format depends on the need for design control, editing ease, or structured data management.